Hey there, future investor! Are you ready to dive into mutual funds but don’t know where to start? Well, you’ve landed in the right place. Let’s cut through the financial jargon and get straight to what matters most: making your money work smarter for you. Best Flexi-Cap mutual funds are like the Swiss Army knife of investments—they’re versatile, adaptable, and packed with potential. But with so many options, how do you pick the right one? Don’t worry; we’ve got you covered. In this guide, we’ll break down everything you need to know about the top Flexi-Cap mutual funds, all in an easy-to-understand and super-engaging way. Ready to turn your investment game up a notch? Let’s get started!

What Are Flexi-Cap Mutual Funds?

As the name suggests, Flexi-Cap funds have the flexibility to invest across market capitalizations – large-cap, mid-cap, and small-cap stocks. This flexibility allows fund managers to diversify and maximize returns based on market conditions. But with flexibility comes the need for careful selection. So, let’s look at which funds are currently leading the pack.

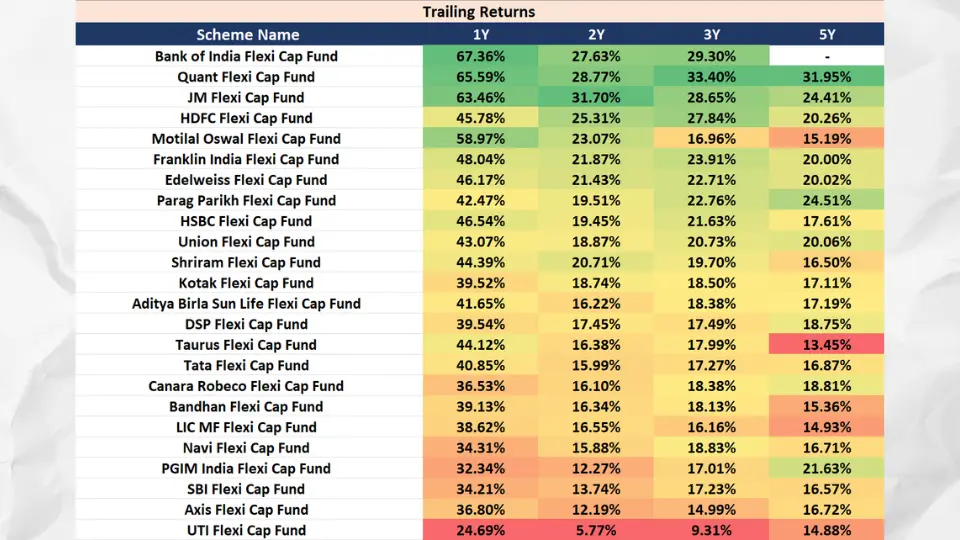

Returns Analysis

Top Performing Flexi-Cap Funds: A Year-by-Year Analysis

Data as of 30 Apr,2024

1-Year Returns

Starting with the short-term perspective, here’s how the funds stack up:

| Scheme Name | 1Y |

| Bank of India Flexi Cap Fund | 67.36% |

| Quant Flexi Cap Fund | 65.59% |

| JM Flexi Cap Fund | 63.46% |

| HDFC Flexi Cap Fund | 45.78% |

| Motilal Oswal Flexi Cap Fund | 58.97% |

| Franklin India Flexi Cap Fund | 48.04% |

| Edelweiss Flexi Cap Fund | 46.17% |

| Parag Parikh Flexi Cap Fund | 42.47% |

| HSBC Flexi Cap Fund | 46.54% |

| Union Flexi Cap Fund | 43.07% |

| Shriram Flexi Cap Fund | 44.39% |

| Kotak Flexi Cap Fund | 39.52% |

| Aditya Birla Sun Life Flexi Cap Fund | 41.65% |

| DSP Flexi Cap Fund | 39.54% |

| Taurus Flexi Cap Fund | 44.12% |

| Tata Flexi Cap Fund | 40.85% |

| Canara Robeco Flexi Cap Fund | 36.53% |

| Bandhan Flexi Cap Fund | 39.13% |

| LIC MF Flexi Cap Fund | 38.62% |

| Navi Flexi Cap Fund | 34.31% |

| PGIM India Flexi Cap Fund | 32.34% |

| SBI Flexi Cap Fund | 34.21% |

| Axis Flexi Cap Fund | 36.80% |

| UTI Flexi Cap Fund | 24.69% |

Analysis:

Bank of India Flexi Cap Fund takes the top spot with an impressive 67.36% return over the past year, closely followed by Quant Flexi Cap Fund at 65.59% and JM Flexi Cap Fund at 63.46%. These funds have significantly outperformed their peers, showcasing their potential for short-term solid gains.

2-Year Returns

Let’s extend our horizon to see how these funds performed over two years:

| Scheme Name | 2Y |

| JM Flexi Cap Fund | 31.70% |

| Quant Flexi Cap Fund | 28.77% |

| Bank of India Flexi Cap Fund | 27.63% |

| HDFC Flexi Cap Fund | 25.31% |

| Motilal Oswal Flexi Cap Fund | 23.07% |

| Franklin India Flexi Cap Fund | 21.87% |

| Edelweiss Flexi Cap Fund | 21.43% |

| Parag Parikh Flexi Cap Fund | 19.51% |

| HSBC Flexi Cap Fund | 19.45% |

| Union Flexi Cap Fund | 18.87% |

| Shriram Flexi Cap Fund | 20.71% |

| Kotak Flexi Cap Fund | 18.74% |

| Aditya Birla Sun Life Flexi Cap Fund | 16.22% |

| DSP Flexi Cap Fund | 17.45% |

| Taurus Flexi Cap Fund | 16.38% |

| Tata Flexi Cap Fund | 15.99% |

| Canara Robeco Flexi Cap Fund | 16.10% |

| Bandhan Flexi Cap Fund | 16.34% |

| LIC MF Flexi Cap Fund | 16.55% |

| Navi Flexi Cap Fund | 15.88% |

| PGIM India Flexi Cap Fund | 12.27% |

| SBI Flexi Cap Fund | 13.74% |

| Axis Flexi Cap Fund | 12.19% |

| UTI Flexi Cap Fund | 5.77% |

Analysis:

JM Flexi Cap Fund leads the two-year returns with 31.70%, demonstrating consistent performance. Quant Flexi Cap Fund and Bank of India Flexi Cap Fund also maintain strong positions with 28.77% and 27.63% returns, respectively.

3-Year Returns

Now, let’s look at the three-year performance:

| Scheme Name | 3Y |

| Quant Flexi Cap Fund | 33.40% |

| Bank of India Flexi Cap Fund | 29.30% |

| JM Flexi Cap Fund | 28.65% |

| HDFC Flexi Cap Fund | 27.84% |

| Franklin India Flexi Cap Fund | 23.91% |

| Edelweiss Flexi Cap Fund | 22.71% |

| Parag Parikh Flexi Cap Fund | 22.76% |

| HSBC Flexi Cap Fund | 21.63% |

| Union Flexi Cap Fund | 20.73% |

| Shriram Flexi Cap Fund | 19.70% |

| Kotak Flexi Cap Fund | 18.50% |

| Aditya Birla Sun Life Flexi Cap Fund | 18.38% |

| DSP Flexi Cap Fund | 17.49% |

| Taurus Flexi Cap Fund | 17.99% |

| Tata Flexi Cap Fund | 17.27% |

| Canara Robeco Flexi Cap Fund | 18.38% |

| Bandhan Flexi Cap Fund | 18.13% |

| LIC MF Flexi Cap Fund | 16.16% |

| Navi Flexi Cap Fund | 18.83% |

| PGIM India Flexi Cap Fund | 17.01% |

| SBI Flexi Cap Fund | 17.23% |

| Axis Flexi Cap Fund | 14.99% |

| UTI Flexi Cap Fund | 9.31% |

Analysis:

Quant Flexi Cap Fund has a remarkable 33.40% return over three years. Bank of India Flexi Cap Fund and JM Flexi Cap Fund also exhibit strong performances, making them reliable options for mid-term investments.

5-Year Returns

How do these funds perform in the longer term? Here’s the five-year analysis:

| Scheme Name | 5Y |

| Quant Flexi Cap Fund | 31.95% |

| JM Flexi Cap Fund | 24.41% |

| Parag Parikh Flexi Cap Fund | 24.51% |

| HDFC Flexi Cap Fund | 20.26% |

| Franklin India Flexi Cap Fund | 20.00% |

| Edelweiss Flexi Cap Fund | 20.02% |

| HSBC Flexi Cap Fund | 17.61% |

| Union Flexi Cap Fund | 20.06% |

| Shriram Flexi Cap Fund | 16.50% |

| Kotak Flexi Cap Fund | 17.11% |

| Aditya Birla Sun Life Flexi Cap Fund | 17.19% |

| DSP Flexi Cap Fund | 18.75% |

| Taurus Flexi Cap Fund | 13.45% |

| Tata Flexi Cap Fund | 16.87% |

| Canara Robeco Flexi Cap Fund | 18.81% |

| Bandhan Flexi Cap Fund | 15.36% |

| LIC MF Flexi Cap Fund | 14.93% |

| Navi Flexi Cap Fund | 16.71% |

| PGIM India Flexi Cap Fund | 21.63% |

| SBI Flexi Cap Fund | 16.57% |

| Axis Flexi Cap Fund | 16.72% |

| UTI Flexi Cap Fund | 14.88% |

Analysis:

Quant Flexi Cap Fund maintains its lead with a stellar 31.95% return over five years. Parag Parikh Flexi Cap Fund also shows long-term solid performance at 24.51%, making these funds excellent choices for investors seeking sustained growth.

10-Year Returns

Finally, let’s check out the decade-long returns:

| Scheme Name | 10Y |

| Quant Flexi Cap Fund | 24.36% |

| JM Flexi Cap Fund | 20.65% |

| Parag Parikh Flexi Cap Fund | 20.16% |

| HDFC Flexi Cap Fund | 17.83% |

| Franklin India Flexi Cap Fund | 18.37% |

| Kotak Flexi Cap Fund | 18.27% |

| DSP Flexi Cap Fund | 17.33% |

| Bandhan Flexi Cap Fund | 15.49% |

| HSBC Flexi Cap Fund | 16.25% |

| SBI Flexi Cap Fund | 17.89% |

| UTI Flexi Cap Fund | 14.99% |

| Canara Robeco Flexi Cap Fund | 16.42% |

| Axis Flexi Cap Fund | 17.89% |

Analysis:

Quant Flexi Cap Fund continues to dominate with an impressive 24.36% return over the past decade. JM Flexi Cap Fund and Parag Parikh Flexi Cap Fund also show solid long-term performance, offering stable growth for patient investors.

Key Takeaways

- Short-Term Stars: Bank of India Flexi Cap Fund, Quant Flexi Cap Fund, and JM Flexi Cap Fund deliver exceptional returns in the 1-year category.

- Consistent Performers: Quant Flexi Cap Fund consistently ranks high across all time frames, making it a top contender for short- and long-term investments.

- Mid-Term Reliability: For 3-year returns, Quant Flexi Cap Fund and Bank of India Flexi Cap Fund stand out with impressive performance.

- Long-Term Growth: For those looking at a 5-year or 10-year horizon, Quant Flexi Cap Fund remains a strong choice with sustained high returns.

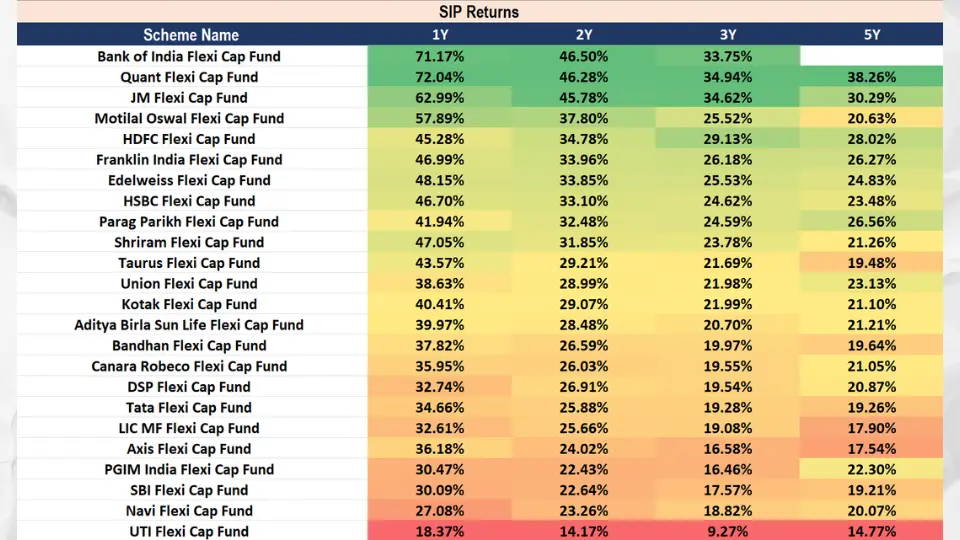

SIP Returns Comparative Analysis

Data as of 30 Apr 2024

1-Year SIP Returns

Let’s start by examining the SIP returns over the past year. Here’s a look at the top performers:

| Scheme Name | 1Y |

| Quant Flexi Cap Fund | 72.04% |

| Bank of India Flexi Cap Fund | 71.17% |

| JM Flexi Cap Fund | 62.99% |

| Motilal Oswal Flexi Cap Fund | 57.89% |

| HDFC Flexi Cap Fund | 45.28% |

| Franklin India Flexi Cap Fund | 46.99% |

| Edelweiss Flexi Cap Fund | 48.15% |

| HSBC Flexi Cap Fund | 46.70% |

| Parag Parikh Flexi Cap Fund | 41.94% |

| Shriram Flexi Cap Fund | 47.05% |

| Taurus Flexi Cap Fund | 43.57% |

| Union Flexi Cap Fund | 38.63% |

| Kotak Flexi Cap Fund | 40.41% |

| Aditya Birla Sun Life Flexi Cap Fund | 39.97% |

| Bandhan Flexi Cap Fund | 37.82% |

| Canara Robeco Flexi Cap Fund | 35.95% |

| DSP Flexi Cap Fund | 32.74% |

| Tata Flexi Cap Fund | 34.66% |

| LIC MF Flexi Cap Fund | 32.61% |

| Axis Flexi Cap Fund | 36.18% |

| PGIM India Flexi Cap Fund | 30.47% |

| SBI Flexi Cap Fund | 30.09% |

| Navi Flexi Cap Fund | 27.08% |

| UTI Flexi Cap Fund | 18.37% |

Analysis:

Quant Flexi Cap Fund tops the list with a phenomenal 72.04% return, closely followed by Bank of India Flexi Cap Fund at 71.17%. These funds have shown exceptional performance over the past year, making them ideal for investors seeking high short-term gains through SIPs.

2-Year SIP Returns

Next, let’s see how these funds performed over two years:

| Scheme Name | 2Y |

| Bank of India Flexi Cap Fund | 46.50% |

| Quant Flexi Cap Fund | 46.28% |

| JM Flexi Cap Fund | 45.78% |

| HDFC Flexi Cap Fund | 34.78% |

| Motilal Oswal Flexi Cap Fund | 37.80% |

| Franklin India Flexi Cap Fund | 33.96% |

| Edelweiss Flexi Cap Fund | 33.85% |

| HSBC Flexi Cap Fund | 33.10% |

| Parag Parikh Flexi Cap Fund | 32.48% |

| Shriram Flexi Cap Fund | 31.85% |

| Taurus Flexi Cap Fund | 29.21% |

| Union Flexi Cap Fund | 28.99% |

| Kotak Flexi Cap Fund | 29.07% |

| Aditya Birla Sun Life Flexi Cap Fund | 28.48% |

| Bandhan Flexi Cap Fund | 26.59% |

| Canara Robeco Flexi Cap Fund | 26.03% |

| DSP Flexi Cap Fund | 26.91% |

| Tata Flexi Cap Fund | 25.88% |

| LIC MF Flexi Cap Fund | 25.66% |

| Axis Flexi Cap Fund | 24.02% |

| PGIM India Flexi Cap Fund | 22.43% |

| SBI Flexi Cap Fund | 22.64% |

| Navi Flexi Cap Fund | 23.26% |

| UTI Flexi Cap Fund | 14.17% |

Analysis:

Bank of India Flexi Cap Fund leads the two-year SIP returns with 46.50%, followed closely by Quant Flexi Cap Fund and JM Flexi Cap Fund. These funds have consistently delivered strong returns, making them excellent choices for mid-term SIP investments.

3-Year SIP Returns

Here’s how the funds performed over three years:

| Scheme Name | 3Y |

| Quant Flexi Cap Fund | 34.94% |

| JM Flexi Cap Fund | 34.62% |

| Bank of India Flexi Cap Fund | 33.75% |

| HDFC Flexi Cap Fund | 29.13% |

| Motilal Oswal Flexi Cap Fund | 25.52% |

| Franklin India Flexi Cap Fund | 26.18% |

| Edelweiss Flexi Cap Fund | 25.53% |

| HSBC Flexi Cap Fund | 24.62% |

| Parag Parikh Flexi Cap Fund | 24.59% |

| Shriram Flexi Cap Fund | 23.78% |

| Taurus Flexi Cap Fund | 21.69% |

| Union Flexi Cap Fund | 21.98% |

| Kotak Flexi Cap Fund | 21.99% |

| Aditya Birla Sun Life Flexi Cap Fund | 20.70% |

| Bandhan Flexi Cap Fund | 19.97% |

| Canara Robeco Flexi Cap Fund | 19.55% |

| DSP Flexi Cap Fund | 19.54% |

| Tata Flexi Cap Fund | 19.28% |

| LIC MF Flexi Cap Fund | 19.08% |

| Axis Flexi Cap Fund | 16.58% |

| PGIM India Flexi Cap Fund | 16.46% |

| SBI Flexi Cap Fund | 17.57% |

| Navi Flexi Cap Fund | 18.82% |

| UTI Flexi Cap Fund | 9.27% |

Analysis:

Quant Flexi Cap Fund again takes the lead with a 34.94% return over three years, showing its strength and consistency. JM Flexi Cap Fund and Bank of India Flexi Cap Fund also deliver impressive returns, making them reliable choices for longer-term SIP investments.

5-Year SIP Returns

For those looking at a longer-term horizon, here’s the five-year performance:

| Scheme Name | 5Y |

| Quant Flexi Cap Fund | 38.26% |

| JM Flexi Cap Fund | 30.29% |

| HDFC Flexi Cap Fund | 28.02% |

| Franklin India Flexi Cap Fund | 26.27% |

| Motilal Oswal Flexi Cap Fund | 20.63% |

| HSBC Flexi Cap Fund | 23.48% |

| Parag Parikh Flexi Cap Fund | 26.56% |

| Shriram Flexi Cap Fund | 21.26% |

| Taurus Flexi Cap Fund | 19.48% |

| Union Flexi Cap Fund | 23.13% |

| Kotak Flexi Cap Fund | 21.10% |

| Aditya Birla Sun Life Flexi Cap Fund | 21.21% |

| Bandhan Flexi Cap Fund | 19.64% |

| Canara Robeco Flexi Cap Fund | 21.05% |

| DSP Flexi Cap Fund | 20.87% |

| Tata Flexi Cap Fund | 19.26% |

| LIC MF Flexi Cap Fund | 17.90% |

| Axis Flexi Cap Fund | 17.54% |

| PGIM India Flexi Cap Fund | 22.30% |

| SBI Flexi Cap Fund | 19.21% |

| Navi Flexi Cap Fund | 20.07% |

| UTI Flexi Cap Fund | 14.77% |

Analysis:

Quant Flexi Cap Fund continues to shine with a 38.26% return over five years, demonstrating its potential for substantial long-term gains. JM Flexi Cap Fund also shows strong performance, making these funds excellent choices for SIP investors with a long-term view.

10-Year SIP Returns

Finally, let’s see the decade-long performance of these funds:

| Scheme Name | 10Y |

| Quant Flexi Cap Fund | 25.66% |

| JM Flexi Cap Fund | 21.27% |

| HDFC Flexi Cap Fund | 19.05% |

| Franklin India Flexi Cap Fund | 18.20% |

| HSBC Flexi Cap Fund | 16.25% |

| Parag Parikh Flexi Cap Fund | 20.99% |

| Union Flexi Cap Fund | 16.72% |

| Kotak Flexi Cap Fund | 16.87% |

| Aditya Birla Sun Life Flexi Cap Fund | 16.55% |

| Bandhan Flexi Cap Fund | 14.19% |

| Canara Robeco Flexi Cap Fund | 17.02% |

| DSP Flexi Cap Fund | 16.80% |

| LIC MF Flexi Cap Fund | 12.83% |

| UTI Flexi Cap Fund | 13.91% |

Analysis:

Quant Flexi Cap Fund leads again with a robust 25.66% return over the past decade, showcasing its reliability and firm performance in the long term. JM Flexi Cap Fund and Parag Parikh Flexi Cap Fund also offer solid long-term returns, making them good choices for investing over ten years.

Key Takeaways

- Short-Term Gains: Quant Flexi Cap Fund and Bank of India Flexi Cap Fund are the top performers for 1-year SIP returns, with 72.04% and 71.17%, respectively.

- Consistent Performers: Over the 2-year and 3-year periods, Bank of India Flexi Cap Fund, Quant Flexi Cap Fund, and JM Flexi Cap Fund consistently deliver strong returns.

- Long-Term Growth: For a 5-year horizon, Quant Flexi Cap Fund remains a top choice with a 38.26% return. Over 10 years, it continues to lead with a 25.66% return, making it a reliable option for long-term SIP investors.

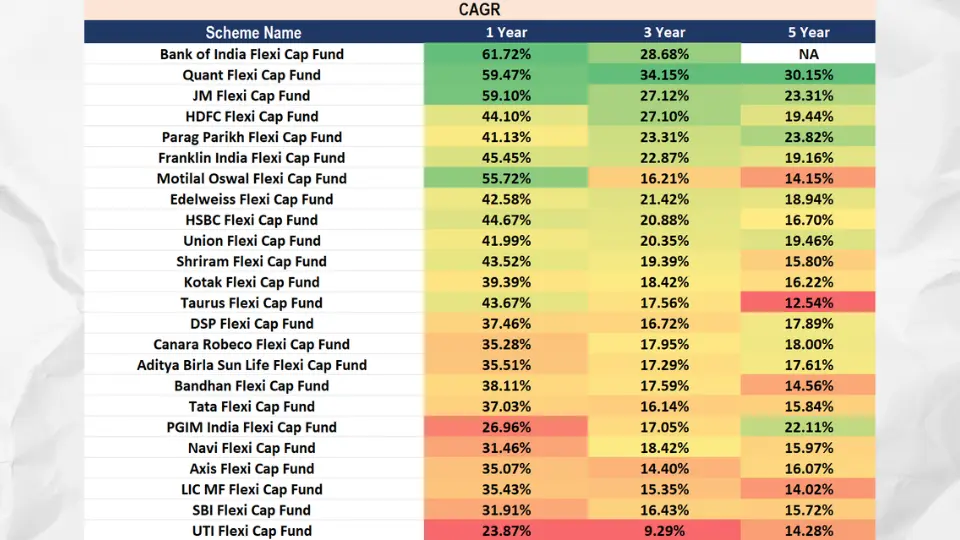

CAGR Comparative Analysis

1-Year CAGR Returns

First, let’s look at the short-term performance of these funds:

| Scheme Name | 1 Year |

| Bank of India Flexi Cap Fund | 61.72% |

| Quant Flexi Cap Fund | 59.47% |

| JM Flexi Cap Fund | 59.10% |

| Motilal Oswal Flexi Cap Fund | 55.72% |

| HDFC Flexi Cap Fund | 44.10% |

| Franklin India Flexi Cap Fund | 45.45% |

| Edelweiss Flexi Cap Fund | 42.58% |

| HSBC Flexi Cap Fund | 44.67% |

| Parag Parikh Flexi Cap Fund | 41.13% |

| Union Flexi Cap Fund | 41.99% |

| Shriram Flexi Cap Fund | 43.52% |

| Kotak Flexi Cap Fund | 39.39% |

| Taurus Flexi Cap Fund | 43.67% |

| DSP Flexi Cap Fund | 37.46% |

| Canara Robeco Flexi Cap Fund | 35.28% |

| Aditya Birla Sun Life Flexi Cap Fund | 35.51% |

| Bandhan Flexi Cap Fund | 38.11% |

| Tata Flexi Cap Fund | 37.03% |

| PGIM India Flexi Cap Fund | 26.96% |

| Navi Flexi Cap Fund | 31.46% |

| Axis Flexi Cap Fund | 35.07% |

| LIC MF Flexi Cap Fund | 35.43% |

| SBI Flexi Cap Fund | 31.91% |

| UTI Flexi Cap Fund | 23.87% |

Analysis:

Bank of India Flexi Cap Fund takes the lead with a whopping 61.72% return, closely followed by Quant Flexi Cap Fund at 59.47% and JM Flexi Cap Fund at 59.10%. These funds have delivered exceptional returns over the past year, making them attractive options for short-term investors.

3-Year CAGR Returns

Next, let’s extend our horizon to see the 3-year performance:

| Scheme Name | 3 Year |

| Quant Flexi Cap Fund | 34.15% |

| Bank of India Flexi Cap Fund | 28.68% |

| JM Flexi Cap Fund | 27.12% |

| HDFC Flexi Cap Fund | 27.10% |

| Parag Parikh Flexi Cap Fund | 23.31% |

| Franklin India Flexi Cap Fund | 22.87% |

| Motilal Oswal Flexi Cap Fund | 16.21% |

| Edelweiss Flexi Cap Fund | 21.42% |

| HSBC Flexi Cap Fund | 20.88% |

| Union Flexi Cap Fund | 20.35% |

| Shriram Flexi Cap Fund | 19.39% |

| Kotak Flexi Cap Fund | 18.42% |

| Taurus Flexi Cap Fund | 17.56% |

| DSP Flexi Cap Fund | 16.72% |

| Canara Robeco Flexi Cap Fund | 17.95% |

| Aditya Birla Sun Life Flexi Cap Fund | 17.29% |

| Bandhan Flexi Cap Fund | 17.59% |

| Tata Flexi Cap Fund | 16.14% |

| PGIM India Flexi Cap Fund | 17.05% |

| Navi Flexi Cap Fund | 18.42% |

| Axis Flexi Cap Fund | 14.40% |

| LIC MF Flexi Cap Fund | 15.35% |

| SBI Flexi Cap Fund | 16.43% |

| UTI Flexi Cap Fund | 9.29% |

Analysis:

Quant Flexi Cap Fund has an impressive 34.15% return over three years. Bank of India Flexi Cap Fund and JM Flexi Cap Fund also perform well, making them reliable choices for mid-term investments.

5-Year CAGR Returns

How do these funds perform in the longer term? Here’s the five-year analysis:

| Scheme Name | 5 Year |

| Quant Flexi Cap Fund | 30.15% |

| JM Flexi Cap Fund | 23.31% |

| Parag Parikh Flexi Cap Fund | 23.82% |

| HDFC Flexi Cap Fund | 19.44% |

| Franklin India Flexi Cap Fund | 19.16% |

| Edelweiss Flexi Cap Fund | 18.94% |

| HSBC Flexi Cap Fund | 16.70% |

| Union Flexi Cap Fund | 19.46% |

| Shriram Flexi Cap Fund | 15.80% |

| Kotak Flexi Cap Fund | 16.22% |

| Taurus Flexi Cap Fund | 12.54% |

| DSP Flexi Cap Fund | 17.89% |

| Canara Robeco Flexi Cap Fund | 18.00% |

| Aditya Birla Sun Life Flexi Cap Fund | 17.61% |

| Bandhan Flexi Cap Fund | 14.56% |

| Tata Flexi Cap Fund | 15.84% |

| PGIM India Flexi Cap Fund | 22.11% |

| Navi Flexi Cap Fund | 15.97% |

| Axis Flexi Cap Fund | 16.07% |

| LIC MF Flexi Cap Fund | 14.02% |

| SBI Flexi Cap Fund | 15.72% |

| UTI Flexi Cap Fund | 14.28% |

Analysis:

Quant Flexi Cap Fund continues to lead with a robust 30.15% return over five years. Parag Parikh Flexi Cap Fund and JM Flexi Cap Fund also exhibit strong performance, making them excellent choices for long-term investors seeking stable growth.

9-Year CAGR Returns

Finally, let’s check out the decade-long returns:

| Scheme Name | 9 Year |

| Quant Flexi Cap Fund | 21.56% |

| Parag Parikh Flexi Cap Fund | 18.32% |

| JM Flexi Cap Fund | 17.52% |

| HDFC Flexi Cap Fund | 15.46% |

| Franklin India Flexi Cap Fund | 14.64% |

| Kotak Flexi Cap Fund | 14.90% |

| Taurus Flexi Cap Fund | 9.23% |

| DSP Flexi Cap Fund | 14.01% |

| Canara Robeco Flexi Cap Fund | 13.92% |

| Aditya Birla Sun Life Flexi Cap Fund | 14.01% |

| Bandhan Flexi Cap Fund | 11.10% |

| Tata Flexi Cap Fund | 14.09% |

| LIC MF Flexi Cap Fund | 9.42% |

| UTI Flexi Cap Fund | 12.03% |

Analysis:

Quant Flexi Cap Fund stands out with a 21.56% return over the past nine years, showcasing its reliability and firm performance in the long term. Parag Parikh Flexi Cap Fund and JM Flexi Cap Fund also offer solid long-term returns, making them good choices for those looking to invest over an extended period.

Key Takeaways

- Short-Term Stars: Bank of India Flexi Cap Fund, Quant Flexi Cap Fund, and JM Flexi Cap Fund deliver exceptional returns in the 1-year category, exceeding 59%.

- Consistent Performers: Over the 3-year and 5-year periods, Quant Flexi Cap Fund consistently ranks high, making it a top contender for short- and long-term investments.

- Long-Term Growth: For those looking at a 9-year horizon, Quant Flexi Cap Fund remains a strong choice with a 21.56% return. Parag Parikh Flexi Cap Fund and JM Flexi Cap Fund also show significant long-term performance.

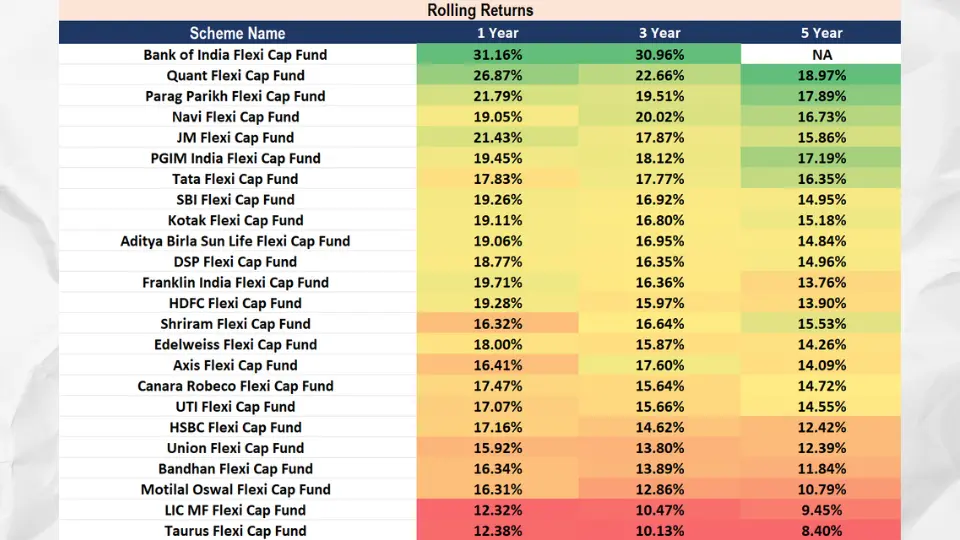

Rolling Returns Comparative Analysis

1-Year Rolling Returns

Let’s start with the short-term performance of these funds:

| Scheme Name | 1 Year |

| Bank of India Flexi Cap Fund | 31.16% |

| Quant Flexi Cap Fund | 26.87% |

| Parag Parikh Flexi Cap Fund | 21.79% |

| Navi Flexi Cap Fund | 19.05% |

| JM Flexi Cap Fund | 21.43% |

| PGIM India Flexi Cap Fund | 19.45% |

| Tata Flexi Cap Fund | 17.83% |

| SBI Flexi Cap Fund | 19.26% |

| Kotak Flexi Cap Fund | 19.11% |

| Aditya Birla Sun Life Flexi Cap Fund | 19.06% |

| DSP Flexi Cap Fund | 18.77% |

| Franklin India Flexi Cap Fund | 19.71% |

| HDFC Flexi Cap Fund | 19.28% |

| Shriram Flexi Cap Fund | 16.32% |

| Edelweiss Flexi Cap Fund | 18.00% |

| Axis Flexi Cap Fund | 16.41% |

| Canara Robeco Flexi Cap Fund | 17.47% |

| UTI Flexi Cap Fund | 17.07% |

| HSBC Flexi Cap Fund | 17.16% |

| Union Flexi Cap Fund | 15.92% |

| Bandhan Flexi Cap Fund | 16.34% |

| Motilal Oswal Flexi Cap Fund | 16.31% |

| LIC MF Flexi Cap Fund | 12.32% |

| Taurus Flexi Cap Fund | 12.38% |

Analysis:

Bank of India Flexi Cap Fund leads with an impressive 31.16% return over the past year, followed by Quant Flexi Cap Fund at 26.87% and Parag Parikh Flexi Cap Fund at 21.79%. These funds have delivered robust short-term returns, making them striking options for investors seeking high returns over one year.

3-Year Rolling Returns

Next, let’s look at the 3-year performance:

| Scheme Name | 3 Year |

| Bank of India Flexi Cap Fund | 30.96% |

| Quant Flexi Cap Fund | 22.66% |

| Parag Parikh Flexi Cap Fund | 19.51% |

| Navi Flexi Cap Fund | 20.02% |

| JM Flexi Cap Fund | 17.87% |

| PGIM India Flexi Cap Fund | 18.12% |

| Tata Flexi Cap Fund | 17.77% |

| SBI Flexi Cap Fund | 16.92% |

| Kotak Flexi Cap Fund | 16.80% |

| Aditya Birla Sun Life Flexi Cap Fund | 16.95% |

| DSP Flexi Cap Fund | 16.35% |

| Franklin India Flexi Cap Fund | 16.36% |

| HDFC Flexi Cap Fund | 15.97% |

| Shriram Flexi Cap Fund | 16.64% |

| Edelweiss Flexi Cap Fund | 15.87% |

| Axis Flexi Cap Fund | 17.60% |

| Canara Robeco Flexi Cap Fund | 15.64% |

| UTI Flexi Cap Fund | 15.66% |

| HSBC Flexi Cap Fund | 14.62% |

| Union Flexi Cap Fund | 13.80% |

| Bandhan Flexi Cap Fund | 13.89% |

| Motilal Oswal Flexi Cap Fund | 12.86% |

| LIC MF Flexi Cap Fund | 10.47% |

| Taurus Flexi Cap Fund | 10.13% |

Analysis:

Bank of India Flexi Cap Fund continues to lead with a stellar 30.96% return over three years. Quant Flexi Cap Fund and Parag Parikh Flexi Cap Fund also perform well, making them reliable choices for mid-term investments.

5-Year Rolling Returns

How do these funds perform in the longer term? Here’s the five-year analysis:

| Scheme Name | 5 Year |

| Quant Flexi Cap Fund | 18.97% |

| Parag Parikh Flexi Cap Fund | 17.89% |

| Navi Flexi Cap Fund | 16.73% |

| JM Flexi Cap Fund | 15.86% |

| PGIM India Flexi Cap Fund | 17.19% |

| Tata Flexi Cap Fund | 16.35% |

| SBI Flexi Cap Fund | 14.95% |

| Kotak Flexi Cap Fund | 15.18% |

| Aditya Birla Sun Life Flexi Cap Fund | 14.84% |

| DSP Flexi Cap Fund | 14.96% |

| Franklin India Flexi Cap Fund | 13.76% |

| HDFC Flexi Cap Fund | 13.90% |

| Shriram Flexi Cap Fund | 15.53% |

| Edelweiss Flexi Cap Fund | 14.26% |

| Axis Flexi Cap Fund | 14.09% |

| Canara Robeco Flexi Cap Fund | 14.72% |

| UTI Flexi Cap Fund | 14.55% |

| HSBC Flexi Cap Fund | 12.42% |

| Union Flexi Cap Fund | 12.39% |

| Bandhan Flexi Cap Fund | 11.84% |

| Motilal Oswal Flexi Cap Fund | 10.79% |

| LIC MF Flexi Cap Fund | 9.45% |

| Taurus Flexi Cap Fund | 8.40% |

Analysis:

Quant Flexi Cap Fund leads the 5-year rolling returns with a solid 18.97% return. Parag Parikh Flexi Cap Fund and Navi Flexi Cap Fund also demonstrate strong performance, making them attractive options for long-term investors.

9-Year Rolling Returns

Finally, let’s check out the nine-year returns:

| Scheme Name | 9 Year |

| Quant Flexi Cap Fund | 21.73% |

| Parag Parikh Flexi Cap Fund | 18.66% |

| JM Flexi Cap Fund | 17.65% |

| SBI Flexi Cap Fund | 16.69% |

| Kotak Flexi Cap Fund | 16.60% |

| Aditya Birla Sun Life Flexi Cap Fund | 16.55% |

| Franklin India Flexi Cap Fund | 16.31% |

| HDFC Flexi Cap Fund | 15.90% |

| DSP Flexi Cap Fund | 15.87% |

| Axis Flexi Cap Fund | 15.12% |

| Canara Robeco Flexi Cap Fund | 15.12% |

| HSBC Flexi Cap Fund | 14.42% |

| Bandhan Flexi Cap Fund | 14.09% |

| UTI Flexi Cap Fund | 14.86% |

| Motilal Oswal Flexi Cap Fund | 14.23% |

| Union Flexi Cap Fund | 13.28% |

| LIC MF Flexi Cap Fund | 10.35% |

| Taurus Flexi Cap Fund | 10.21% |

Analysis:

Quant Flexi Cap Fund stands out with a 21.73% return over the past nine years, showcasing its reliability and firm performance in the long term. Parag Parikh Flexi Cap Fund and JM Flexi Cap Fund also offer solid long-term returns, making them good choices for those looking to invest over an extended period.

Key Takeaways

- Short-Term Stars: Bank of India Flexi Cap Fund, Quant Flexi Cap Fund, and Parag Parikh Flexi Cap Fund deliver exceptional returns in the 1-year category, exceeding 21%.

- Consistent Performers: Over the 3-year- and 5-year periods, Bank of India Flexi Cap Fund and Quant Flexi Cap Fund consistently rank high, making them top contenders for short- and long-term investments.

- Long-Term Growth: For those looking at a 9-year horizon, Quant Flexi Cap Fund remains a strong choice with a 21.73% return. Parag Parikh Flexi Cap Fund and JM Flexi Cap Fund also show significant long-term performance.

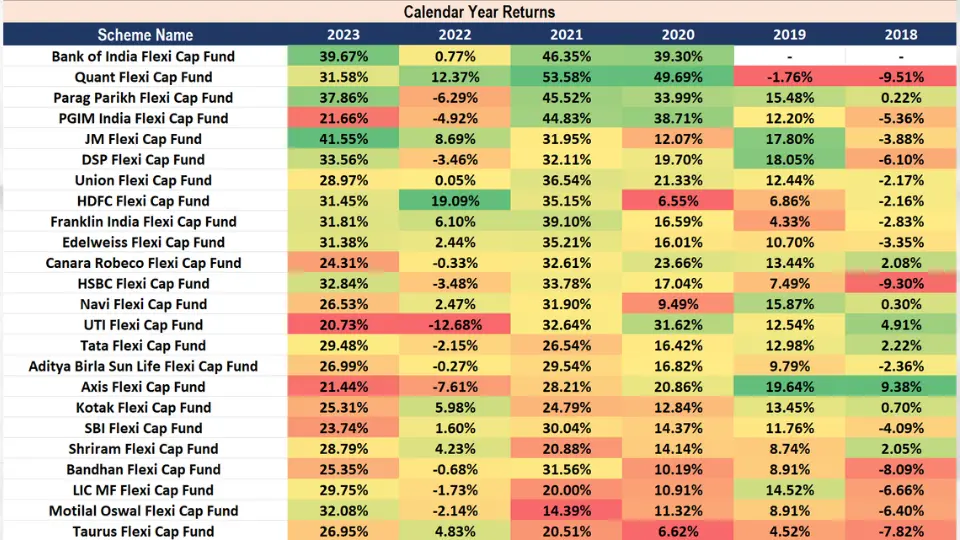

Calendar Year Returns Comparative Analysis

2023 Calendar Year Returns

Starting with the most recent year, here’s a look at the top performers for 2023:

| Scheme Name | 2023 |

| Bank of India Flexi Cap Fund | 39.67% |

| JM Flexi Cap Fund | 41.55% |

| DSP Flexi Cap Fund | 33.56% |

| HSBC Flexi Cap Fund | 32.84% |

| Motilal Oswal Flexi Cap Fund | 32.08% |

| Quant Flexi Cap Fund | 31.58% |

| Franklin India Flexi Cap Fund | 31.81% |

| HDFC Flexi Cap Fund | 31.45% |

| Edelweiss Flexi Cap Fund | 31.38% |

| Union Flexi Cap Fund | 28.97% |

| Tata Flexi Cap Fund | 29.48% |

| LIC MF Flexi Cap Fund | 29.75% |

| Shriram Flexi Cap Fund | 28.79% |

| Parag Parikh Flexi Cap Fund | 37.86% |

| Axis Flexi Cap Fund | 21.44% |

| PGIM India Flexi Cap Fund | 21.66% |

| Navi Flexi Cap Fund | 26.53% |

| UTI Flexi Cap Fund | 20.73% |

| Canara Robeco Flexi Cap Fund | 24.31% |

| Aditya Birla Sun Life Flexi Cap Fund | 26.99% |

| Kotak Flexi Cap Fund | 25.31% |

| SBI Flexi Cap Fund | 23.74% |

| Bandhan Flexi Cap Fund | 25.35% |

| Taurus Flexi Cap Fund | 26.95% |

Analysis:

Bank of India Flexi Cap Fund tops the list with a 39.67% return for 2023, followed closely by JM Flexi Cap Fund and DSP Flexi Cap Fund with 41.55% and 33.56%, respectively. These funds have shown strong performance in 2023, making them attractive options for investors.

2022 Calendar Year Returns

Next, let’s look at the performance for 2022:

| Scheme Name | 2022 |

| JM Flexi Cap Fund | 8.69% |

| HDFC Flexi Cap Fund | 19.09% |

| SBI Flexi Cap Fund | 1.60% |

| Bandhan Flexi Cap Fund | -0.68% |

| Quant Flexi Cap Fund | 12.37% |

| Parag Parikh Flexi Cap Fund | -6.29% |

| PGIM India Flexi Cap Fund | -4.92% |

| Axis Flexi Cap Fund | -7.61% |

| UTI Flexi Cap Fund | -12.68% |

| Canara Robeco Flexi Cap Fund | -0.33% |

| DSP Flexi Cap Fund | -3.46% |

| Franklin India Flexi Cap Fund | 6.10% |

| Edelweiss Flexi Cap Fund | 2.44% |

| HSBC Flexi Cap Fund | -3.48% |

| Navi Flexi Cap Fund | 2.47% |

| Tata Flexi Cap Fund | -2.15% |

| Aditya Birla Sun Life Flexi Cap Fund | -0.27% |

| Kotak Flexi Cap Fund | 5.98% |

| Shriram Flexi Cap Fund | 4.23% |

| LIC MF Flexi Cap Fund | -1.73% |

| Motilal Oswal Flexi Cap Fund | -2.14% |

| Taurus Flexi Cap Fund | 4.83% |

Analysis:

Despite a challenging year for many funds, JM Flexi Cap Fund delivered a positive return of 8.69% in 2022. HDFC Flexi Cap Fund also performed well with a 19.09% return, demonstrating resilience in a volatile market.

2021 Calendar Year Returns

Here’s the performance for 2021:

| Scheme Name | 2021 |

| Quant Flexi Cap Fund | 53.58% |

| Parag Parikh Flexi Cap Fund | 45.52% |

| PGIM India Flexi Cap Fund | 44.83% |

| Franklin India Flexi Cap Fund | 39.10% |

| Bank of India Flexi Cap Fund | 46.35% |

| JM Flexi Cap Fund | 31.95% |

| DSP Flexi Cap Fund | 32.11% |

| Union Flexi Cap Fund | 36.54% |

| HDFC Flexi Cap Fund | 35.15% |

| Edelweiss Flexi Cap Fund | 35.21% |

| Canara Robeco Flexi Cap Fund | 32.61% |

| HSBC Flexi Cap Fund | 33.78% |

| Navi Flexi Cap Fund | 31.90% |

| UTI Flexi Cap Fund | 32.64% |

| Tata Flexi Cap Fund | 26.54% |

| Aditya Birla Sun Life Flexi Cap Fund | 29.54% |

| Axis Flexi Cap Fund | 28.21% |

| Kotak Flexi Cap Fund | 24.79% |

| SBI Flexi Cap Fund | 30.04% |

| Shriram Flexi Cap Fund | 20.88% |

| Bandhan Flexi Cap Fund | 31.56% |

| LIC MF Flexi Cap Fund | 20.00% |

| Motilal Oswal Flexi Cap Fund | 14.39% |

| Taurus Flexi Cap Fund | 20.51% |

Analysis:

Quant Flexi Cap Fund was the top performer in 2021, with a remarkable return of 53.58%. Parag Parikh Flexi Cap Fund and PGIM India Flexi Cap Fund also showed strong performance, delivering returns of 45.52% and 44.83%, respectively.

2020 Calendar Year Returns

How did these funds fare in the pandemic year of 2020? Let’s find out:

| Scheme Name | 2020 |

| Quant Flexi Cap Fund | 49.69% |

| Bank of India Flexi Cap Fund | 39.30% |

| Franklin India Flexi Cap Fund | 39.10% |

| PGIM India Flexi Cap Fund | 38.71% |

| Parag Parikh Flexi Cap Fund | 33.99% |

| Union Flexi Cap Fund | 21.33% |

| Edelweiss Flexi Cap Fund | 16.01% |

| HDFC Flexi Cap Fund | 6.55% |

| SBI Flexi Cap Fund | 14.37% |

| DSP Flexi Cap Fund | 19.70% |

| JM Flexi Cap Fund | 12.07% |

| Tata Flexi Cap Fund | 16.42% |

| Canara Robeco Flexi Cap Fund | 23.66% |

| HSBC Flexi Cap Fund | 17.04% |

| Navi Flexi Cap Fund | 9.49% |

| Axis Flexi Cap Fund | 20.86% |

| Kotak Flexi Cap Fund | 12.84% |

| Aditya Birla Sun Life Flexi Cap Fund | 16.82% |

| Shriram Flexi Cap Fund | 14.14% |

| Bandhan Flexi Cap Fund | 10.19% |

| LIC MF Flexi Cap Fund | 10.91% |

| Motilal Oswal Flexi Cap Fund | 11.32% |

| Taurus Flexi Cap Fund | 6.62% |

Analysis:

Quant Flexi Cap Fund again leads with a stellar return of 49.69% in 2020. Bank of India Flexi Cap Fund and Franklin India Flexi Cap Fund also delivered impressive returns of 39.30% and 39.10%, respectively, highlighting their strong performance during a challenging year.

2019 Calendar Year Returns

| Scheme Name | 2019 |

| Parag Parikh Flexi Cap Fund | 15.48% |

| PGIM India Flexi Cap Fund | 12.20% |

| JM Flexi Cap Fund | 17.80% |

| DSP Flexi Cap Fund | 18.05% |

| Union Flexi Cap Fund | 12.44% |

| HDFC Flexi Cap Fund | 6.86% |

| Franklin India Flexi Cap Fund | 4.33% |

| Edelweiss Flexi Cap Fund | 10.70% |

| Canara Robeco Flexi Cap Fund | 13.44% |

| HSBC Flexi Cap Fund | 7.49% |

| Navi Flexi Cap Fund | 15.87% |

| UTI Flexi Cap Fund | 12.54% |

| Tata Flexi Cap Fund | 12.98% |

| Aditya Birla Sun Life Flexi Cap Fund | 9.79% |

| Axis Flexi Cap Fund | 19.64% |

| Kotak Flexi Cap Fund | 13.45% |

| SBI Flexi Cap Fund | 11.76% |

| Shriram Flexi Cap Fund | 8.74% |

| Bandhan Flexi Cap Fund | 8.91% |

| LIC MF Flexi Cap Fund | 14.52% |

| Motilal Oswal Flexi Cap Fund | 8.91% |

| Taurus Flexi Cap Fund | 4.52% |

Analysis:

Parag Parikh Flexi Cap Fund led the pack in 2019 with a return of 15.48%. JM Flexi Cap Fund and DSP Flexi Cap Fund also delivered strong performance with returns of 17.80% and 18.05%, respectively.

The 2018 Calendar Year Returns

| Scheme Name | 2018 |

| Canara Robeco Flexi Cap Fund | 2.08% |

| Bandhan Flexi Cap Fund | -8.09% |

| Axis Flexi Cap Fund | 9.38% |

| Aditya Birla Sun Life Flexi Cap Fund | -2.36% |

| SBI Flexi Cap Fund | -4.09% |

| Kotak Flexi Cap Fund | 0.70% |

| Franklin India Flexi Cap Fund | -2.83% |

| HDFC Flexi Cap Fund | -2.16% |

| Union Flexi Cap Fund | -2.17% |

| DSP Flexi Cap Fund | -6.10% |

| JM Flexi Cap Fund | -3.88% |

| PGIM India Flexi Cap Fund | -5.36% |

| Parag Parikh Flexi Cap Fund | 0.22% |

| Quant Flexi Cap Fund | -9.51% |

| HSBC Flexi Cap Fund | -9.30% |

| Motilal Oswal Flexi Cap Fund | -6.40% |

| LIC MF Flexi Cap Fund | -6.66% |

| UTI Flexi Cap Fund | 4.91% |

| Navi Flexi Cap Fund | 0.30% |

| Shriram Flexi Cap Fund | 2.05% |

| Tata Flexi Cap Fund | 2.22% |

| Taurus Flexi Cap Fund | -7.82% |

Analysis:

2018 was challenging for many funds, but Canara Robeco Flexi Cap Fund delivered a positive return of 2.08%. Bandhan Flexi Cap Fund faced the steepest decline with -8.09%, showcasing the market’s volatility that year.

The 2017 Calendar Year Returns

| Scheme Name | 2017 |

| Edelweiss Flexi Cap Fund | 47.90% |

| PGIM India Flexi Cap Fund | 38.58% |

| Parag Parikh Flexi Cap Fund | 30.10% |

| Quant Flexi Cap Fund | 46.74% |

| JM Flexi Cap Fund | 40.97% |

| DSP Flexi Cap Fund | 41.06% |

| Union Flexi Cap Fund | 28.35% |

| HDFC Flexi Cap Fund | 38.05% |

| Franklin India Flexi Cap Fund | 32.07% |

| Axis Flexi Cap Fund | 1.70% |

| SBI Flexi Cap Fund | 38.57% |

| Kotak Flexi Cap Fund | 35.86% |

| Aditya Birla Sun Life Flexi Cap Fund | 35.07% |

| Canara Robeco Flexi Cap Fund | 38.70% |

| HSBC Flexi Cap Fund | 41.31% |

| Navi Flexi Cap Fund | – |

| UTI Flexi Cap Fund | 30.69% |

| Tata Flexi Cap Fund | – |

| Shriram Flexi Cap Fund | – |

| Bandhan Flexi Cap Fund | 39.09% |

| LIC MF Flexi Cap Fund | 26.90% |

| Motilal Oswal Flexi Cap Fund | 44.42% |

| Taurus Flexi Cap Fund | 32.68% |

Analysis:

Edelweiss Flexi Cap Fund had an outstanding year in 2017 with a return of 47.90%, followed by PGIM India Flexi Cap Fund at 38.58% and Quant Flexi Cap Fund at 46.74%. This year highlighted the potential for significant gains in Flexi-Cap funds.

Key Takeaways

- Top Performers of 2023: Bank of India Flexi Cap Fund, JM Flexi Cap Fund, and DSP Flexi Cap Fund lead with impressive returns of 39.67%, 41.55%, and 33.56%, respectively.

- Consistent Strong Performers: Quant Flexi Cap Fund and Parag Parikh Flexi Cap Fund consistently deliver high returns across multiple years, making them reliable choices for long-term investors.

- Challenging Years: The performance in 2018 was generally lower, with Canara Robeco Flexi Cap Fund being one of the few funds to post a positive return.

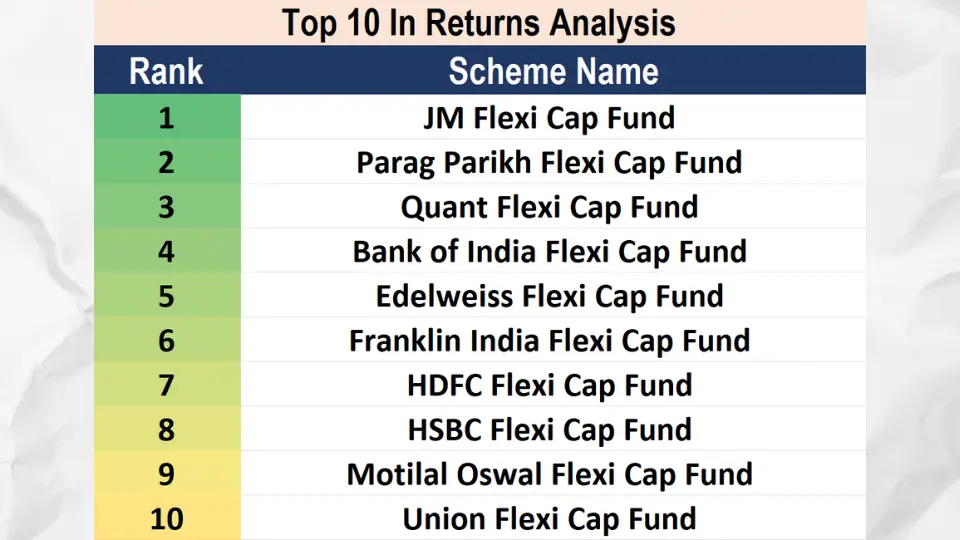

Top 10 Flexi-Cap Mutual Funds: Based on Returns

The table below highlights the top Flexi-Cap mutual funds based on the number of times they have appeared in the top 10 in returns analysis.

| Rank | Scheme Name | No. of Times in Top 10 |

| 1 | JM Flexi Cap Fund | 5 |

| 2 | Parag Parikh Flexi Cap Fund | 5 |

| 3 | Quant Flexi Cap Fund | 5 |

| 4 | Bank of India Flexi Cap Fund | 4 |

| 5 | Edelweiss Flexi Cap Fund | 4 |

| 6 | Franklin India Flexi Cap Fund | 4 |

| 7 | HDFC Flexi Cap Fund | 4 |

| 8 | HSBC Flexi Cap Fund | 3 |

| 9 | Motilal Oswal Flexi Cap Fund | 3 |

| 10 | Union Flexi Cap Fund | 3 |

| 11 | PGIM India Flexi Cap Fund | 2 |

| 12 | Aditya Birla Sun Life Flexi Cap Fund | 1 |

| 13 | DSP Flexi Cap Fund | 1 |

| 14 | Kotak Flexi Cap Fund | 1 |

| 15 | Navi Flexi Cap Fund | 1 |

| 16 | SBI Flexi Cap Fund | 1 |

| 17 | Shriram Flexi Cap Fund | 1 |

| 18 | Tata Flexi Cap Fund | 1 |

Analysis of Top Performers

1. JM Flexi Cap Fund

JM Flexi Cap Fund has performed exceptionally, ranking in the top 10 five times. This consistent performance is a testament to the fund’s robust management and investment strategy. With a strong focus on diversified investments across various sectors, it has delivered impressive returns year after year.

2. Parag Parikh Flexi Cap Fund

Parag Parikh Flexi Cap Fund is another top performer, appearing in the top 10 five times. Known for its strategic allocation and active management, this fund has successfully navigated market volatilities to provide stable and high returns. Its emphasis on investing in high-quality stocks has paid off, making it a reliable choice for investors.

3. Quant Flexi Cap Fund

Quant Flexi Cap Fund also boasts five top 10 appearances. The fund’s dynamic asset allocation approach and ability to capitalize on market trends have made it stand out. Investors searching for a fund with a proven track record of adapting to market conditions will find this fund appealing.

4. Bank of India Flexi Cap Fund

With four top-10 appearances, the Bank of India Flexi Cap Fund has shown solid performance. Its focus on a diversified portfolio and risk management has enabled it to achieve consistent returns. This fund is an excellent option for those seeking stability and growth.

5. Edelweiss Flexi Cap Fund

Edelweiss Flexi Cap Fund has also appeared in the top 10 four times. The fund’s emphasis on thorough research and strategic stock selection has resulted in consistent performance. It’s a strong contender for investors looking for a balanced approach to growth and risk.

6. Franklin India Flexi Cap Fund

Franklin India Flexi Cap Fund is another reliable performer with four top-10 appearances. The fund’s disciplined investment approach and focus on fundamental analysis have contributed to its sustained success. It’s a solid choice for long-term investors.

7. HDFC Flexi Cap Fund

HDFC Flexi Cap Fund, with four top-10 rankings, has consistently delivered strong returns. Its robust investment process and experienced management team have enabled it to navigate market cycles effectively. This fund is perfect for investors seeking a well-managed and reliable investment.

8. HSBC Flexi Cap Fund

HSBC Flexi Cap Fund has appeared in the top 10 three times. The fund’s diversified portfolio and active management strategy have allowed it to achieve notable returns. It’s a good option for investing in a globally diversified fund.

9. Motilal Oswal Flexi Cap Fund

Motilal Oswal Flexi Cap Fund has secured three top 10 spots. The fund’s focus on investing in high-quality businesses with strong growth potential has paid off. It’s a suitable choice for investors seeking long-term capital appreciation.

10. Union Flexi Cap Fund

With three top-10 appearances, Union Flexi Cap Fund has demonstrated solid performance. Its balanced approach to investing across various market segments has enabled it to deliver consistent returns. This fund is ideal for those looking for a balanced risk-reward profile.

Key Takeaways

- Top Performers: JM Flexi Cap Fund, Parag Parikh Flexi Cap Fund, and Quant Flexi Cap Fund lead the pack with five top 10 appearances each.

- Consistent Performers: Bank of India Flexi Cap Fund, Edelweiss Flexi Cap Fund, Franklin India Flexi Cap Fund, and HDFC Flexi Cap Fund each have four top 10 appearances, showcasing their reliability.

- Solid Choices: HSBC Flexi Cap Fund, Motilal Oswal Flexi Cap Fund, and Union Flexi Cap Fund, with three top 10 rankings each, are strong contenders for consistent performance.

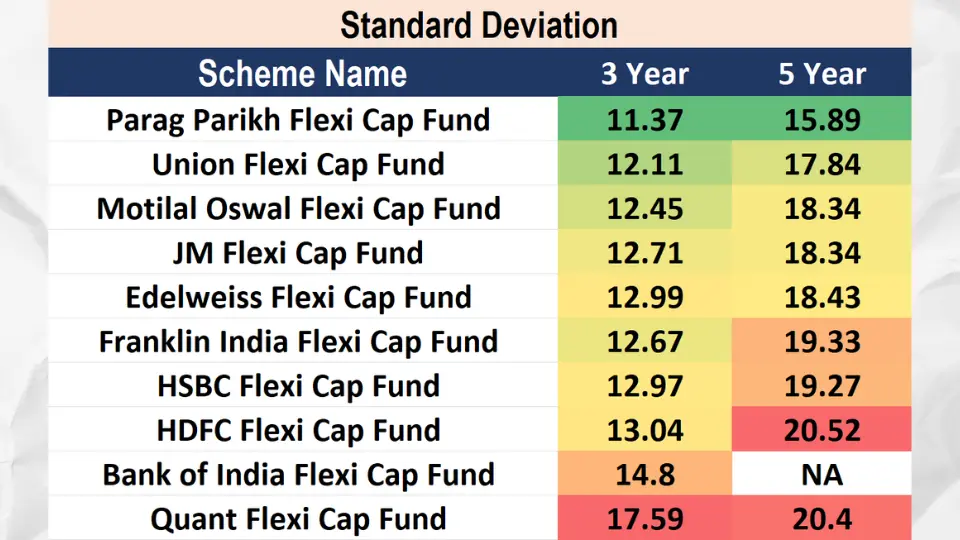

Risk Analysis: Top 10 Flexi-Cap Funds

Standard Deviation Analysis

3-Year Standard Deviation

First, let’s look at the standard deviation of these funds over 3 years:

| Scheme Name | 3 Year |

| Parag Parikh Flexi Cap Fund | 11.37 |

| Union Flexi Cap Fund | 12.11 |

| Motilal Oswal Flexi Cap Fund | 12.45 |

| JM Flexi Cap Fund | 12.71 |

| Edelweiss Flexi Cap Fund | 12.99 |

| Franklin India Flexi Cap Fund | 12.67 |

| HSBC Flexi Cap Fund | 12.97 |

| HDFC Flexi Cap Fund | 13.04 |

| Bank of India Flexi Cap Fund | 14.8 |

| Quant Flexi Cap Fund | 17.59 |

Analysis:

Parag Parikh Flexi Cap Fund has the lowest standard deviation over three years at 11.37, indicating the least volatility among the top funds. This makes it an exceptional choice for risk-averse investors. On the other hand, Quant Flexi Cap Fund has the highest standard deviation at 17.59, suggesting higher volatility and risk.

5-Year Standard Deviation

Now, let’s extend our analysis to 5 years:

| Scheme Name | 5 Year |

| Parag Parikh Flexi Cap Fund | 15.89 |

| Union Flexi Cap Fund | 17.84 |

| Motilal Oswal Flexi Cap Fund | 18.34 |

| JM Flexi Cap Fund | 18.34 |

| Edelweiss Flexi Cap Fund | 18.43 |

| Franklin India Flexi Cap Fund | 19.33 |

| HSBC Flexi Cap Fund | 19.27 |

| HDFC Flexi Cap Fund | 20.52 |

| Quant Flexi Cap Fund | 20.4 |

| Bank of India Flexi Cap Fund | NA |

Analysis:

Over five years, Parag Parikh Flexi Cap Fund continues to demonstrate the lowest volatility with a standard deviation of 15.89. HDFC Flexi Cap Fund and Quant Flexi Cap Fund exhibit higher volatility with standard deviations of 20.52 and 20.4, respectively.

Quant Flexi Cap Fund exhibits the highest volatility, indicating higher risk. This fund may appeal to aggressive investors seeking higher returns despite the increased risk.

Key Takeaways

- Low Volatility Leaders: Parag Parikh Flexi Cap Fund stands out with the lowest standard deviation over both 3-year and 5-year periods, making it the best choice for risk-averse investors.

- Moderate Risk Options: Union Flexi Cap Fund, Motilal Oswal Flexi Cap Fund, and JM Flexi Cap Fund offer moderate risk levels, suitable for investors with a balanced risk tolerance.

- High Volatility: Quant Flexi Cap Fund shows the highest volatility, catering to aggressive investors comfortable with higher risk for potentially higher returns.

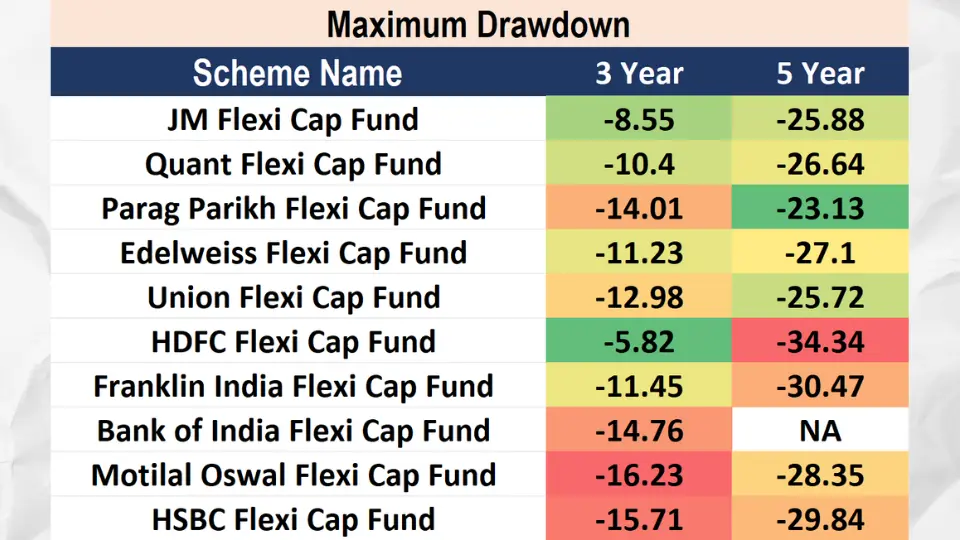

Maximum Drawdown Analysis

3-Year Maximum Drawdown

Let’s start with the drawdowns over the past three years:

| Scheme Name | 3 Year |

| HDFC Flexi Cap Fund | -5.82 |

| JM Flexi Cap Fund | -8.55 |

| Quant Flexi Cap Fund | -10.4 |

| Edelweiss Flexi Cap Fund | -11.23 |

| Franklin India Flexi Cap Fund | -11.45 |

| Union Flexi Cap Fund | -12.98 |

| Parag Parikh Flexi Cap Fund | -14.01 |

| Bank of India Flexi Cap Fund | -14.76 |

| HSBC Flexi Cap Fund | -15.71 |

| Motilal Oswal Flexi Cap Fund | -16.23 |

Analysis:

HDFC Flexi Cap Fund has the lowest drawdown of -5.82% over three years, indicating excellent risk management and resilience during market downturns. JM Flexi Cap Fund also shows a relatively low drawdown of -8.55%, making it a stable choice for investors. On the higher end, Motilal Oswal Flexi Cap Fund has a drawdown of -16.23%, indicating higher volatility and risk.

5-Year Maximum Drawdown

Now, let’s examine the drawdowns over five years:

| Scheme Name | 5 Year |

| Parag Parikh Flexi Cap Fund | -23.13 |

| Quant Flexi Cap Fund | -26.64 |

| JM Flexi Cap Fund | -25.88 |

| Union Flexi Cap Fund | -25.72 |

| Edelweiss Flexi Cap Fund | -27.1 |

| Motilal Oswal Flexi Cap Fund | -28.35 |

| HSBC Flexi Cap Fund | -29.84 |

| Franklin India Flexi Cap Fund | -30.47 |

| HDFC Flexi Cap Fund | -34.34 |

| Bank of India Flexi Cap Fund | NA |

Analysis:

Over five years, Parag Parikh Flexi Cap Fund shows the lowest maximum drawdown of -23.13%, indicating strong performance during market downturns. On the other hand, HDFC Flexi Cap Fund has a significant drawdown of -34.34%, suggesting higher risk over a more extended period.

Quant Flexi Cap Fund has moderate drawdowns in both periods, reflecting balanced risk management.

Key Takeaways

- Short-Term Stability: HDFC Flexi Cap Fund and JM Flexi Cap Fund offer excellent short-term stability with low 3-year drawdowns.

- Long-Term Resilience: Parag Parikh Flexi Cap Fund demonstrates strong long-term resilience with the lowest 5-year drawdown, making it a robust choice for long-term investors.

- Balanced Risk: Quant Flexi Cap Fund and Union Flexi Cap Fund provide balanced risk management with moderate drawdowns across both periods.

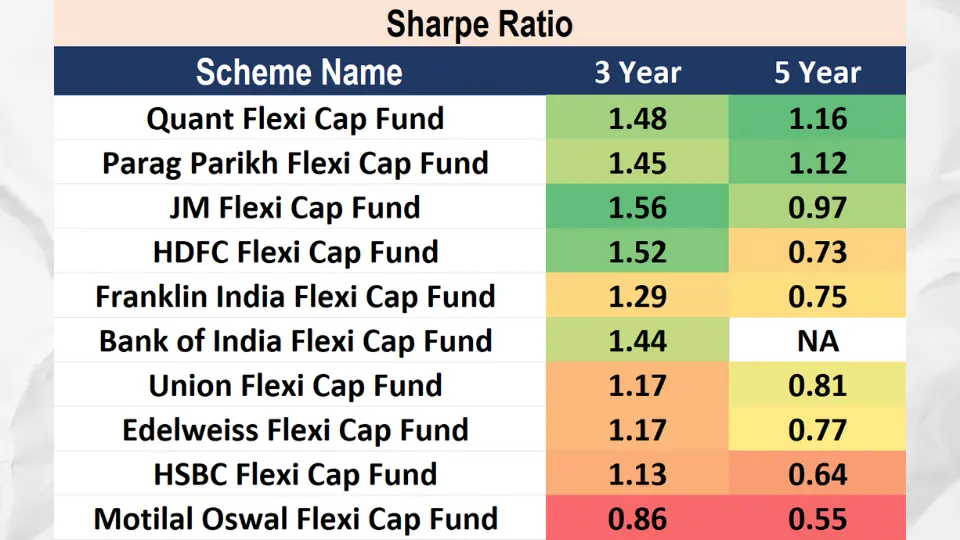

Sharpe Ratio Analysis

3-Year Sharpe Ratio

First, let’s analyze the Sharpe ratios over the past three years:

| Scheme Name | 3 Year |

| JM Flexi Cap Fund | 1.56 |

| HDFC Flexi Cap Fund | 1.52 |

| Quant Flexi Cap Fund | 1.48 |

| Parag Parikh Flexi Cap Fund | 1.45 |

| Bank of India Flexi Cap Fund | 1.44 |

| Franklin India Flexi Cap Fund | 1.29 |

| Union Flexi Cap Fund | 1.17 |

| Edelweiss Flexi Cap Fund | 1.17 |

| HSBC Flexi Cap Fund | 1.13 |

| Motilal Oswal Flexi Cap Fund | 0.86 |

Analysis:

JM Flexi Cap Fund has the highest 3-year Sharpe ratio of 1.56, indicating it has provided the best risk-adjusted returns over the short term. HDFC Flexi Cap Fund follows closely with a Sharpe ratio of 1.52. These funds have managed to deliver high returns with relatively low risk. Conversely, Motilal Oswal Flexi Cap Fund has the lowest Sharpe ratio of 0.86, suggesting lower risk-adjusted performance.

5-Year Sharpe Ratio

Now, let’s look at the 5-year Sharpe ratios:

| Scheme Name | 5 Year |

| Quant Flexi Cap Fund | 1.16 |

| Parag Parikh Flexi Cap Fund | 1.12 |

| JM Flexi Cap Fund | 0.97 |

| Bank of India Flexi Cap Fund | NA |

| Union Flexi Cap Fund | 0.81 |

| Edelweiss Flexi Cap Fund | 0.77 |

| Franklin India Flexi Cap Fund | 0.75 |

| HDFC Flexi Cap Fund | 0.73 |

| HSBC Flexi Cap Fund | 0.64 |

| Motilal Oswal Flexi Cap Fund | 0.55 |

Analysis:

Quant Flexi Cap Fund leads the pack with the highest 5-year Sharpe ratio of 1.16, showcasing superior risk-adjusted returns over the long term. Parag Parikh Flexi Cap Fund also demonstrates strong performance with a Sharpe ratio 1.12. Motilal Oswal Flexi Cap Fund again has the lowest Sharpe ratio of 0.55, indicating it has struggled to provide high returns relative to its risk.

Parag Parikh Flexi Cap Fund also shows strong performance, maintaining high Sharpe ratios over short and long terms, indicating robust risk management and consistent returns.

Key Takeaways

- Short-Term Leaders: JM Flexi Cap Fund and HDFC Flexi Cap Fund have the highest Sharpe ratios over three years, indicating excellent short-term risk-adjusted returns.

- Long-Term Consistency: Quant Flexi Cap Fund and Parag Parikh Flexi Cap Fund lead in long-term risk-adjusted performance, making them ideal for long-term investors.

- Areas for Improvement: Motilal Oswal Flexi Cap Fund has the lowest Sharpe ratios over both periods, suggesting it may need to improve its risk management strategies.

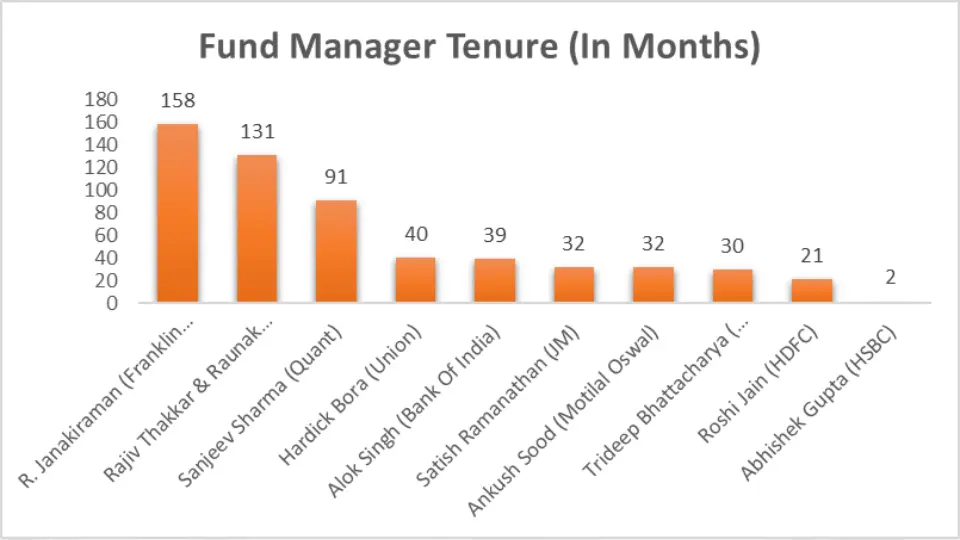

Top Flexi-Cap Fund’s Fund Management

The table below provides an overview of the top Flexi-Cap mutual funds, their respective fund managers, and the tenure of these managers.

| Scheme Name | Fund Manager | Fund Manager Tenure (In Months) |

| Franklin India Flexi Cap Fund | R. Janakiraman (Franklin India) | 158 |

| Parag Parikh Flexi Cap Fund | Rajiv Thakkar & Raunak Onkar (Parag Parikh) | 131 |

| Quant Flexi Cap Fund | Sanjeev Sharma (Quant) | 91 |

| Union Flexi Cap Fund | Hardick Bora (Union) | 40 |

| Bank of India Flexi Cap Fund | Alok Singh (Bank Of India) | 39 |

| JM Flexi Cap Fund | Satish Ramanathan (JM) | 32 |

| Motilal Oswal Flexi Cap Fund | Ankush Sood (Motilal Oswal) | 32 |

| Edelweiss Flexi Cap Fund | Trideep Bhattacharya (Edelweiss) | 30 |

| HDFC Flexi Cap Fund | Roshi Jain (HDFC) | 21 |

| HSBC Flexi Cap Fund | Abhishek Gupta (HSBC) | 2 |

Detailed Analysis of Fund Managers and Their Tenure

1. Franklin India Flexi Cap Fund

- Fund Manager: R. Janakiraman

- Tenure: 158 Months

R. Janakiraman has an impressive tenure of 158 months, showcasing stability and extensive experience. His long-term management has likely contributed to the fund’s consistent performance and robust risk management.

2. Parag Parikh Flexi Cap Fund

- Fund Managers: Rajiv Thakkar & Raunak Onkar

- Tenure: 131 Months

Rajiv Thakkar and Raunak Onkar have jointly managed this fund for 131 months. Their combined expertise and strategic vision have steered the fund through various market conditions, contributing to its strong performance and resilience.

3. Quant Flexi Cap Fund

- Fund Manager: Sanjeev Sharma

- Tenure: 91 Months

Sanjeev Sharma’s 91-month tenure indicates a significant period of consistent management. His strategic decisions and market insights have played a crucial role in the fund’s performance, making it a reliable choice for investors.

4. Union Flexi Cap Fund

- Fund Manager: Hardick Bora

- Tenure: 40 Months

With 40 months of experience managing the Union Flexi Cap Fund, Hardick Bora has demonstrated his capability to navigate market fluctuations and deliver stable returns.

5. Bank of India Flexi Cap Fund

- Fund Manager: Alok Singh

- Tenure: 39 Months

Alok Singh’s 39-month tenure reflects a period of stability and strategic growth. His management has contributed to the fund’s steady performance, making it a dependable option for investors.

6. JM Flexi Cap Fund

- Fund Manager: Satish Ramanathan

- Tenure: 32 Months

Satish Ramanathan’s tenure of 32 months indicates a period of strategic management and consistent performance. His experience has helped maintain the fund’s stability and growth.

7. Motilal Oswal Flexi Cap Fund

- Fund Manager: Ankush Sood

- Tenure: 32 Months

With 32 months at the helm, Ankush Sood has driven the fund’s performance. His strategic insights and market expertise have contributed to its robust returns.

8. Edelweiss Flexi Cap Fund

- Fund Manager: Trideep Bhattacharya

- Tenure: 30 Months

Trideep Bhattacharya’s 30-month tenure showcases his effective management and strategic decisions. His efforts have ensured the fund’s consistent performance and risk management.

9. HDFC Flexi Cap Fund

- Fund Manager: Roshi Jain

- Tenure: 21 Months

Despite a relatively shorter tenure of 21 months, Roshi Jain has demonstrated strong management capabilities. Her strategic approach has contributed to the fund’s notable performance.

10. HSBC Flexi Cap Fund

- Fund Manager: Abhishek Gupta

- Tenure: 2 Months

Abhishek Gupta is a recent addition to the HSBC Flexi Cap Fund, with only 2 months in the role. While it’s early to assess his impact, his fresh perspective could bring new strategic insights to the fund.

Impact of Fund Manager Tenure on Performance

A longer tenure often correlates with better fund performance due to the manager’s familiarity with the fund’s strategy and market conditions. Managers like R. Janakiraman and, Rajiv Thakkar & Raunak Onkar have demonstrated that extended periods of consistent management lead to stable and robust returns.

Conversely, newer managers like Abhishek Gupta may bring fresh strategies but come with the risk of unproven performance in the new role. Investors must monitor the fund’s performance closely in such cases.

Key Takeaways

- Long-Term Stability: Funds managed by experienced managers with long tenures, such as Franklin India Flexi Cap Fund and Parag Parikh Flexi Cap Fund, tend to exhibit stable and robust performance.

- Consistent Management: Managers with tenures of around 30-40 months, like Hardick Bora and Satish Ramanathan, provide a balance of stability and fresh strategic insights.

- New Perspectives: Newly appointed managers, such as Abhishek Gupta, offer potential for new growth strategies but come with the risk of unproven performance.

Final Rankings of Best Flexi Cap Funds 2024

Top 3 Flexi cap Mutual Funds For Investors with Average to High-Risk Appetite

| Rank | Scheme Name |

| 1 | Parag Parikh Flexi Cap Fund |

| 2 | Quant Flexi Cap Fund |

| 3 | JM Flexi Cap Fund |

Top 3 Flexi cap Mutual Funds For Investors with Very High-Risk Appetite

| Rank | Scheme Name |

| 1 | Bank of India Flexi Cap Fund |

| 2 | Quant Flexi Cap Fund |

| 3 | JM Flexi Cap Fund |

These are the Best Flexi cap mutual funds for long term investment in 2024 for the mutual fund investors.

Conclusion

Investing in Flexi-Cap mutual funds offers a balanced approach to capitalizing on market opportunities while managing risk. By focusing on consistent performance, risk metrics, and the experience of fund managers, you can make informed choices that align with your risk acceptance and investment goals.

Investing in Flexi-Cap mutual funds can be a game-changer for your portfolio, offering a balanced mix of growth and stability. After analyzing performance consistency, risk metrics, and fund manager expertise, JM Flexi Cap Fund emerges as the top performer across all parameters, making it a solid choice for most investors.

Parag Parikh Flexi Cap Fund is the best option for those with an average to high-risk appetite due to its consistent returns and strong management.

Meanwhile, investors with a high-risk appetite should consider the Bank of India Flexi Cap Fund, which offers higher returns despite greater volatility.

Refer a financial advisor to tailor your investment strategy to your specific needs. Happy investing!

We hope you found this guide on mutual funds helpful.

If you have any mutual fund-related queries, feel free to comment below—we’re here to help! S.K. Singh, a registered professional with the Association of Mutual Funds in India (AMFI), will answer your queries and holds the ARN-251149.

Invest wisely!

FAQs-Best Flexi-Cap Mutual Funds

What are Flexi-Cap mutual funds?

Flexi-Cap mutual funds are versatile investment funds that invest across various market capitalizations, including large-cap, mid-cap, and small-cap stocks. This flexibility allows fund managers to adjust the portfolio according to market conditions, aiming for optimal returns and risk management

Which Flexi-Cap mutual fund is the best overall performer?

Our comprehensive analysis shows that the JM Flexi Cap Fund is the best overall performer across all parameters, including consistency, risk-adjusted returns, and manager expertise.

Which Flexi-Cap fund should I choose if I have a moderate to high-risk appetite?

The Parag Parikh Flexi Cap Fund is an excellent choice for mutual fund investors with a mild to high-risk appetite. It offers consistent returns and robust management, making it suitable for balanced growth and risk.

What is the best Flexi-Cap fund for investors with a very high-risk appetite?

The Bank of India Flexi Cap Fund is recommended if you have a high-risk appetite. It offers higher potential returns but has greater volatility, making it ideal for aggressive investors seeking significant growth.

Why is the Sharpe ratio important in evaluating mutual funds?

The Sharpe ratio is crucial because it measures the risk-adjusted return of an investment. A higher Sharpe ratio indicates better returns for a given level of risk, helping investors choose funds that offer the most efficient risk-return balance.

How does fund manager tenure impact mutual fund performance?

Fund manager tenure can significantly impact mutual fund performance. Longer tenures often correlate with better performance due to the manager’s experience and consistent investment strategy. At the same time, frequent management changes can lead to volatility and inconsistent returns.

Which fund manager has the longest tenure among the top Flexi-Cap funds?

R. Janakiraman of the Franklin India Flexi Cap Fund has the longest tenure, managing the fund for an impressive 158 months. His extensive experience contributes to the fund’s stability and consistent performance.

What is maximum drawdown, and why is it important?

Maximum drawdown measures the most significant peak-to-trough decline in a fund’s value before a new peak is attained. Understanding the potential risk and recovery period during market downturns is crucial, helping investors gauge the stability of their investments

How do I choose the right Flexi-Cap fund based on my risk tolerance?

To select the right Flexi-Cap fund, assess your risk tolerance and investment goals. For moderate to high-risk appetites, consider the Parag Parikh Flexi Cap Fund. The Bank of India Flexi Cap Fund is suitable for very high-risk appetites. JM Flexi Cap Fund is an excellent choice if you prefer balanced performance across all parameters.

Are Flexi-Cap mutual funds suitable for long-term investment?

Flexi-Cap mutual funds are ideal for long-term investment due to their diversified approach and flexibility in adjusting to market conditions. They offer growth and risk management potential, making them suitable for long-term financial goals.

How does the standard deviation affect mutual fund investments?

Standard deviation measures the risk of volatility of a mutual fund’s returns. A lower standard deviation indicates less variability and lower risk, while a higher standard deviation suggests higher volatility. It helps investors understand the potential fluctuations in their investment value.

What is the significance of fund manager expertise in mutual fund performance?

Fund manager expertise is crucial as it directly impacts a mutual fund’s strategic decisions, risk management, and overall performance. Experienced managers with a proven track record tend to deliver more consistent and higher returns.

Which Flexi-Cap fund has the best risk-adjusted returns?

The JM Flexi Cap Fund has the highest Sharpe ratio over 3 years, indicating the best risk-adjusted returns. This makes it an attractive option for investors seeking a balance between risk and return.

Why should investors consider the maximum drawdown of a mutual fund?

nvestors should consider the maximum drawdown to understand a mutual fund’s potential risk and recovery period during market downturns. It helps gauge the fund’s stability and resilience in adverse market conditions.

How does a Flexi-Cap fund’s performance during market downturns impact its attractiveness?

A Flexi-Cap fund that performs well during market downturns, with lower maximum drawdowns, is generally more attractive as it indicates better risk management and resilience. It gives investors confidence in the fund’s ability to weather market volatility.

Can a new fund manager affect the performance of a Flexi-Cap mutual fund?

Yes, a new fund manager can affect the performance of a Flexi-Cap mutual fund. While they may bring fresh perspectives and strategies, there is also a risk of unproven performance and potential changes in the fund’s investment approach.

What factors should I consider when selecting a Flexi-Cap mutual fund?

When selecting a Flexi-Cap mutual fund, evaluate past performance, risk metrics (standard deviation and maximum drawdown), fund manager tenure and expertise, Sharpe ratio, and alignment with your risk acceptance and investment goals.

Are Flexi-Cap funds better than large-cap or small-cap funds?

Flexi-cap funds offer a balance by investing across different market capitalizations, unlike large-cap or small-cap funds focusing on a specific segment. This flexibility can provide better risk management and potentially higher returns, making them suitable for many

How often should I review my investment in Flexi-Cap mutual funds?

Reviewing your investment in Flexi-Cap mutual funds at least annually or semi-annually is advisable. Regular reviews help ensure that the fund continues to align with your financial aims and risk acceptance, allowing you to make necessary adjustments.

What role does diversification play in Flexi-Cap mutual funds?

Standard deviation measures the risk of volatility of a mutual fund’s returns. A lower standard deviation indicates less variability and lower risk, while a higher standard deviation suggests higher volatility. It helps investors understand the potential fluctuations in their investment value.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.