Regarding mutual funds, infrastructure funds have always been an exciting choice for many investors. But why, you ask? Infrastructure funds focus on investing in companies involved in various sectors like transportation, energy, water supply, and more. These sectors are the backbone of any economy, especially in a fast-developing country like India.

Understanding the Infrastructure Theme

Infrastructure mutual funds primarily invest in stocks of companies engaged in infrastructure-related activities. This includes sectors such as:

- Transportation: Roads, railways, ports, and airports.

- Energy: Power generation, distribution, and renewable energy.

- Telecommunication: Network infrastructure and communication systems.

- Urban Development: Housing, commercial real estate, and smart cities.

- Water Supply and Sanitation: Water treatment plants, sewage systems, and desalination plants.

Investing in infrastructure is like betting on the future growth of the nation. As these sectors expand and improve, the companies involved will likely see increased revenues and profits, translating into higher investor returns.

Returns Analysis

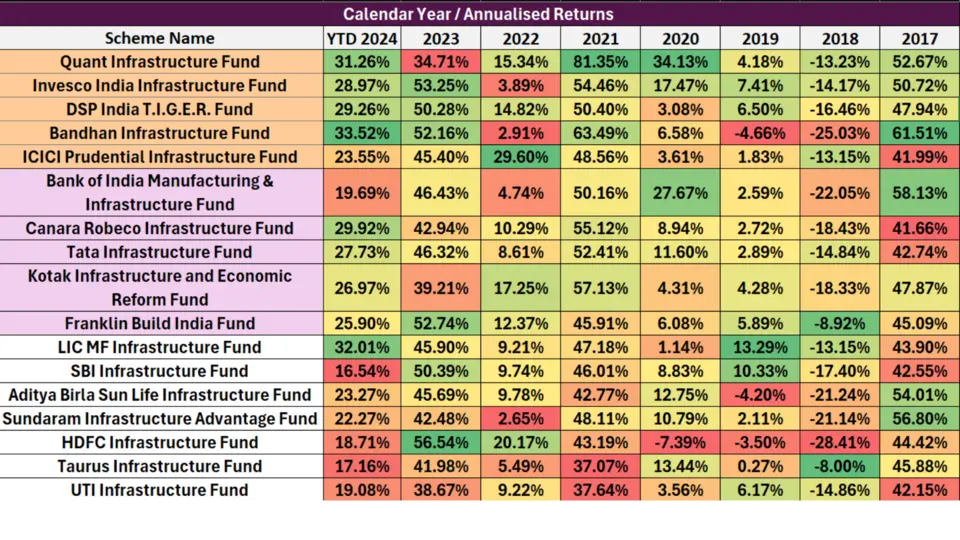

Calendar Year / Annualised Returns

Let’s dive into the performance data of some of the top infrastructure mutual funds. This section will provide a comparative analysis based on calendar year and annualized returns.

1. Quant Infrastructure Fund

The Quant Infrastructure Fund stands out for its stellar performance in 2021, with an impressive return of 81.35%. This high return highlights the fund’s ability to capture growth in the infrastructure sector. Despite a dip in 2018, the fund has consistently bounced back, showcasing its resilience and strong management.

2. Invesco India Infrastructure Fund

The Invesco India Infrastructure Fund is another top performer, particularly noted for its 53.25% return in 2023. Although it saw a lower return of 3.89% in 2022, the overall trend is positive. This fund has shown a solid capability to leverage market opportunities, making it a good option for long-term investors.

3. D.S.P. India T.I.G.E.R. Fund

The D.S.P. India T.I.G.E.R. Fund has delivered robust returns, particularly in 2023 and 2021. Its 50.28% return in 2023 indicates strong growth potential. Although the fund had a challenging year in 2018 with a -16.46% return, it has demonstrated consistent performance in subsequent years.

4. Bandhan Infrastructure Fund

Bandhan Infrastructure Fund has shown remarkable returns, with a 63.49% return in 2021. The fund’s performance in 2024 and 2023 also stands out, indicating strong management and a well-diversified portfolio. Despite the significant drop in 2018, the fund has recovered and performed well.

5. I.C.I.C.I. Prudential Infrastructure Fund

The I.C.I.C.I. Prudential Infrastructure Fund has shown consistent returns, particularly in 2022 and 2021. The fund has demonstrated a solid growth trajectory with a 29.60% return in 2022 and 48.56% in 2021. Its performance in recent years suggests that it is a reliable option for investors seeking exposure to infrastructure.

Key Takeaways

- Resilience and Growth: Most top-performing funds have shown resilience and strong recovery post-2018, indicating good management and strategic investment choices.

- High Returns: Funds like Quant Infrastructure and Bandhan Infrastructure have provided exceptionally high returns, especially in 2021 and 2023, making them attractive for high-risk, high-reward investors.

- Consistent Performance: Funds such as I.C.I.C.I. Prudential and Invesco India have consistently performed, making them suitable for long-term investment strategies.

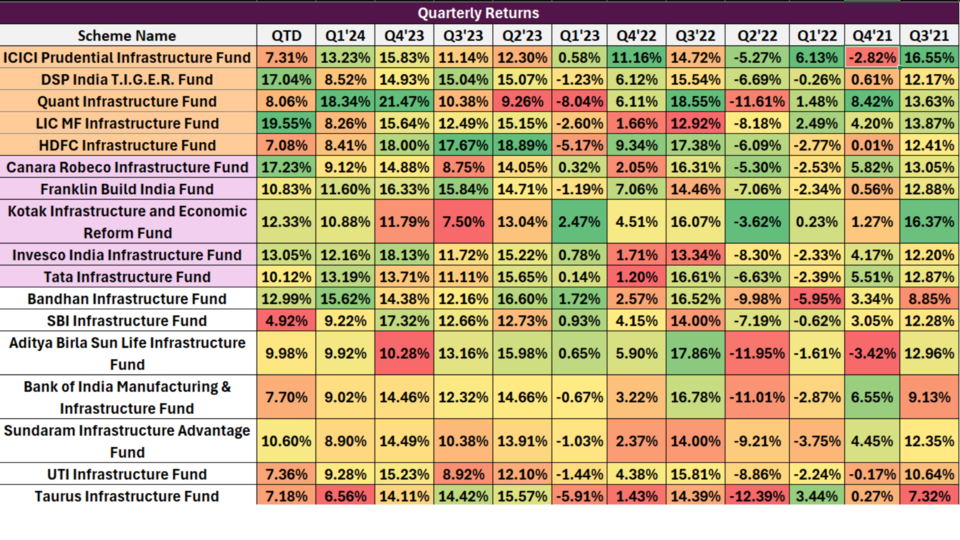

Quarterly Returns Analysis

Let’s dive into the top-performing infrastructure mutual funds based on quarterly returns and see what makes them tick.

1. I.C.I.C.I. Prudential Infrastructure Fund

I.C.I.C.I. Prudential Infrastructure Fund has shown robust performance, particularly in Q4’23, with a return of 15.83%. Despite a slight dip in Q1’22 and Q4’21, the fund has consistently bounced back, demonstrating resilience and strong management.

2. D.S.P. India T.I.G.E.R. Fund

The D.S.P. India T.I.G.E.R. Fund has been a top performer, especially in Q.T.D., with a 17.04% return. Although it faced some challenges in Q1’23 and Q2’22, the overall trend is upward, making it an attractive option for investors.

3. Quant Infrastructure Fund

Quant Infrastructure Fund stands out for its high returns in Q1’24 and Q4’23, with 18.34% and 21.47%, respectively. Despite a significant dip in Q2’22, the fund has managed impressive rebounds, indicating strong potential for growth.

4. L.I.C. M.F. Infrastructure Fund

L.I.C. M.F. Infrastructure Fund has delivered strong performance, particularly with a 19.55% return in Q.T.D. Its steady returns in Q4’23 and Q3’23 demonstrate its ability to maintain consistent growth, making it a reliable choice for investors.

5. H.D.F.C. Infrastructure Fund

H.D.F.C. Infrastructure Fund has shown significant returns, especially in Q4’23 and Q3’23 with 18.00% and 17.67% respectively. Although it faced challenges in Q1’23, the fund’s strong performance in other quarters highlights its potential for steady growth.

Key Takeaways

- Consistency is Key: Funds like I.C.I.C.I. Prudential and D.S.P. India T.I.G.E.R. have consistently performed, making them reliable options for long-term investors.

- High Returns: Quant Infrastructure and L.I.C. M.F. Infrastructure Funds have delivered high returns in recent quarters, indicating strong growth potential.

Rolling Returns Analysis

Let’s dive deeply into the performance of the top infrastructure mutual funds based on rolling returns.

1. Quant Infrastructure Fund

The Quant Infrastructure Fund stands out for its exceptional performance, boasting a 1-year return of 27.47% and a 9-year return of 20.20%. This consistency across multiple time frames highlights the fund’s robust investment strategy and strong management. The high returns suggest that the fund has been able to capitalize on growth opportunities within the infrastructure sector effectively.

2. Franklin Build India Fund

The Franklin Build India Fund is another top performer, with a 1-year return of 26.46% and a 9-year return of 19.95%. This fund has demonstrated solid growth, particularly in the short to medium term. Its performance indicates a well-diversified portfolio and firm investment decisions that have paid off over time.

3. Invesco India Infrastructure Fund

Invesco India Infrastructure Fund showcases steady performance, with a 1-year return of 24.37% and a 9-year return of 18.94%. The fund’s ability to maintain consistent returns over various periods suggests a balanced approach to investing in infrastructure-related companies. This makes it a reliable choice for investors looking for stable growth.

4. Kotak Infrastructure and Economic Reform Fund

Kotak Infrastructure and Economic Reform Fund has shown commendable performance with a 1-year return of 24.03% and a 9-year return of 18.42%. The fund’s strategy identifies critical opportunities within economic reforms and infrastructure projects, leading to consistent returns across different time frames.

5. Bank of India Manufacturing & Infrastructure Fund

The Bank of India Manufacturing & Infrastructure Fund rounds out the top five with a 1-year return of 22.77% and a 9-year return of 17.40%. This fund’s performance indicates a strong emphasis on manufacturing and infrastructure, which are critical to India’s growth. Its steady returns reflect a well-managed portfolio that benefits from the growth in these areas.

Key Takeaways

- Top Performers: The Quant Infrastructure Fund and Franklin Build India Fund are the top performers, delivering high returns across multiple periods, indicating strong management and strategic investments.

- Consistent Growth: Funds like Invesco India Infrastructure and Kotak Infrastructure and Economic Reform have shown consistent growth, making them reliable choices for long-term investment.

CAGR / Compounded Returns Analysis

Let’s explore the performance of the top infrastructure mutual funds based on their CAGR (Compound Annual Growth Rate) and compounded returns over different periods.

1. Quant Infrastructure Fund

The Quant Infrastructure Fund shines brightly with an impressive 1-year return of 77.37%, showcasing its ability to capture significant short-term gains. Its performance remains strong over the long term, with a 9-year return of 21.41%. This fund’s consistently high returns suggest a robust investment strategy focused on seizing growth opportunities in the infrastructure sector.

2. HDFC Infrastructure Fund

The HDFC Infrastructure Fund leads the pack with an outstanding 1-year return of 82.36%. Its 3-year return of 41.18% also stands out, indicating strong short- to medium-term growth. However, its 5-year and 9-year returns, although positive, show a more moderate growth trajectory. This suggests that the fund has capitalized on recent opportunities but has experienced variability over the longer term.

3. Franklin Build India Fund

The Franklin Build India Fund exhibits strong performance across all periods, with a notable 1-year return of 78.21% and a solid 9-year return of 18.26%. Its balanced returns over various periods indicate a well-managed fund that has consistently identified and invested in high-growth infrastructure projects.

4. Bandhan Infrastructure Fund

Bandhan Infrastructure Fund delivers an impressive 1-year return of 79.12%, maintaining strong performance across different timeframes. With a 9-year return of 17.01%, the fund demonstrates its ability to provide sustained growth by effectively managing investments in the infrastructure sector.

5. D.S.P. India T.I.G.E.R. Fund

The D.S.P. India T.I.G.E.R. Fund rounds out the top five with robust returns, including a 1-year return of 76.04% and a 3-year return of 38.45%. Its performance over the 5-year and 9-year periods remains strong, highlighting its consistent investment strategy and ability to capitalize on infrastructure growth.

Key Takeaways

- Short-Term Gains: The H.D.F.C. Infrastructure Fund and Quant Infrastructure Fund lead the way with exceptional short-term returns, making them attractive for investors seeking quick gains.

- Consistent Long-Term Performance: Franklin Build India Fund and Bandhan Infrastructure Fund have consistently performed over the long term, indicating strong management and strategic investment choices.

- Balanced Approach: D.S.P. India T.I.G.E.R. Fund offers a balanced approach with solid returns across different timeframes, making it a reliable choice for a diversified portfolio.

Trailing Returns Analysis

Let’s delve into the trailing returns of the top infrastructure mutual funds and uncover which ones are leading the pack.

1. Quant Infrastructure Fund

The Quant Infrastructure Fund has consistently delivered high returns, making it one of the top performers in the infrastructure mutual fund category. With an astounding 1-year return of 85.27%, this fund has shown exceptional short-term growth. Over a more extended period, its 10-year return of 21.51% highlights its potential for sustained growth, proving it to be a robust choice for both short and long-term investors.

2. Invesco India Infrastructure Fund

The Invesco India Infrastructure Fund is another stellar performer with a 1-year return of 84.37%. Its 2-year return of 48.80% indicates a solid ability to generate significant returns in the medium term. Additionally, the 10-year return of 22.03% underscores the fund’s capacity for delivering consistent long-term gains, making it a reliable investment choice.

3. D.S.P. India T.I.G.E.R. Fund

D.S.P. India T.I.G.E.R. Fund stands out with a remarkable 2-year return of 50.96%, showcasing its exceptional performance in recent years. The fund’s 1-year return of 84.82% and 3-year return of 39.93% further highlight its strong growth potential. While its 10-year return of 19.72% is slightly lower than others, it still represents solid long-term performance.

4. Bandhan Infrastructure Fund

Bandhan Infrastructure Fund leads the pack with the highest 1-year return of 86.79%. Its 2-year return of 50.90% also places it among the top performers. The fund has demonstrated strong returns across various periods, with a 10-year return of 19.32%, indicating its resilience and consistent performance over time.

5. Franklin Build India Fund

Franklin Build India Fund boasts an impressive 2-year return of 51.52%, the highest among its peers. Its 1-year return of 82.70% and 10-year return of 23.35% highlight its strong short- and long-term performance. This fund’s ability to deliver consistent returns makes it a compelling option for investors looking for stability and growth.

Key Takeaways

- Exceptional Short-Term Performance: Bandhan Infrastructure Fund and Quant Infrastructure Fund have shown the highest short-term returns, making them attractive for investors seeking immediate gains.

- Medium to Long-Term Growth: Invesco India Infrastructure Fund and Franklin Build India Fund have demonstrated solid medium to long-term growth, indicating strong management and strategic investments.

- Balanced Returns: D.S.P. India T.I.G.E.R. Fund offers balanced returns across various periods, making it a reliable choice for a diversified portfolio.

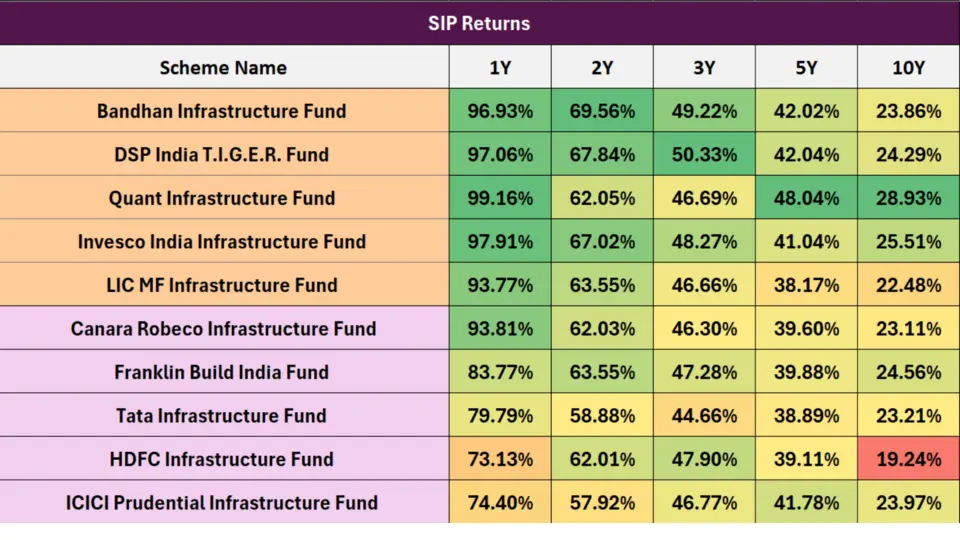

S.I.P. Returns Analysis

Let’s explore the top infrastructure mutual funds based on their S.I.P. returns to understand which funds offer the best growth potential for your investments.

1. Bandhan Infrastructure Fund

The Bandhan Infrastructure Fund has shown remarkable performance with a 1-year S.I.P. return of 96.93%, making it a top contender for short-term gains. Its consistent growth over the years, with a 10-year return of 23.86%, indicates a robust investment strategy focused on long-term growth. This fund is ideal for investors looking to maximize returns over short and extended periods.

2. D.S.P. India T.I.G.E.R. Fund

D.S.P. India T.I.G.E.R. Fund stands out with an impressive 1-year S.I.P. return of 97.06%, showcasing its potential for significant short-term growth. The fund’s 10-year return of 24.29% further solidifies its position as a strong performer, making it a reliable option for long-term investment strategies focused on infrastructure.

3. Quant Infrastructure Fund

Quant Infrastructure Fund leads the pack with a phenomenal 1-year S.I.P. return of 99.16%, the highest among its peers. Its 10-year return of 28.93% is equally impressive, indicating a well-managed fund with a strategic focus on high-growth opportunities in the infrastructure sector. This fund is perfect for aggressive investors seeking maximum returns.

4. Invesco India Infrastructure Fund

The Invesco India Infrastructure Fund showcases strong performance with a 1-year S.I.P. return of 97.91%. Its consistent growth over the years, with a 10-year return of 25.51%, highlights its ability to deliver substantial returns while maintaining a balanced investment approach. This fund is suitable for investors seeking steady growth in the infrastructure sector.

5. L.I.C. M.F. Infrastructure Fund

L.I.C. M.F. Infrastructure Fund has delivered solid returns, with a 1-year S.I.P. return of 93.77%. Its 10-year return of 22.48% indicates a steady growth trajectory, making it a reliable choice for long-term investors. The fund’s consistent performance across different time frames suggests a well-diversified portfolio that can weather market fluctuations.

Key Takeaways

- Short-Term Gains: Quant Infrastructure Fund and D.S.P. India T.I.G.E.R. Fund lead with exceptional short-term S.I.P. returns, making them attractive for investors seeking immediate gains.

- Long-Term Stability: Invesco India Infrastructure Fund and L.I.C. M.F. Infrastructure Fund have shown consistent long-term performance, making them ideal for steady, long-term investment strategies.

- Balanced Growth: Bandhan Infrastructure Fund offers a balanced approach with solid returns across short and long periods, which suits investors looking for consistent growth.

- Aggressive Strategy: Quant Infrastructure Fund’s high returns suggest an aggressive investment strategy focused on maximizing returns, perfect for high-risk, high-reward investors.

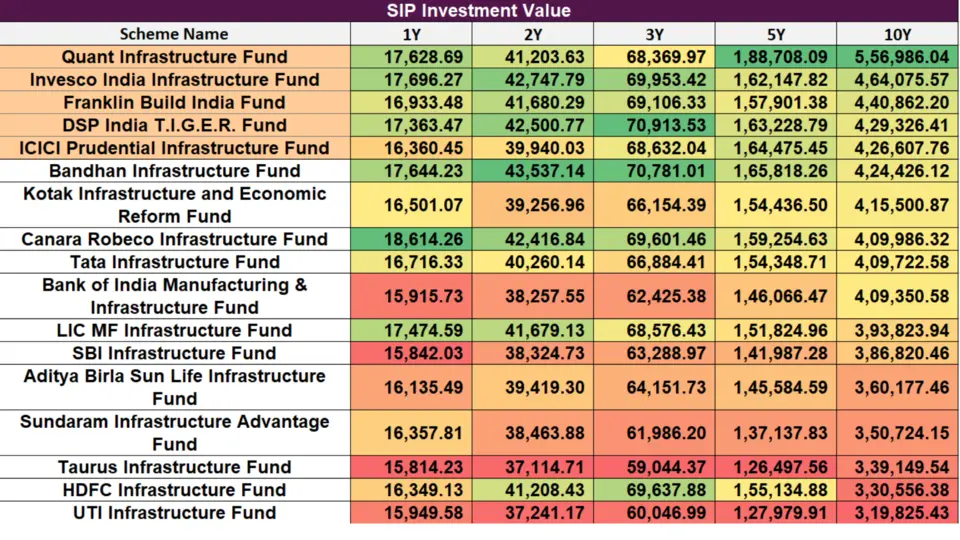

S.I.P. Investment Value Analysis

Let’s dive into the performance of the top infrastructure mutual funds based on their S.I.P. investment values to determine which funds offer the best growth potential.

1. Quant Infrastructure Fund

The Quant Infrastructure Fund stands out with the highest S.I.P. investment value over 10 years, amounting to ₹5,56,986.04. This demonstrates the fund’s robust performance and ability to deliver exceptional long-term growth. Its impressive 5-year value of ₹1,88,708.09 also highlights its consistency in generating substantial returns over a shorter period.

2. Invesco India Infrastructure Fund

Invesco India Infrastructure Fund showcases strong performance with a 10-year S.I.P. investment value of ₹4,64,075.57. Its 3-year and 5-year values of ₹69,953.42 and ₹1,62,147.82 indicate solid medium-term returns, making it a reliable choice for long-term investors seeking steady growth.

3. Franklin Build India Fund

The Franklin Build India Fund delivers a strong performance with a 10-year S.I.P. investment value of ₹4,40,862.20. Its 5-year value of ₹1,57,901.38 and 3-year value of ₹69,106.33 underscore its ability to provide consistent returns over varying investment horizons, making it an attractive option for diversified portfolios.

4. D.S.P. India T.I.G.E.R. Fund

D.S.P. India T.I.G.E.R. Fund stands out with strong S.I.P. investment values, particularly its 3-year value of ₹70,913.53 and 5-year value of ₹1,63,228.79. Its 10-year value of ₹4,29,326.41 indicates a well-managed fund with a strategic focus on long-term growth, ideal for investors looking for stable returns over the long run.

5. Bandhan Infrastructure Fund

Bandhan Infrastructure Fund has impressive performance with a 2-year S.I.P. investment value of ₹43,537.14 and a 10-year value of ₹4,24,426.12. Its consistent growth over various timeframes makes it a reliable option for investors seeking long-term capital appreciation in the infrastructure sector.

Key Takeaways

- Exceptional Long-Term Growth: Quant Infrastructure Fund leads with the highest 10-year S.I.P. investment value, making it an excellent choice for investors focusing on long-term growth.

- Strong Medium-Term Performance: Invesco India Infrastructure Fund and D.S.P. India T.I.G.E.R. Fund showcase strong medium-term returns, providing balanced growth over 3 to 5 years.

- Consistent Returns: Franklin Build India Fund and Bandhan Infrastructure Fund offer consistent performance across different investment horizons, which is ideal for diversified portfolios.

Risk Analysis

Standard Deviation Analysis

To understand their risk profiles, let’s analyse the top infrastructure mutual funds based on their standard deviation.

1. S.B.I. Infrastructure Fund

The S.B.I. Infrastructure Fund has the lowest standard deviation over 3 years, making it one of the most minor volatile funds. Its 10-year standard deviation of 19.67 also indicates moderate volatility over the long term. This fund suits conservative investors looking for stable returns with lower risk.

2. Bank of India Manufacturing & Infrastructure Fund

Bank of India Manufacturing & Infrastructure Fund shows relatively low volatility, with a 3-year standard deviation of 13.94 and a 10-year standard deviation of 19.28. This fund provides a good balance of stability and growth potential, making it ideal for risk-averse investors.

3. Taurus Infrastructure Fund

Taurus Infrastructure Fund exhibits low to moderate volatility, with the lowest 10-year standard deviation of 18.78 among the analyzed funds. Its consistent performance with minimal fluctuations makes it a safe bet for investors seeking steady returns.

4. Kotak Infrastructure and Economic Reform Fund

Kotak Infrastructure and Economic Reform Fund has the lowest 3-year standard deviation of 12.23, indicating very low volatility in the short term. However, its 5-year and 10-year standard deviations are slightly higher, suggesting moderate risk over more extended periods.

5. L.I.C. M.F. Infrastructure Fund

L.I.C. M.F. Infrastructure Fund maintains low to moderate volatility across all periods, with a 3-year standard deviation of 13.35 and a 10-year standard deviation of 19.25. This fund is suitable for mutual fund investor investors seeking an equilibrium between risk and return.

Key Takeaways

- Low Volatility: Funds like S.B.I. Infrastructure Fund and Bank of India Manufacturing & Infrastructure Fund exhibit low volatility, making them ideal for conventional investors looking for stable returns with minimal risk.

- Moderate Risk: Taurus Infrastructure Fund and L.I.C. M.F. Infrastructure Fund provide a good balance of stability and growth potential, suitable for risk-averse investors.

- Short-Term Stability: Kotak Infrastructure and Economic Reform Fund offers very low short-term volatility, making it a safe option for short-term investments.

Beta Analysis

Let’s analyse the beta of the top infrastructure mutual funds over different periods.

1. Kotak Infrastructure and Economic Reform Fund

Kotak Infrastructure and Economic Reform Fund has the lowest 3-year beta of 0.79, indicating lower volatility and less sensitivity to market movements in the short term. Its 10-year beta of 1.04 suggests it becomes slightly more volatile over the long term, but it still aligns closely with the market.

2. Bank of India Manufacturing & Infrastructure Fund

Bank of India Manufacturing & Infrastructure Fund maintains a consistently low beta over 3 and 5 years, indicating low volatility. Its 10-year beta of 1.02 shows minimal increase in volatility, making it a stable investment option with low risk.

Taurus Infrastructure Fund demonstrates stable volatility with a 3 and 5-year beta of 0.92. Its 10-year beta of 1.02 indicates a slight increase in volatility over the long term. Still, it remains a low-risk option compared to the market.

3. Taurus Infrastructure Fund

4. S.B.I. Infrastructure Fund

S.B.I. Infrastructure Fund shows low volatility in the short term with a 3-year beta of 0.86. Its 10-year beta of 1.06 suggests that the fund’s volatility aligns closely with the market over the long term, providing a balanced risk profile.

5. L.I.C. M.F. Infrastructure Fund

L.I.C. M.F. Infrastructure Fund has low short-term volatility with a 3-year beta of 0.86. Its 10-year beta of 1.06 indicates slightly higher volatility. Still, it aligns closely with the market, making it a stable long-term investment option.

Key Takeaways

- Low Volatility Funds: Kotak Infrastructure and Economic Reform Fund and S.B.I. Infrastructure Funds exhibit low volatility, making them ideal for traditional investors seeking stable returns with minimal risk.

- Stable Long-Term Options: Bank of India Manufacturing & Infrastructure Fund and Taurus Infrastructure Fund provide low volatility over short and long periods, which is suitable for risk-averse investors.

- Balanced Risk Profile: L.I.C. M.F. Infrastructure Fund offers a balanced risk profile with low short-term and market-aligned long-term volatility, making it a reliable choice for long-term investments.

- Moderate Volatility: Invesco India Infrastructure Fund and Tata Infrastructure Fund demonstrate moderate volatility, balancing risk and return well.

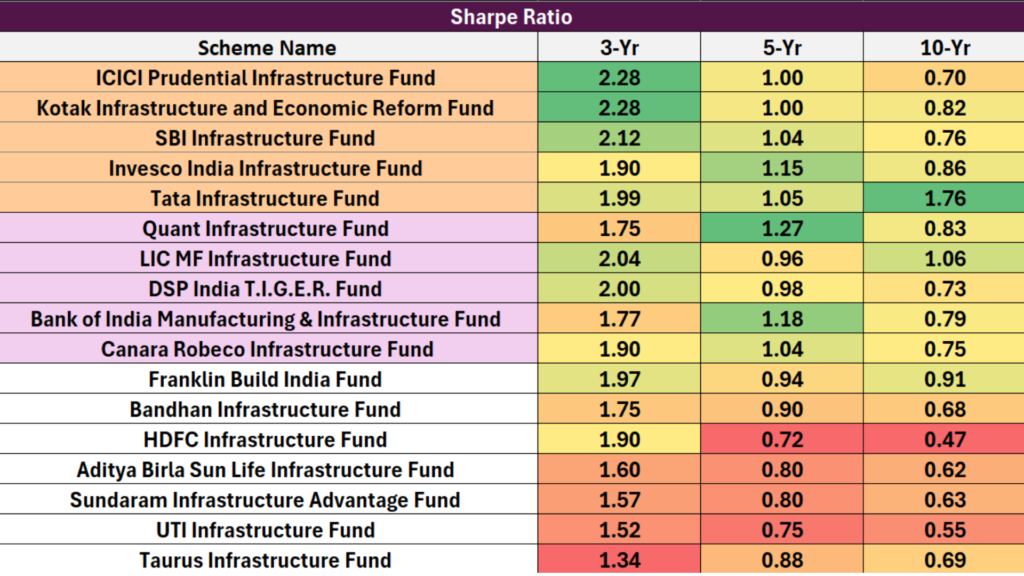

Sharpe Ratio Analysis

Let’s dive into the performance of the top infrastructure mutual funds based on their Sharpe Ratios over different periods.

1. I.C.I.C.I. Prudential Infrastructure Fund

I.C.I.C.I. Prudential Infrastructure Fund boasts a high 3-year Sharpe Ratio of 2.28, indicating excellent risk-adjusted returns in the short term. Its 10-year Sharpe Ratio of 0.70 shows moderate performance over the long term, but it remains a solid choice for risk-adjusted gains.

2. Kotak Infrastructure and Economic Reform Fund

Kotak Infrastructure and Economic Reform Fund matches I.C.I.C.I. Prudential with a 3-year Sharpe Ratio of 2.28. It maintains decent performance over the long term with a 10-year Sharpe Ratio of 0.82, suggesting good risk management and consistent returns.

3. S.B.I. Infrastructure Fund

S.B.I. Infrastructure Fund has a strong 3-year Sharpe Ratio of 2.12, indicating good risk-adjusted returns. Its 5-year and 10-year Sharpe Ratios of 1.04 and 0.76, respectively, reflect steady performance, making it a reliable option for balanced risk and return.

4. Invesco India Infrastructure Fund

Invesco India Infrastructure Fund exhibits a balanced approach with a 3-year Sharpe Ratio of 1.90 and a solid 10-year Sharpe Ratio of 0.86. This indicates consistent risk-adjusted returns over various periods, making it a rock-solid choice for long-term investments.

5. Tata Infrastructure Fund

Tata Infrastructure Fund shines with a 10-year Sharpe Ratio of 1.76, the best among its peers. Its 3-year and 5-year Sharpe Ratios of 1.99 and 1.05, respectively, highlight its ability to provide excellent risk-adjusted returns across different time frames.

Key Takeaways

- Top Performers: I.C.I.C.I. Prudential Infrastructure Fund and Kotak Infrastructure and Economic Reform Fund lead with the highest 3-year Sharpe Ratios, indicating superior short-term risk-adjusted returns.

- Consistent Returns: Invesco India Infrastructure Fund and Tata Infrastructure Fund offer strong long-term Sharpe Ratios, reflecting steady performance and sound risk management.

- Balanced Risk-Return: S.B.I. Infrastructure Fund demonstrates balanced risk-adjusted returns across various periods, making it a reliable option for diversified portfolios.

- Strong Long-Term Performance: Tata Infrastructure Fund’s outstanding 10-year Sharpe Ratio makes it a top choice for investors seeking superior long-term risk-adjusted returns.

Alpha Analysis

Let’s delve into the performance of the top infrastructure mutual funds based on their alpha values over different periods.

1. Quant Infrastructure Fund

Quant Infrastructure Fund leads with high alpha values across all periods, indicating strong outperformance relative to its benchmark. With a 3-year alpha of 15.55 and a 10-year alpha of 6.17, this fund consistently delivers superior returns, making it an attractive choice for growth-focused investors.

2. I.C.I.C.I. Prudential Infrastructure Fund

I.C.I.C.I. Prudential Infrastructure Fund shows an exceptional 3-year alpha of 18.65, suggesting significant short-term outperformance. Although its 10-year alpha is 2.75, indicating moderate long-term outperformance, the fund remains a strong performer in the infrastructure sector.

3. Invesco India Infrastructure Fund

Invesco India Infrastructure Fund demonstrates consistent outperformance with a 3-year alpha of 14.56 and a 10-year alpha of 5.94. This indicates that the fund has consistently generated returns above the benchmark.

4. Kotak Infrastructure and Economic Reform Fund

Kotak Infrastructure and Economic Reform Fund has a high 3-year alpha of 16.60, showing short-term solid performance. Its 10-year alpha of 5.24 indicates that the fund has maintained its outperformance over the long term.

5. D.S.P. India T.I.G.E.R. Fund

D.S.P. India T.I.G.E.R. Fund exhibits robust outperformance with a 3-year alpha of 15.82 and a 5-year alpha of 7.37. Its 10-year alpha of 3.27 suggests that while it performs well in the short and medium term, its long-term outperformance is moderate.

Key Takeaways

- Top Performers: Quant Infrastructure Fund and I.C.I.C.I. Prudential Infrastructure Fund leads with high alpha values, indicating significant outperformance and robust management strategies.

- Consistent Outperformance: Invesco India Infrastructure Fund and Kotak Infrastructure and Economic Reform Fund offer consistent outperformance across various periods, making them reliable options for long-term investors.

- Balanced Growth: D.S.P. India T.I.G.E.R. Fund shows strong short to medium-term outperformance, making it a good choice for investors seeking balanced growth.

- Strong Short-Term Performance: Funds like I.C.I.C.I. Prudential and Quant Infrastructure have shown exceptional short-term performance, making them attractive for investors looking for immediate gains.

Ranking

Ranking Based on Returns

Key Takeaways

- Top Performers: Quant Infrastructure Fund and D.S.P. India T.I.G.E.R. Fund lead the rankings with exceptional returns, making them attractive for short-term and long-term investors.

- Balanced Growth: Funds like Invesco India Infrastructure Fund and Franklin Build India Fund offer balanced growth across various periods, providing a reliable option for diversified portfolios.

- Long-Term Stability: I.C.I.C.I. Prudential Infrastructure Fund and L.I.C. M.F. Infrastructure Fund have shown consistent long-term performance, which is ideal for investors seeking stable growth over extended periods.

- Diversified Strategy: Investing in a mix of these top-performing funds can provide a balanced exposure to the infrastructure sector, leveraging high returns while mitigating risks.

Ranking Based on Risk-Adjusted Returns

Key Takeaways

- Top Performers: Kotak Infrastructure and Economic Reform Fund and S.B.I. Infrastructure Fund leads the rankings, indicating superior risk-adjusted returns and robust management strategies.

- Consistent Returns: Bank of India Manufacturing & Infrastructure Fund and Invesco India Infrastructure Fund offer consistent risk-adjusted returns, making them reliable options for long-term investors.

- Balanced Approach: Funds like I.C.I.C.I. Prudential Infrastructure Fund and L.I.C. M.F. Infrastructure Fund demonstrate a balanced approach to risk and return, providing stable growth with moderate risk.

- Aggressive Strategy: Quant Infrastructure Fund’s position reflects its aggressive growth strategy. It suits investors willing to take on higher risk for possibly higher returns.

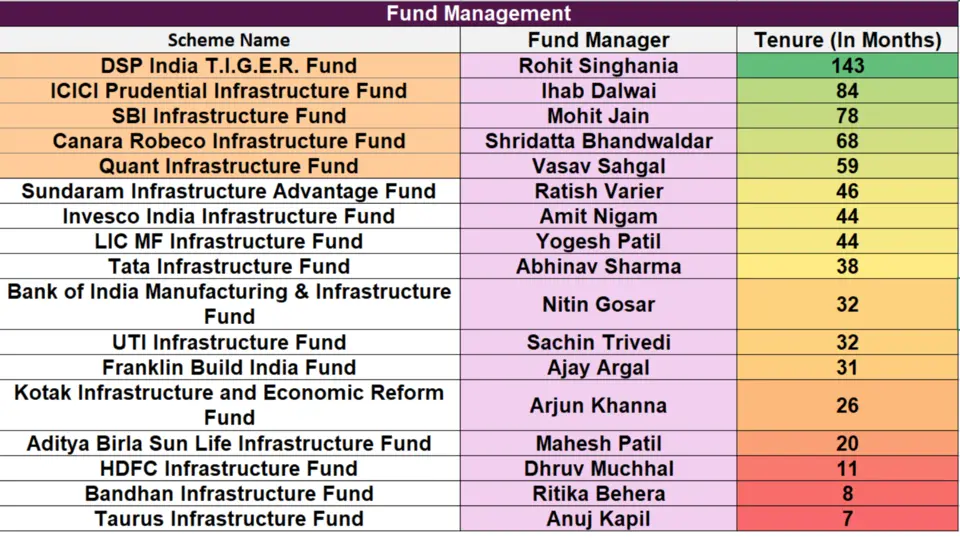

Fund Management Analysis

Let’s delve into the profiles of the top infrastructure mutual funds’ managers and their tenure to understand the impact of their leadership.

Key Takeaways

- Experienced Leadership: Funds managed by experienced leaders like Rohit Singhania (D.S.P. India T.I.G.E.R. Fund) and Ihab Dalwai (I.C.I.C.I. Prudential Infrastructure Fund) tend to perform consistently well, indicating the value of stable and knowledgeable management.

- Mid-Tenure Managers: Managers like Mohit Jain (S.B.I. Infrastructure Fund) and Shridatta Bhandwaldar (Canara Robeco Infrastructure Fund), with medium tenures, have shown effective management and balance growth and stability.

- Aggressive Growth: Managers like Vasav Sahgal (Quant Infrastructure Fund) demonstrate aggressive strategies leading to high returns, which are suitable for investors keen to take on higher risk.

- Emerging Leaders: Newer managers like Dhruv Muchhal (H.D.F.C. Infrastructure Fund) and Ritika Behera (Bandhan Infrastructure Fund) have not established long-term performance but have brought fresh perspectives to fund management.

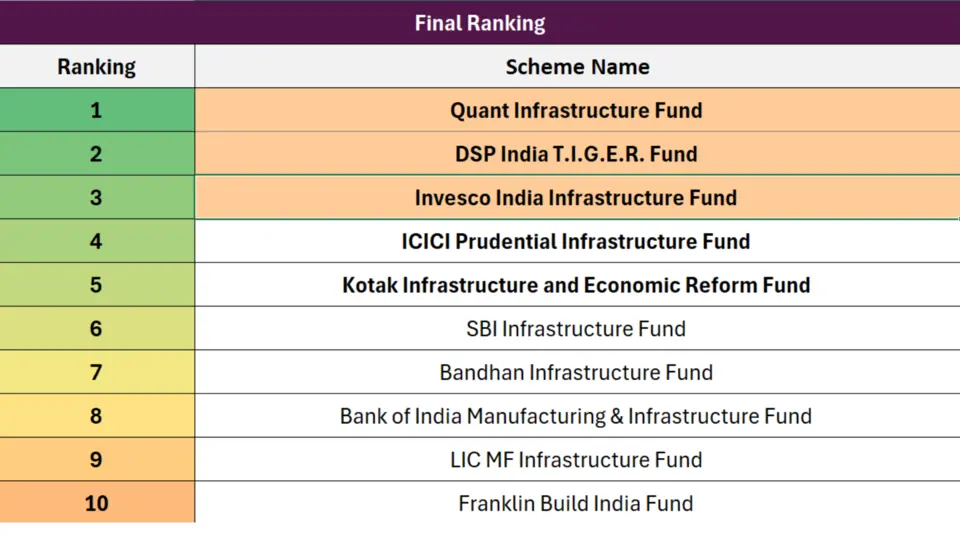

Final Ranking

The 3 Best Infrastructure Mutual Funds in 2024

After analysing various factors, including returns, risk-adjusted performance, management experience, and consistency, we have reached the final ranking of the top infrastructure mutual funds.

1. Quant Infrastructure Fund

- Overview: The Quant Infrastructure Fund ranks first due to its exceptional performance across multiple metrics. It has shown high returns, risk-adjusted solid performance, and effective fund management.

- Strengths:

- High alpha and Sharpe ratio indicating superior risk-adjusted returns.

- Managed by Vasav Sahgal with a tenure of 59 months.

- Consistent top performer in terms of absolute returns and S.I.P. investment value.

2. D.S.P. India T.I.G.E.R. Fund

- Overview: D.S.P. India T.I.G.E.R. Fund secures the second position, thanks to its consistently high performance and the long tenure of its fund manager.

- Strengths:

- Managed by Rohit Singhania with an impressive tenure of 143 months.

- Solid returns and favourable alpha and Sharpe ratio.

- Stable and consistent returns over long periods make it a reliable investment.

3. Invesco India Infrastructure Fund

- Overview: Invesco India Infrastructure Fund ranks third, reflecting its balanced performance and robust risk management.

- Strengths:

- Managed by Amit Nigam with a tenure of 44 months.

- High returns with a balanced approach to risk.

- Consistent alpha values indicate outperformance relative to the benchmark.

4. I.C.I.C.I. Prudential Infrastructure Fund

- Overview: I.C.I.C.I. Prudential Infrastructure Fund is fourth, driven by its short-term solid performance and effective risk management.

- Strengths:

- Managed by Ihab Dalwai with a tenure of 84 months.

- High short-term alpha and strong Sharpe ratio.

- Effective in balancing risk and return, providing reliable growth.

5. Kotak Infrastructure and Economic Reform Fund

- Overview: Kotak Infrastructure and Economic Reform Fund ranks fifth, showing risk-adjusted solid returns and a balanced investment strategy.

- Strengths:

- Managed by Arjun Khanna with a tenure of 26 months.

- High alpha and Sharpe ratio, indicating risk-adjusted solid performance.

- Consistent returns with effective risk management.

Key Takeaways

- Top Performer: The Quant Infrastructure Fund stands out as the top performer due to its high returns and risk-adjusted solid performance, making it an excellent choice for growth-focused investors.

- Experienced Management: D.S.P. India T.I.G.E.R. Fund benefits from the long tenure of its manager, ensuring stability and consistent performance, which is ideal for long-term investors.

- Balanced Approach: Invesco India Infrastructure Fund and I.C.I.C.I. Prudential Infrastructure Fund offers a balanced approach to risk and return, making them reliable options for diversified portfolios.

- Firm Risk Management: Kotak Infrastructure and Economic Reform Fund excels in risk-adjusted returns, indicating effective risk management and consistent performance.

Conclusion

In conclusion, the Quant Infrastructure Fund is the best overall performer, excelling across all parameters, including high returns, risk-adjusted solid performance, and effective fund management. It is ideal for growth-focused investors seeking robust long-term gains.

For those with a moderate risk appetite, the D.S.P. India T.I.G.E.R. Fund and I.C.I.C.I. Prudential Infrastructure Fund offers balanced risk and return profiles, ensuring stable and consistent growth. Meanwhile, conservative investors looking for lower volatility and steady returns might find the S.B.I. Infrastructure Fund and Invesco India Infrastructure Fund are the most suitable choices, thanks to their strong risk management and reliable performance over various periods.

If you have any mutual fund-related queries, please comment below—we’re here to help!

F.A.Q.s – Best Infrastructure Mutual Funds in India

What are the best infrastructure mutual funds to invest in 2024?

The top 5 infrastructure mutual funds to invest in 2024 are the Quant Infrastructure Fund, D.S.P. India T.I.G.E.R. Fund, Invesco India Infrastructure Fund, I.C.I.C.I. Prudential Infrastructure Fund, and Kotak Infrastructure and Economic Reform Fund. These funds have shown strong performance, high returns, and effective risk management.

Which infrastructure mutual fund has the highest returns?

The Quant Infrastructure Fund boasts the highest returns across multiple timeframes, making it the top performer in terms of absolute returns. Its robust growth strategy and strong management contribute to its leading position.

Which fund is best for conservative investors?

For conservative investors seeking low volatility and steady returns, the S.B.I. Infrastructure Fund and Invesco India Infrastructure Fund are excellent choices. These funds offer balanced risk-adjusted returns and robust risk management.

Which infrastructure mutual fund is the best for aggressive investors?

Aggressive investors looking for high returns with a higher risk appetite should consider the Quant Infrastructure Fund. Its aggressive growth strategy has consistently delivered superior returns, making it ideal for those willing to take on more risk.

How do I choose the proper infrastructure mutual fund based on risk appetite?

Choosing the proper infrastructure mutual fund depends on your risk tolerance. The Quant Infrastructure Fund is the best choice for high-risk, high-reward investments. For moderate risk, consider the D.S.P. India T.I.G.E.R. Fund or I.C.I.C.I. Prudential Infrastructure Fund. Conservative investors should opt for the S.B.I. Infrastructure Fund or Invesco India Infrastructure Fund for lower volatility and steady returns.

Why is the Quant Infrastructure Fund considered the best overall?

The Quant Infrastructure Fund is considered the best overall due to its outstanding performance across all metrics, including high returns, risk-adjusted solid performance, and effective management. Its consistent outperformance makes it the top choice for investors.

How important is fund manager tenure in mutual fund performance?

The tenure of a fund manager is crucial as it indicates stability and consistent management strategies. Longer tenures, like that of Rohit Singhania with the D.S.P. India T.I.G.E.R. Fund, often correlate with steady performance and reliable returns.

Are infrastructure mutual funds a good investment for 2024?

Yes, infrastructure mutual funds are a promising investment for 2024 due to India’s growing emphasis on infrastructure development. Investing in top-performing funds like those analysed provides exposure to this sector’s growth potential.

How does the Sharpe Ratio impact the choice of mutual funds?

The Sharpe Ratio measures risk-adjusted returns, helping investors understand how much excess return they get for the risk taken. Funds with a high Sharpe Ratio, like I.C.I.C.I. Prudential Infrastructure Fund and Kotak Infrastructure and Economic Reform Fund are preferred for superior risk management.

What should investors consider when investing in infrastructure mutual funds?

Investors should consider historical returns, risk-adjusted performance (Sharpe Ratio), management expertise, and fund manager tenure. Diversifying across top-performing funds can provide balanced exposure and mitigate risks.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing