Investing in mutual funds is a popular choice for those looking to grow their savings over time. With so many options on the market, deciding where to place your trust and your money can be overwhelming. Today, we’re zooming in on two growth-oriented mutual funds: the ICICI Prudential Quant Fund and the Quant Quantamental Fund. By comparing their performance, investment style, and returns over different periods, we aim to provide a detailed overview to help you make an informed investment decision.

- Investment Style Analysis

- Returns Analysis

- Risk Analysis

- Portfolio Overlap Comparison

- General Details

- Conclusion

- FAQ:ICICI Prudential Quant Fund vs Quant Quantamental Fund

Investment Style Analysis

The ICICI Prudential Quant Fund and the Quant Quantamental Fund are classified under the growth investment style. This means they primarily focus on stocks that offer the potential for high earnings growth, which may also come with higher volatility. For investors who can stomach potential fluctuations in exchange for higher returns in the long run, either of these funds could be a suitable choice

Returns Analysis

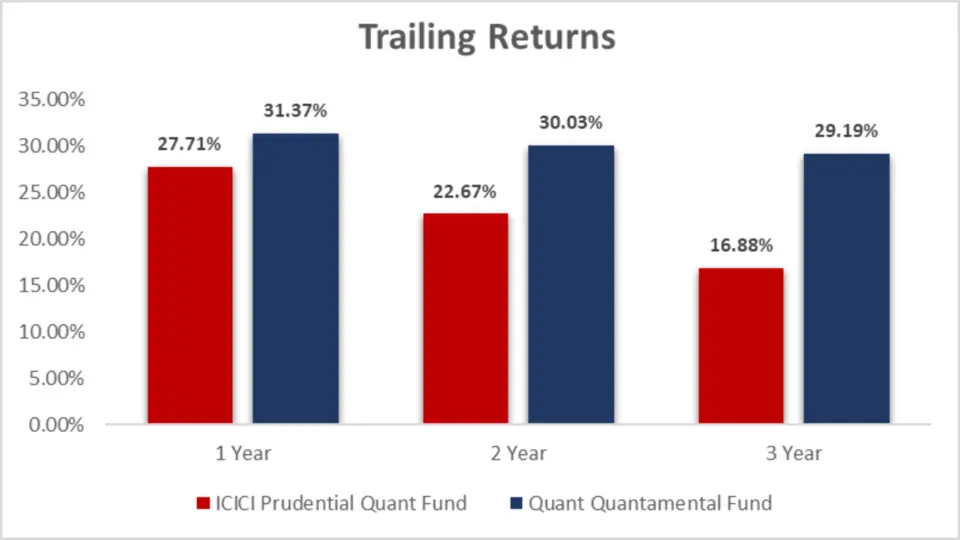

Trailing Returns

| Period Invested For | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| 1 Year | 27.71% | 31.37% |

| 2 Year | 22.67% | 30.03% |

| 3 Year | 16.88% | 29.19% |

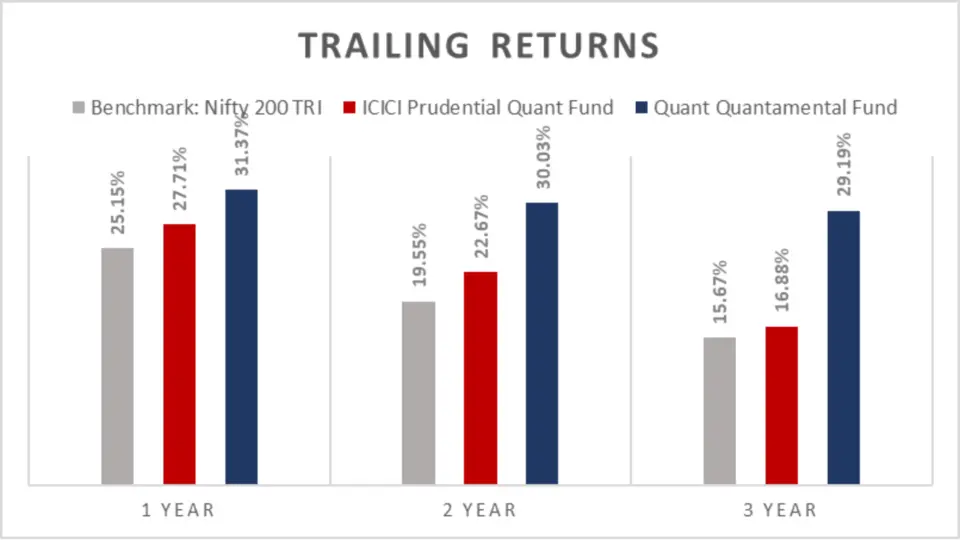

Comparison with Nifty 200 TRI Benchmark

| Period Invested For | Benchmark: Nifty 200 TRI | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| 1 Year | 25.15% | 27.71% | 31.37% |

| 2 Year | 19.55% | 22.67% | 30.03% |

| 3 Year | 15.67% | 16.88% | 29.19% |

Analysis

- Short-term performance (1-Year): The Quant Quantamental Fund offers a robust return of 31.37%, outstripping the ICICI Prudential Quant Fund and the Nifty 200 TRI benchmark. This makes it an attractive option for quick gains within a year.

- Medium-term Performance (2-Year): Over two years, the Quant Quantamental Fund again stands out with a 30.03% return, significantly higher than its counterpart’s 22.67%. This suggests consistency in its performance, making it a reliable choice for medium-term investors.

- Long-term performance (3 years): With nearly double the return rate of the ICICI Prudential Quant Fund over three years, the Quant Quantamental Fund demonstrates its potential for sustained growth, which is crucial for long-term investments.

Key Takeaways

- Short-term Performance: The Quant Quantamental Fund’s robust 1-year return of 31.37% positions it as a strong candidate for investors seeking short-term gains.

- Medium-term Performance: Its Performance over two years, maintaining a significant lead, underscores its consistency and reliability for medium-term investment strategies.

- Long-term Performance: The impressive long-term returns of the Quant Quantamental Fund highlight its potential for sustained growth, making it a compelling option for long-term investors.

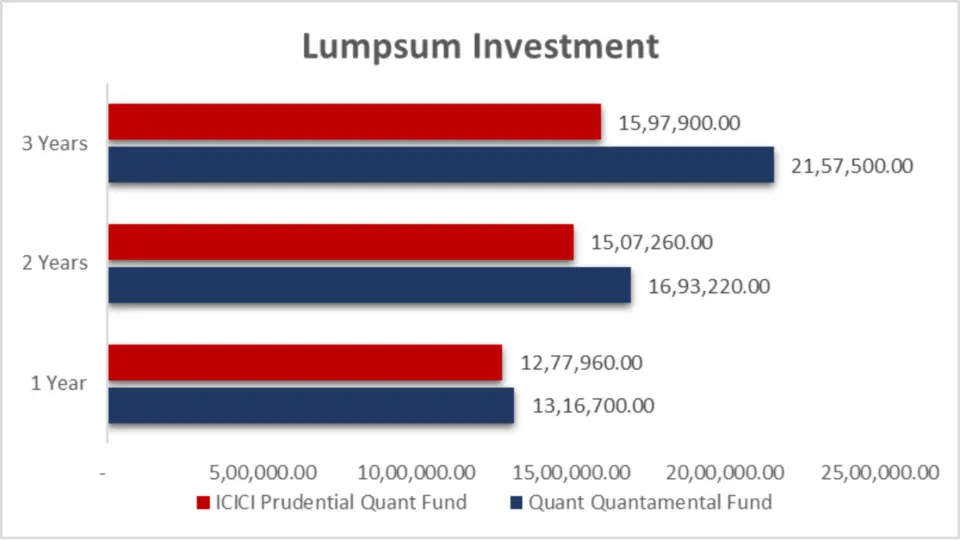

Lumpsum Investment Analysis

| Period Invested For | ICICI Prudential Quant Fund (₹) | Quant Quantamental Fund (₹) |

| 1 Year | 12,77,960.00 | 13,16,700.00 |

| 2 Years | 15,07,260.00 | Not Available |

| 3 Years | 15,97,900.00 | 16,93,220.00 |

Analysis

- 1-Year Investment: The Quant Quant Fund slightly outperforms the ICICI Prudential Quant Fund, offering ₹13,16,700 compared to ₹12,77,960. This suggests a more aggressive or potentially more profitable allocation strategy by the Quant Quant Fund in the short term.

- 2-Year Investment: Only ICICI Prudential Quant Fund data is available, showing an increase to ₹15,07,260. The absence of data for Quant Quantamental Fund precludes a direct comparison for this period.

- 3-Year Investment: Over a more extended period, the Quant Quantamental Fund significantly outpaces ICICI Prudential Quant, with returns of ₹16,93,220 versus ₹15,97,900, indicating better performance stability or higher growth strategies implemented by the Quant Quantamental Fund over the long run.

Key Takeaways

- The Quant Quantamental Fund offers better returns in both the one and three-year scenarios where comparisons are possible, suggesting it may be more suitable for investors looking for growth and who can tolerate potential short-term volatility.

SIP Returns Analysis

| Period Invested For | ICICI Prudential Quant Fund (%) | Quant Quantamental Fund (%) |

| 1 Year | 20.74% | 5.28% |

| 2 Years | 26.49% | 28.67% |

| 3 Years | 22.98% | 30.87% |

Analysis

- 1-Year SIP: ICICI Prudential Quant Fund provides a substantial return of 20.74%, far exceeding the 5.28% return from the Quant Quantamental Fund. This stark difference suggests that the ICICI fund might have been less volatile or more resilient during this period.

- 2-Year SIP: While ICICI shows strong performance at 26.49%, Quant Quantamental Fund edges out slightly with a 28.67% return, demonstrating its robust growth strategies over medium-term investments.

- 3-Year SIP: Quant Quantamental Fund continues to excel with a return of 30.87% compared to 22.98% by ICICI Prudential Quant Fund, indicating better performance over the longer term.

Key Takeaways

- For SIP investments, the Quant Quantamental Fund shows a stronger performance in the extended 2-year and 3-year periods. In contrast, ICICI Prudential Quant Fund is more favourable for the shorter 1-year period.

SIP Investment Returns

| Period Invested For | Investments (₹) | ICICI Prudential Quant Fund (₹) | Quant Quantamental Fund (₹) |

| 1 Year | 1,20,000.00 | 1,33,104.40 | 1,23,410.50 |

| 2 Years | 2,40,000.00 | 3,09,493.20 | 3,15,489.40 |

| 3 Years | 3,60,000.00 | 5,03,357.60 | 5,60,174.70 |

Analysis

- 1-Year SIP: The ICICI Prudential Quant Fund offers a return of ₹1,33,104.40 on an investment of ₹1,20,000, outperforming the Quant Quantamental Fund, which returned ₹1,23,410.50. This indicates a more favourable short-term performance for the ICICI Fund in this period.

- 2-Year SIP: Over two years, the Quantamental Fund slightly edges out with ₹3,15,489.40 compared to ₹3,09,493.20 from the ICICI Fund, showcasing its strength in medium-term investment strategies.

- 3-Year SIP: The trend continues over three years, with the Quant Quantamental Fund providing a significantly higher return of ₹5,60,174.70 versus ₹5,03,357.60 by the ICICI Fund, indicating robust long-term growth.

Key Takeaways

- Quant Quantamental Fund shows superior performance over more extended investment periods (2 and 3 years), suggesting better long-term growth potential.

- ICICI Prudential Quant Fund performs better in the short-term scenario, making it suitable for investors looking for quick gains.

CAGR Performance Comparison

| Category | 1 Year (%) | 3 Years (%) |

| ICICI Prudential Quant Fund | 35.20% | 14.81% |

| Quant Quantamental Fund | 44.79% | 29.01% |

Analysis

- 1-Year Growth Rate: The Quant Quantamental Fund exhibits a remarkable growth rate of 44.79%, substantially higher than the 35.20% of the ICICI Fund, reflecting its aggressive investment strategy and potentially higher risk tolerance.

- 3-Year Growth Rate: Consistency is key in long-term investments, and the Quant Quantamental Fund maintains a superior growth rate of 29.01% over three years, compared to 14.81% by the ICICI Fund, underscoring its effectiveness in capital growth over time.

Key Takeaways

- The Quant Quant Fund provides higher returns and grows faster, making it an attractive option for those seeking aggressive growth and who can handle potential volatility.

- The ICICI Prudential Quant Fund may appeal to more conservative investors or those looking for stable, albeit slower, growth.

Comparison with Nifty 200 TRI Benchmark

| Category | 1 Year CAGR (%) | 3 Year CAGR (%) |

| Benchmark – BSE 200 – TRI | 35.05% | 14.57% |

| ICICI Prudential Quant Fund | 35.20% | 14.81% |

| Quant Quantamental Fund | 44.79% | 29.01% |

Analysis

- 1-Year CAGR Performance:

- ICICI Prudential Quant Fund delivered a CAGR of 35.20% in the past year, which is marginally higher than the 35.05% of the benchmark, BSE 200 – TRI. However, it was still outpaced by the Quantamental Fund, which posted an impressive 44.79% in one year. This makes the Quant Quantamental Fund the standout performer for short-term growth.

- 3-Year CAGR Performance:

- When looking at the 3-year CAGR, the Quant Quantamental Fund leads with a stellar 29.01% return, significantly outperforming the ICICI Prudential Quant Fund (14.81%) and the BSE 200 – TRI (14.57%). This highlights the Quant Quantamental Fund‘s ability to sustain higher growth over a longer horizon, which can be crucial for long-term investors.

Key Takeaways

- Short-Term performance (1-Year):

- The Quant Quant Fund excels in short-term returns, surpassing the benchmark and ICICI Prudential Quant Fund. If you’re looking for aggressive growth in the short term, Quant Quant Quant Fund appears to be the better choice.

- Long-Term performance (3-Year):

- Over the long run, the Quant Quantamental Fund shows clear dominance with a 29.01% CAGR. It has nearly doubled the returns of ICICI Prudential Quant Fund (14.81%) and substantially outperformed the BSE 200 – TRI (14.57%). This suggests that the Quant Quantamental Fund may be better suited for investors with a longer time horizon seeking strong compounding returns.

Rolling Returns

| Fund | 3-Year Rolling Returns (%) |

| Category Benchmark | 20.56% |

| ICICI Prudential Quant Fund | 34.76% |

Analysis

- Over 3 years, ICICI Prudential Quant Fund has shown its strength with a return of 34.76%, notably higher than the 20.56% return of the Category Benchmark. This indicates that the fund has not only delivered exceptional short-term returns but has also shown consistent performance over a more extended period.

- The Category Benchmark posted a respectable return of 20.56%. Still, ICICI Prudential Quant Fund’s outperformance suggests its higher volatility could provide better returns in this case.

Key Takeaways

- The ICICI Prudential Quant Fund maintains its outperformance over 3 years, making it a solid choice for those looking for consistent growth.

- Despite the potentially higher risk, the ICICI Prudential Quant Fund offers significant returns over a longer horizon.

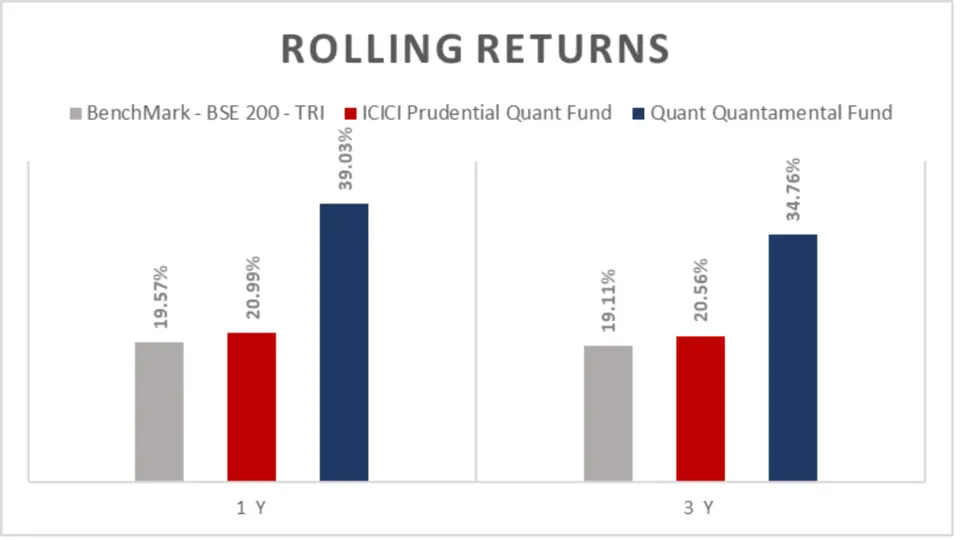

Rolling ReturnsComparison with Nifty 200 TRI Benchmark

| Category | 1-Year Rolling Returns | 3 Year Rolling Returns |

| Benchmark – BSE 200 – TRI | 19.57% | 19.11% |

| ICICI Prudential Quant Fund | 20.99% | 20.56% |

| Quant Quantamental Fund | 39.03% | 34.76% |

Analysis

- Short-Term Performance (1 Year)

- The Quantamental Fund almost doubles the benchmark’s return with a stunning 39.03% return, far surpassing the ICICI Prudential Quant Fund’s respectable 20.99%.

- This indicates a highly effective fund management strategy that adapts well to market conditions over the short term.

- Long-Term Performance (3 Years)

- Over three years, the Quant Quantamental Fund maintained a strong lead with 34.76% returns, still well above the benchmark’s 19.11% and the ICICI Fund’s 20.56%.

- Consistency in performance over this extended period underscores the fund’s robust investment strategy and capability to generate value for its investors despite varying market conditions.

Key Takeaways

- For Short-Term Investors:

- The Quant Quantamental Fund is the better choice for quick, high returns, as demonstrated by its exceptional 1-year rolling returns.

- For Long-Term Growth:

- Investors planning for the long term would benefit from considering the Quant Quantamental Fund due to its impressive 3-year rolling returns, indicating sustained performance and growth.

- Comparison with Benchmark:

- Both funds outperform the BSE 200 – TRI benchmark. Still, the Quant Quantamental Fund does so by a significant margin, highlighting its superior fund management and investment strategy.

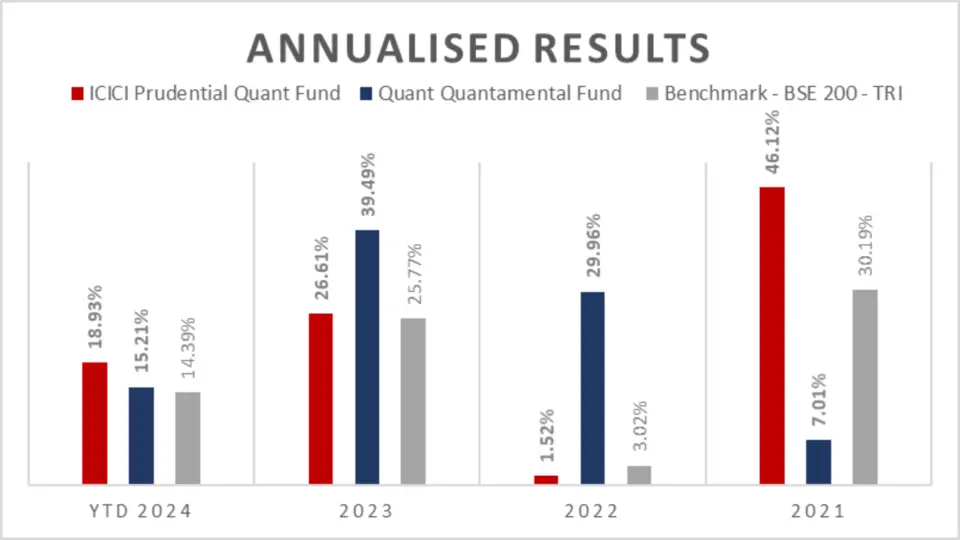

Annualized/Calendar Year Returns (NAV as of 5th Dec 2024)

| Period | ICICI Prudential Quant Fund | Quant Quantamental Fund | Benchmark – BSE 200 – TRI |

| YTD 2024 | 18.93% | 15.21% | 14.39% |

| 2023 | 26.61% | 39.49% | 25.77% |

| 2022 | 1.52% | 29.96% | 3.02% |

| 2021 | 46.12% | 7.01% | 30.19% |

Analysis

- 2024 (YTD): The ICICI Prudential Quant Fund leads with 18.93%, significantly outperforming both the Quant Quantamental Fund (15.21%) and the benchmark (14.39%).

- 2023: The Quant Quantamental Fund had an outstanding year, with 39.49% returns, well above both ICICI Prudential Quant Fund (26.61%) and the Benchmark (25.77%).

- 2022: The Quant Quant Fund performed exceptionally well with 29.96% returns, compared to the minimal growth of 1.52% for ICICI Prudential Quant Fund.

- 2021: ICICI Prudential Quant Fund saw stellar returns of 46.12%, a remarkable outperformance compared to Quant Quantamental Fund (7.01%) and the Benchmark (30.19%).

Key Takeaways

- ICICI Prudential Quant Fund performs exceptionally well in 2021 and 2024, while Quant Quantamental Fund shows impressive growth in 2023 and 2022.

- Both funds have demonstrated their ability to outperform the benchmark. Still, they do so in different years, suggesting varying strengths in various market conditions.

Total and Average Returns Comparison

| Metric | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| Total Return | 93.18% | 91.67% |

| Average Return | 23.30% | 22.92% |

| No. of Times Outperformance | 2 | 2 |

Analysis

- Total Return: ICICI Prudential Quant Fund has a slightly higher total return at 93.18%, outperforming Quant Quantamental Fund at 91.67%.

- Average Return: The ICICI Prudential Quant Fund has a marginally higher average return of 23.30% compared to Quant Quantamental Fund’s 22.92%.

- Outperformance: Both funds have outperformed the benchmark 2 times, showing their resilience in different market conditions.

Key Takeaways

- The ICICI Prudential Quant Fund has demonstrated a slightly stronger performance regarding total and average returns.

- Both funds have outperformed the benchmark twice, indicating consistent fund management and strategic growth.

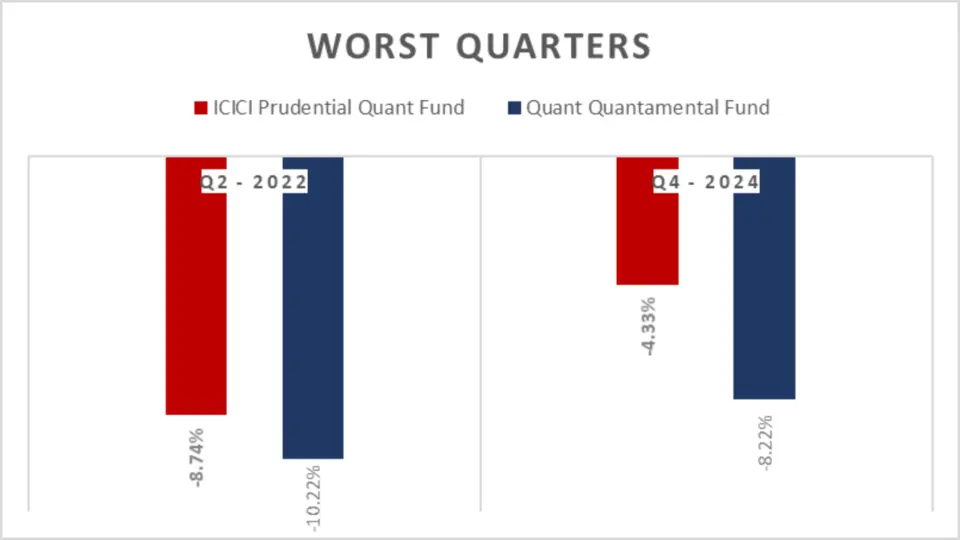

Worst Quarters (NAV as of 5th Dec 2024)

| Period | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| Q2 2022 | -8.74% | -10.22% |

| Q2 2022 | -4.33% | -8.22% |

Analysis

- Q2 2022: The ICICI Prudential Quant Fund performed better during the worst quarters, with a lesser loss of -8.74% compared to Quant Quantamental Fund at -10.22%.

- Q2 2022 (Secondary Worst Quarter): The ICICI Prudential Quant Fund experienced a -4.33% loss, whereas Quant Quantamental Fund suffered a -8.22% decline.

Key Takeaways

- ICICI Prudential Quant Fund shows more resilience in managing downturns compared to Quant Quantamental Fund during the worst quarters. This suggests a more stable investment strategy, especially in volatile market conditions.

Quarterly Results (NAV as of 5th Dec 2024)

| Period | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| Q4 – 2024 | -4.33% | -8.22% |

| Q3 – 2024 | 9.19% | 3.31% |

| Q2 – 2024 | 10.22% | 9.77% |

| Q1 – 2024 | 4.76% | 13.39% |

| Q4 – 2023 | 9.77% | 17.73% |

| Q3 – 2023 | 6.39% | 7.95% |

| Q2 – 2023 | 10.37% | 15.12% |

| Q1 – 2023 | -1.76% | -4.67% |

| Q4 – 2022 | 4.92% | 11.58% |

| Q3 – 2022 | 5.88% | 17.13% |

| Q2 – 2022 | -8.74% | -10.22% |

| Q1 – 2022 | -2.14% | 8.79% |

| Q4 – 2021 | 0.69% | 1.91% |

| Q3 – 2021 | 10.45% | 4.51% |

Analysis

- 2024: The ICICI Prudential Quant Fund saw positive growth in three quarters: Q1 (4.76%), Q2 (10.22%), and Q3 (9.19%). However, it faced a sharp decline in Q4 (-4.33%). The Quant Quantamental Fund, on the other hand, faced a more significant loss in Q4 (-8.22%) but delivered strong growth in Q1 (13.39%) and Q3 (17.73%).

- 2023: Both funds showed strength in Q4, with ICICI Prudential Quant Fund returning 9.77% and Quant Quantamental Fund achieving 17.73%. The Quant Quant Fund was particularly impressive in Q2, delivering 15.12%, whereas ICICI Prudential Quant Fund had a more moderate performance.

- 2022: ICICI Prudential Quant Fund experienced a substantial decline in Q2 (-8.74%), while Quant Quantamental Fund faced a similar dip of -10.22% during the same period.

Key Takeaways

- ICICI Prudential Quant Fund appears to have better stability, especially in Q3 and Q4, with strong positive returns and less severe downturns compared to Quant Quantamental Fund.

- Quant Quantamental Fund demonstrated higher growth potential in Q1 2024 and Q3 2023 but also faced more profound losses in Q4 2024 and Q1 2023.

Total Return and Average Return Comparison

| Metric | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| Total Return | 55.67% | 88.08% |

| Average Return | 3.98% | 6.29% |

| Outperformance | 6 | 8 |

| Next 11 | 3 | 4 |

| First 11 | 3 | 4 |

Analysis

- Total Return: Quant Quantamental Fund outperforms 88.08%, compared to 55.67% for ICICI Prudential Quant Fund. This indicates that, overall, Quant Quantamental Fund has been the better performer in terms of overall growth.

- Average Return: Despite the higher total return, Quant Quantamental Fund‘s average return is 6.29%, still higher than ICICI Prudential Quant Fund‘s 3.98%, showing a more consistent performance.

- Outperformance: Both funds have outperformed the benchmark a similar number of times (6 times for ICICI Prudential Quant Fund and 8 times for Quant Quantamental Fund), but Quant Quantamental Fund shows a better overall performance.

Key Takeaways

- Quant Quantamental Fund has consistently delivered higher returns in total and average performance.

- ICICI Prudential Quant Fund shows more stability with lower volatility. Still, Quant Quantamental Fund clearly stands out regarding total return.

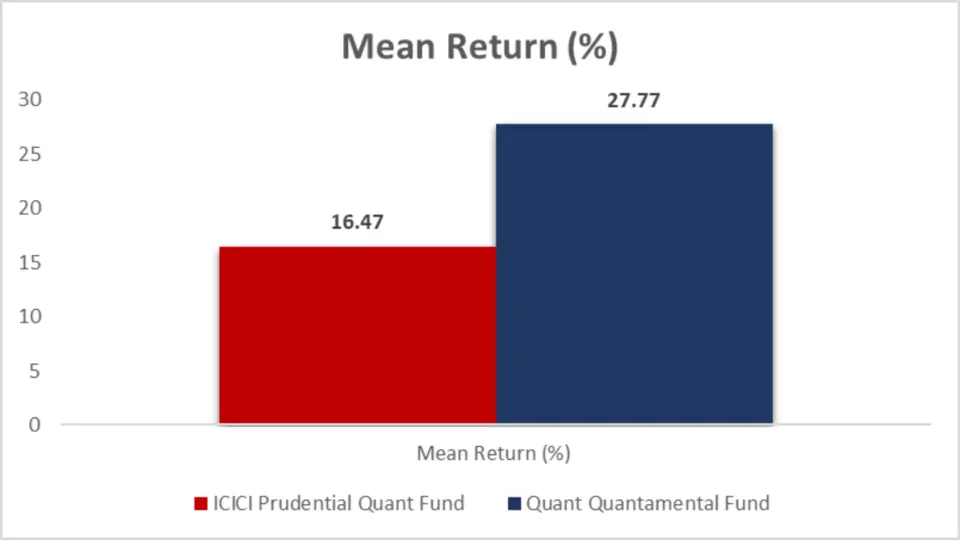

Risk Analysis

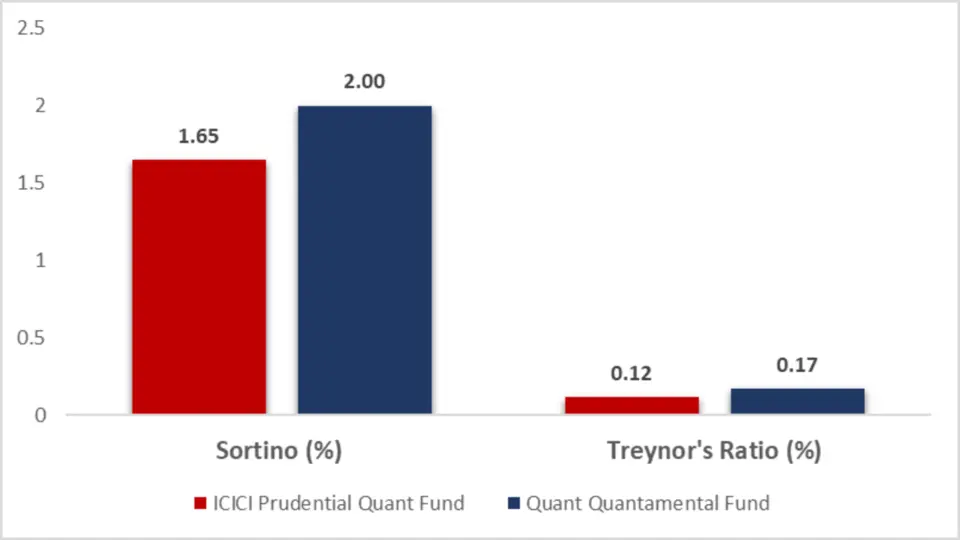

| Metric | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| Mean return (%) | 16.47% | 27.77% |

| Sortino (%) | 1.65 | 2.00 |

| Treynor’s Ratio (%) | 0.12 | 0.17 |

Analysis

- Mean Return: The Quant Quantamental Fund outperforms with a mean return of 27.77%, while the ICICI Prudential Quant Fund achieves 16.47%. This indicates that the Quant Quantamental Fund has historically provided better overall returns.

- Sortino Ratio: The Sortino ratio indicates the risk-adjusted return. A higher ratio means better performance regarding reward per unit of risk. Here, Quant Quantamental Fund again outperforms with a ratio of 2.00, compared to 1.65 for ICICI Prudential Quant Fund.

- Treynor’s Ratio: The Treynor ratio, which evaluates the return earned more than the risk-free rate per unit of market risk, is also higher for Quant Quantamental Fund (0.17) compared to ICICI Prudential Quant Fund (0.12).

Standard Deviation

| Fund | Standard Deviation (%) 3Y |

| ICICI Prudential Quant Fund | 11.12% |

| Quant Quantamental Fund | 16.89% |

Analysis

- ICICI Prudential Quant Fund has a lower standard deviation (11.12%) than Quant Quantamental Fund at 16.89%. This suggests that the ICICI Prudential Quant Fund is less volatile, offering more stability in its returns over the past three years.

- Quant Quantamental Fund, with a higher standard deviation, indicates it has been more volatile. While this could mean higher returns during favourable market conditions, it also implies greater investor risk.

Key Takeaways

- The ICICI Prudential Quant Fund may be more suitable if you value stability and lower risk.

- Suppose you’re willing to accept higher volatility for the potential of higher returns. In that case, Quant Quantamental Fund might be the better option.

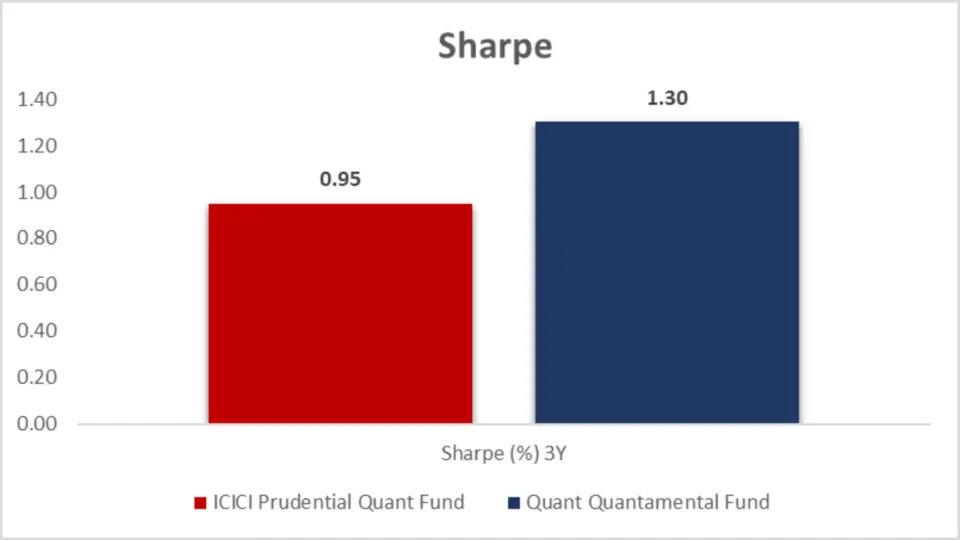

Sharpe Ratio

| Fund | Sharpe Ratio (%) 3Y |

| ICICI Prudential Quant Fund | 0.95 |

| Quant Quantamental Fund | 1.30 |

Analysis

- Quant Quantamental Fund leads with a Sharpe ratio 1.30, compared to 0.95 for the ICICI Prudential Quant Fund. Quant Quant Quant Fund has provided a better return relative to ICICI Prudential Quant Fund for every unit of risk taken.

- A higher Sharpe ratio indicates that the Quant Quantamental Fund is more efficient in converting risk into returns.

Key Takeaways

- Suppose you’re an investor interested in maximizing returns for the risk taken. In that case, the Quant Quantamental Fund stands out with its higher Sharpe ratio.

- However, ICICI Prudential Quant Fund may be safer for risk-averse investors who prefer stability and consistent returns.

Beta (3Y) Comparison

| Fund | Beta (%) 3Y |

| ICICI Prudential Quant Fund | 0.79 |

| Quant Quantamental Fund | 1.08 |

Analysis

- ICICI Prudential Quant Fund has a Beta of 0.79, which indicates that it has been less volatile than the broader market over the last three years. In other words, it is a more stable investment, making it a good choice for risk-averse investors who want lower exposure to market fluctuations.

- Quant Quantamental Fund, on the other hand, has a Beta of 1.08, meaning it is more volatile than the market. This means that the Quant Quantamental Fund has likely experienced more significant swings in value, which could mean higher potential returns during favourable market conditions and more risk during downturns.

Key Takeaway

- Suppose you prefer lower volatility and more stability in your investments. In that case, the ICICI Prudential Quant Fund is likely a better choice.

- If you’re willing to take on more risk for potentially higher returns, the Quant Quantamental Fund may be more suitable.

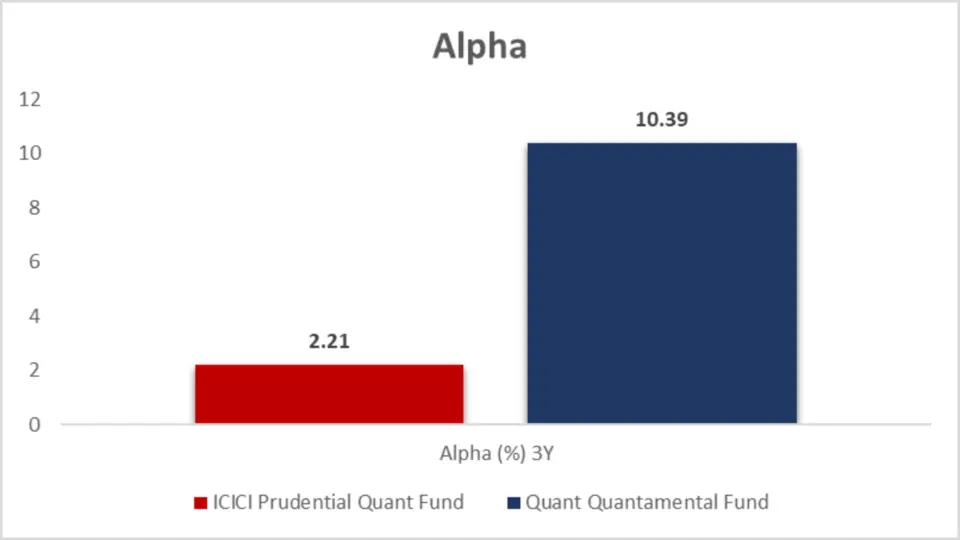

Alpha

| Fund | Alpha (%) 3Y |

| ICICI Prudential Quant Fund | 2.21 |

| Quant Quantamental Fund | 10.39 |

Analysis

- ICICI Prudential Quant Fund has an Alpha of 2.21%, indicating that it has outperformed the market by 2.21% over the past three years after adjusting for risk. This suggests that ICICI Prudential Quant Fund has been a solid performer, delivering returns above expected given its risk profile.

- Quant Quantamental Fund has a much higher Alpha of 10.39%, which indicates that it has significantly outperformed the market. This higher Alpha suggests that the Quant Quantamental Fund has provided more substantial risk-adjusted returns than the broader market.

Key Takeaway

- Quant Quantamental Fund has delivered superior risk-adjusted returns compared to ICICI Prudential Quant Fund, as shown by its higher Alpha.

- If you’re an investor seeking performance above market expectations, Quant Quant Fund is a compelling choice.

Portfolio Overlap Comparison

| Fund | Portfolio Overlap Total (%) |

| ICICI Prudential Quant Fund | 10.58% |

| Quant Quantamental Fund | 29.60% |

Analysis

- ICICI Prudential Quant Fund has a relatively low portfolio overlap of 10.58% with Quant Quantamental Fund. This suggests that the two funds are not heavily correlated regarding their assets, offering investors an opportunity for diversification when holding both funds.

- Quant Quantamental Fund, on the other hand, has a much higher portfolio overlap of 29.60%, meaning that a significant portion of the fund’s holdings overlap with other similar funds or benchmarks. This can indicate less diversification when compared to ICICI Prudential Quant Fund.

Key Takeaway

- ICICI Prudential Quant Fund provides better diversification due to its low portfolio overlap with Quant Quantamental Fund. ICICI Prudential Quant Fund might be a better option if you want diversification across funds.

- Suppose you’re looking for more similar funds that can complement each other with slightly higher overlap. In that case, the Quant Quantamental Fund might be a suitable choice.

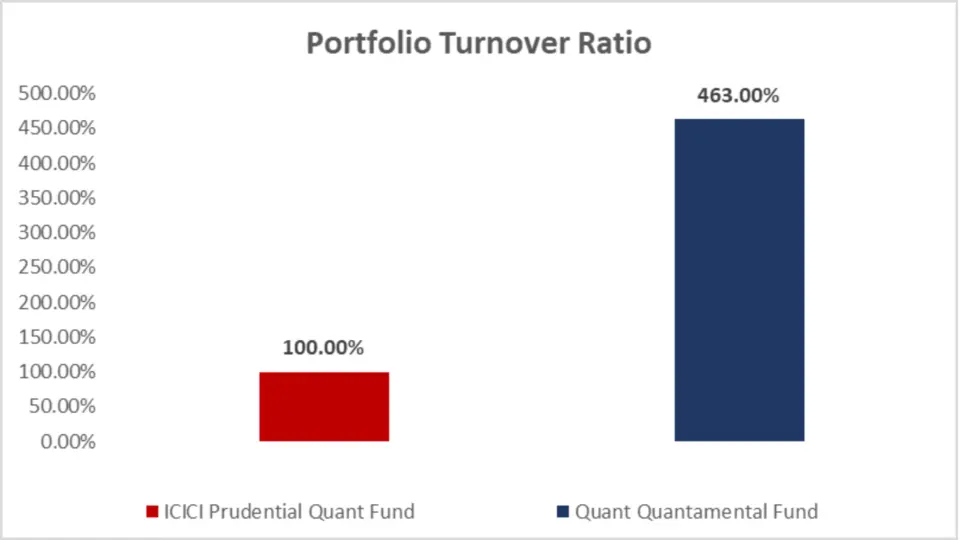

Portfolio Turnover Ratio Comparison

| Fund | Portfolio Turnover Ratio |

| ICICI Prudential Quant Fund | 100.00% |

| Quant Quantamental Fund | 463.00% |

Analysis

- ICICI Prudential Quant Fund has a turnover ratio of 100%, indicating that the fund buys and sells its assets at a relatively moderate pace. This active management suggests that the fund manager is likely changing the portfolio based on market conditions, potentially capturing opportunities while managing risk.

- Quant Quantamental Fund has a high turnover ratio of 463%, which is substantially higher. This indicates that the fund is actively traded and frequently bought and sold assets. While this can potentially lead to higher returns, it also comes with higher transaction costs and increased market risk.

Key Takeaways

- ICICI Prudential Quant Fund has a moderate turnover ratio, suggesting a balanced trading and portfolio management approach.

- Quant Quantamental Fund, with its very high turnover ratio, is more aggressive in managing its portfolio. This could lead to higher potential returns and expose investors to higher costs and risks due to more frequent trading.

Portfolio Comparison

| Category | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| Equity | 86.57% | 96.53% |

| Debt | 0.00% | 2.46% |

| Cash & Cash Equivalents | 13.43% | 1.01% |

| Real Estate, Gold, Others | — | — |

| Commodities | — | — |

Analysis

- Equity: Quant Quant Fund holds a significantly higher percentage of Equity at 96.53%, compared to ICICI Prudential Quant Fund‘s 86.57%. Quant Quant Quantamental Fund is more aggressive in its investment strategy, focusing heavily on equities. This high allocation to stocks suggests the potential for higher returns but also increased volatility.

- Debt: ICICI Prudential Quant Fund has no debt exposure (0%), whereas Quant Quantamental Fund has a small allocation of 2.46% in debt. This indicates that Quant Quantamental Fund has a slightly lower risk profile than ICICI Prudential Quant Fund in terms of fixed-income securities, though the difference is relatively small.

- Cash & Cash Equivalents: ICICI Prudential Quant Fund holds 13.43% of its portfolio in Cash & Cash Equivalents, which suggests a more conservative approach to managing liquidity and reducing risk. On the other hand, Quant Quantamental Fund has only 1.01% cash, indicating a higher commitment to invested capital and less liquidity.

Key Takeaways

- Quant Quantamental Fund is more aggressive with a higher equity allocation and less focus on debt or cash. This might appeal to investors looking for higher returns with a tolerance for more significant risk.

- ICICI Prudential Quant Fund, with its higher cash allocation, seems to take a more balanced and conservative approach, which may suit those who prefer stability and a lower-risk profile.

Portfolio Turnover Ratio

| Fund | Portfolio Turnover Ratio |

| ICICI Prudential Quant Fund | 100.00% |

| Quant Quantamental Fund | 463.00% |

Analysis

- ICICI Prudential Quant Fund has a turnover ratio of 100%, which indicates that the fund manager is actively buying and selling securities within the portfolio. This suggests that the fund is dynamically managed, adjusting based on market conditions.

- Quant Quantamental Fund, with an extremely high turnover ratio of 463%, indicates active management. The fund manager frequently adjusts positions to take advantage of short-term market opportunities, which could lead to higher transaction costs and more significant potential for short-term gains.

Key Takeaways

- Quant Quantamental Fund is much more active in its management style, which can lead to greater returns in a favourable market but also introduces higher risk and transaction costs.

- ICICI Prudential Quant Fund offers a moderately active strategy with a lower turnover ratio, indicating a less aggressive approach to portfolio management and potentially lower transaction costs.

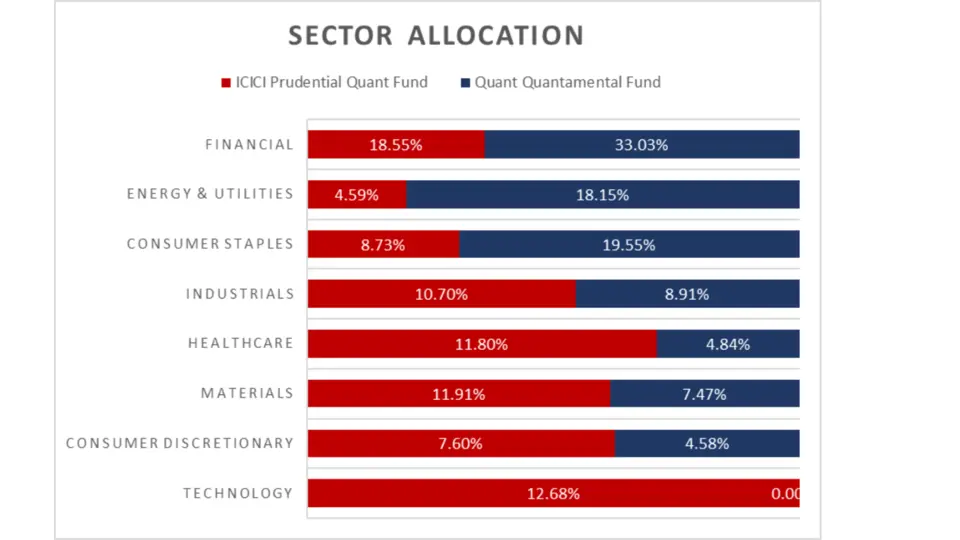

Sector Allocation Comparison

| Sector | ICICI Prudential Quant Fund | Quant Quantamental Fund |

| Technology | 12.68% | NA |

| Consumer Discretionary | 7.60% | 4.58% |

| Materials | 11.91% | 7.47% |

| Healthcare | 11.80% | 4.84% |

| Industrials | 10.70% | 8.91% |

| Consumer Staples | 8.73% | 19.55% |

| Energy & Utilities | 4.59% | 18.15% |

| Financial | 18.55% | 33.03% |

Analysis

- Technology: ICICI Prudential Quant Fund has a 12.68% allocation to technology, a significant portion of its portfolio. This fund is positioning itself with some exposure to growth sectors like tech. However, the Quant Quantamental Fund doesn’t provide data on this sector.

- Consumer Discretionary: ICICI Prudential Quant Fund holds 7.60% of consumer discretionary spending, while Quant Quantamental Fund has a smaller allocation of 4.58%. This indicates that ICICI Prudential Quant Fund has slightly more exposure to consumer-focused industries like retail and leisure.

- Materials: Both funds have notable exposure to materials, with ICICI Prudential Quant Fund allocating 11.91%, compared to Quant Quantamental Fund‘s 7.47%. This suggests that ICICI Prudential Quant Fund aligns more with industries that rely on physical goods and commodities.

- Healthcare: ICICI Prudential Quant Fund also has a higher allocation to healthcare (11.80%) than Quant Quantamental Fund (4.84%). This exposes ICICI Prudential Quant Fund to sectors like pharma, biotech, and healthcare services, often considered more defensive.

- Consumer Staples: Quant Quant Fund has a significantly higher exposure to consumer staples (19.55%) than ICICI Prudential Quant Fund (8.73%). This indicates that Quant Quant Fund focuses more on industries like food, beverages, and personal care products, considered essential and stable even in downturns.

- Energy & Utilities: Quant Quantamental Fund allocates 18.15% to energy & utilities, whereas ICICI Prudential Quant Fund has a much smaller allocation of 4.59%. The more significant exposure in energy & utilities for Quant Quantamental Fund suggests a focus on energy stocks and utilities, sectors that tend to perform well with economic growth.

- Financials: Quant Quantamental Fund has a massive 33.03% in financials, compared to 18.55% in ICICI Prudential Quant Fund. This substantial allocation to financials could be seen as a bet on the banking, insurance, and financial services industries, which might be more volatile but offer higher returns when economic conditions improve.

Key Takeaways

- ICICI Prudential Quant Fund has more exposure to growth-oriented sectors like technology and healthcare. At the same time, Quant Quantamental Fund focuses more on stable, defensive sectors like consumer staples and financials.

- Quant Quantamental Funds are much more concentrated in financials, indicating a higher risk and the potential for higher returns during favourable market conditions.

- ICICI Prudential Quant Fund has a more diversified exposure, with a balanced mix of growth and defensive sectors.

Fund Management Comparison

| Fund | Fund Manager | No. of Months |

| ICICI Prudential Quant Fund | Roshan Chutkey | 47 |

| Sharmila D’Mello | 28 | |

| Quant Quantamental Fund | Sandeep Tandon | 43 |

| Ankit A. Pande | 43 | |

| Vasav Sahgal | 43 | |

| Sanjeev Sharma | 43 |

Analysis

- ICICI Prudential Quant Fund has two fund managers: Roshan Chutkey, who has 47 months of experience, and Sharmila D’Mello, who has 28 months. This team brings a mix of experience, with Roshan Chutkey having a significant role in guiding the fund’s strategy, while Sharmila D’Mello adds fresh perspectives.

- Quant Quantamental Fund has a team of four managers with 43 months of experience: Sandeep Tandon, Ankit A. Pande, Vasav Sahgal, and Sanjeev Sharma. This diverse team offers a more collaborative approach to managing the fund, which might bring diversity in decision-making and broader market insights.

Key Takeaways

- ICICI Prudential Quant Fund has a more senior and experienced management team, with one key manager holding a longer tenure. This could lead to a more consistent approach to fund management.

- Quant Quant Fund has a larger team with more balanced experience, which could allow for a broader range of strategies and a more agile management style in adapting to market changes.

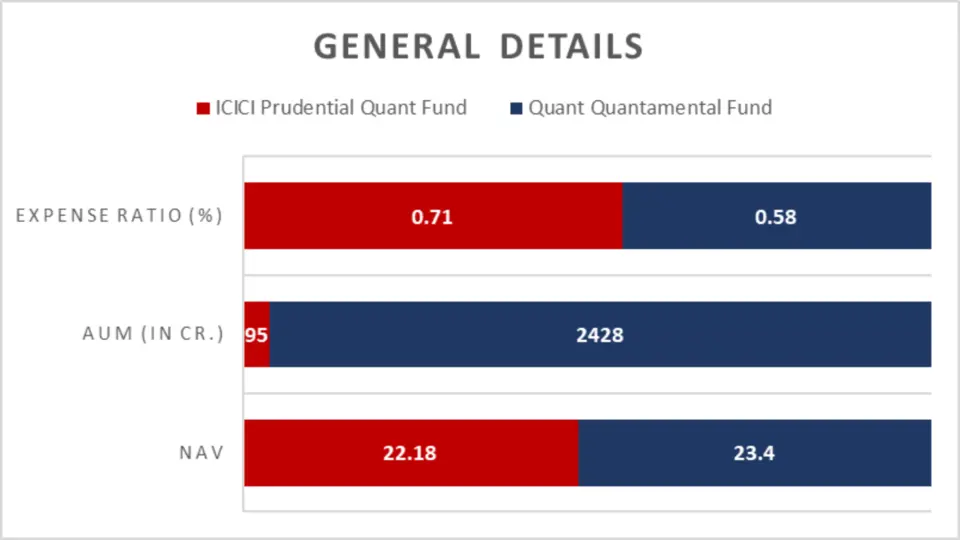

General Details

| Fund | NAV (₹) | AUM (in Cr.) | Expense Ratio (%) | Benchmark |

| ICICI Prudential Quant Fund | 22.18 | 95 | 0.71 | BSE 200 – TRI |

| Quant Quantamental Fund | 23.4 | 2428 | 0.58 | NIFTY 200 – TRI |

Analysis

- NAV (Net Asset Value):

- ICICI Prudential Quant Fund has an NAV of ₹22.18, while Quant Quantamental Fund has a slightly higher NAV of ₹23.4. NAV represents the price per unit of the mutual fund. While both funds are in a similar price range, Quant Quantamental Fund‘s slightly higher NAV could indicate a higher asset value per unit.

- AUM (Assets Under Management):

- The AUM of ICICI Prudential Quant Fund is ₹95 crores, whereas Quant Quantamental Fund has a significantly higher ₹2428 crores in AUM. A larger AUM suggests that Quant Quantamental Fund has more widespread acceptance and a larger pool of investors, which may indicate its popularity and trust in the market.

- Expense Ratio:

- A fund’s expense ratio is the annual fee expressed as a percentage of its average assets under management (AUM). ICICI Prudential Quant Fund has an expense ratio of 0.71%, while Quant Quantamental Fund has a slightly lower expense ratio of 0.58%. This suggests that Quant Quantamental Fund is more cost-efficient, as investors will pay lower fees than their fund investment.

- Benchmark:

- ICICI Prudential Quant Fund is benchmarked against the BSE 200 – TRI, while Quant Quantamental Fund is benchmarked against the NIFTY 200 – TRI. Both benchmarks represent large-cap indices, but NIFTY 200 is generally seen as a more broadly representative index of the Indian stock market. At the same time, the BSE 200 is more focused on a slightly smaller set of stocks. Quant Quant Quant Fund might have a more diverse market focus than ICICI Prudential Quant Fund.

Key Takeaways

- Quant Quantamental Fund has a higher NAV and AUM, which could indicate a more mature fund with a more extensive investor base.

- Quant Quant Fund has a lower expense ratio, making it more cost-efficient for investors than ICICI Prudential Quant Fund.

- The choice of benchmark index reflects the market focus of each fund, with Quant Quantamental Fund being more diversified.

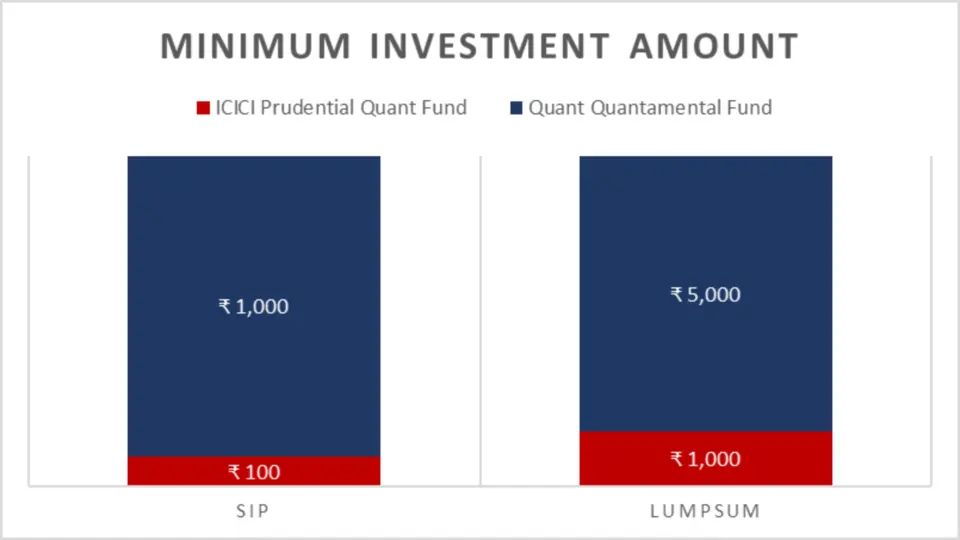

Minimum Investment Requirements

| Fund | SIP Minimum (₹) | Lumpsum Minimum (₹) |

| ICICI Prudential Quant Fund | 100 | 1,000 |

| Quant Quantamental Fund | 1,000 | 5,000 |

Analysis

- SIP Minimum:

- ICICI Prudential Quant Fund has a minimum SIP amount of ₹100, which makes it accessible to a broader range of investors, especially those who want to start small and invest regularly. This lower SIP minimum is a significant advantage for investors looking to gradually build their portfolio without committing a large sum upfront.

- On the other hand, Quant Quantamental Fund requires a minimum SIP of ₹1,000, which could be restrictive for some investors, particularly those new to investing or those looking to invest smaller amounts periodically.

- Lumpsum Minimum:

- ICICI Prudential Quant Fund requires a lumpsum minimum investment of ₹1,000, making it relatively easy for investors who prefer to make a one-time investment in the fund.

- Quant Quantamental Fund has a higher lump sum minimum of ₹5,000, which could be a barrier for smaller investors or those who prefer to test the waters before committing more significant amounts.

Key Takeaways

- ICICI Prudential Quant Fund offers lower minimum investment amounts, making it more accessible for investors with smaller budgets through SIP or lumpsum.

- Quant Quantamental Fund has a higher minimum investment requirement, which might be better suited for investors comfortable committing more significant sums but less appealing for beginners or those with limited capital.

Conclusion

Both ICICI Prudential Quant Fund and Quant Quantamental Fund have their unique strengths. If you’re looking for aggressive growth with a higher tolerance for risk, Quant Quantamental Fund emerges as the winner. On the other hand, if you prefer a safer, more stable investment that offers consistent returns over time, ICICI Prudential Quant Fund might be a better fit for your investment portfolio.

FAQ:ICICI Prudential Quant Fund vs Quant Quantamental Fund

What are the main differences between ICICI Prudential Quant Fund and Quant Quantamental Fund?

The ICICI Prudential Quant Fund primarily follows a quantitative approach targeting large-cap stocks. In contrast, the Quant Quantamental Fund blends quantitative analysis with fundamental research, focusing on high-quality companies poised for growth. Given its robust long-term performance, the Quant Quantamental Fund is more aggressive and potentially more profitable in the long run.

Which fund has shown better performance over the short term?

Over the short term, the Quant Quant Fund has outperformed, delivering a 31.37% return in the first year compared to ICICI Prudential Quant Fund’s 27.71%. This performance makes it an appealing choice for investors seeking rapid gains.

How do the funds compare in terms of long-term investment?

The Quant Quantamental Fund has consistently shown higher growth potential for long-term investments. Over three years, it returned 29.19%, significantly outperforming the ICICI Prudential Quant Fund, which posted a return of 16.88%.

What are the SIP returns like for these funds?

ICICI Prudential Quant Fund offers better returns in the short term, particularly over the first year, with a 20.74% return. However, Quant Quantamental Fund excels in the medium to long term, with returns of 28.67% over two years and 30.87% over three years, indicating stronger performance as the investment period extends.

Which fund suits investors looking for stability and lower risk?

The ICICI Prudential Quant Fund is more suitable for investors who prioritize stability and lower risk due to its less aggressive investment strategy and lower volatility, as evidenced by its lower standard deviation compared to the Quant Quantamental Fund.

What is the minimum investment required for each fund?

ICICI Prudential Quant Fund is more accessible, with a minimum SIP investment of ₹100 and a lumpsum investment of ₹1,000. The Quant Quantamental Fund requires a higher initial investment, with a minimum SIP of ₹1,000 and a lumpsum minimum of ₹5,000, catering to those who might have a more considerable capital outlay.

How do the expense ratios of these funds compare?

The Quant Quantamental Fund has a lower expense ratio of 0.58% compared to 0.71% for the ICICI Prudential Quant Fund. A lower expense ratio can enhance net returns over time, making the Quant Quantamental Fund slightly more cost-efficient.

Which fund has a better risk-adjusted return profile?

Quant Quantamental Fund exhibits superior risk-adjusted returns, highlighted by its higher Sharpe Ratio of 1.30 compared to 0.95 for the ICICI Prudential Quant Fund. This suggests that the Quant Quantamental Fund compensates better for the risks it takes.

How do the funds perform in adverse market conditions?

The ICICI Prudential Quant Fund tends to perform better in adverse market conditions, showing more resilience during downturns with less severe losses than the Quant Quantamental Fund.

Which fund is recommended for aggressive growth and higher returns?

For aggressive growth and higher returns, the Quant Quantamental Fund is recommended due to its stronger performance in both short-term and long-term periods, particularly excelling with higher returns and growth rates, as shown in its CAGR and SIP returns analysis.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing