Are you ready to dive deep into the best small cap mutual funds in 2024? In this blog, we’ll explore detailed, in-depth analysis and not just stop at delivering the best analysis but also unravel the best strategies to follow in the current market situation. We’ll discuss everything from SIPs to lump-sum investments in this blog.

Let’s kickstart with returns analysis, focusing on high returns and consistent performance. Which funds have outperformed in the small-cap category? Let’s start our journey with a thorough examination of returns!

Returns Analysis:

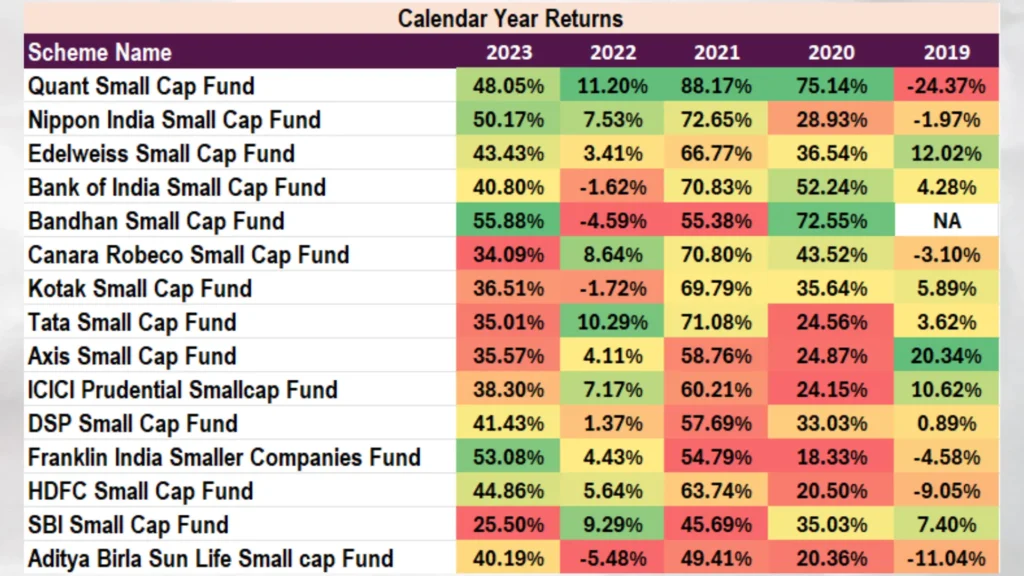

Calendar Year Returns

Analysis and Key Takeaways

- Quant Small Cap Fund: Impressive growth across the years with significant positive returns, showcasing consistency and reliability. The fund experienced a remarkable turnaround from negative returns in 2019 to substantial gains in subsequent years.

- Nippon India Small Cap Fund: Another top performer, consistently delivering solid returns, albeit with slight fluctuations. Investors can rely on its stability and potential for growth.

- Bandhan Small Cap Fund: Despite missing data for 2019, it has demonstrated robust returns in recent years, making it a noteworthy contender for investment consideration.

- Franklin India Smaller Companies Fund: Exhibits fluctuating returns, with notable growth in 2023, followed by a dip in 2024. Investors should assess risk tolerance before considering this fund.

- SBI Small Cap Fund: While showing positive returns, it exhibits lower growth than some peers, suggesting a more conservative investment approach.

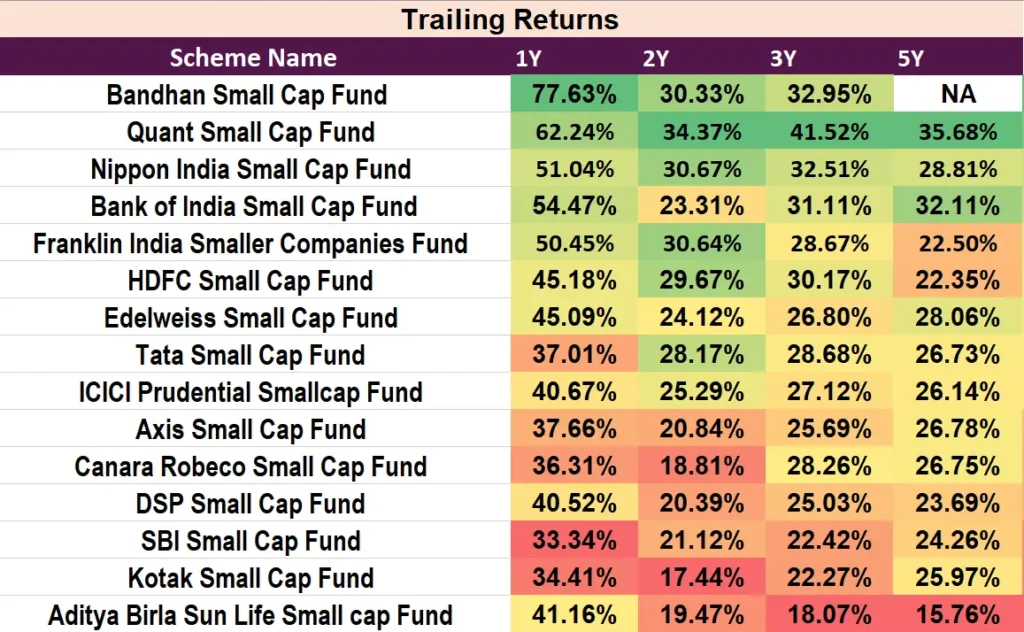

Trailing Returns Analysis

Analysis and Key Takeaways

- Bandhan Small Cap Fund: Displays exceptional returns over the past year, making it a standout performer in the small-cap category. However, data for the 5 years is unavailable, limiting the long-term analysis.

- Quant Small Cap Fund: Boasts impressive returns across all time frames, indicating consistent growth and reliability. Investors seeking stability and potential for growth may find this fund appealing.

- Nippon India Small Cap Fund: Another strong contender with notable returns and steady performance over the years. Investors can rely on its track record for consistent growth.

- Aditya Birla Sun Life Small Cap Fund: While showing positive returns, it lags behind some peers in growth, suggesting a more conservative investment approach.

- HDFC Small Cap Fund: Exhibits consistent performance, although with slightly lower returns than top performers like Quant Small Cap Fund and Nippon India Small Cap Fund.

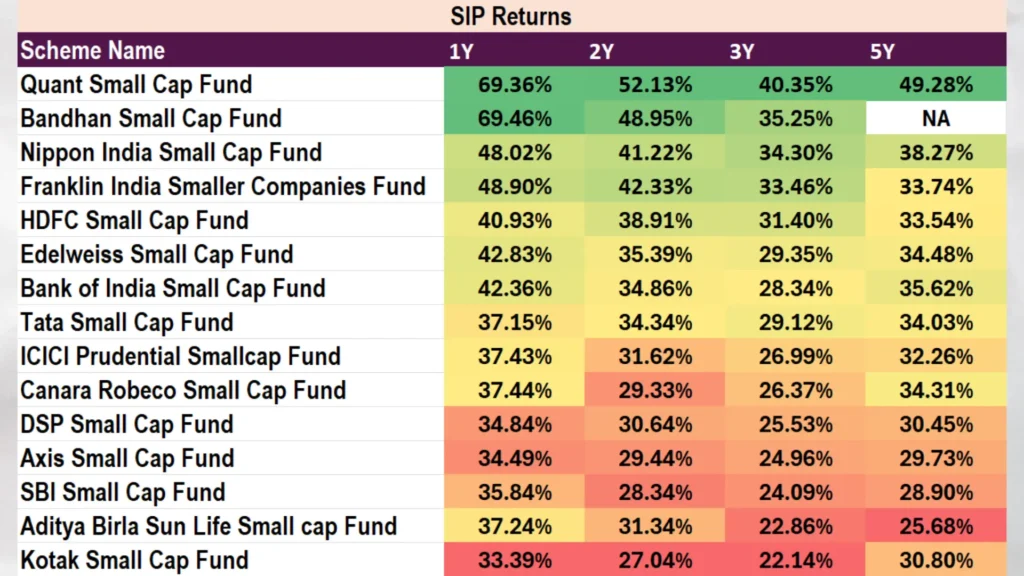

SIP Returns Analysis

Analysis and Key Takeaways

- Quant Small Cap Fund: Emerges as the top performer across all time frames, with impressive SIP returns. This fund showcases consistency and reliability, making it a strong contender for long-term investment goals.

- Bandhan Small Cap Fund: Follows closely behind Quant Small Cap Fund, exhibiting robust returns over the past year and demonstrating growth potential. However, data for the 5 years is unavailable, limiting long-term analysis.

- Nippon India Small Cap Fund: While showing positive returns, it lags behind the top performers, suggesting a more moderate growth trajectory. Investors should assess risk tolerance before considering this fund.

- HDFC Small Cap Fund: Displays steady performance, although with slightly lower returns than top performers like Quant Small Cap Fund and Bandhan Small Cap Fund. Investors seeking stability may find this fund appealing.

- Aditya Birla Sun Life Small Cap Fund: Shows positive returns but trails behind in growth compared to some peers. This fund may suit investors with a more conservative risk appetite.

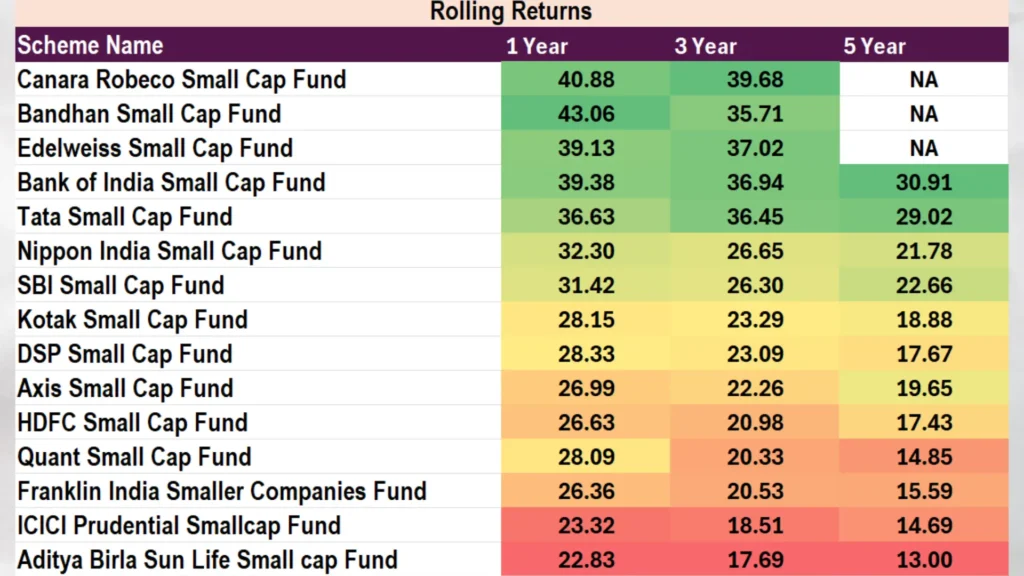

Rolling Returns Analysis

Analysis and Key Takeaways

- Bandhan Small Cap Fund: Emerges as a top performer across all time frames, boasting impressive rolling returns. With consistent growth over the years, this fund demonstrates its potential to generate substantial returns for investors.

- Canara Robeco Small Cap Fund: Another strong contender, particularly in the 1-year and 3-year rolling return categories. Although data for the 5 years is unavailable, its performance in shorter time frames is commendable.

- Bank of India Small Cap Fund: Shows promising returns, especially over the 3 years, positioning it as a favourable choice for investors seeking steady growth potential.

- Tata Small Cap Fund: Exhibits consistent performance across various time frames, offering investors a reliable option for long-term investment goals.

- Nippon India Small Cap Fund and SBI Small Cap Fund: While delivering positive returns, these funds lag behind some peers in growth, indicating a more moderate performance trajectory.

- Aditya Birla Sun Life Small Cap Fund: Shows relatively lower returns than top performers, suggesting a more conservative growth pattern.

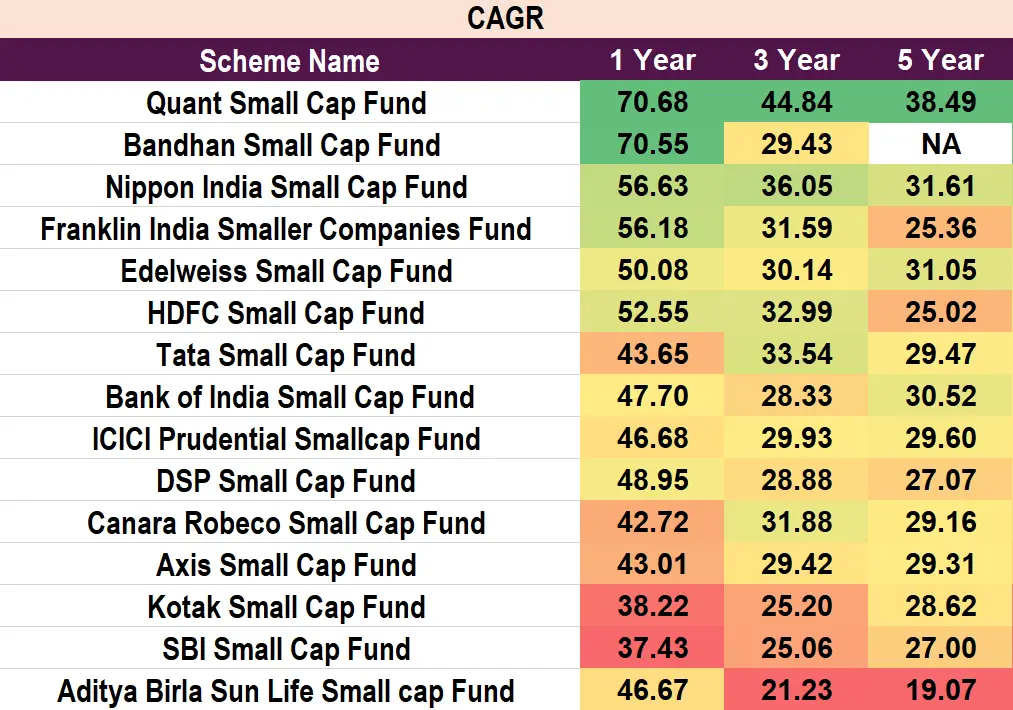

Comparative Analysis of CAGR

Analysis and Key Takeaways

- Quant Small Cap Fund: Leads the pack with impressive CAGR across all time frames, making it a top contender for investors seeking high-growth opportunities in the small-cap segment.

- Bandhan Small Cap Fund: Exhibits stellar CAGR in the 1 year but lacks data for the 5 years. However, its short-term performance highlights its potential for significant returns.

- Nippon India Small Cap Fund and Franklin India Smaller Companies Fund: Show consistent growth over different time frames, positioning them as reliable options for long-term investors looking for steady returns.

- Edelweiss Small Cap Fund and HDFC Small Cap Fund: Demonstrate commendable performance, particularly in the 3 years, showcasing their ability to deliver consistent returns to investors.

- Aditya Birla Sun Life Small Cap Fund: While exhibiting a relatively lower CAGR than top performers, it still offers a viable investment option for those seeking a balanced approach to small-cap investments.

Risk Analysis:

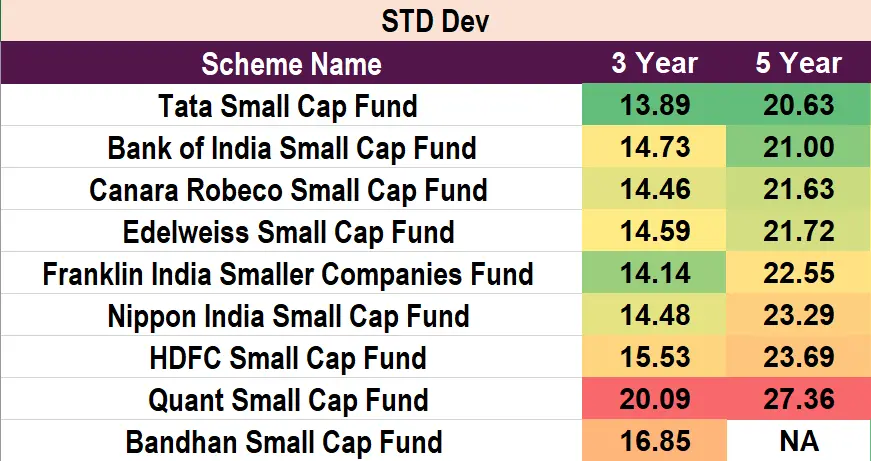

Comparative Analysis of Standard Deviation

Analysis and Key Takeaways

- Tata Small Cap Fund: Exhibits relatively lower standard deviation than its peers over the 3-year and 5-year periods, indicating comparatively lower volatility. This could be appealing to investors seeking stability in their investment portfolios.

- Bank of India Small Cap Fund and Canara Robeco Small Cap Fund: Demonstrate consistent standard deviation figures across both time frames, reflecting moderate levels of volatility. These funds offer a balanced risk-return profile for investors with a moderate risk appetite.

- Edelweiss Small Cap Fund and Franklin India Smaller Companies Fund Show marginally higher standard deviation figures, particularly in the 5 years, suggesting slightly higher volatility. Investors considering these funds should be prepared for fluctuations in returns.

- Nippon India Small Cap Fund and HDFC Small Cap Fund: Exhibit higher standard deviation figures, indicating greater volatility in returns. While these funds may offer the prospective for higher returns, investors should be aware of the increased risk associated with them.

- Quant Small Cap Fund: This fund stands out with the highest standard deviation figures among the analyzed funds, highlighting its significantly higher volatility. Investors considering this fund should be prepared for potentially more significant return fluctuations.

- Bandhan Small Cap Fund: While data for the 5-year standard deviation is unavailable, its 3-year standard deviation falls within the mid-range compared to other funds, suggesting moderate volatility.

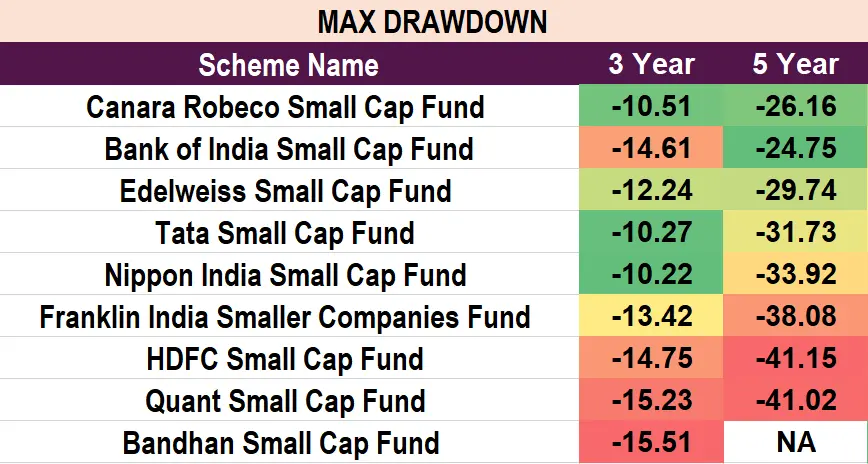

Comparative Analysis of Maximum Drawdown

Analysis and Key Takeaways

- Canara Robeco Small Cap Fund: Exhibits relatively lower maximum drawdown figures than other funds over the 3-year- and 5-year periods. This suggests the fund has experienced comparatively smaller declines from its peak value, indicating lower risk.

- Bank of India Small Cap Fund and Edelweiss Small Cap Fund: Demonstrate moderate maximum drawdown figures, reflecting a moderate level of risk exposure. While these funds have experienced significant declines, they may still appeal to investors seeking a balance between risk and potential returns.

- Tata Small Cap Fund and Nippon India Small Cap Fund Show relatively lower maximum drawdown figures over the 3 years but exhibit higher drawdowns over the 5 years. This indicates that while the funds may have experienced smaller declines in the short term, they have faced greater risk exposure over a longer duration.

- Franklin India Smaller Companies Fund, HDFC Small Cap Fund, and Quant Small Cap Fund: Display higher maximum drawdown figures, suggesting higher risk levels associated with these funds. Investors considering these funds should be prepared for more significant potential losses during market downturns.

- Bandhan Small Cap Fund: Data for the 5-year maximum drawdown is unavailable. However, its 3-year drawdown falls within the mid-range compared to other funds, indicating a moderate level of risk.

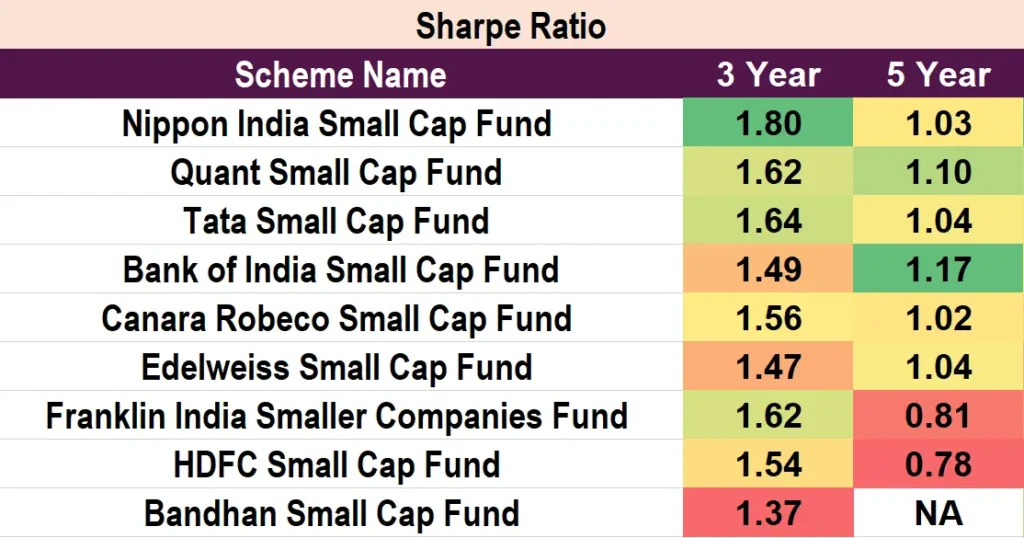

Comparative Analysis of Sharpe Ratio

Analysis and Key Insights

- Nippon India Small Cap Fund: Leads the pack with the highest Sharpe Ratio over the 3-year and 5-year periods, indicating superior risk-adjusted returns. Investors in this fund have enjoyed attractive returns relative to the level of risk taken.

- Quant Small Cap Fund and Tata Small Cap Fund: Demonstrate strong Sharpe Ratios, signalling efficient risk management and competitive returns. These funds offer a favourable balance between risk and reward, making them appealing options for investors seeking stable performance.

- Bank of India Small Cap Fund and Canara Robeco Small Cap Fund: Exhibit respectable Sharpe Ratios, showcasing their ability to generate returns while effectively managing risk. These funds may appeal to investors seeking stability and growth potential.

- Edelweiss Small Cap Fund and Franklin India Smaller Companies Fund: Show competitive Sharpe Ratios, indicating reasonable risk-adjusted returns. While these funds have delivered satisfactory performance, investors should evaluate their risk-taking capacity and investment goals sensibly.

- HDFC Small Cap Fund: Displays a moderate Sharpe Ratio over the 3 years but experiences a decline in the 5-year ratio. This suggests a decrease in risk-adjusted returns over the longer term, signalling a potential need for closer scrutiny.

- Bandhan Small Cap Fund: Data for the 5-year Sharpe Ratio is unavailable. However, its 3-year ratio falls within the mid-range compared to other funds, indicating a moderate level of risk-adjusted returns.

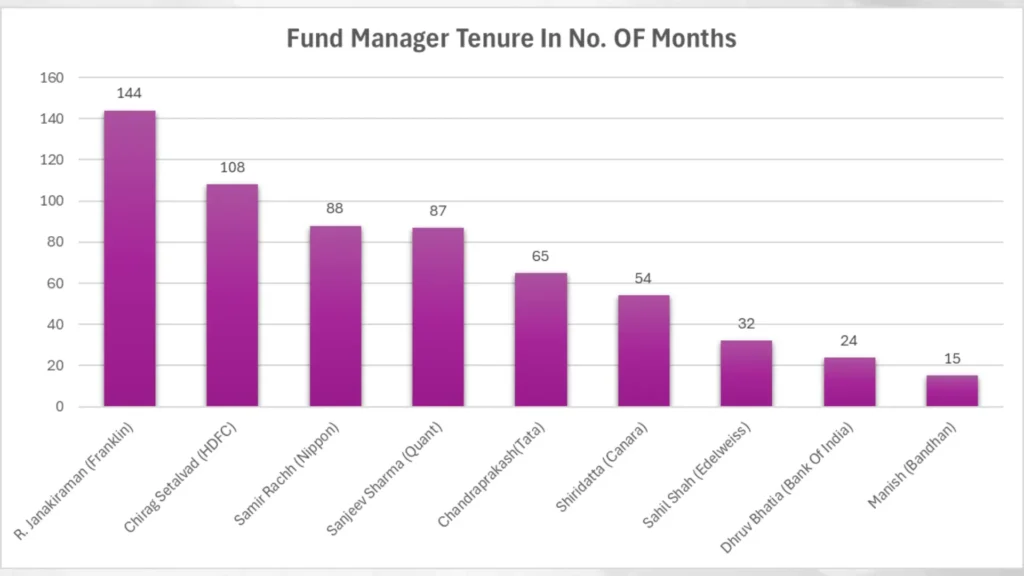

Fund Management Analysis:

Comparative Analysis of Fund Managers

Analysis and Key Insights

- Franklin India Smaller Companies Fund: Managed by R. Janakiraman from Franklin, boasts the longest tenure among the fund managers analyzed, with an impressive track record spanning 144 months. Janakiraman’s extensive experience brings stability and depth to the management of this fund.

- HDFC Small Cap Fund: Overseen by Chirag Setalvad from HDFC, with a tenure of 108 months. Setalvad’s tenure reflects a significant commitment to the fund’s long-term performance and stability, contributing to investor confidence.

- Nippon India Small Cap Fund: Managed by Samir Rachh from Nippon, demonstrates a tenure of 88 months. Rachh’s management style and expertise have played a crucial role in navigating market dynamics and delivering consistent returns to investors.

- Quant Small Cap Fund: Helmed by Sanjeev Sharma from Quant, with a tenure of 87 months. Sharma’s strategic approach to fund management has contributed to the fund’s resilience and ability to capitalize on market opportunities.

- Tata Small Cap Fund: Managed by Chandraprakash from Tata, showcasing a tenure of 65 months. Chandraprakash’s leadership has been instrumental in steering the fund through various market cycles, delivering value to investors over the long term.

- Canara Robeco Small Cap Fund: Led by Shiridatta from Canara, with a tenure of 54 months. Shiridatta’s management philosophy emphasizes disciplined investment and risk management, fostering investor trust and loyalty.

- Edelweiss Small Cap Fund: Managed by Sahil Shah from Edelweiss, demonstrating a tenure of 32 months. Shah’s leadership brings a fresh perspective to fund management, driving innovation and adaptability in a dynamic market environment.

- Bank of India Small Cap Fund: Overseen by Dhruv Bhatia from Bank of India, with a tenure of 24 months. Bhatia’s tenure reflects a relatively shorter period, indicating a developing track record and potential for growth under his stewardship.

- Bandhan Small Cap Fund: Managed by Manish from Bandhan, with a tenure of 15 months. While Manish’s tenure is relatively short, his leadership sets the foundation for future growth and performance in this fund.

Final Results

Best 3 Small Cap Funds with High-Risk

Investors seeking the highest potential returns often turn to high-risk small-cap funds. These funds typically invest in companies with smaller market capitalizations, which can lead to greater volatility but also greater rewards. Let’s take a look at the top three high-risk small-cap funds:

| Scheme Name | Risk Level |

| Quant Small Cap Fund | High |

| Nippon India Small Cap Fund | High |

| Bandhan Small Cap Fund | High |

Analysis and Insights:

- Quant Small Cap Fund: This fund has consistently delivered strong returns despite the higher risk associated with small-cap investments. With a focus on identifying promising small-cap stocks, Quant Small Cap Fund has attracted investors seeking aggressive growth opportunities.

- Nippon India Small Cap Fund: Another top performer in the high-risk category, Nippon India Small Cap Fund has demonstrated resilience and agility in navigating market fluctuations. Managed by experienced professionals, this fund aims to capitalize on emerging trends and untapped market segments.

- Bandhan Small Cap Fund: With a focus on high-growth potential companies, Bandhan Small Cap Fund aims to generate significant returns for investors willing to tolerate increased volatility. While relatively newer than other funds, it has shown promise in delivering above-average returns.

Best 3 Small Cap Funds with Above-High Risk

For investors looking to balance growth potential and risk, above-high risk small cap funds present an attractive option. These funds offer the potential for considerable returns without exposing investors to excessively high levels of volatility. Here are the top three above-high-risk small-cap funds:

| Scheme Name | Risk Level |

| Tata Small Cap Fund | Ave-High |

| Bank of India Small Cap Fund | Ave-High |

| Canara Robeco Small Cap Fund | Ave-High |

Analysis and Insights:

- Tata Small Cap Fund: Positioned as an above-high-risk fund, Tata Small Cap Fund aims to capture growth opportunities while managing risk through a diversified portfolio. With a focus on quality stocks and rigorous research, it offers investors a balanced approach to small-cap investing.

- Bank of India Small Cap Fund: Managed by seasoned professionals, Bank of India Small Cap Fund seeks to identify undervalued small cap stocks with the potential for long-term growth. Despite the inherent risk of small caps, the fund aims to provide stability through disciplined investment strategies.

- Canara Robeco Small Cap Fund: With a track record of delivering consistent returns, the Canara Robeco Small Cap Fund is well-suited for investors seeking above-average growth potential. By leveraging market insights and extensive research, the fund aims to capitalize on emerging opportunities in the small-cap segment.

Key Takeaways

- Diversification is Key: Investing in small-cap funds can be rewarding, but it’s essential to diversify your portfolio to mitigate risk.

- Understand Your Risk Tolerance: Assess your risk tolerance before investing in high-risk small-cap funds, which can be volatile.

- Regular Monitoring: Keep track of fund performance and market trends to make informed investment decisions.

Investment Strategy for Small Cap Funds in 2024

After witnessing a rally of over 70% in the past year, small-cap funds are now highly valued in the current market scenario. What strategy should you follow for SIP and lump sum investments in such a situation? Investing in SIP mode may prove to be the best and most effective for your investment portfolio. If there is a correction in the market in the coming times, the value of SIP can increase, and you can top up each year. On the other hand, when it comes to lump sum investments, it’s best to avoid them in the current market peak. Consider lump sum investment if there is a correction of at least 20 to 30% in the market.

Conclusion:

In conclusion, analyzing small-cap funds in 2024 provides valuable insights for investors seeking growth opportunities. Among the funds evaluated, Quant Small Cap is the top performer across all parameters, showcasing consistent returns and reliability. For investors with a high-risk appetite, Quant Small Cap, Nippon India Small Cap, and Bandhan Small Cap Funds present attractive options, offering potential for substantial returns despite market volatility.

However, for those seeking a balanced approach, Tata Small Cap, Bank of India Small Cap, and Canara Robeco Small Cap Funds stand out as better choices, providing growth potential with moderate risk levels. Regardless of the risk appetite, diversification and regular monitoring remain crucial strategies for maximizing returns and navigating market fluctuations effectively.

We hope you found this guide on mutual funds helpful.

If you have any mutual fund-related queries, feel free to comment below—we’re here to help! S.K. Singh, a registered professional with the Association of Mutual Funds in India (AMFI), will answer your queries and holds the ARN-251149.

Invest wisely!

FAQs – Best Small Cap Mutual Funds of 2024

Which small-cap funds have outperformed in terms of returns?

Quant Small Cap Fund, Nippon India Small Cap Fund, and Bandhan Small Cap Fund have demonstrated impressive returns consistently, making them top performers in the small-cap category.

What is the best investment strategy for small-cap funds in 2024?

For SIP investments, opting for a systematic investment plan (SIP) can be beneficial, allowing investors to capitalize on potential market corrections. However, lump-sum investments are advised to be avoided during market peaks and considered only after significant corrections.

Which small-cap funds are suitable for investors with a high-risk appetite?

Investors seeking high-risk opportunities may consider Quant Small Cap, Nippon India Small Cap, and Bandhan Small Cap Funds, known for their potential for substantial returns despite market volatility.

What are the top small-cap funds for investors looking for above-high-risk options?

Tata Small Cap Fund, Bank of India Small Cap Fund, and Canara Robeco Small Cap Fund are recommended for investors seeking above-average growth potential with moderate risk levels.

How important is diversification in investing in small-cap funds?

Diversification is crucial in small-cap fund investing to mitigate risk. By spreading investments across multiple funds, investors can reduce exposure to individual stock or market risks.

What factors should investors consider before investing in small-cap funds?

Investors should assess their risk tolerance, investment goals, and time horizon before investing in small-cap funds. Additionally, considering fund performance, volatility, and fund manager expertise are essential factors to evaluate.

Which fund emerges as the top performer across all parameters in the analysis?

Quant Small Cap Fund stands out as the top performer across all parameters, showcasing consistent returns and reliability.

How can investors make informed decisions while investing in small-cap funds?

Regular monitoring of fund performance and market trends, understanding risk tolerance, and staying updated with fund manager expertise are key to making informed investment decisions in small-cap funds.

What is the significance of the Sharpe Ratio in evaluating small-cap funds?

The Sharpe Ratio helps investors assess the risk-adjusted returns of a fund. Funds with higher Sharpe Ratios offer better returns relative to the risk taken, indicating efficient risk management.

Is it advisable to invest in small-cap funds during market peaks?

It’s generally advisable to be cautious with lump-sum investments during market peaks. Instead, investors can opt for SIP mode to manage market fluctuations effectively and capitalize on potential corrections.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.