Introduction

Choosing a suitable Aggressive Hybrid Fund can be overwhelming, especially when you have options like the ICICI Prudential Equity and Debt Fund vs Quant Absolute Fund, both of which have shown significant performance over time. This article aims to break down their essential aspects, including returns, investment style, and more, so you can decide which fund best aligns with your financial goals. And help you decide on your long-term investment strategy.

Investment Style

Let’s start by looking at the Investment Style of both funds.

| Fund Name | Investment Style |

| ICICI Prudential Equity and Debt Fund | Growth |

| Quant Absolute Fund | Blend |

- ICICI Prudential Equity and Debt Fund: This fund follows a Growth strategy, meaning it focuses on investing in stocks that are anticipated to grow at an above-average rate compared to the benchmark index and broader market.

- Quant Absolute Fund: This investment style blends growth and value investing, offering a balanced approach that seeks both capital appreciation and income generation.

Returns Analysis

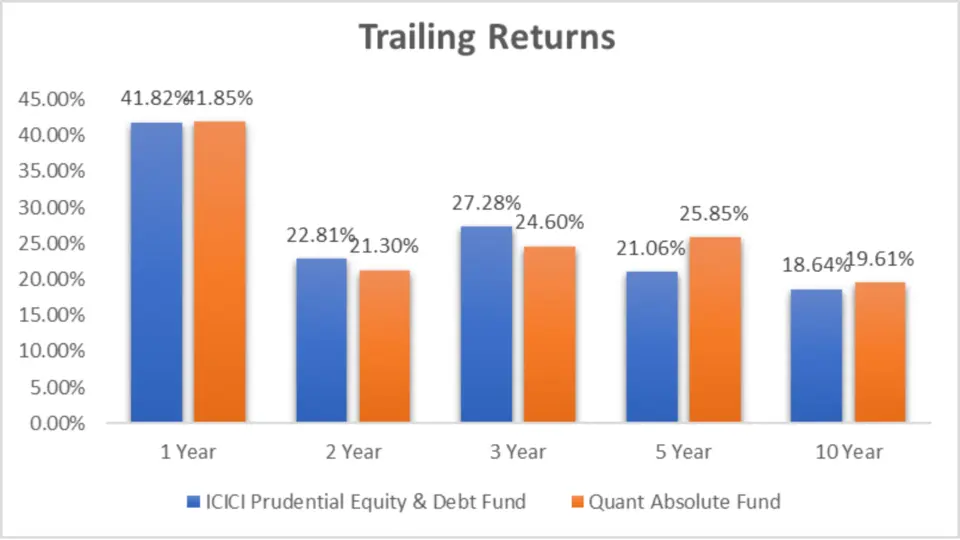

Trailing Returns

| Period Invested for | ICICI Prudential Equity and Debt Fund | Quant Absolute Fund |

| 1 Year | 41.82% | 41.85% |

| 2 Year | 22.81% | 21.30% |

| 3 Year | 27.28% | 24.60% |

| 5 Year | 21.06% | 25.85% |

| 10 Year | 18.64% | 19.61% |

Analysis

- 1-Year Returns: Both funds delivered nearly identical returns, with Quant Absolute Fund slightly edging out with 41.85%.

- 2-Year Returns: The ICICI Prudential fund led the race with 22.81%, compared to 21.30% by Quant Absolute.

- 3-Year Returns: ICICI Prudential continued to perform better with 27.28%, while Quant Absolute lagged at 24.60%.

- 5-Year Returns: The Quant Absolute Fund outshined here with 25.85%, surpassing the 21.06% returns from the ICICI Prudential Fund.

- 10-Year Returns: Over the long term, the Quant Absolute Fund maintained a slight advantage with a 19.61% return compared to 18.64% from ICICI Prudential.

Key Takeaways

- Short-Term Performance: For those looking at a short-term investment (1-3 years), the ICICI Prudential Equity and Debt Fund has shown more robust performance.

- Long-Term Performance: However, for a more extended investment horizon (5-10 years), the Quant Absolute Fund takes the lead, particularly in the 5-year mark.

- Balanced Approach: The Quant Absolute Fund’s blend strategy seems to work well over the long term, balancing risk and reward.

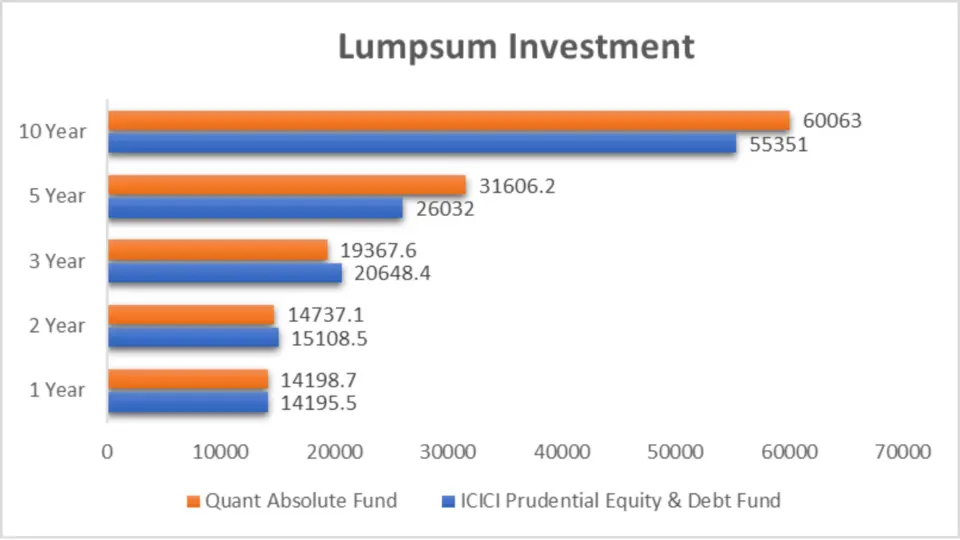

Lumpsum Investment Value Analysis

| Period Invested for | ICICI Prudential Equity and Debt Fund | Quant Absolute Fund |

| 1 Year | ₹14,195.5 | ₹14,198.7 |

| 2 Year | ₹15,108.5 | ₹14,737.1 |

| 3 Year | ₹20,648.4 | ₹19,367.6 |

| 5 Year | ₹26,032 | ₹31,606.2 |

| 10 Year | ₹55,351 | ₹60,063 |

Analysis

- 1-Year Investment Value: A lump sum of ₹10,000 would have grown to almost the same amount in both funds, with the Quant Absolute Fund just slightly ahead.

- 2-Year Investment Value: ICICI Prudential holds the higher value at ₹15,108.5.

- 3-Year Investment Value: The gap widens in favour of ICICI Prudential, with an investment value of ₹20,648.4.

- 5-Year Investment Value: Here, the Quant Absolute Fund pulls ahead, with a value of ₹31,606.2, significantly higher than ICICI Prudential’s ₹26,032.

- 10-Year Investment Value: Over a decade, the Quant Absolute Fund further cements its lead, with a lumpsum value of ₹60,063 compared to ₹55,351 from ICICI Prudential.

Key Takeaways

- Investment Strategy: Both funds have distinct investment strategies, with ICICI Prudential following a growth approach and Quant Absolute employing a blend of growth and value.

- Short vs Long Term: If you’re looking at a short-term investment horizon, ICICI Prudential Equity and Debt Fund might be the better option. However, from a long-term perspective, the Quant Absolute Fund has shown superior performance, especially over 5 to 10 years.

- Lumpsum Investments: The lump sum analysis shows that both funds have their strengths depending on the investment period. Quant Absolute Fund seems to be more suitable for those planning to invest for more than 5 years.

- Overall Recommendation: For a balanced and potentially higher long-term return, the Quant Absolute Fund may be more suitable. However, if you prioritize short-term gains, ICICI Prudential Equity & Debt Fund could be your go-to choice.

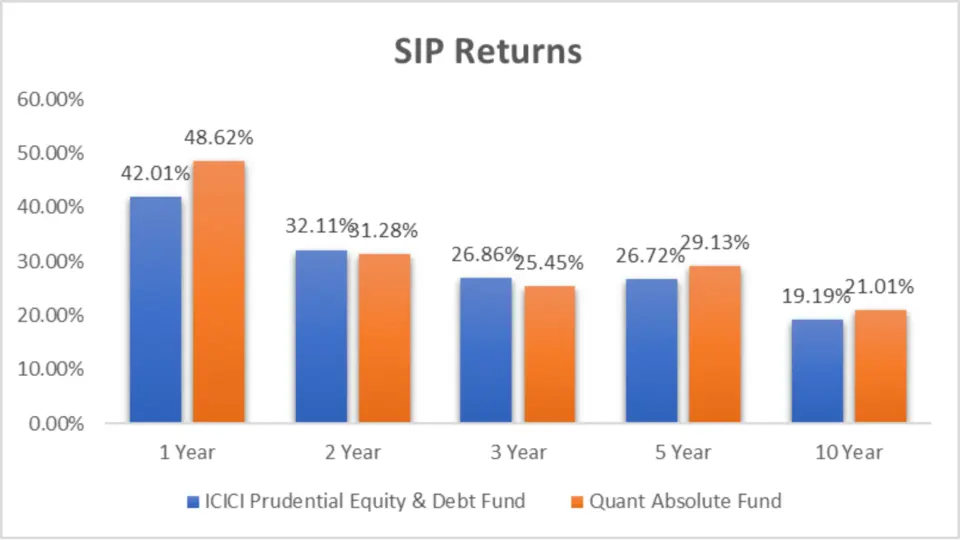

SIP Returns

| Period Invested for | ICICI Prudential Equity and Debt Fund | Quant Absolute Fund |

| 1 Year | 42.01% | 48.62% |

| 2 Year | 32.11% | 31.28% |

| 3 Year | 26.86% | 25.45% |

| 5 Year | 26.72% | 29.13% |

| 10 Year | 19.19% | 21.01% |

Analysis

- 1-Year SIP Returns: Quant Absolute Fund outperformed with an impressive 48.62% return compared to ICICI Prudential’s 42.01%.

- 2-Year SIP Returns: ICICI Prudential slightly edged out with 32.11%, but Quant Absolute wasn’t far behind at 31.28%.

- 3-Year SIP Returns: ICICI Prudential performed marginally better with a 26.86% return.

- 5-Year SIP Returns: The roles reversed here, with Quant Absolute delivering higher returns of 29.13%.

- 10-Year SIP Returns: Over the long haul, Quant Absolute once again took the lead with 21.01%, surpassing ICICI Prudential’s 19.19%.

Key Takeaways

- Short-Term Performance: Quant Absolute Fund has shown more robust performance in the short term, especially in the 1-year and 5-year periods.

- Consistency: ICICI Prudential Equity & Debt Fund shows a more consistent performance across different time frames, making it a solid choice for risk-averse investors.

- Long-Term Edge: For long-term investors (10 years and above), the Quant Absolute Fund offers a slight return edge, making it an attractive option for those willing to ride out market fluctuations.

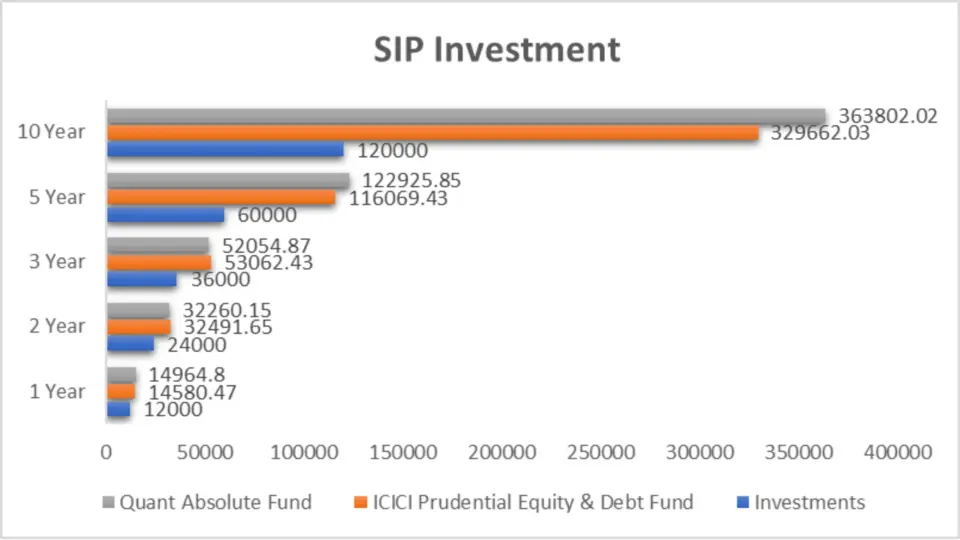

SIP Investment Value Analysis

| Period Invested for | Investments | ICICI Prudential Equity & Debt Fund | Quant Absolute Fund |

| 1 Year | ₹12,000 | ₹14,580.47 | ₹14,964.8 |

| 2 Year | ₹24,000 | ₹32,491.65 | ₹32,260.15 |

| 3 Year | ₹36,000 | ₹53,062.43 | ₹52,054.87 |

| 5 Year | ₹60,000 | ₹1,16,069.43 | ₹1,22,925.85 |

| 10 Year | ₹1,20,000 | ₹3,29,662.03 | ₹3,63,802.02 |

Analysis

- 1-Year SIP Investment Value: If you had invested ₹12,000 in SIPs, your investment would have grown to ₹14,964.8 with Quant Absolute, slightly more than the ₹14,580.47 from ICICI Prudential.

- 2-Year SIP Investment Value: ICICI Prudential takes the lead with a value of ₹32,491.65, compared to ₹32,260.15 from Quant Absolute.

- 3-Year SIP Investment Value: The gap narrows, with ICICI Prudential offering a slightly higher return of ₹53,062.43.

- 5-Year SIP Investment Value: Quant Absolute starts to pull ahead with a value of ₹1,22,925.85, compared to ₹1,16,069.43 from ICICI Prudential.

- 10-Year SIP Investment Value: Quant Absolute Fund outperforms over a decade, with a lumpsum value of ₹3,63,802.02 against ₹3,29,662.03 from ICICI Prudential.

Key Takeaways

- Initial Years: In the first few years, both funds offer competitive returns, but Quant Absolute Fund has a slight edge in the concise term (1 year).

- Mid-Term Growth: The 5-year mark is where Quant Absolute Fund starts to significantly outperform ICICI Prudential, making it an appealing option for mid-term investors.

- Long-Term Wealth Creation: For those with a long-term horizon, the Quant Absolute Fund proves to be a stronger candidate, offering higher investment value over 10 years.

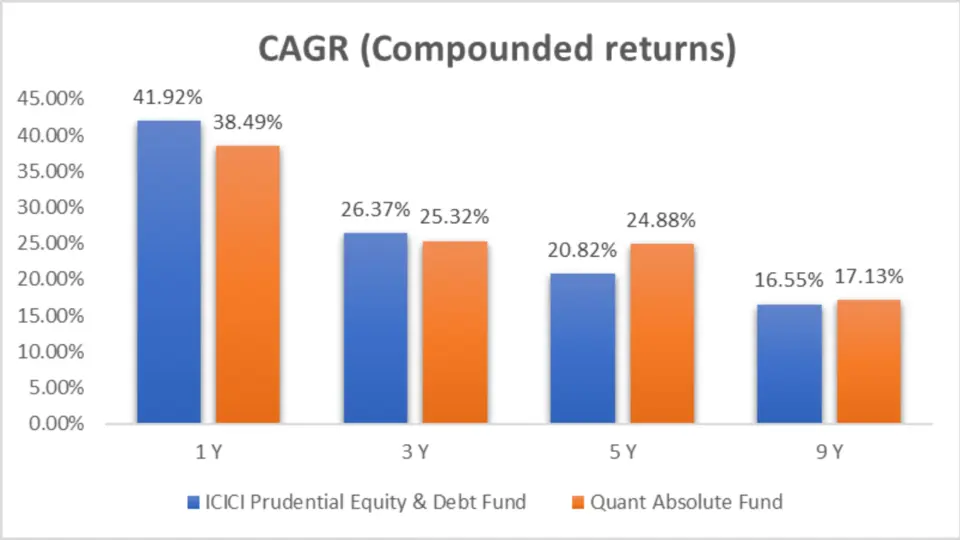

CAGR

| Category | 1 Year | 3 Year | 5 Year | 9 Year |

| ICICI Prudential Equity & Debt Fund | 41.92% | 26.37% | 20.82% | 16.55% |

| Quant Absolute Fund | 38.49% | 25.32% | 24.88% | 17.13% |

Analysis

- 1-Year CAGR: ICICI Prudential Fund leads with 41.92%, whereas Quant Absolute Fund trails slightly with 38.49%.

- 3-Year CAGR: ICICI Prudential maintains its lead at 26.37%, while Quant Absolute follows closely at 25.32%.

- 5-Year CAGR: Quant Absolute takes the lead with a higher CAGR of 24.88%, compared to 20.82% from ICICI Prudential.

- 9-Year CAGR: Over 9 years, Quant Absolute edges out ICICI Prudential with a CAGR of 17.13% compared to 16.55%.

Key Takeaways

- Short-Term Returns: For those looking for quick returns (1-3 years), ICICI Prudential Equity & Debt Fund generally offers better returns, although Quant Absolute Fund can deliver a more substantial boost in very short-term scenarios.

- Mid to Long-Term Growth: Quant Absolute Fund has demonstrated superior performance if your investment horizon stretches over 5 years or more, making it a better choice for wealth creation.

- Investment Value: Quant Absolute Fund outshines in terms of the SIP investment value, especially for those with a long-term perspective.

- CAGR Performance: ICICI Prudential Equity & Debt Fund may offer better short-term CAGR. Quant Absolute Fund takes the crown in the long run, with higher growth rates over 5-9 years

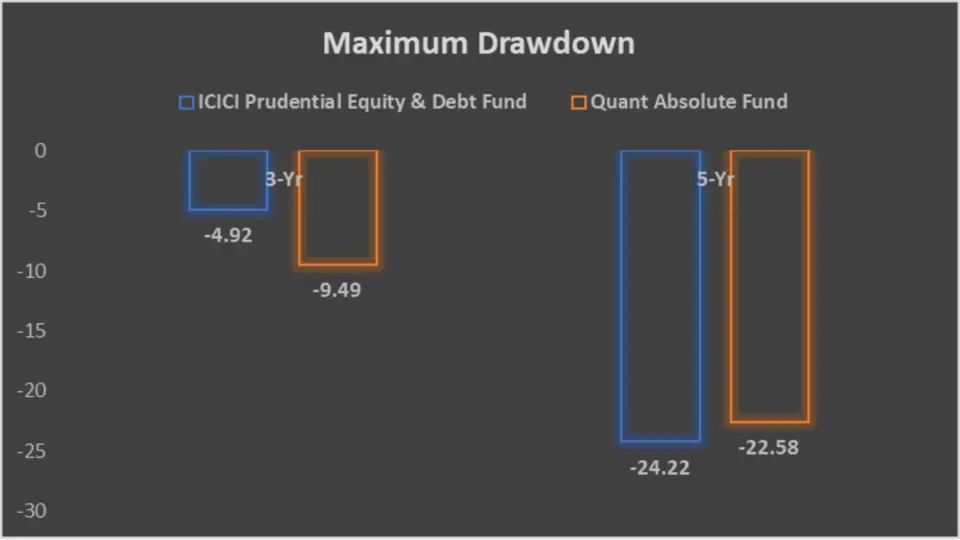

Risk Analysis

Maximum Drawdown Data:

| Fund | 3-Year Drawdown (%) | 5-Year Drawdown (%) |

| ICICI Prudential Equity & Debt Fund | -4.92 | -24.22 |

| Quant Absolute Fund | -9.49 | -22.58 |

Data Analysis:

- ICICI Prudential Equity & Debt Fund:

- 3-Year Maximum Drawdown: The fund experienced a drawdown of -4.92% over three years, which is relatively low, indicating that the fund has managed to protect investors from significant losses over a short-term period.

- 5-Year Maximum Drawdown: Over a more extended 5-year period, the fund’s maximum Drawdown was -24.22%. This indicates a higher risk over longer durations, possibly due to market fluctuations impacting its performance.

- Quant Absolute Fund:

- 3-Year Maximum Drawdown: Quant Absolute Fund saw a more substantial drawdown of -9.49% over three years, which is higher than ICICI Prudential. This suggests that the fund is more susceptible to short-term market downturns, potentially leading to more significant short-term losses for investors.

- 5-Year Maximum Drawdown: Interestingly, over five years, the Drawdown for Quant Absolute Fund decreased to -22.58%, which is lower than ICICI Prudential’s 5-year Drawdown. This shift indicates that the Quant Absolute Fund recovered better over the long term despite being more volatile in the short term.

Key Takeaways:

- ICICI Prudential Equity & Debt Fund provides better protection against short-term losses, as indicated by its lower 3-year Drawdown. This makes it more appealing to investors with a lower risk tolerance, especially those needing access to their funds within a few years.

- Quant Absolute Fund, while showing a higher short-term risk, demonstrates better long-term recovery with a lower 5-year drawdown. This could make it more suitable for investors who can afford to weather short-term volatility for potentially better long-term gains.

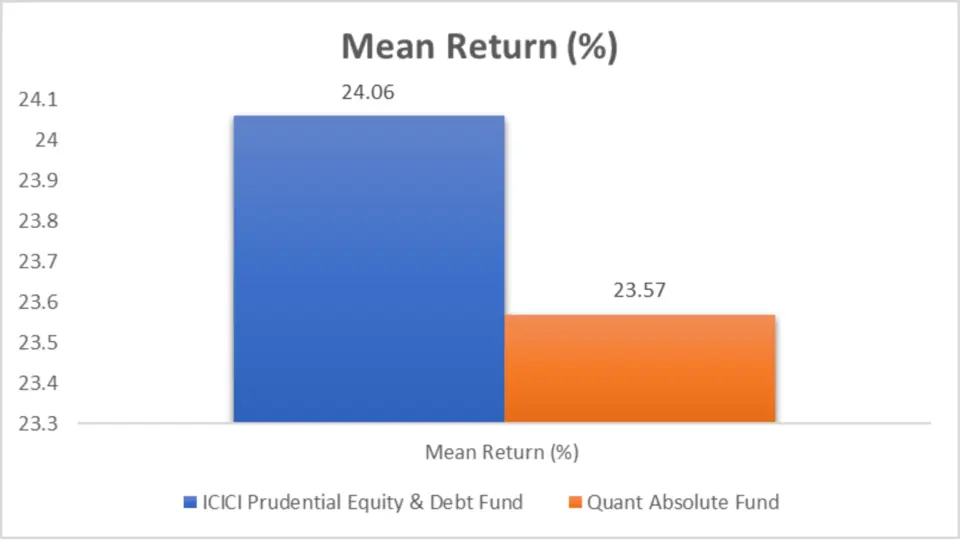

Mean Return

| Fund | Mean Return (%) |

| ICICI Prudential Equity & Debt Fund | 24.06 |

| Quant Absolute Fund | 23.57 |

Data Analysis:

- ICICI Prudential Equity & Debt Fund: With a mean return of 24.06%, this fund slightly outperforms Quant Absolute Fund.

- Quant Absolute Fund: Although not far behind, with a mean return of 23.57%, it shows a slightly lower return than its peers.

Key Takeaways

ICICI Prudential Equity & Debt Fund has a slight edge, delivering better average performance over the analysed period.

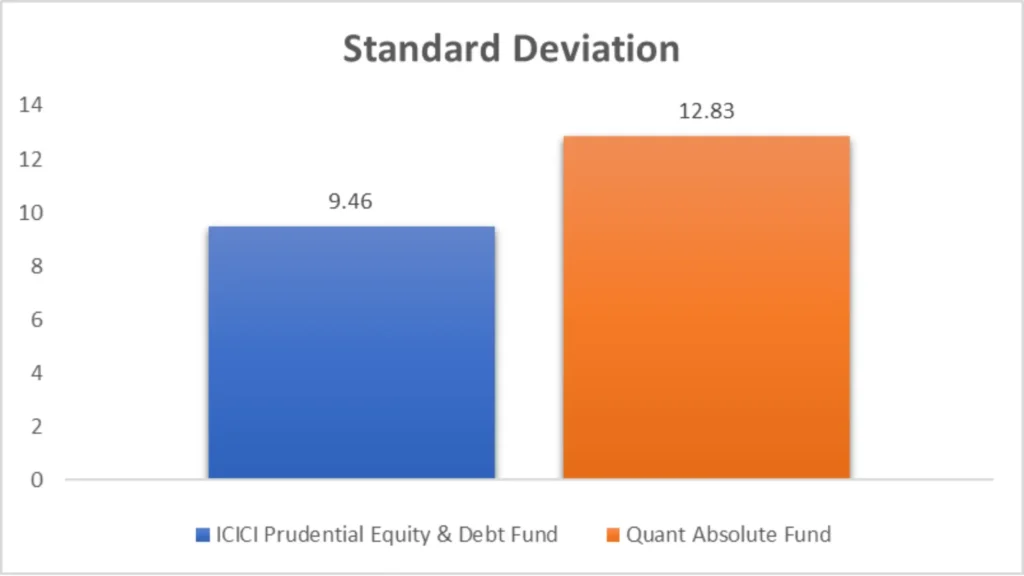

Standard Deviation

| Fund | Std Dev (%) 3Y |

| ICICI Prudential Equity & Debt Fund | 9.46 |

| Quant Absolute Fund | 12.83 |

Analysis:

- ICICI Prudential Equity & Debt Fund: A lower standard deviation of 9.46% suggests this fund is less volatile and more stable in its returns.

- Quant Absolute Fund: With a higher standard deviation of 12.83%, this fund is more volatile, indicating higher risk.

Key Takeaways

If stability is your priority, ICICI Prudential Equity & Debt Fund is the less risky option with lower volatility.

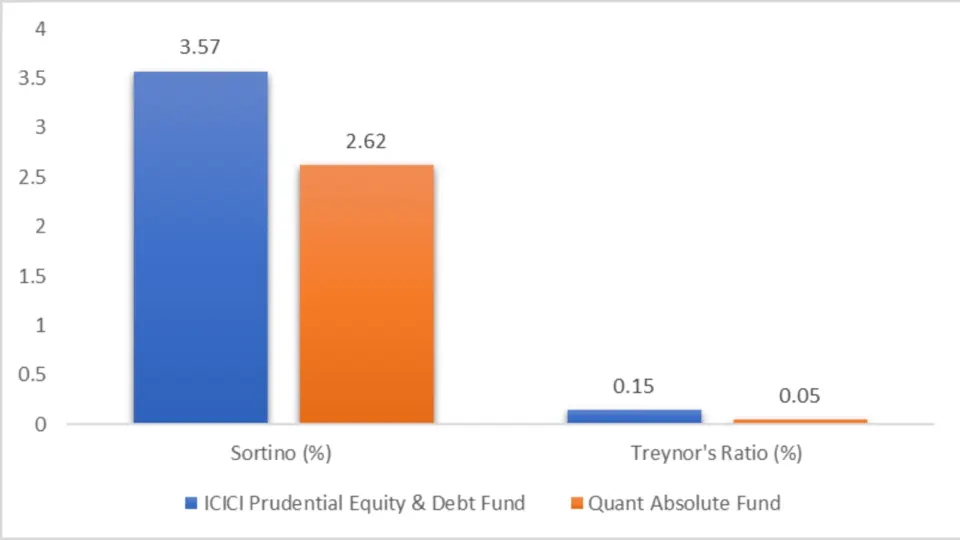

Sortino and Treynor’s Ratios

| Fund | Sortino Ratio (%) | Treynor’s Ratio (%) |

| ICICI Prudential Equity & Debt Fund | 3.57 | 0.15 |

| Quant Absolute Fund | 2.62 | 0.05 |

Analysis:

-

- The fund has a Sortino Ratio 2.62, which, while still respectable, is lower than that of ICICI Prudential. This suggests that Quant Absolute Fund offers lower risk-adjusted returns when considering downside risk.

- With a Treynor’s Ratio of 0.05, Quant Absolute Fund shows that it is less efficient at delivering returns relative to the market risk it takes on. This makes it less appealing for investors who are focused on market risk compensation.

Key Takeaways:

- Superior Risk Management: ICICI Prudential Equity & Debt Fund outperforms Quant Absolute Fund in both risk-adjusted metrics. Its higher Sortino Ratio indicates better protection against downside risk. At the same time, its superior Treynor’s Ratio shows a more efficient use of market risk to generate returns.

- Best for Risk-Averse Investors: For those who prioritize minimizing losses and maximizing risk-adjusted returns, ICICI Prudential Equity & Debt Fund stands out as the better option. It offers a more robust approach to managing both downside and market risks.

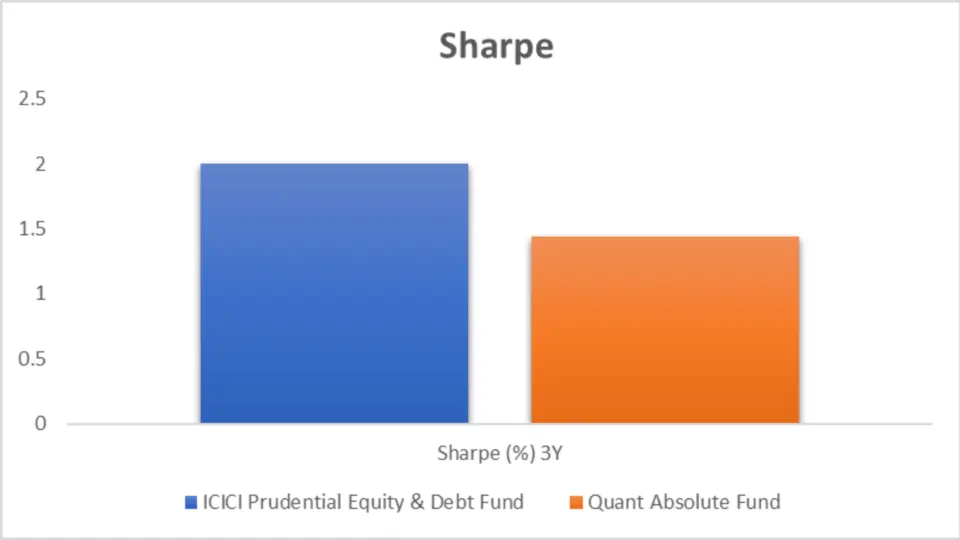

Sharpe Ratio

| Fund | Sharpe Ratio (%) 3Y |

| ICICI Prudential Equity & Debt Fund | 2.00 |

| Quant Absolute Fund | 1.44 |

Analysis:

- ICICI Prudential Equity & Debt Fund: With a Sharpe Ratio of 2.00, this fund offers better risk-adjusted returns, meaning it delivers more returns for its risk level.

- Quant Absolute Fund: A Sharpe Ratio of 1.44 is still vital but falls short of what ICICI Prudential provides.

Key Takeaways:

A higher Sharpe ratio indicates better risk-adjusted returns. ICICI Prudential Equity & Debt Fund has a higher Sharpe ratio, making it the more efficient choice to maximize returns relative to risk over the past 3 years

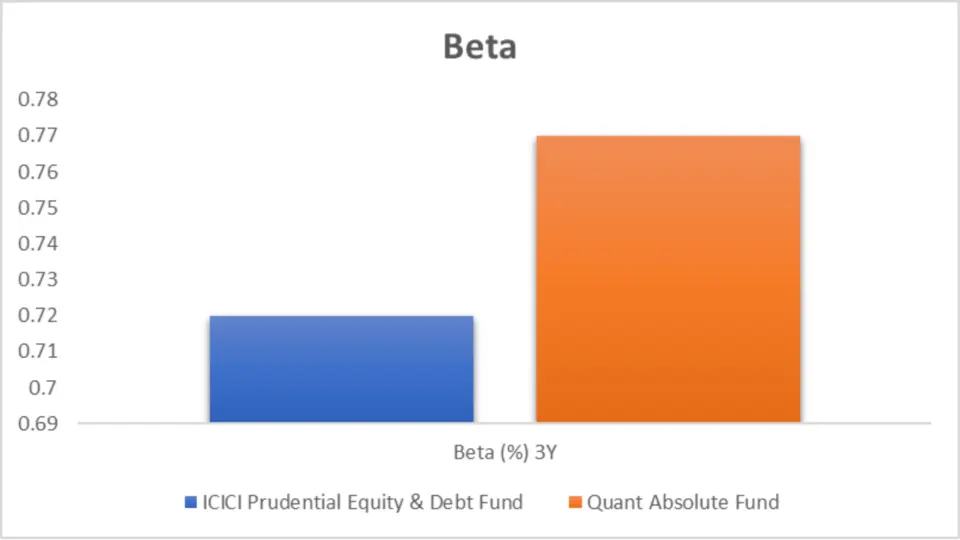

Beta

| Fund | Beta (%) 3Y |

| ICICI Prudential Equity & Debt Fund | 0.72 |

| Quant Absolute Fund | 0.77 |

Analysis:

- ICICI Prudential Equity & Debt Fund: With a beta of 0.72 over 3 years, this fund exhibits lower volatility, making it a safer option during market downturns.

- Quant Absolute Fund: A beta of 0.77 indicates slightly higher volatility than ICICI Prudential but still less than the overall market.

Key Takeaways

Beta measures the fund’s volatility compared to the market. A Beta lower than 1 indicates less volatility than the market. With a lower Beta, ICICI Prudential Equity & Debt Fund is less volatile and, therefore, a safer choice than Quant Absolute Fund.

Alpha

| Fund | Alpha (%) 3Y |

| ICICI Prudential Equity & Debt Fund | 12.16 |

| Quant Absolute Fund | 11.13 |

Analysis:

- ICICI Prudential Equity & Debt Fund: With an alpha of 12.16%, this fund has outperformed its benchmark by a significant margin, reflecting its manager’s ability to add value.

- Quant Absolute Fund: An alpha of 11.13% is still impressive but falls short of ICICI Prudential’s performance.

Key Takeaways:

Alpha represents the fund’s performance relative to the market. A higher Alpha indicates better outperformance. ICICI Prudential Equity & Debt Fund has a higher Alpha, signifying it has outperformed its benchmark more effectively than Quant Absolute Fund over the past 3 years.

Portfolio Analysis

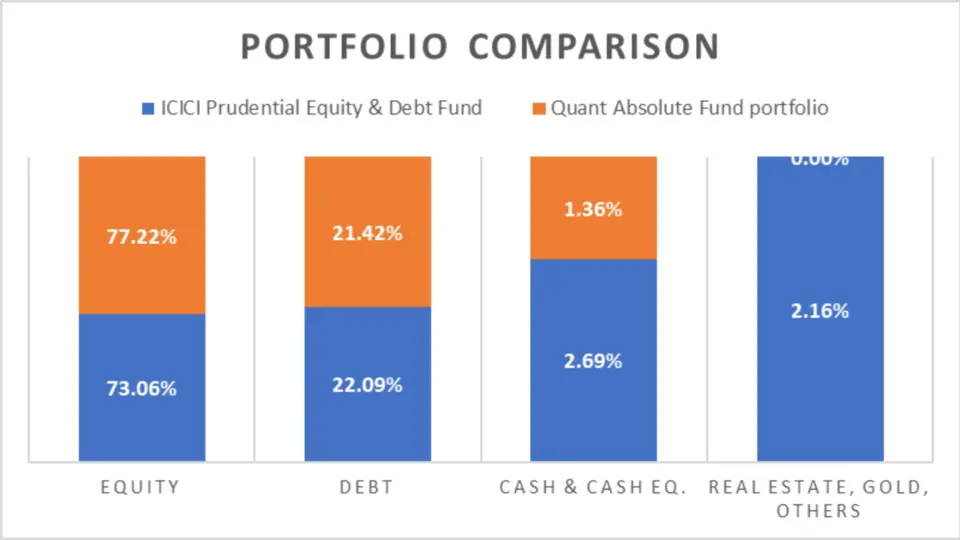

Portfolio Comparison

| Asset Type | ICICI Prudential Equity & Debt Fund | Quant Absolute Fund |

| Equity | 73.06% | 77.22% |

| Debt | 22.09% | 21.42% |

| Cash & Cash Equivalents | 2.69% | 1.36% |

| Real Estate, Gold, Others | 2.16% | 0.00% |

| Commodities | – | – |

Analysis

- Equity Exposure: Quant Absolute Fund has a higher allocation to equities at 77.22% compared to ICICI Prudential’s 73.06%.

- Debt Allocation: Both funds maintain a significant portion in debt, with ICICI Prudential slightly ahead at 22.09%.

- Cash & Equivalents: ICICI Prudential holds more cash (2.69%) than Quant Absolute (1.36%), which could provide better liquidity.

- Diversification: ICICI Prudential offers some diversification into real estate and gold, while Quant Absolute focuses more on equities.

Key Takeaways

Quant Absolute Fund has a slightly higher equity exposure, which may lead to higher returns and more volatility. ICICI Prudential offers a more diversified approach with real estate and gold exposure.

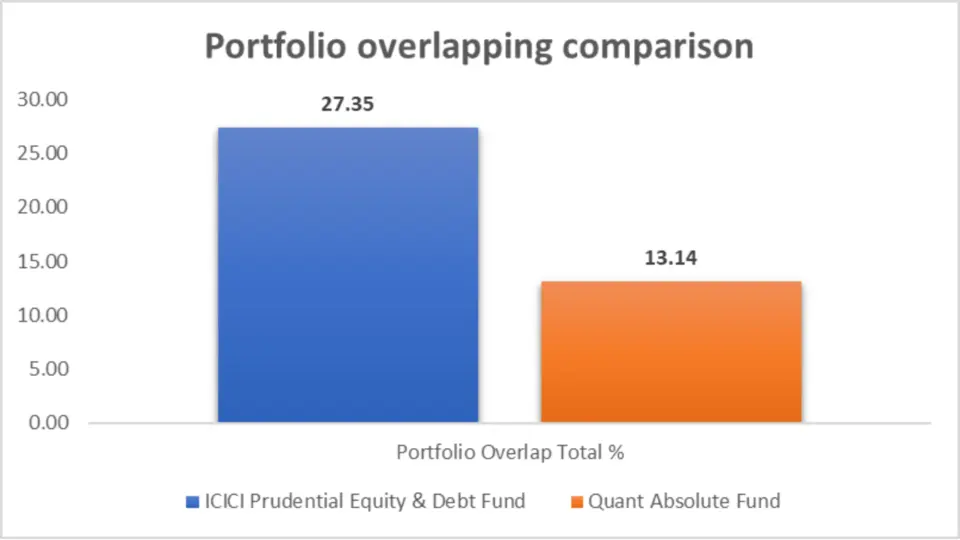

Portfolio Overlap:

| Fund | Portfolio Overlap (%) |

| ICICI Prudential Equity & Debt Fund | 13.14 |

| Quant Absolute Fund | 27.35 |

Data Analysis:

- ICICI Prudential Equity & Debt Fund: With a portfolio overlap of just 13.14%, this fund offers more unique exposure than Quant Absolute.

- Quant Absolute Fund: A higher overlap of 27.35% indicates that a significant portion of its portfolio shares similarities with other funds, potentially reducing diversification benefits.

Key Takeaways

Quant Absolute Fund has a significantly higher portfolio overlap, indicating it may share more common investments with other funds, potentially reducing diversification benefits.

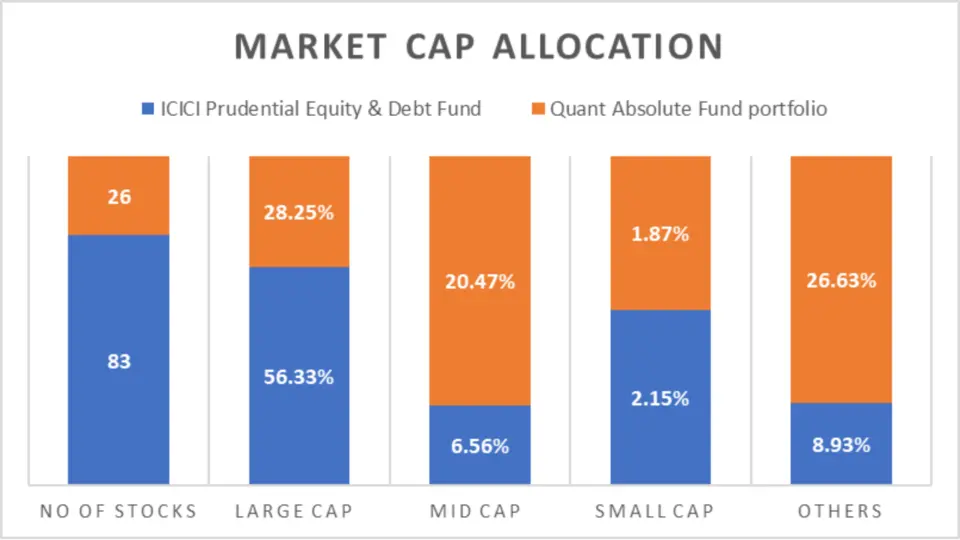

Market Cap Allocation

| Market Cap Segment | ICICI Prudential Equity & Debt Fund | Quant Absolute Fund |

| Large Cap | 56.33% | 28.25% |

| Mid Cap | 6.56% | 20.47% |

| Small Cap | 2.15% | 1.87% |

| Others | 8.93% | 26.63% |

Analysis

- Significant Cap Focus: ICICI Prudential has a significantly higher allocation to large-cap stocks (56.33%) than Quant Absolute (28.25%), indicating a preference for stability.

- Mid-Cap Exposure: Quant Absolute Fund has a greater exposure to mid-cap stocks (20.47%), which could offer higher growth potential but with increased risk.

- Other Category: Quant Absolute Fund allocates a more significant portion to different segments (26.63%), suggesting a more diversified or non-traditional approach.

Key Takeaways

- Conservative vs Aggressive: ICICI Prudential Equity & Debt Fund appears to be the more conservative option, with a greater focus on large-cap stocks and a more balanced asset allocation.

- Growth Potential: Quant Absolute Fund’s higher exposure to mid-cap and other segments suggests potential for higher growth, albeit with more risk.

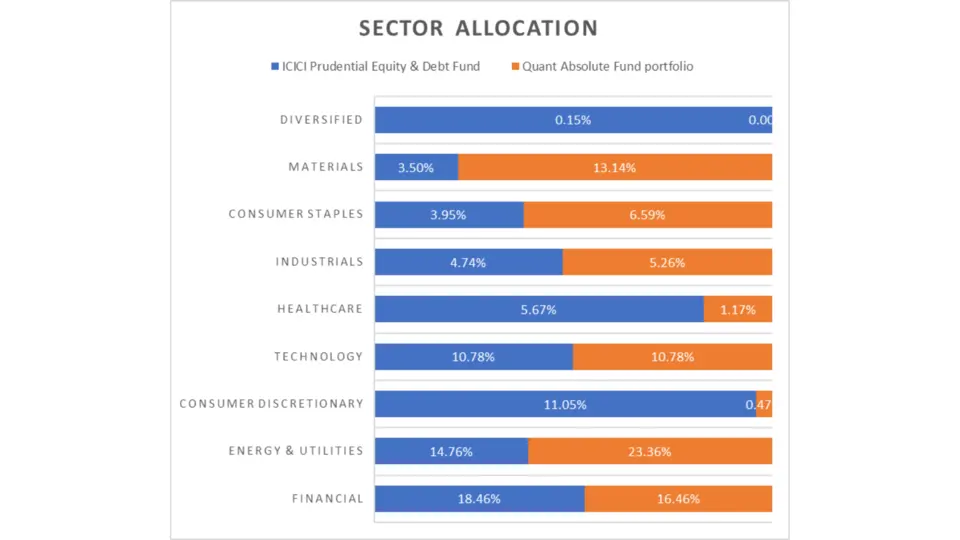

Sector Allocation

Sector allocation gives you an idea of the industries your fund invests in, which can impact the fund’s performance depending on market conditions.

| Sector | ICICI Prudential Equity & Debt Fund | Quant Absolute Fund |

| Financial | 18.46% | 16.46% |

| Energy & Utilities | 14.76% | 23.36% |

| Consumer Discretionary | 11.05% | 0.47% |

| Technology | 10.78% | 10.78% |

| Healthcare | 5.67% | 1.17% |

| Industrials | 4.74% | 5.26% |

| Consumer Staples | 3.95% | 6.59% |

| Materials | 3.50% | 13.14% |

| Diversified | 0.15% | N/A |

Analysis

- Financial Sector: Both funds have substantial exposure to the financial sector, with ICICI Prudential slightly ahead.

- Energy & Utilities: Quant Absolute Fund has a significant allocation to energy and utilities (23.36%), compared to 14.76% for ICICI Prudential.

- Consumer Discretionary: ICICI Prudential has a notable allocation here (11.05%), while Quant Absolute’s exposure is minimal.

- Technology Sector: Both funds have an equal allocation to technology, reflecting confidence in this high-growth sector.

Key Takeaways

- Sector Preferences: ICICI Prudential Equity & Debt Fund has a more diversified sector allocation, while Quant Absolute Fund is more heavily invested in energy, utilities, and materials, sectors that can be more cyclical and volatile.

- Balanced vs Concentrated: ICICI Prudential’s approach is more balanced, making it potentially more resilient in various market conditions. Quant Absolute’s sector bets could lead to higher returns and risks.

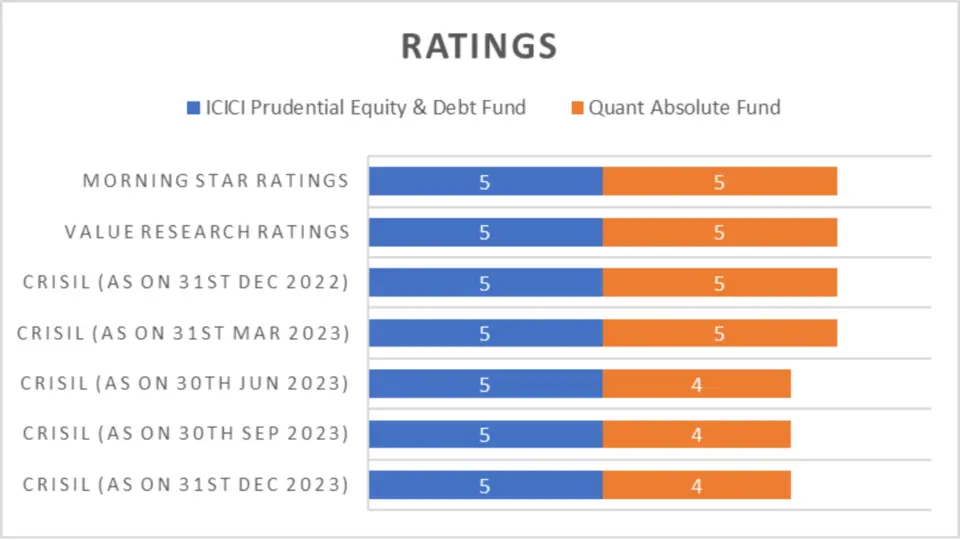

Ratings

Ratings from independent agencies provide an external validation of a fund’s performance and management.

| Rating Agency | ICICI Prudential Equity & Debt Fund | Quant Absolute Fund |

| CRISIL (31st December 2023) | 5 | 4 |

| CRISIL (30th Sep 2023) | 5 | 4 |

| CRISIL (30th Jun 2023) | 5 | 4 |

| CRISIL (31st Mar 2023) | 5 | 5 |

| CRISIL (31st December 2022) | 5 | 5 |

| Value Research Ratings | 5 | 5 |

| Morning Star Ratings | 5 | 5 |

Analysis

- Consistent Ratings: ICICI Prudential has consistently been rated higher or equal to Quant Absolute by CRISIL, indicating strong performance and management.

- Equal Standing: Both funds have received top ratings from Value Research and Morning Star, reflecting strong investor confidence.

Key Takeaways

- External Validation: ICICI Prudential’s consistently high ratings suggest a reliable track record, making it a safer bet for cautious investors.

- Trust and Confidence: Both funds are highly rated overall, so choosing between them may come down to specific risk and return preferences.

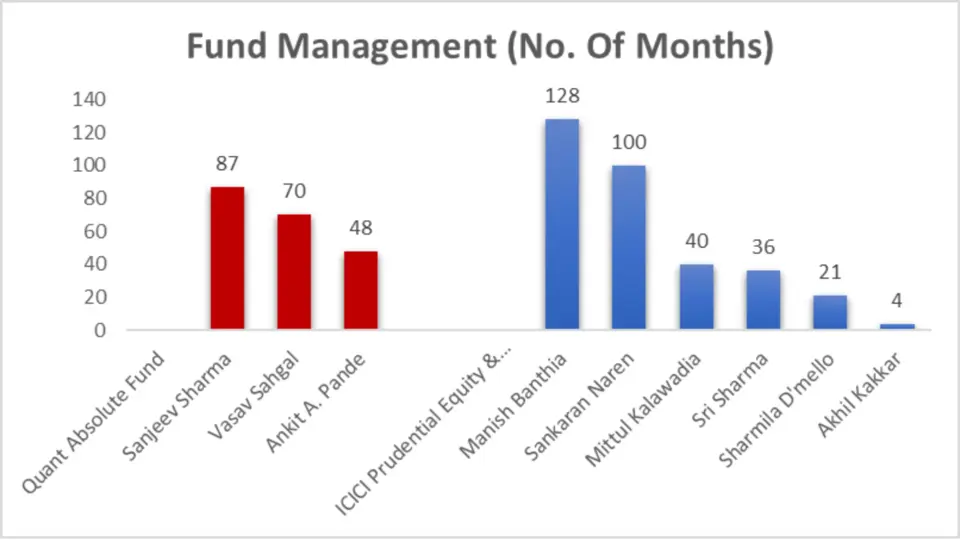

Fund Management

Fund managers’ experience and expertise can significantly impact a mutual fund’s performance. Let’s compare the fund managers of ICICI Prudential Equity & Debt Fund and Quant Absolute Fund regarding their tenure.

| Fund | Fund Manager | No. of Months |

| Quant Absolute Fund | Sanjeev Sharma | 87 |

| Vasav Sahgal | 70 | |

| Ankit A. Pande | 48 | |

| ICICI Prudential Equity & Debt Fund | Manish Banthia | 128 |

| Sankaran Naren | 100 | |

| Mittal Kalawadia | 40 | |

| Sri Sharma | 36 | |

| Sharmila D’mello | 21 | |

| Akhil Kakkar | 4 |

Analysis

- ICICI Prudential Equity & Debt Fund: The fund boasts a more experienced team, with Manish Banthia leading the way at 128 months and Sankaran Naren at 100 months.

- Quant Absolute Fund: Managed by a team with a slightly shorter tenure, led by Sanjeev Sharma with 87 months.

- Experience Advantage: ICICI Prudential Equity & Debt Fund’s management team has a longer tenure, which could translate to more stability and experience in handling market fluctuations.

- Balanced Leadership: Quant Absolute Fund, though with slightly less tenure, still brings substantial experience to the table, particularly with a focused team of three managers.

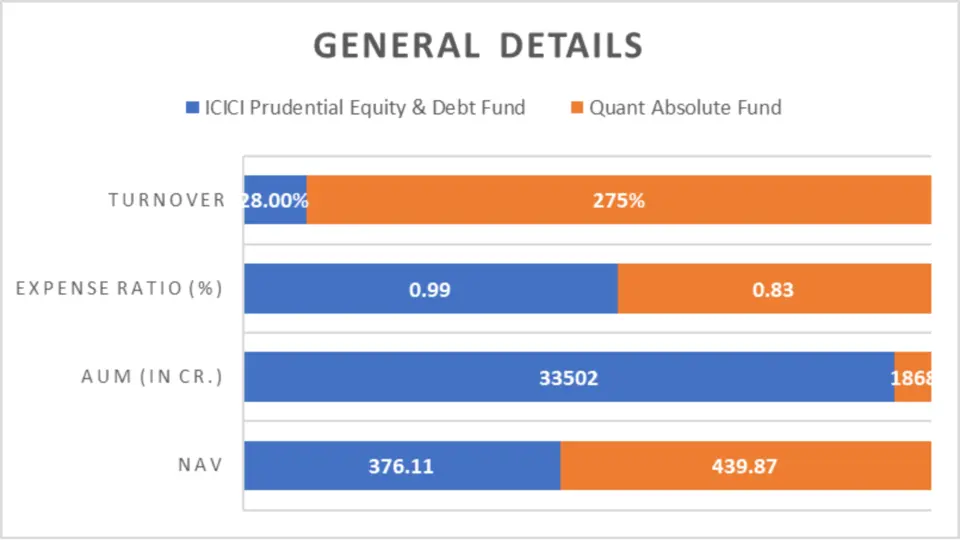

General Details

| Metric | ICICI Prudential Equity & Debt Fund | Quant Absolute Fund |

| NAV | ₹376.11 | ₹439.87 |

| AUM (in Cr.) | ₹33,502 | ₹1,868 |

| Expense Ratio (%) | 0.99 | 0.83 |

| Turnover (%) | 28.00% | 275% |

| Benchmark | NIFTY 50 | NIFTY 50 |

Analysis

- Net Asset Value (NAV): Quant Absolute Fund has a higher NAV at ₹439.87 compared to ₹376.11 for ICICI Prudential.

- Assets Under Management (AUM): ICICI Prudential Equity & Debt Fund commands a significantly larger AUM of ₹33,502 Cr., indicating its popularity and trust among investors.

- Expense Ratio: Quant Absolute Fund is more cost-effective with a lower expense ratio of 0.83% compared to ICICI Prudential’s 0.99%.

- Turnover: Quant Absolute Fund shows a very high turnover of 275%, suggesting an active management style. In comparison, ICICI Prudential’s turnover is a more conservative 28%.

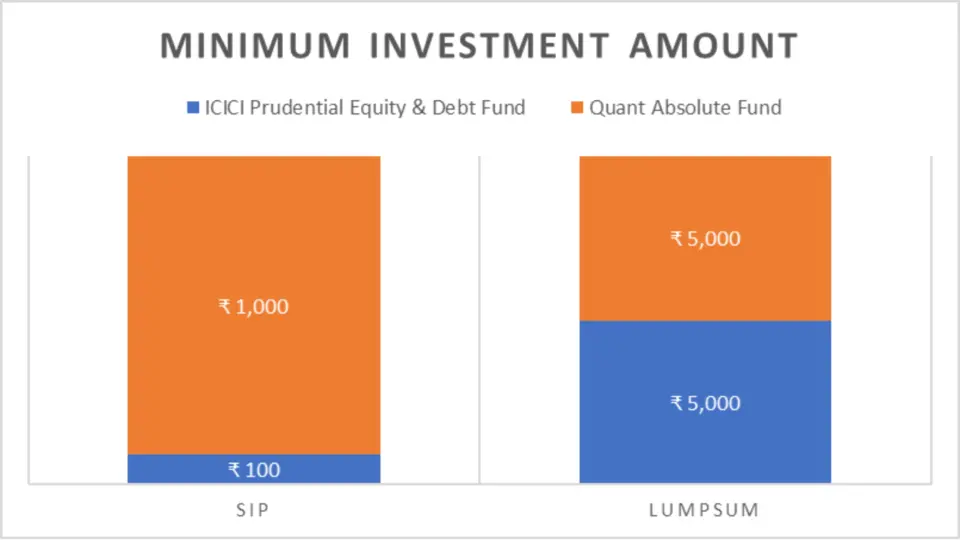

Minimum Investment Requirements

| Investment Type | ICICI Prudential Equity & Debt Fund | Quant Absolute Fund |

| SIP | ₹100 | ₹1,000 |

| Lumpsum | ₹5,000 | ₹5,000 |

Analysis

- SIP Minimum: ICICI Prudential is more accessible to small investors with a minimum SIP of ₹100, compared to ₹1,000 for Quant Absolute.

- Lumpsum Minimum: Both funds require a minimum lumpsum investment of ₹5,000, making them equally accessible in this regard.

Conclusion

The ICICI Prudential Equity & Debt Fund and the Quant Absolute Fund have unique strengths and appeal to different types of investors. Quant Absolute Fund excels in long-term growth, making it the better choice for those prepared to take on more risk for higher returns over 5-10 years. It also shines in terms of cost-effectiveness with its lower expense ratio and offers a more aggressive investment strategy.

On the other hand, the ICICI Prudential Equity & Debt Fund is the stronger performer in the short term, with a more consistent and stable approach, making it a safer bet for conservative investors or those looking for short-term gains. Quant Absolute Fund is the preferred choice for investors with a higher risk appetite seeking significant growth potential.

In contrast, those with a lesser risk tolerance looking for steady returns might find ICICI Prudential Equity & Debt Fund to be a more suitable option.

FAQs:ICICI Prudential Equity and Debt Fund vs Quant Absolute Fund

Which fund has a better long-term performance: Quant Absolute Fund vs ICICI Prudential Equity & Debt Fund?

The Quant Absolute Fund has demonstrated superior long-term performance, especially over a 5-10-year horizon, making it more appropriate for mutual fund investors with a long-term investment strategy.

Which fund is more suitable for short-term investments?

The ICICI Prudential Equity & Debt Fund has shown more robust performance in the short term (1-3 years), making it a better choice for investors seeking short-term gains.

How do the expense ratios of ICICI Prudential Equity & Debt Fund and Quant Absolute Fund compare?

The Quant Absolute Fund is more cost-effective, with a lower expense ratio of 0.83%, compared to 0.99% for the ICICI Prudential Equity & Debt Fund.

What is the minimum SIP investment required for each fund?

ICICI Prudential Equity & Debt Fund has a lower SIP minimum investment of ₹100, making it more accessible to small investors. In contrast, Quant Absolute Fund requires a minimum SIP of ₹1,000.

Which fund offers better risk-adjusted returns?

ICICI Prudential Equity & Debt Fund provides better risk-adjusted returns, as indicated by higher Sortino and Sharpe ratios and lower beta, making it a safer option for conservative investors.

How does the sector allocation differ between these two funds?

ICICI Prudential Equity & Debt Fund has a more diversified sector allocation. In contrast, Quant Absolute Fund has higher exposure to sectors like energy, utilities, and materials, which can be more volatile but offer higher growth potential.

What are the critical differences in fund management between ICICI Prudential Equity & Debt Fund and Quant Absolute Fund?

ICICI Prudential Equity & Debt Fund has a more experienced management team. Key managers have longer tenures, which may translate to more stability. Quant Absolute Fund has a strong management team but slightly less tenure.

Which fund is better for conservative investors?

ICICI Prudential Equity & Debt Fund is better suited for conservative investors due to its lower volatility, consistent short-term performance, and more balanced portfolio.

How do the AUM and NAV compare between these two funds?

ICICI Prudential Equity & Debt Fund has a significantly larger AUM of ₹33,502 Cr. compared to ₹1,868 Cr. for Quant Absolute Fund. In contrast, Quant Absolute Fund has a higher NAV at ₹439.87 compared to ₹376.11 for ICICI Prudential.

What is the turnover rate, and how does it affect these funds?

Quant Absolute Fund has a much higher turnover rate of 275%, indicating a more aggressive management style, which could result in higher returns but also comes with higher risk. In contrast, ICICI Prudential Equity & Debt Fund has a more conservative turnover rate of 28%.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing