When investing in PSU (Public Sector Undertaking) mutual funds, having a thorough understanding of past performance can help make informed decisions. Let’s dive into a detailed analysis of three top-performing PSU equity funds: Aditya Birla Sun Life PSU Equity Fund, Invesco India PSU Equity Fund, and SBI PSU Fund. We’ll break down their year-wise and annualized returns, providing a complete overview to help you determine which fund might Best PSU Mutual Fund 2024 suit your investment goals.

Understanding PSU Mutual Funds

PSU mutual funds focus on investing in public sector companies, which are government-owned entities. These funds can be attractive due to the perceived stability and potential for high returns associated with government backing. However, as with any investment, examining historical performance is crucial to gauge future potential.

Returns Analysis of PSU Mutual Funds

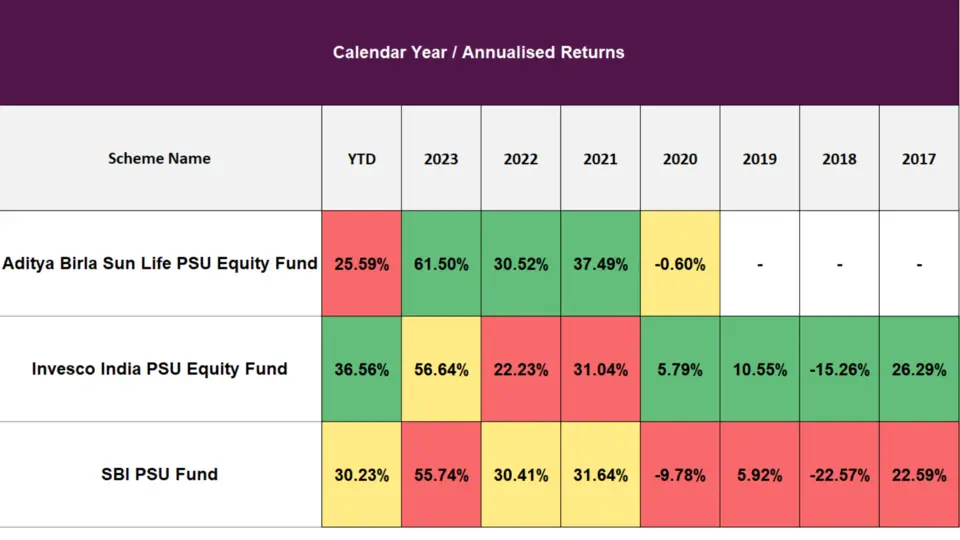

Comparative Analysis of Calendar Year Returns

Here’s a detailed, comparative look at the annual returns of the three funds mentioned above. We’ll examine their performance year-to-date (YTD) and move backwards, analyzing each year for critical insights.

1. Aditya Birla Sun Life PSU Equity Fund

| Year | Annualized Returns |

| YTD | 25.59% |

| 2023 | 61.50% |

| 2022 | 30.52% |

| 2021 | 37.49% |

| 2020 | -0.60% |

Key Takeaways:

- Strong Recent Performance: The YTD return is impressive at 25.59%, indicating robust performance in 2024.

- Remarkable 2023: A significant 61.50% return in 2023, showcasing strong recovery or growth.

- Consistent Growth: Returns above 30% in 2021 and 2022 highlight consistent performance.

2. Invesco India PSU Equity Fund

| Year | Annualized Returns |

| YTD | 36.56% |

| 2023 | 56.64% |

| 2022 | 22.23% |

| 2021 | 31.04% |

| 2020 | 5.79% |

| 2019 | 10.55% |

| 2018 | -15.26% |

| 2017 | 26.29% |

| 2016 | 18.48% |

| 2015 | 3.94% |

| 2014 | 55.99% |

| 2013 | -15.87% |

Key Takeaways:

- High YTD Return: Leading with a 36.56% YTD return in 2024.

- Steady Gains: Notable returns in 2023 (56.64%) and consistently positive returns since 2017.

- Volatility: Some years, like 2018, saw negative returns, but long-term growth is evident.

3. SBI PSU Fund

| Year | Annualized Returns |

| YTD | 30.23% |

| 2023 | 55.74% |

| 2022 | 30.41% |

| 2021 | 31.64% |

| 2020 | -9.78% |

| 2019 | 5.92% |

| 2018 | -22.57% |

| 2017 | 22.59% |

| 2016 | 15.83% |

| 2015 | -10.97% |

| 2014 | 41.64% |

| 2013 | -13.97% |

Key Takeaways:

- Solid YTD Return: Strong start in 2024 with a 30.23% return.

- Impressive 2023: A substantial return of 55.74%.

- Mixed Performance: Some negative years, such as 2020 and 2018, but also periods of significant growth.

Detailed Analysis and Insights

Aditya Birla Sun Life PSU Equity Fund

This fund has shown exceptional performance in recent years, particularly in 2023, with a staggering 61.50% return. The positive trend continues into 2024 with a YTD return of 25.59%. This indicates strong momentum and could be attractive for investors looking for growth. However, the lack of data for years before 2020 is worth noting, which might make long-term trend analysis challenging.

Invesco India PSU Equity Fund

Invesco’s fund stands out with its leading YTD return of 36.56% in 2024. The fund has maintained solid returns in recent years, including 56.64% in 2023 and consistent positive returns in 2017, barring the dip in 2018. This fund appears to offer a balance of growth and stability, although investors should be aware of its past volatility.

SBI PSU Fund

SBI’s fund shows a strong performance with a YTD return of 30.23% in 2024, following a robust 55.74% return in 2023. While it has experienced some negative returns (notably in 2020 and 2018), the fund has also had periods of high growth. Investors seeking a blend of potentially high returns with a willingness to accept some volatility might find this fund appealing.

Key Takeaways

- Aditya Birla Sun Life PSU Equity Fund: Outstanding recent performance with consistent growth over the past few years. Best suited for investors looking for high growth in the near term.

- Invesco India PSU Equity Fund: Leading the pack with the highest YTD return in 2024. Shows a balance of growth and stability despite some past volatility.

- SBI PSU Fund: Offers significant potential returns with some volatility. Ideal for investors willing to ride out short-term dips for potential long-term gains.

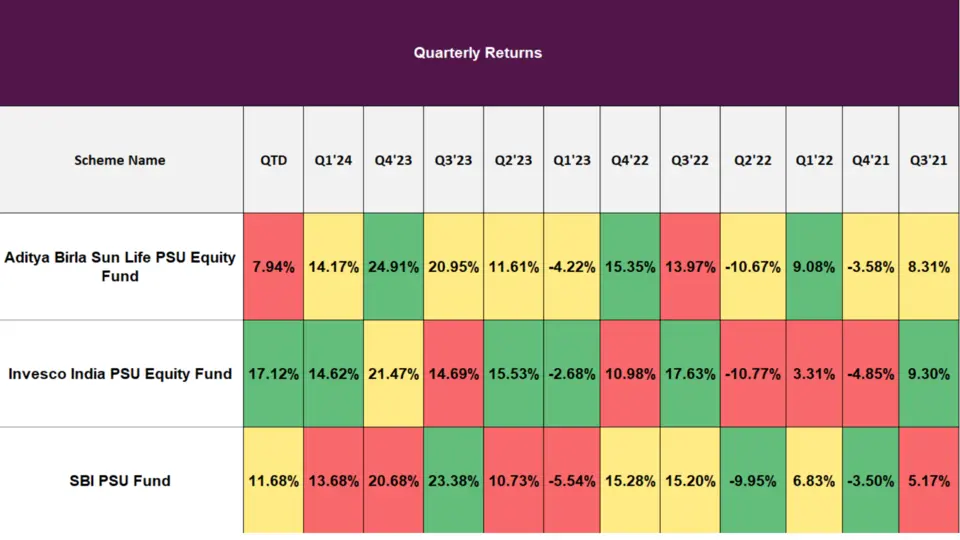

Comparative Analysis of Quarterly Returns

Let’s break down the quarterly returns of these three funds, providing a detailed analysis of their performance over the recent quarters. This will give us insights into their short-term performance trends and volatility.

1. Aditya Birla Sun Life PSU Equity Fund

| Quarter | Return |

| QTD | 7.94% |

| Q1’24 | 14.17% |

| Q4’23 | 24.91% |

| Q3’23 | 20.95% |

| Q2’23 | 11.61% |

| Q1’23 | -4.22% |

| Q4’22 | 15.35% |

| Q3’22 | 13.97% |

| Q2’22 | -10.67% |

| Q1’22 | 9.08% |

| Q4’21 | -3.58% |

| Q3’21 | 8.31% |

Key Takeaways:

- Strong Q1 2024: Kicking off the year with a solid 14.17% return.

- Impressive Q4 2023: Achieved a remarkable 24.91% return, indicating strong performance at the end 2023.

- Volatility in 2022: Experienced significant fluctuations, with Q2’22 showing a negative return of -10.67%.

2. Invesco India PSU Equity Fund

| Quarter | Return |

| QTD | 17.12% |

| Q1’24 | 14.62% |

| Q4’23 | 21.47% |

| Q3’23 | 14.69% |

| Q2’23 | 15.53% |

| Q1’23 | -2.68% |

| Q4’22 | 10.98% |

| Q3’22 | 17.63% |

| Q2’22 | -10.77% |

| Q1’22 | 3.31% |

| Q4’21 | -4.85% |

| Q3’21 | 9.30% |

Key Takeaways:

- Leading QTD Performance: Currently leading with a 17.12% return, making it the top performer for the current quarter.

- Consistent Gains: Exhibited stable returns throughout 2023, with no drastic dips.

- Recovery in Q3’22: Bounced back with a strong 17.63% return after a negative Q2’22.

3. SBI PSU Fund

| Quarter | Return |

| QTD | 11.68% |

| Q1’24 | 13.68% |

| Q4’23 | 20.68% |

| Q3’23 | 23.38% |

| Q2’23 | 10.73% |

| Q1’23 | -5.54% |

| Q4’22 | 15.28% |

| Q3’22 | 15.20% |

| Q2’22 | -9.95% |

| Q1’22 | 6.83% |

| Q4’21 | -3.50% |

| Q3’21 | 5.17% |

Key Takeaways:

- Strong Q3 2023: Notable performance with a 23.38% return, highlighting significant gains.

- Mixed 2022 Performance: Experienced both positive and negative quarters, indicating some volatility.

- Current QTD Return: Maintains a decent 11.68% return, showcasing steady performance.

Detailed Analysis Of Quarterly Returns

Aditya Birla Sun Life PSU Equity Fund

Aditya Birla Sun Life PSU Equity Fund has shown strong performance in recent quarters, with a standout Q4 2023 return of 24.91%. The Q1 2024 return of 14.17% indicates a positive start to the year. However, the fund experienced significant volatility in 2022, including a sharp decline of -10.67% in Q2. Despite these fluctuations, the overall trend suggests resilience and potential for growth.

Invesco India PSU Equity Fund

Invesco India PSU Equity Fund leads the QTD returns with an impressive 17.12%. The fund performed in 2023 with a 21.47% return in Q4. Despite a dip in Q1 2023, the fund quickly recovered, showing its ability to bounce back from short-term setbacks. The steady returns in recent quarters make this fund a compelling choice for investors seeking stability and growth.

SBI PSU Fund

SBI PSU Fund has displayed strong performance, particularly in Q3 2023, with a return of 23.38%. The fund’s QT return of 11.68% shows a steady start to 2024. However, it has also faced periods of negative returns, such as -5.54% in Q1 2023. Despite these challenges, the fund’s ability to achieve significant gains in other quarters highlights its potential for high returns, albeit with some volatility.

Key Takeaways

- Aditya Birla Sun Life PSU Equity Fund: Demonstrates recent solid performance with some volatility in the past. Suitable for investors looking for high returns and willing to accept short-term fluctuations.

- Invesco India PSU Equity Fund: Leading in current quarter returns, showcasing consistent performance and resilience. Ideal for investors seeking a balance of stability and growth.

- SBI PSU Fund: Offers significant potential returns, with notable gains in certain quarters. Best for investors comfortable with some volatility in exchange for the possibility of high returns.

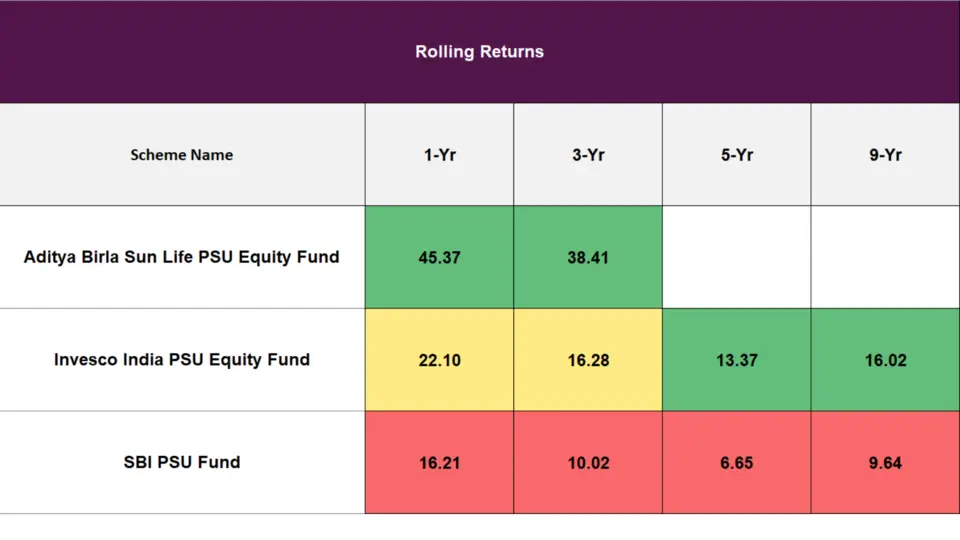

Comparative Analysis of Rolling Returns

Let’s break down the rolling returns of the three funds, analyzing their performance over 1-year, 3-year, 5-year, and 9-year periods. This will help us understand their long-term potential and volatility.

1. Aditya Birla Sun Life PSU Equity Fund

| Period | Rolling Return |

| 1-Yr | 45.37 |

| 3-Yr | 38.41 |

Key Takeaways:

- Outstanding 1-Year Return: The fund has achieved a remarkable 45.37% return over the past year, indicating short-term solid performance.

- Consistent 3-Year Performance: With a 3-year rolling return of 38.41%, the fund has shown consistent growth over the medium term.

- Lack of Long-Term Data: No data for the 5-year- and 9-year periods are available, making long-term analysis difficult.

2. Invesco India PSU Equity Fund

| Period | Rolling Return |

| 1-Yr | 22.10 |

| 3-Yr | 16.28 |

| 5-Yr | 13.37 |

| 9-Yr | 16.02 |

Key Takeaways:

- Moderate 1-Year Return: The fund has a 1-year rolling return of 22.10%, indicating decent short-term performance.

- Stable Medium-Term Returns: With a 3-year return of 16.28% and a 5-year return of 13.37%, the fund shows stability over the medium term.

- Long-Term Growth: The 9-year rolling return of 16.02% reflects the fund’s ability to sustain growth over a more extended period.

3. SBI PSU Fund

| Period | Rolling Return |

| 1-Yr | 16.21 |

| 3-Yr | 10.02 |

| 5-Yr | 6.65 |

| 9-Yr | 9.64 |

Key Takeaways:

- Modest 1-Year Return: The fund’s 1-year % rolling return of 16.21% is the lowest among the three, indicating slower short-term growth.

- Lower Medium-Term Performance: With a 3-year return of 10.02% and a 5-year return of 6.65%, the fund has shown relatively modest growth over the medium term.

- Consistent Long-Term Returns: The 9-year % rolling return of 9.64% suggests steady long-term performance, albeit at a lower growth rate compared to its peers.

Interactive Comparative Analysis Table

Here’s an interactive table for a more precise comparison of the rolling returns across different time frames:

| Scheme Name | 1-Yr | 3-Yr | 5-Yr | 9-Yr |

| Aditya Birla Sun Life PSU Equity Fund | 45.37 | 38.41 | – | – |

| Invesco India PSU Equity Fund | 22.10 | 16.28 | 13.37 | 16.02 |

| SBI PSU Fund | 16.21 | 10.02 | 6.65 | 9.64 |

Detailed Data Analysis Rolling Returns

Aditya Birla Sun Life PSU Equity Fund

Aditya Birla Sun Life PSU Equity Fund has shown exceptional short- and medium-term performance. The 1-year rolling return of 45.37% indicates recent solid growth. The 3-year return of 38.41% demonstrates the fund’s ability to generate substantial returns over a relatively short period. However, the lack of data for more extended time frames means that investors should consider other factors when evaluating long-term potential.

Invesco India PSU Equity Fund

Invesco India PSU Equity Fund offers a balanced performance across different time frames. The fund has shown moderate short-term growth with a 1-year return of 22.10%. The 3-year and 5-year returns of 16.28% and 13.37%, respectively, reflect stable medium-term performance. The 9-year return of 16.02% indicates the fund’s ability to sustain growth over a more extended period, making it a reliable choice for long-term investors.

SBI PSU Fund

SBI PSU Fund has demonstrated more modest returns compared to its peers. The 1-year % rolling return of 16.21% is the lowest among the three funds. The 3-year and 5-year returns of 10.02% and 6.65%, respectively, indicate slower growth over the medium term. However, the 9-year return of 9.64% shows that the fund has delivered consistent, albeit lower, long-term returns. Investors seeking stability with lower volatility might find this fund appealing.

Key Takeaways

- Aditya Birla Sun Life PSU Equity Fund: Exceptional short-term and medium-term performance with a lack of long-term data. Suitable for investors seeking high returns over shorter periods.

- Invesco India PSU Equity Fund: Balanced performance across all time frames, making it a reliable choice for medium- and long-term investors.

- SBI PSU Fund: Modest returns with consistent long-term performance. Ideal for investors to prioritize stability over high returns.

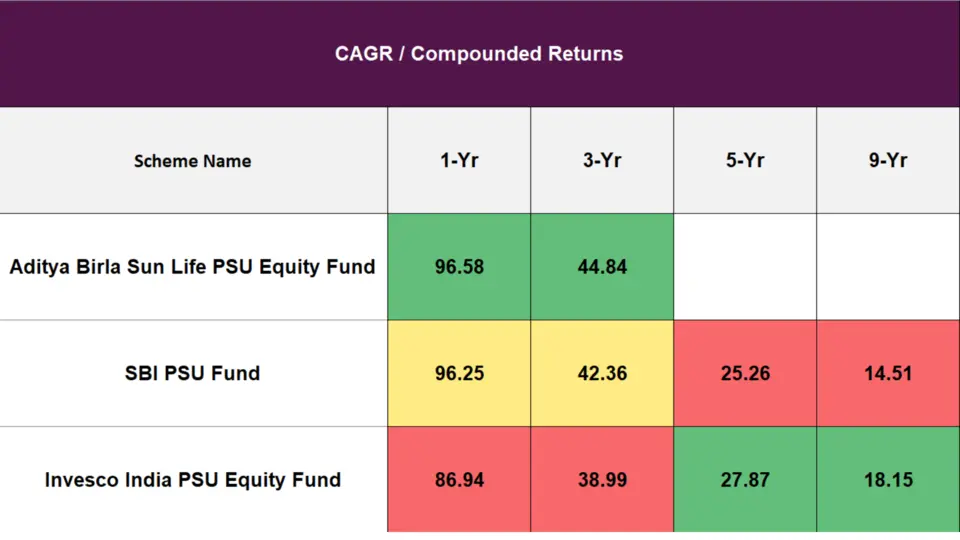

Comparative Analysis of CAGR / Compounded Returns

Let’s break down the CAGR of the three funds, analyzing their performance over 1-year, 3-year, 5-year, and 9-year periods. This will give us insights into their long-term potential and consistency.

1. Aditya Birla Sun Life PSU Equity Fund

| Period | CAGR / Compounded Return |

| 1-Yr | 96.58% |

| 3-Yr | 44.84% |

Key Takeaways:

- Exceptional 1-Year Return: The fund has achieved a staggering 96.58% return over the past year, showcasing robust short-term performance.

- Strong 3-Year Performance: With a 3-year CAGR of 44.84%, the fund has demonstrated significant medium-term growth.

- Lack of Long-Term Data: The absence of 5-year and 9-year data limits our ability to assess long-term performance.

2. SBI PSU Fund

| Period | CAGR / Compounded Return |

| 1-Yr | 96.25% |

| 3-Yr | 42.36% |

| 5-Yr | 25.26% |

| 9-Yr | 14.51% |

Key Takeaways:

- High 1-Year Return: The fund has a 1-year CAGR of 96.25%, nearly matching the Aditya Birla fund.

- Consistent Medium-Term Growth: With a 3-year CAGR of 42.36%, the fund has shown stable growth.

- Steady Long-Term Performance: The 5-year CAGR of 25.26% and 9-year CAGR of 14.51% indicate sustained performance over extended periods.

3. Invesco India PSU Equity Fund

| Period | CAGR / Compounded Return |

| 1-Yr | 86.94% |

| 3-Yr | 38.99% |

| 5-Yr | 27.87% |

| 9-Yr | 18.15% |

Key Takeaways:

- Strong 1-Year Return: The fund has a 1-year CAGR of 86.94%, indicating robust short-term performance.

- Stable Medium-Term Growth: The fund shows reliable medium-term growth with a 3-year CAGR of 38.99%.

- Impressive Long-Term Returns: The 5-year CAGR of 27.87% and 9-year CAGR of 18.15% reflect the fund’s ability to deliver strong returns over more extended periods.

Interactive Comparative Analysis Table

Here’s an interactive table for a more precise comparison of the CAGR across different time frames:

| Scheme Name | 1-Yr | 3-Yr | 5-Yr | 9-Yr |

| Aditya Birla Sun Life PSU Equity Fund | 96.58 | 44.84 | – | – |

| SBI PSU Fund | 96.25 | 42.36 | 25.26 | 14.51 |

| Invesco India PSU Equity Fund | 86.94 | 38.99 | 27.87 | 18.15 |

Detailed Data Analysis CAGR

Aditya Birla Sun Life PSU Equity Fund

Aditya Birla Sun Life PSU Equity Fund has delivered exceptional short- and medium-term returns. The 1-year CAGR of 96.58% is impressive, indicating robust recent performance. The 3-year CAGR of 44.84% further highlights the fund’s medium-term solid growth. However, the lack of long-term data means investors should consider additional factors when evaluating its long-term potential.

SBI PSU Fund

SBI PSU Fund has shown consistent performance across all time frames. The 1-year CAGR of 96.25% is nearly on par with the Aditya Birla fund, showcasing short-term solid growth. The 3-year CAGR of 42.36% and 5-year CAGR of 25.26% indicate stable medium-term performance. The 9-year CAGR of 14.51% reflects sustained long-term growth, making it a trustworthy choice for long-term investors.

Invesco India PSU Equity Fund

Invesco India PSU Equity Fund offers a balanced performance across all time frames. The 1-year CAGR of 86.94% indicates short-term solid growth. The 3-year CAGR of 38.99% and 5-year CAGR of 27.87% reflect stable medium-term performance. The 9-year CAGR of 18.15% suggests robust long-term returns, making it a prudent investment choice for long-term investors seeking consistent growth.

Key Takeaways

- Aditya Birla Sun Life PSU Equity Fund: Exceptional short-term and medium-term performance with a lack of long-term data. Suitable for investors seeking high returns over shorter periods.

- SBI PSU Fund: Consistent performance across all time frames makes it a reliable choice for medium- and long-term investors.

- Invesco India PSU Equity Fund: Balanced performance with short-term solid and long-term returns. Ideal for investors seeking stability and growth.

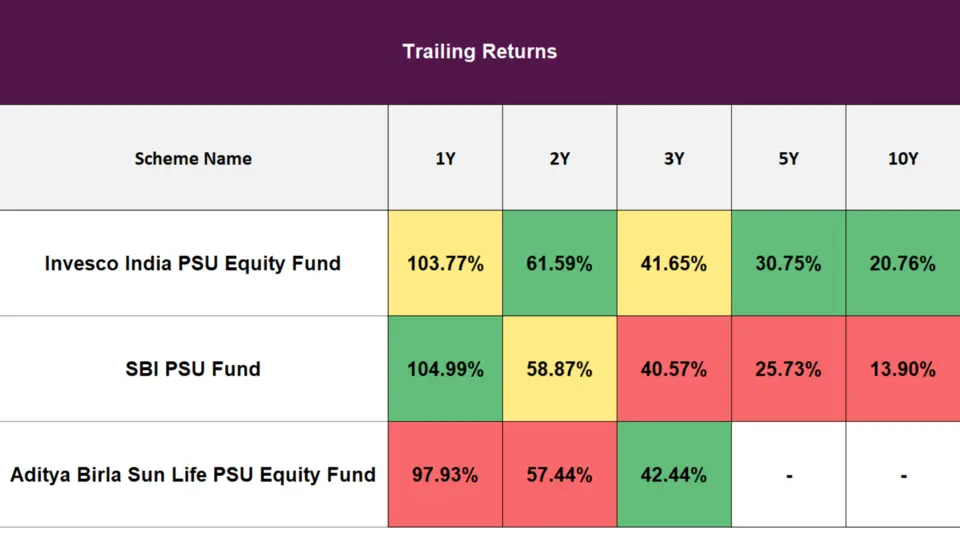

Comparative Analysis of Trailing Returns

Let’s break down the trailing returns of these three funds, analyzing their performance over 1-year, 2-year, 3-year, 5-year, and 10-year periods.

1. Invesco India PSU Equity Fund

| Period | Trailing Return |

| 1Y | 103.77% |

| 2Y | 61.59% |

| 3Y | 41.65% |

| 5Y | 30.75% |

| 10Y | 20.76% |

Key Takeaways:

- Impressive 1-Year Return: The fund achieved a 1-year return of 103.77%, indicating recent solid performance.

- Consistent Growth: The fund shows stable growth over extended periods, with a 2-year return of 61.59% and a 10-year return of 20.76%.

2. SBI PSU Fund

| Period | Trailing Return |

| 1Y | 104.99% |

| 2Y | 58.87% |

| 3Y | 40.57% |

| 5Y | 25.73% |

| 10Y | 13.90% |

Key Takeaways:

- Leading 1-Year Return: The fund has the highest 1-year return of 104.99%, showcasing robust recent performance.

- Steady Long-Term Growth: With a 10-year return of 13.90%, the fund demonstrates sustained growth over the long term.

3. Aditya Birla Sun Life PSU Equity Fund

| Period | Trailing Return |

| 1Y | 97.93% |

| 2Y | 57.44% |

| 3Y | 42.44% |

Key Takeaways:

- Strong Short-Term Performance: The fund has a 1-year return of 97.93%, indicating solid recent performance.

- Lack of Long-Term Data: The absence of 5-year- and 10-year data limits long-term performance assessment.

Detailed Data Analysis Trailing Returns

Invesco India PSU Equity Fund

Invesco India PSU Equity Fund has delivered outstanding performance across various time frames. The 1-year return of 103.77% is impressive, reflecting recent solid gains. The fund’s consistent growth is evident in its 2-year return of 61.59% and 3-year return of 41.65%. Long-term returns also show stability, with a 10-year return of 20.76%, making it an attractive option for both short-term and long-term investors.

SBI PSU Fund

SBI PSU Fund leads with the highest 1-year return of 104.99%, indicating robust short-term performance. The fund also shows consistent growth over the medium term, with a 2-year return of 58.87% and a 3-year return of 40.57%. Its long-term performance, with a 10-year return of 13.90%, demonstrates sustained growth, albeit at a lower rate than the other funds. This fund suits investors looking for short-term solid gains and steady long-term growth.

Aditya Birla Sun Life PSU Equity Fund

Aditya Birla Sun Life PSU Equity Fund has shown strong short- and medium-term performance. The 1-year return of 97.93% and 2-year return of 57.44% indicate robust recent growth. The fund’s 3-year return of 42.44% also reflects its ability to generate substantial returns over a relatively short period. However, the lack of 5-year and 10-year data makes it challenging to assess long-term performance, suggesting investors should consider additional factors when evaluating this fund.

Key Takeaways

- Invesco India PSU Equity Fund: Offers impressive short-term and long-term performance, making it a strong choice for both short-term gains and long-term growth.

- SBI PSU Fund: Leading in short-term returns with robust performance across all time frames, ideal for investors seeking short-term solid gains and consistent long-term growth.

- Aditya Birla Sun Life PSU Equity Fund: Demonstrates solid short-term and medium-term performance but lacks long-term data, making it suitable for investors focused on shorter investment horizons.

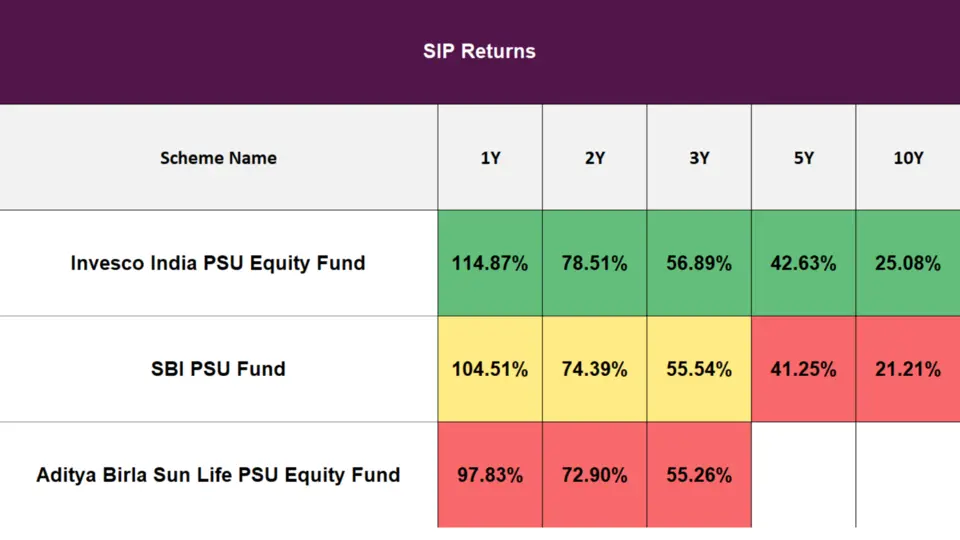

Comparative Analysis of SIP Returns

Let’s break down the SIP returns of these three funds, analyzing their performance over 1-year, 2-year, 3-year, 5-year, and 10-year periods.

1. Invesco India PSU Equity Fund

| Period | SIP Return |

| 1Y | 114.87% |

| 2Y | 78.51% |

| 3Y | 56.89% |

| 5Y | 42.63% |

| 10Y | 25.08% |

Key Takeaways:

- Outstanding 1-Year Return: The fund achieved a 1-year SIP return of 114.87%, indicating recent solid performance.

- Consistent Long-Term Growth: The fund shows stable growth over extended periods, with a 2-year return of 78.51% and a 10-year return of 25.08%.

2. SBI PSU Fund

| Period | SIP Return |

| 1Y | 104.51% |

| 2Y | 74.39% |

| 3Y | 55.54% |

| 5Y | 41.25% |

| 10Y | 21.21% |

Key Takeaways:

- High 1-Year Return: The fund has a 1-year SIP return of 104.51%, showcasing robust recent performance.

- Steady Long-Term Growth: With a 10-year return of 21.21%, the fund demonstrates sustained growth over the long term.

3. Aditya Birla Sun Life PSU Equity Fund

| Time Period | SIP Return |

| 1Y | 97.83% |

| 2Y | 72.90% |

| 3Y | 55.26% |

Key Takeaways:

- Strong Short-Term Performance: The fund has a 1-year SIP return of 97.83%, indicating solid recent performance.

- Lack of Long-Term Data: The absence of 5-year- and 10-year data limits long-term performance assessment.

Detailed Data Analysis SIP Returns

Invesco India PSU Equity Fund

Invesco India PSU Equity Fund has delivered exceptional performance across various time frames. The 1-year SIP return of 114.87% is impressive, reflecting recent solid gains. The fund’s consistent growth is evident in its 2-year return of 78.51% and 3-year return of 56.89%. Long-term returns also show stability, with a 10-year return of 25.08%, making it an attractive option for both short-term and long-term investors.

SBI PSU Fund

SBI PSU Fund shows strong performance across all time frames. The 1-year SIP return of 104.51% highlights robust short-term growth. The fund also demonstrates consistent growth over the medium term, with a 2-year return of 74.39% and a 3-year return of 55.54%. Its long-term performance, with a 10-year return of 21.21%, shows sustained growth, making it a reliable choice for long-term investors.

Aditya Birla Sun Life PSU Equity Fund

Aditya Birla Sun Life PSU Equity Fund has shown strong short- and medium-term performance. The 1-year SIP return of 97.83% and 2-year return of 72.90% indicate robust recent growth. The fund’s 3-year return of 55.26% also reflects its ability to generate substantial returns over a relatively short period. However, the lack of 5-year and 10-year data makes it challenging to assess long-term performance, suggesting investors should consider additional factors when evaluating this fund.

Key Takeaways

- Invesco India PSU Equity Fund: Offers impressive short-term and long-term performance, making it a strong choice for both short-term gains and long-term growth.

- SBI PSU Fund: Leading in short-term returns with robust performance across all time frames, ideal for investors seeking short-term solid gains and consistent long-term growth.

- Aditya Birla Sun Life PSU Equity Fund: Demonstrates solid short-term and medium-term performance but lacks long-term data, making it suitable for investors focused on shorter investment horizons.

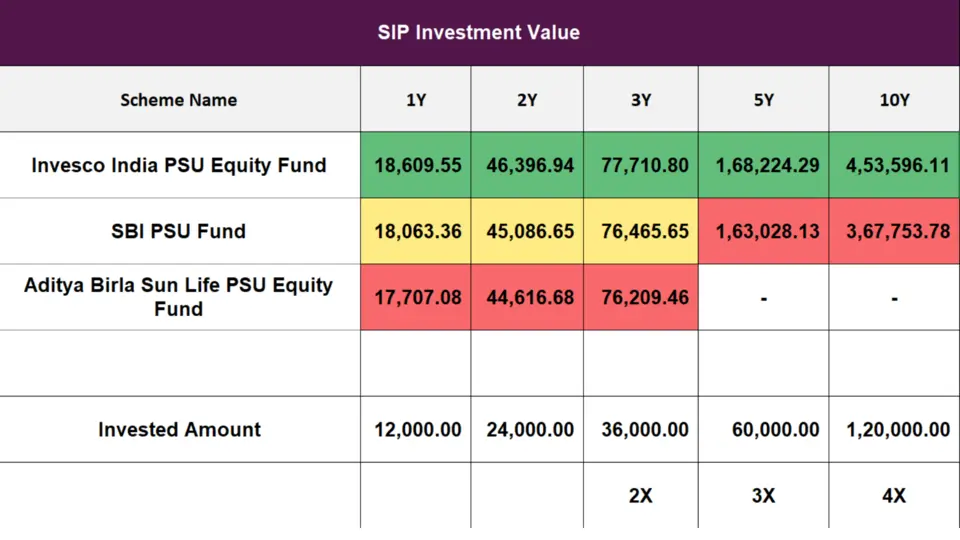

Comparative Analysis of SIP Investment Values

Let’s break down the SIP investment values of these three funds, analyzing their performance over 1-year, 2-year, 3-year, 5-year, and 10-year periods. This will give us insights into how much your investments could grow.

1. Invesco India PSU Equity Fund

| Period | SIP Investment Value (₹) |

| 1Y | 18,609.55 |

| 2Y | 46,396.94 |

| 3Y | 77,710.80 |

| 5Y | 1,68,224.29 |

| 10Y | 4,53,596.11 |

Key Takeaways:

- Outstanding 1-Year Value: The fund achieved an investment value of ₹18,609.55 for 1 year, showcasing recent solid performance.

- Consistent Long-Term Growth: The fund shows substantial growth over extended periods, with a 10-year investment value of ₹4,53,596.11.

2. SBI PSU Fund

| Period | SIP Investment Value (₹) |

| 1Y | 18,063.36 |

| 2Y | 45,086.65 |

| 3Y | 76,465.65 |

| 5Y | 1,63,028.13 |

| 10Y | 3,67,753.78 |

Key Takeaways:

- High 1-Year Value: The fund has an investment value of ₹18,063.36 for 1 year, indicating robust short-term growth.

- Steady Long-Term Growth: With a 10-year investment value of ₹3,67,753.78, the fund demonstrates consistent growth over the long term.

3. Aditya Birla Sun Life PSU Equity Fund

| Period | SIP Investment Value (₹) |

| 1Y | 17,707.08 |

| 2Y | 44,616.68 |

| 3Y | 76,209.46 |

Key Takeaways:

- Strong Short-Term Performance: The fund has a 1-year investment value of ₹17,707.08, showing solid recent performance.

- Lack of Long-Term Data: The absence of 5-year- and 10-year data limits long-term performance assessment.

Detailed Data Analysis SIP Investment Value

Invesco India PSU Equity Fund

Invesco India PSU Equity Fund has delivered exceptional SIP investment values across various time frames. The 1-year value of ₹18,609.55 is impressive, reflecting recent solid gains. The fund’s consistent growth is evident in its 2-year value of ₹46,396.94 and 3-year value of ₹77,710.80. Long-term returns also show significant growth, with a 10-year value of ₹4,53,596.11, making it an attractive option for both short-term and long-term investors.

SBI PSU Fund

SBI PSU Fund shows strong performance across all time frames. The 1-year SIP investment value of ₹18,063.36 highlights robust short-term growth. The fund also demonstrates consistent growth over the medium term, with a 2-year value of ₹45,086.65 and a 3-year value of ₹76,465.65. Its long-term performance, with a 10-year value of ₹3,67,753.78, shows sustained growth, making it a reliable choice for long-term investors.

Aditya Birla Sun Life PSU Equity Fund

Aditya Birla Sun Life PSU Equity Fund has shown strong short- and medium-term performance. The 1-year SIP investment value of ₹17,707.08 and the 2-year value of ₹44,616.68 indicate robust recent growth. The fund’s 3-year value of ₹76,209.46 also reflects its ability to generate substantial returns over a relatively short period. However, the lack of 5-year and 10-year data makes it challenging to assess long-term performance, suggesting investors should consider additional factors when evaluating this fund.

Key Takeaways

- Invesco India PSU Equity Fund: Offers impressive short-term and long-term performance, making it a strong choice for both short-term gains and long-term growth.

- SBI PSU Fund: Leading in short-term returns with robust performance across all time frames, ideal for investors seeking short-term solid gains and consistent long-term growth.

- Aditya Birla Sun Life PSU Equity Fund: Demonstrates solid short-term and medium-term performance but lacks long-term data, making it suitable for investors focused on shorter investment horizons.

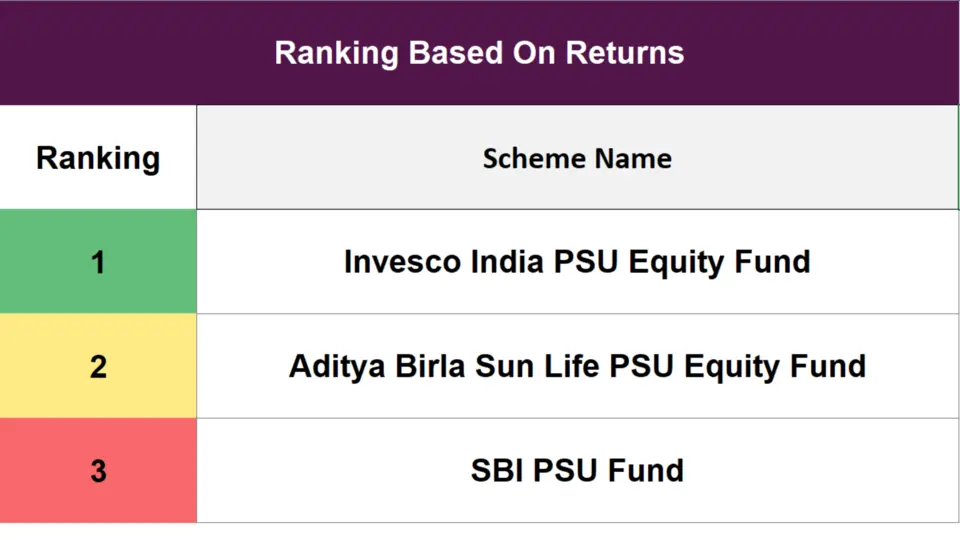

Ranking Based On Returns

Regarding returns, these three funds have shown varying degrees of performance. Let’s look at how they rank:

Risk Analysis

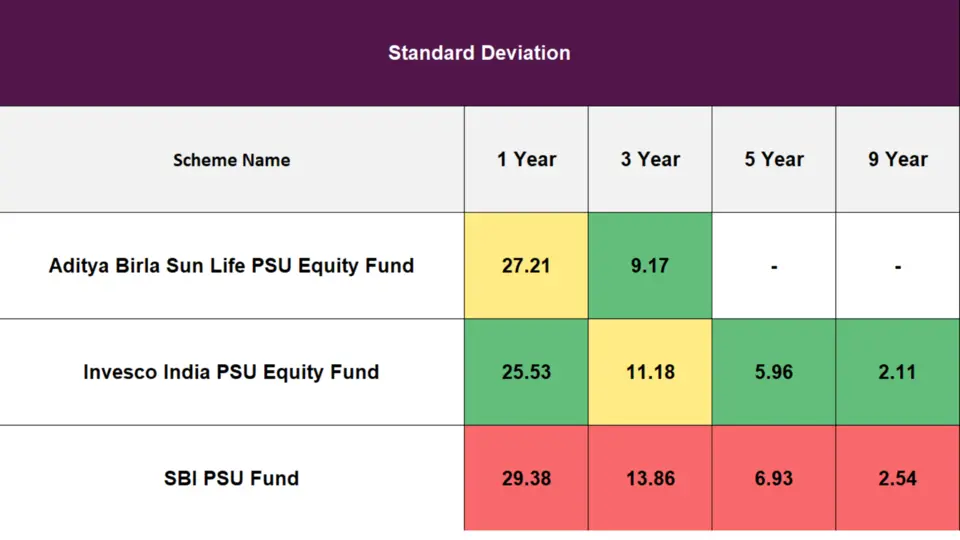

Standard Deviation

A lower standard deviation indicates more stable returns.

Key Takeaways:

- Invesco India PSU Equity Fund has the lowest 1-year standard deviation, indicating relatively stable returns.

- SBI PSU Fund shows the highest volatility in the 1 year.

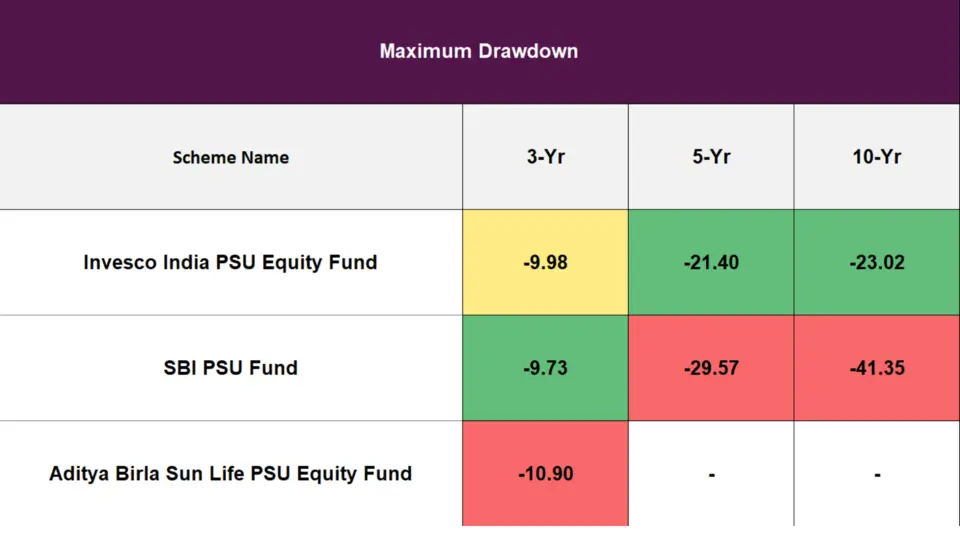

Maximum drawdown

Maximum drawdown measures the maximum negative returns from a peak to a trough of a portfolio, indicating the downside risk.

Key Takeaways:

- Invesco India PSU Equity Fund and SBI PSU Fund have similar 3-year drawdowns. Still, the SBI PSU Fund has a significantly higher drawdown over extended periods.

- Aditya Birla Sun Life PSU Equity Fund has a higher 3-year drawdown than the other two.

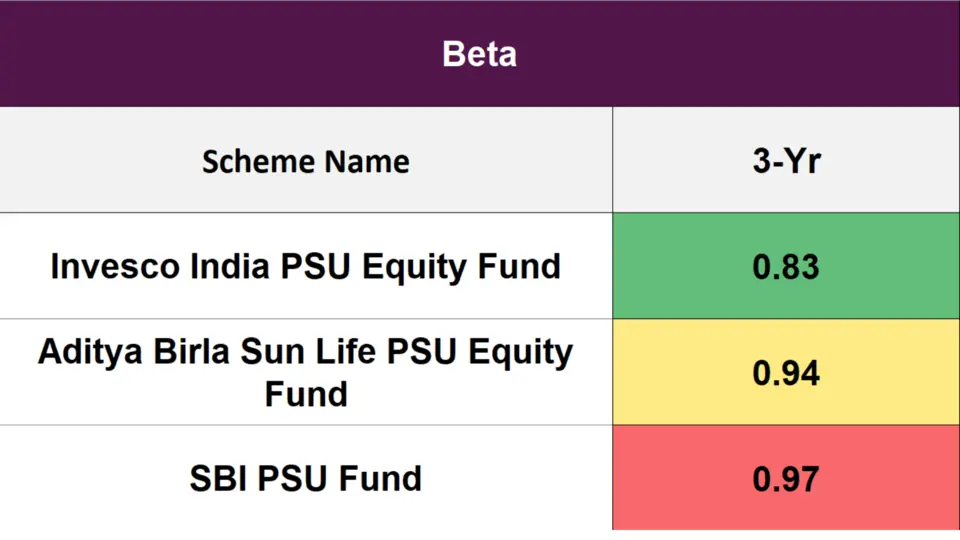

Beta

Beta measures a fund’s sensitivity to market movements. A beta value of less than one indicates lower volatility than the market.

Key Takeaways:

- Invesco India PSU Equity Fund has the lowest beta, indicating the most minor sensitivity to market movements.

- SBI PSU Fund has the highest beta, indicating higher volatility relative to the market.

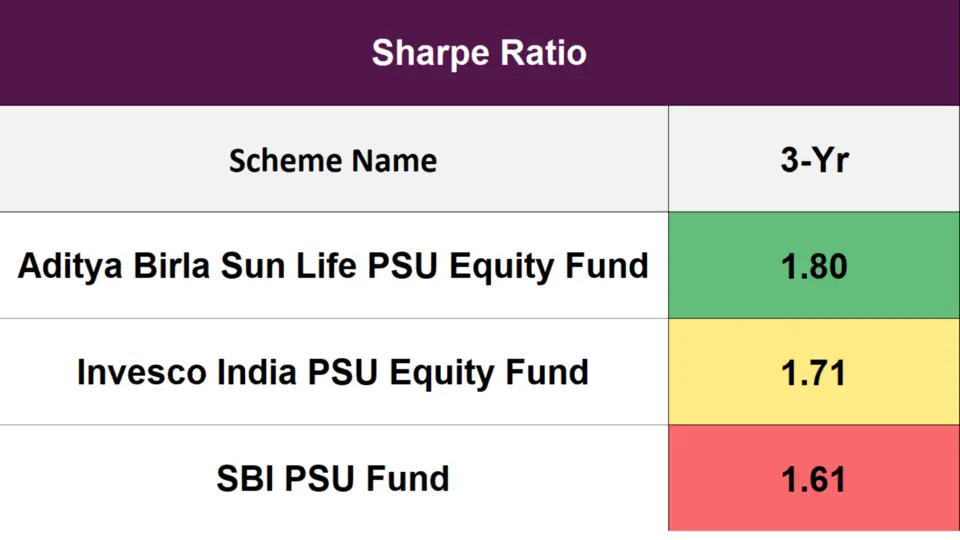

Sharpe Ratio

Sharpe ratio informs us about the risk-adjusted return of a fund. A higher Sharpe ratio indicates better risk-adjusted returns.

Key Takeaways:

- Aditya Birla Sun Life PSU Equity Fund leads with the highest Sharpe ratio, indicating superior risk-adjusted returns.

- SBI PSU Fund has the lowest Sharpe ratio among the three.

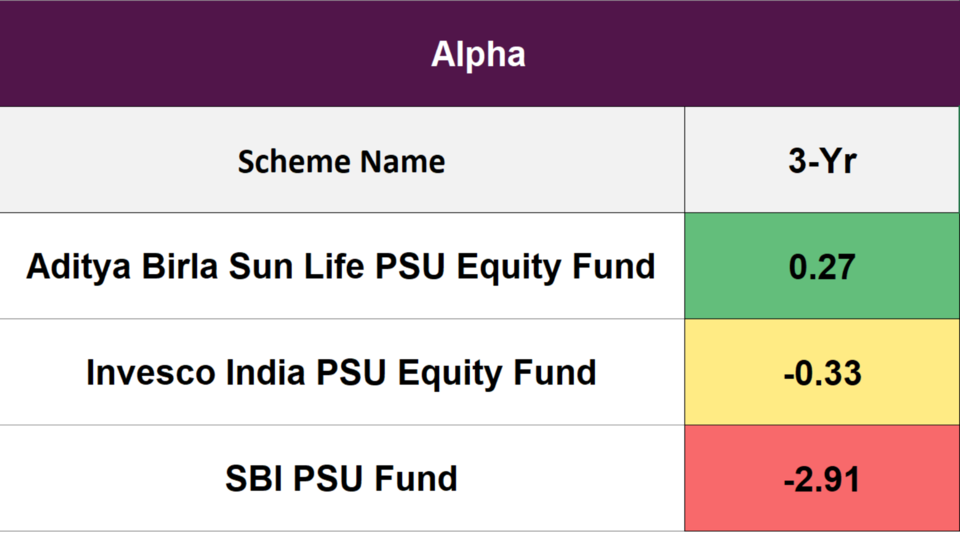

Alpha

Alpha measures a fund’s performance relative to a benchmark. Positive alpha indicates outperformance.

Key Takeaways:

- Aditya Birla Sun Life PSU Equity Fund has a positive alpha, indicating outperformance relative to the benchmark.

- SBI PSU Fund shows the lowest alpha, indicating underperformance.

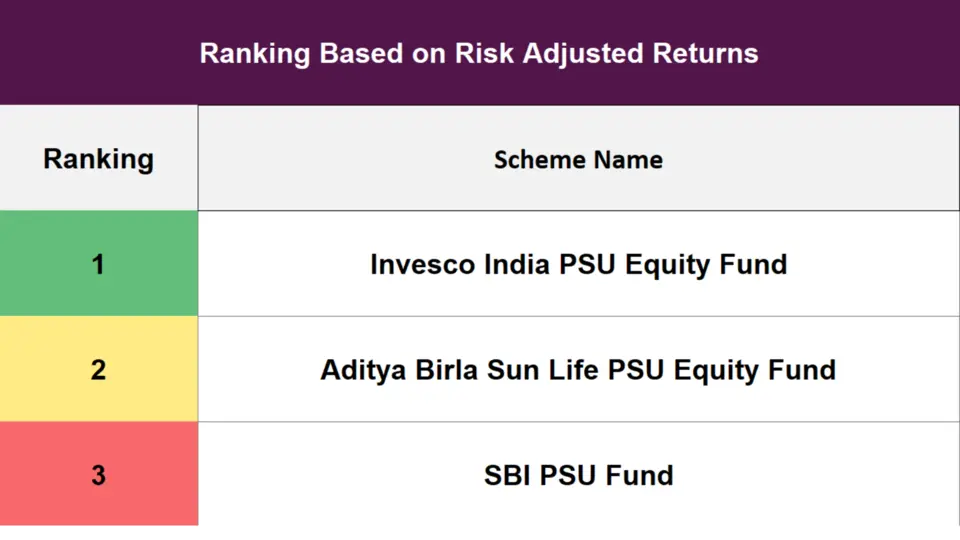

Ranking Based on Risk-Adjusted Returns

When considering risk-adjusted returns, here’s how the funds rank:

Invesco India PSU Equity Fund is at the top, followed by Aditya Birla Sun Life PSU Equity Fund. SBI PSU Fund is in third place.

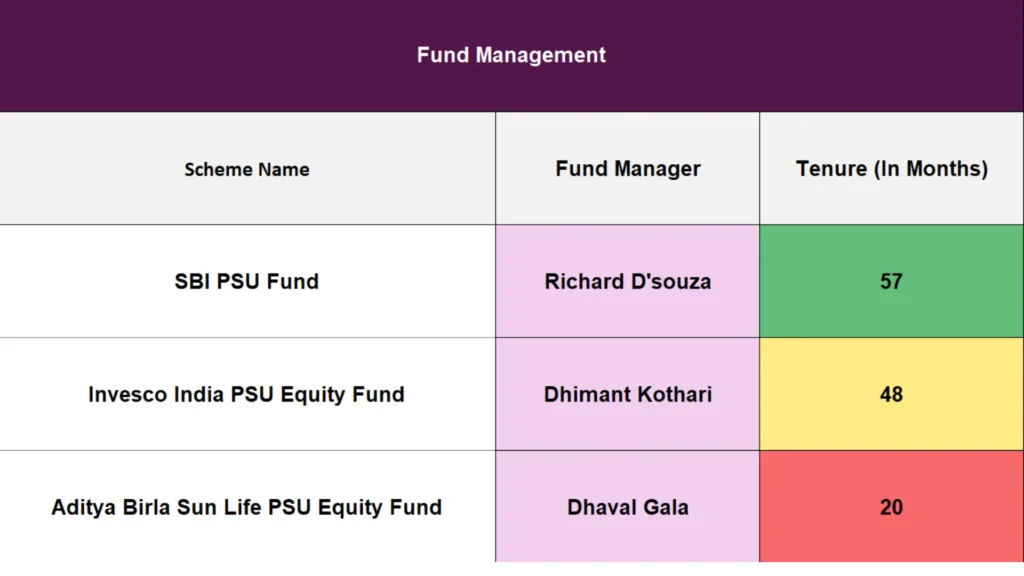

Fund Management Analysis

Fund management plays a crucial role in a fund’s performance. Let’s look at the tenure of the fund managers.

Key Takeaways:

- Richard D’souza of SBI PSU Fund has the longest tenure, suggesting stability in fund management.

- Dhaval Gala of Aditya Birla Sun Life PSU Equity Fund has the shortest tenure, which might indicate recent management changes.

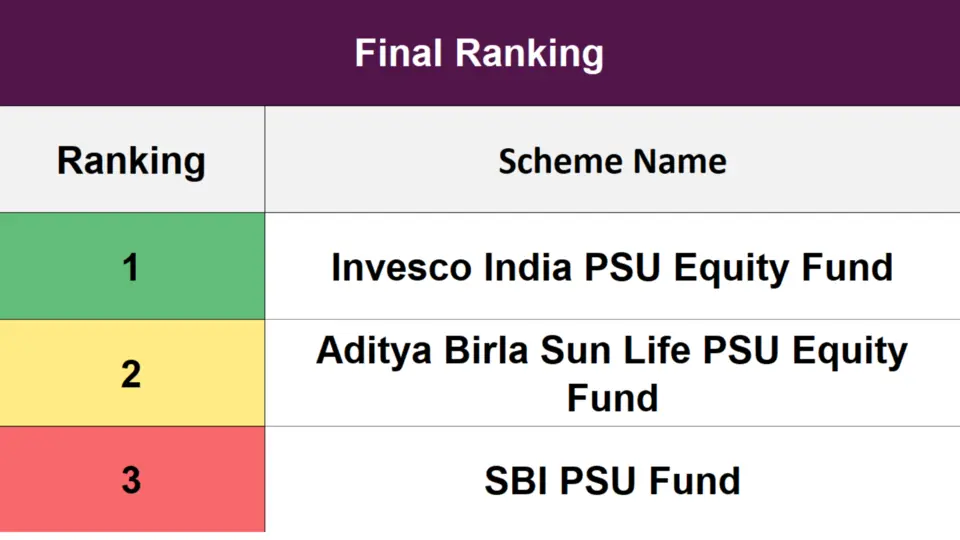

Final Ranking – Best PSU Mutual Fund 2024

Based on the comprehensive analysis, here’s the final ranking of the funds:

| Ranking | Scheme Name |

| 1 | Invesco India PSU Equity Fund |

| 2 | Aditya Birla Sun Life PSU Equity Fund |

| 3 | SBI PSU Fund |

Invesco India PSU Equity Fund emerges as the top performer, followed by Aditya Birla Sun Life PSU Equity Fund and SBI PSU Fund.

Key Takeaways

- Invesco India PSU Equity Fund stands out for its strong performance and lower volatility, making it a brilliant choice for investors looking for growth and stability.

- Aditya Birla Sun Life PSU Equity Fund excels in risk-adjusted returns, making it suitable for investors looking for high returns with moderate risk.

- SBI PSU Fund shows consistent growth but with higher volatility, making it ideal for investors willing to take on more risk for possibly higher rewards.

Conclusion:

In conclusion, the Invesco India PSU Equity Fund is the top performer across all parameters, making it the best overall choice for investors. However, the Aditya Birla Sun Life PSU Equity Fund is a strong contender for those seeking superior risk-adjusted returns. The SBI PSU Fund, while consistent, is more applicable for those with a higher risk tolerance due to its higher volatility.

Remember, if you plan to invest in PSU funds in the current market situation, invest only through the SIP mode. With valuations at an all-time high, avoid lump sum investments and plan for the long term, ideally for 5 to 7 years. Happy investing!

We hope you found this guide on mutual funds helpful.

If you have any mutual fund-related queries, feel free to comment below—we’re here to help! S.K. Singh, a registered professional with the Association of Mutual Funds in India (AMFI), will answer your queries and holds the ARN-251149.

Invest wisely!

FAQs -Best PSU Mutual Fund 2024

Which PSU mutual fund is the best overall performer?

Based on our comprehensive analysis, the Invesco India PSU Equity Fund is the best overall performer. It excels across various performance metrics, including returns, risk-adjusted returns, and stability, making it a strong choice for most investors.

What is the best PSU mutual fund for risk-adjusted returns?

The Aditya Birla Sun Life PSU Equity Fund stands out for its superior risk-adjusted returns. It has the highest Sharpe ratio among the three funds, indicating excellent performance relative to the risk taken.

Which PSU mutual fund is suitable for high-risk investors?

The SBI PSU Fund is better suited for high-risk investors. It shows consistent growth but has higher volatility, making it ideal for those willing to take on more risk for potentially higher rewards.

Q4: Should I invest in PSU funds through SIP or lump sum?

Given the current market situation with valuations at an all-time high, it’s advisable to invest in PSU funds through the SIP (Systematic Investment Plan) mode. This approach helps average the investment cost over time, reducing the impact of market volatility. Avoid lump sum investments and plan for the long term, ideally for 5 to 7 years.

What is the ideal investment horizon for PSU mutual funds?

A long-term investment horizon of at least 5 to 7 years is recommended for PSU mutual funds. This period allows your investment to grow and ride out market fluctuations, maximizing returns

Who manages the Invesco India PSU Equity Fund?

The Invesco India PSU Equity Fund is managed by Dhimant Kothari, who has been at the helm for 48 months. His expertise contributes significantly to the fund’s consistent performance.

What is the standard deviation of the SBI PSU Fund?

The standard deviation of the SBI PSU Fund over 1 year is 29.38, indicating higher volatility. Over more extended periods, such as 9 years, the standard deviation decreases to 2.54, reflecting more stable returns over the long term.

How does the maximum drawdown compare among these funds?

The Invesco India PSU Equity Fund has the lowest maximum drawdown over 10 years at -23.02%, indicating better downside protection. The SBI PSU Fund has the highest maximum drawdown at -41.35%, reflecting higher risk during market downturns.

What does the beta value indicate about these funds?

Beta measures a fund’s sensitivity to market movements. The Invesco India PSU Equity Fund has the lowest beta value at 0.83, indicating lower volatility relative to the market. The SBI PSU Fund has the highest beta at 0.97, suggesting higher market sensitivity

What should be my investment strategy for PSU mutual funds in 2024?

In the current market scenario, investing in PSU mutual funds through SIP mode mitigates high valuations. Avoid lump sum investments and plan long-term, aiming for at least 5 to 7 years to maximize growth and minimize risk

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.