Are You planning to invest in midcap funds and need clarification on the Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund? This blog will help you clarify all your questions and doubts. Here, we will dive deep into a five-step comprehensive comparative analysis of these two midcap mutual funds on all critical parameters. This is to help you choose the most consistent and the best midcap mutual funds for your long-term investment portfolio by investing in the fund that has done well consistently over the period in terms of better risk-adjusted returns and alpha generation.

Investment Style

Let’s kick off with the investment styles of both funds:

- Kotak Emerging Equity Fund: Blend

- SBI Magnum Midcap Fund: Growth

Returns Analysis

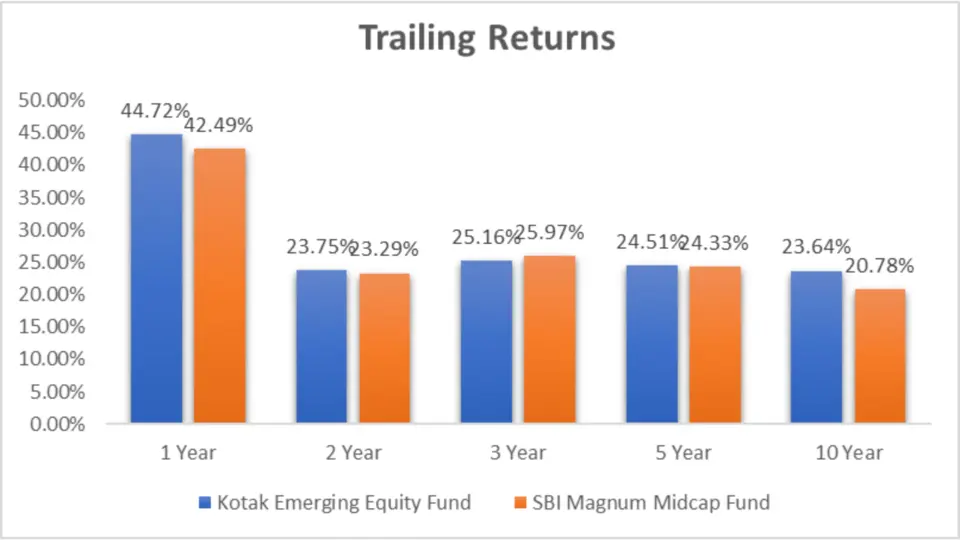

Trailing Returns

| Period Invested for | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| 1 Year | 44.72% | 42.49% |

| 2 Year | 23.75% | 23.29% |

| 3 Year | 25.16% | 25.97% |

| 5 Year | 24.51% | 24.33% |

| 10 Year | 23.64% | 20.78% |

Analysis:

- 1 Year: Kotak Emerging Equity Fund outperformed SBI Magnum Midcap Fund with a return of 44.72% compared to 42.49%.

- 2 Year: Both funds showed similar performance, with Kotak at 23.75% and SBI at 23.29%.

- 3 Year: SBI Magnum Midcap Fund led slightly with 25.97%, compared to Kotak’s 25.16%.

- 5 Year: Kotak again takes the lead with 24.51%, while SBI trails somewhat at 24.33%.

- 10 Year: Kotak significantly outperformed SBI with a return of 23.64% versus 20.78%.

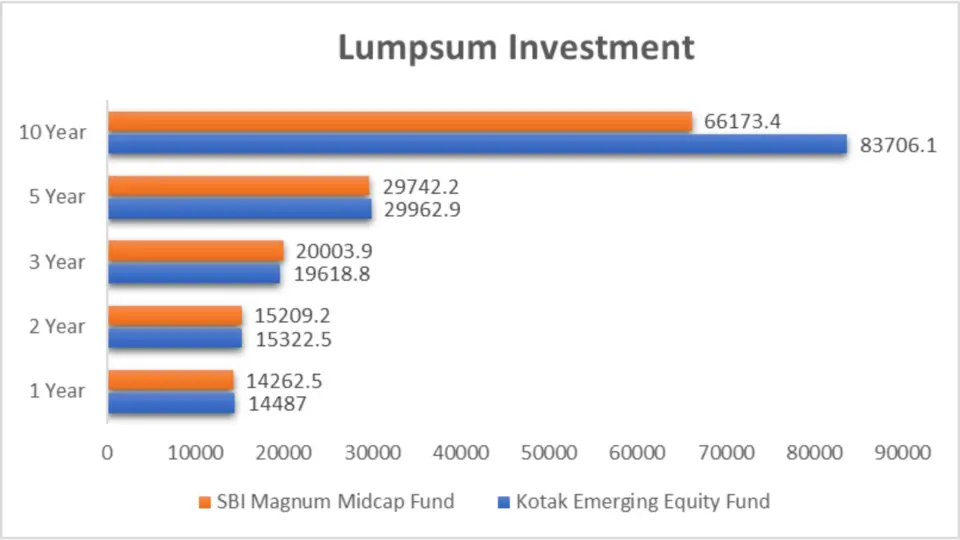

Lumpsum Investment Value

Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund:

| Period Invested for | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| 1 Year | 14487 | 14262.5 |

| 2 Year | 15322.5 | 15209.2 |

| 3 Year | 19618.8 | 20003.9 |

| 5 Year | 29962.9 | 29742.2 |

| 10 Year | 83706.1 | 66173.4 |

Analysis:

- 1 Year: A ₹10,000 investment in Kotak would grow to ₹14,487, slightly more than SBI’s ₹14,262.5.

- 2 Year: Kotak’s investment value stands at ₹15,322.5, just ahead of SBI’s ₹15,209.2.

- 3 Year: SBI takes a slight lead here, growing to ₹20,003.9 compared to Kotak’s ₹19,618.8.

- 5 Year: Kotak edges out again with ₹29,962.9, slightly surpassing SBI’s ₹29,742.2.

- 10 Year: Kotak shows a significant advantage with ₹83,706.1 compared to SBI’s ₹66,173.4.

Key Takeaways

1. Performance Consistency:

- Kotak Emerging Equity Fund has shown consistent outperformance over the longer term, particularly in the 5 and 10-year periods.

- SBI Magnum Midcap Fund performs competitively in the short to medium term but lags behind Kotak in long-term performance.

2. Investment Value:

- Over 10 years, Kotak Emerging Equity Fund provided a significantly higher return on investment (₹83,706.1) than the SBI Magnum Midcap Fund (₹66,173.4).

SIP Returns Analysis

Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund

| Period Invested for | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| 1 Year | 40.42% | 36.23% |

| 2 Year | 32.73% | 31.33% |

| 3 Year | 26.24% | 26% |

| 5 Year | 28.54% | 29.59% |

| 10 Year | 21.38% | 19.85% |

Analysis:

- 1 Year: Kotak Emerging Equity Fund delivered a return of 40.42%, outperforming SBI Magnum Midcap Fund’s 36.23%.

- 2 Year: Kotak continued to lead with a return of 32.73% compared to SBI’s 31.33%.

- 3 Year: Kotak again marginally outperformed SBI, with returns of 26.24% versus 26%.

- 5 Year: SBI Magnum Midcap Fund took % lead here with 29.59%, while Kotak posted 28.54%.

- 10 Year: Kotak returned to the top with 21.38%, outperforming SBI’s 19.85%.

SIP Investment Value

| Period Invested for | Investments | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| 1 Year | 12000 | 14490.67 | 14243.05 |

| 2 Year | 24000 | 32663.49 | 32274.33 |

| 3 Year | 36000 | 52610.24 | 52441.6 |

| 5 Year | 60000 | 121214.49 | 124249.02 |

| 10 Year | 120000 | 371232.39 | 341706.9 |

Analysis:

- 1 Year: With an investment of ₹12,000, Kotak Emerging Equity Fund’s value grew to ₹14,490.67, slightly higher than SBI’s ₹14,243.05.

- 2 Year: Investing ₹24,000 in Kotak yielded ₹32,663.49, compared to ₹32,274.33 in SBI.

- 3 Year: A ₹36,000 investment in Kotak resulted in ₹52,610.24, marginally more than SBI’s ₹52,441.6.

- 5 Year: Here, SBI outperformed Kotak with an investment value of ₹124,249.02 against Kotak’s ₹121,214.49.

- 10 Year: Over a decade, Kotak’s investment value soared to ₹371,232.39, significantly higher than SBI’s ₹341,706.9.

Key Takeaways

1. Short-Term Performance:

- Kotak Emerging Equity Fund: Consistently outperformed SBI Magnum Midcap Fund in the 1, 2, and 3-year periods.

- SBI Magnum Midcap Fund: Slightly lagged behind Kotak in short-term returns.

2. Mid to Long-Term Performance:

- SBI Magnum Midcap Fund: Outperformed Kotak in the 5 years.

- Kotak Emerging Equity Fund: Showed superior performance over the 10 years, making it a better choice for long-term investors.

3. Investment Value Growth:

- Kotak Emerging Equity Fund: Delivered higher investment values in most periods, especially over the long term.

- SBI Magnum Midcap Fund: Competitively close in the short term but lags in the long term.

4. Consistency and Stability:

- Kotak Emerging Equity Fund: Offers more consistent returns across various periods, making it a reliable option for both short and long-term investors.

- SBI Magnum Midcap Fund: Shows strong mid-term performance but slightly falls behind in the long run.

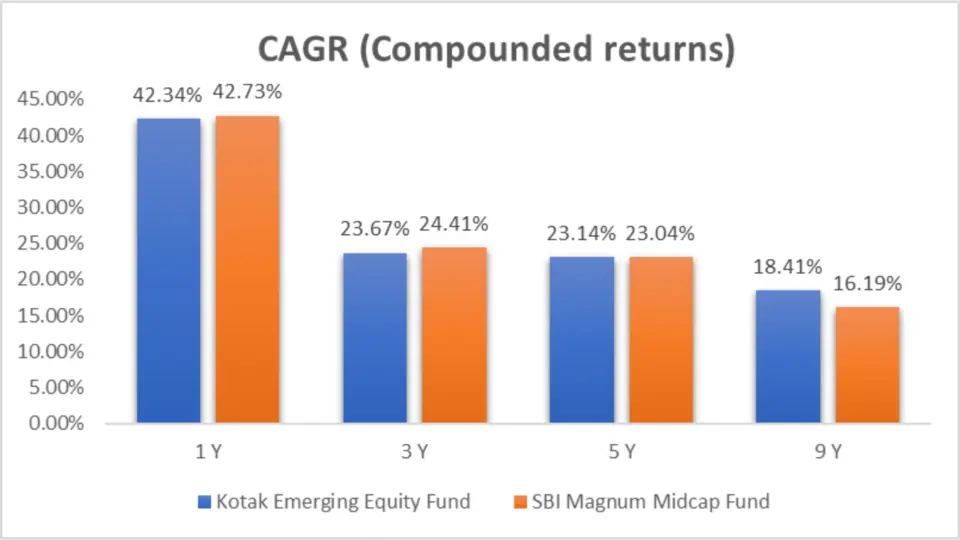

CAGR Analysis

| Category | 1 Y | 3 Y | 5 Y | 9 Y |

| Kotak Emerging Equity Fund | 42.34% | 23.67% | 23.14% | 18.41% |

| SBI Magnum Midcap Fund | 42.73% | 24.41% | 23.04% | 16.19% |

Analysis:

- 1 Year: SBI Magnum Midcap Fund slightly outperformed Kotak Emerging Equity Fund with a CAGR of 42.73% compared to 42.34%.

- 3 Year: SBI again leads with 24.41%, whereas Kotak stands at 23.67%.

- 5 Year: Kotak Emerging Equity Fund closely trails with a CAGR of 23.14% against SBI’s 23.04%.

- 9 Year: Kotak shows more robust long-term performance with an 18.41% CAGR, compared to SBI’s 16.19%.

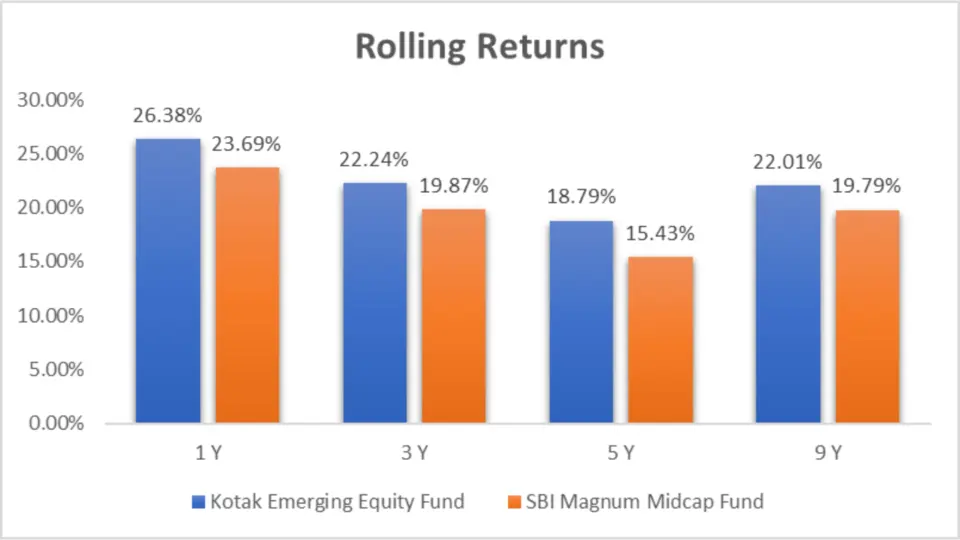

Rolling Returns Analysis

| Category | 1 Y | 3 Y | 5 Y | 9 Y |

| Kotak Emerging Equity Fund | 26.38% | 22.24% | 18.79% | 22.01% |

| SBI Magnum Midcap Fund | 23.69% | 19.87% | 15.43% | 19.79% |

Analysis:

- 1 Year: Kotak Emerging Equity Fund delivered a higher rolling return of 26.38% compared to SBI Magnum Midcap Fund’s 23.69%.

- 3 Year: Kotak maintains its lead with 22.24%, while SBI stands at 19.87%.

- 5 Year: Kotak’s rolling returns are 18.79%, outperforming SBI’s 15.43%.

- 9 Year: Kotak continues to show a more robust performance with 22.01%, compared to SBI’s 19.79%.

Key Takeaways

1. Short-Term Performance:

- Kotak Emerging Equity Fund: Demonstrates superior rolling returns across all short-term periods, indicating consistent performance.

- SBI Magnum Midcap Fund: While slightly ahead in CAGR for 1 and 3-year periods, it lags in rolling returns.

2. Long-Term Performance:

- Kotak Emerging Equity Fund: Shows better performance in CAGR and rolling returns over 9 years, making it a more reliable choice for long-term investors.

- SBI Magnum Midcap Fund: Despite competitive short-term performance, it falls behind Kotak in long-term growth.

3. Consistency and Stability:

- Kotak Emerging Equity Fund: Consistently outperforms in rolling returns, indicating stability and reliable performance over various periods.

- SBI Magnum Midcap Fund: Exhibits good short-term growth but lacks the Consistency of Kotak in the long run.

4. Best Choice for Investors:

- Short to Medium-Term: SBI Magnum Midcap Fund shows promise, especially for those looking at a 1 to 3-year investment horizon.

- Long-Term: Kotak Emerging Equity Fund is the superior choice, given its higher CAGR and rolling returns over extended periods.

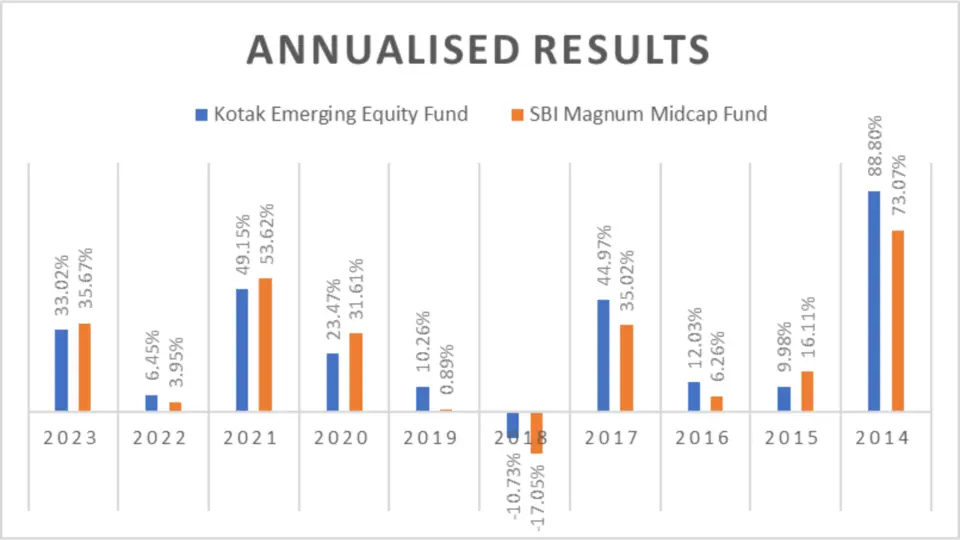

Annualized/Calendar Year Returns

| Period | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| 2023 | 33.02% | 35.67% |

| 2022 | 6.45% | 3.95% |

| 2021 | 49.15% | 53.62% |

| 2020 | 23.47% | 31.61% |

| 2019 | 10.26% | 0.89% |

| 2018 | -10.73% | -17.05% |

| 2017 | 44.97% | 35.02% |

| 2016 | 12.03% | 6.26% |

| 2015 | 9.98% | 16.11% |

| 2014 | 88.80% | 73.07% |

Analysis:

- 2023: SBI Magnum Midcap Fund outperformed Kotak Emerging Equity Fund with returns of 35.67% compared to 33.02%.

- 2022: Kotak Emerging Equity Fund led with 6.45%, surpassing SBI’s 3.95%.

- 2021: SBI again outperformed with a return of 53.62%, while Kotak posted 49.15%.

- 2020: SBI continued to lead with 31.61%, against Kotak’s 23.47%.

- 2019: Kotak emerged stronger with 10.26%, far ahead of SBI’s 0.89%.

- 2018: Both funds had negative returns, but Kotak fared better with -10.73% compared to SBI’s -17.05%.

- 2017: Kotak led with 44.97%, outpacing SBI’s 35.02%.

- 2016: Kotak again outperformed SBI by 12.03%, against SBI’s 6.26%.

- 2015: SBI took the lead with 16.11%, while Kotak had 9.98%.

- 2014: Kotak showed a significant lead with 88.80%, compared to SBI’s 73.07%.

Number of Times Outperformance

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| 6 | 4 |

Analysis:

- Kotak Emerging Equity Fund has outperformed SBI Magnum Midcap Fund 6 times out of the observed periods. In comparison, SBI has outperformed Kotak 4 times.

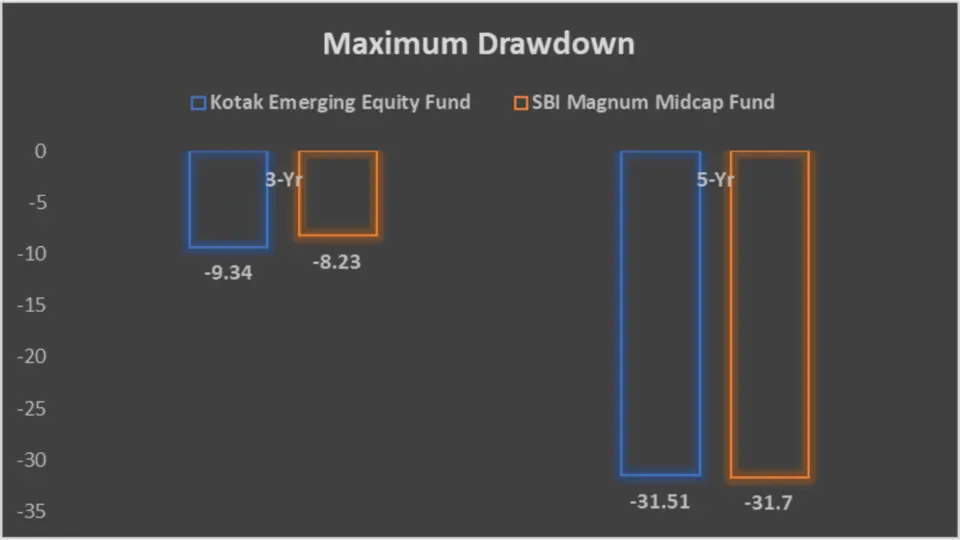

Maximum Drawdown Analysis

Maximum Drawdown

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| 3-Yr | -9.34 | -8.23 |

| 5-Yr | -31.51 | -31.7 |

Analysis:

- 3-Year: SBI Magnum Midcap Fund had a slightly lower drawdown of -8.23% compared to Kotak Emerging Equity Fund’s -9.34%.

- 5-Year: Kotak Emerging Equity Fund had a marginally better drawdown of -31.51% compared to SBI’s -31.7%.

Key Takeaways

1. Short-Term Performance:

- 2023: SBI Magnum Midcap Fund outperformed Kotak Emerging Equity Fund.

- 2022: Kotak led with better returns.

- 2021: SBI outperformed Kotak.

- 2020: SBI again led with higher returns.

2. Long-Term Performance:

- 2019-2018: Kotak showed a more robust performance in these years.

- 2017-2016: Kotak continued to outperform SBI.

- 2015-2014: SBI performed better in 2015, but Kotak dominated in 2014.

3. Consistency and Stability:

- Number of Times Outperformance: Kotak Emerging Equity Fund has outperformed more often (6 times) than SBI Magnum Midcap Fund (4 times).

- Maximum Drawdown: Kotak had slightly better drawdowns over the 5 years, indicating marginally better stability in the long term.

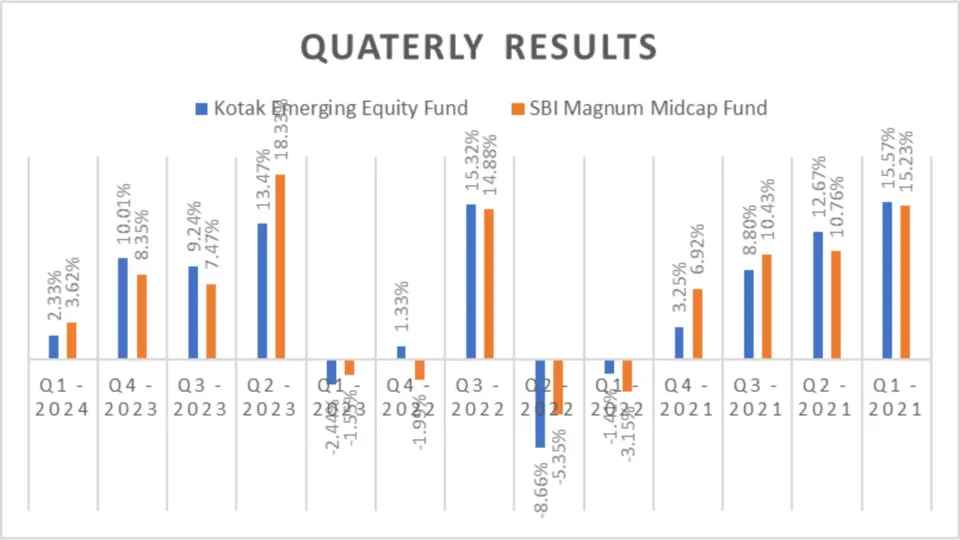

Quarterly Results

| Period | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| Q1 – 2024 | 2.33% | 3.62% |

| Q4 – 2023 | 10.01% | 8.35% |

| Q3 – 2023 | 9.24% | 7.47% |

| Q2 – 2023 | 13.47% | 18.33% |

| Q1 – 2023 | -2.44% | -1.55% |

| Q4 – 2022 | 1.33% | -1.99% |

| Q3 – 2022 | 15.32% | 14.88% |

| Q2 – 2022 | -8.66% | -5.35% |

| Q1 – 2022 | -1.41% | -3.15% |

| Q4 – 2021 | 3.25% | 6.92% |

| Q3 – 2021 | 8.80% | 10.43% |

| Q2 – 2021 | 12.67% | 10.76% |

| Q1 – 2021 | 15.57% | 15.23% |

Outperformance

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| Outperformance | 7 | 6 |

Analysis:

- Q1 – 2024: SBI Magnum Midcap Fund outperformed with a return of 3.62%, compared to Kotak’s 2.33%.

- Q4 – 2023: Kotak Emerging Equity Fund led with 10.01% against SBI’s 8.35%.

- Q3 – 2023: Kotak outperformed with 9.24%, while SBI posted 7.47%.

- Q2 – 2023: SBI took the lead with 18.33% versus Kotak’s 13.47%.

- Q1 – 2023: SBI showed a lesser negative return of -1.55% compared to Kotak’s -2.44%.

- Q4 – 2022: Kotak outperformed with 1.33%, while SBI had a negative return of -1.99%.

- Q3 – 2022: Both funds performed similarly, with Kotak slightly ahead at 15.32%.

- Q2 – 2022: SBI had a lesser negative return of -5.35%, while Kotak posted -8.66%.

- Q1 – 2022: Kotak performed better with -1.41% compared to SBI’s -3.15%.

- Q4 – 2021: SBI outperformed with 6.92%, while Kotak had 3.25%.

- Q3 – 2021: SBI led with 10.43% against Kotak’s 8.80%.

- Q2 – 2021: Kotak performed better with 12.67%, compared to SBI’s 10.76%.

- Q1 – 2021: Kotak marginally outperformed with 15.57%, while SBI had 15.23%.

Kotak Emerging Equity Fund has outperformed SBI Magnum Midcap Fund 7 times, while SBI has outperformed 6 times.

Risk Analysis

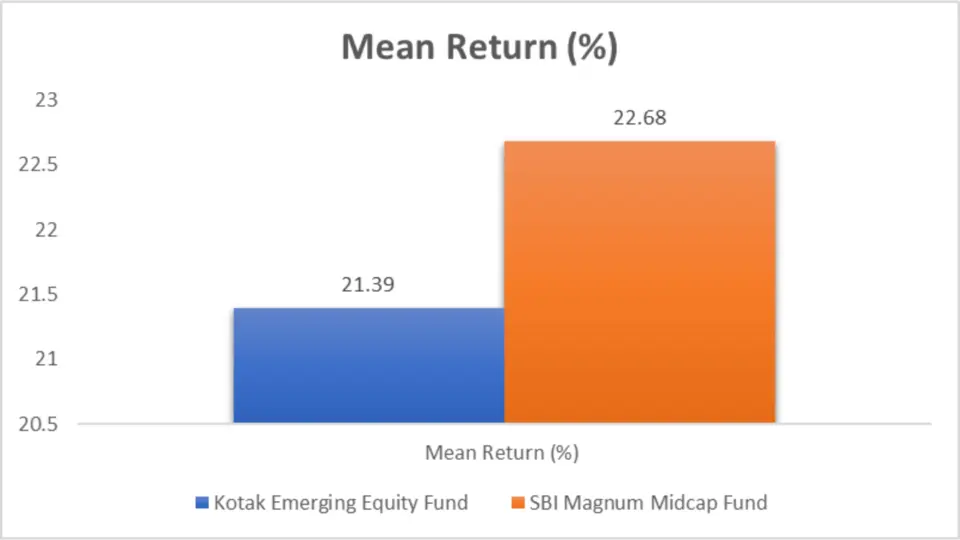

Mean Return, Sortino Ratio, Treynor’s Ratio

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| Mean Return (%) | 21.39 | 22.68 |

| Sortino (%) | 2.22 | 2.33 |

| Treynor’s Ratio (%) | 0.16 | 0.17 |

Analysis:

- Mean Return: SBI Magnum Midcap Fund had a higher mean return of 22.68% compared to Kotak’s 21.39%.

- Sortino Ratio: SBI again leads with a better Sortino ratio of 2.33, indicating better risk-adjusted returns than Kotak’s 2.22.

- Treynor’s Ratio: SBI slightly outperforms with a Treynor’s ratio of 0.17, while Kotak stands at 0.16.

Key Takeaways

1. Quarterly Performance:

- Short-Term Gains: SBI Magnum Midcap Fund showed more muscular short-term gains in Q1 2024 and Q2 2023.

- Consistency: Kotak Emerging Equity Fund demonstrated consistent performance in multiple quarters, outpacing SBI in 7 out of 13 quarters.

2. Risk-Adjusted Returns:

- Mean Return: SBI Magnum Midcap Fund has a higher mean return, indicating better overall performance.

- Sortino Ratio: SBI’s higher Sortino ratio suggests it provides better risk-adjusted returns, reducing downside risk.

- Treynor’s Ratio: SBI also shows a slight edge in risk-adjusted performance per unit of risk taken.

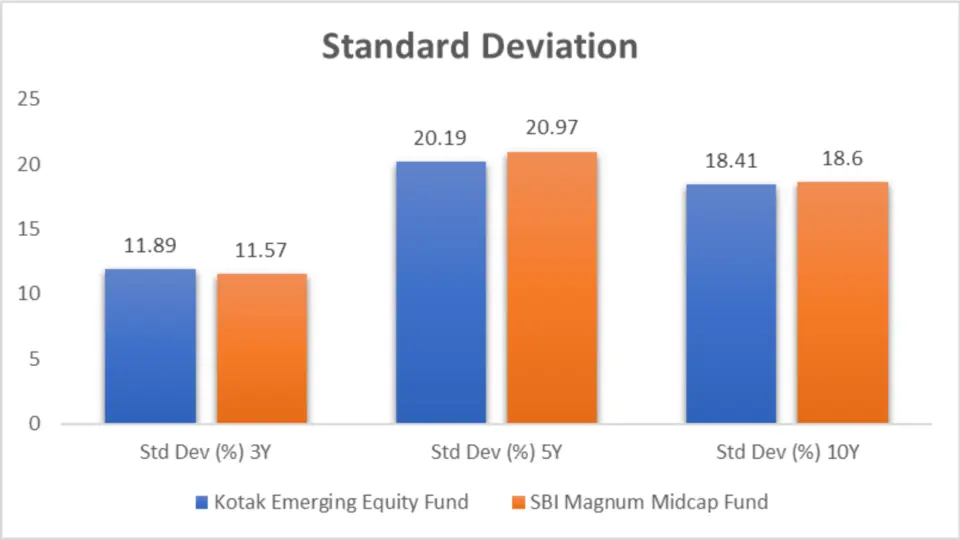

Standard Deviation Analysis

Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| Std Dev (%) 3Y | 11.89 | 11.57 |

| Std Dev (%) 5Y | 20.19 | 20.97 |

| Std Dev (%) 10Y | 18.41 | 18.6 |

Analysis:

- 3 Years: SBI Magnum Midcap Fund has a lower standard deviation (11.57%) than Kotak Emerging Equity Fund (11.89%), indicating lower volatility.

- 5 Years: Kotak Emerging Equity Fund shows lower volatility (20.19%) than SBI (20.97%).

- 10 Years: Kotak Emerging Equity Fund again shows lower volatility (18.41%) than SBI (18.60%).

A lower standard deviation is better as it indicates less risk. Kotak Emerging Equity Fund demonstrates lower volatility in the long term (5 and 10 years). In contrast, the SBI Magnum Midcap Fund shows lower volatility in the short term (3 years).

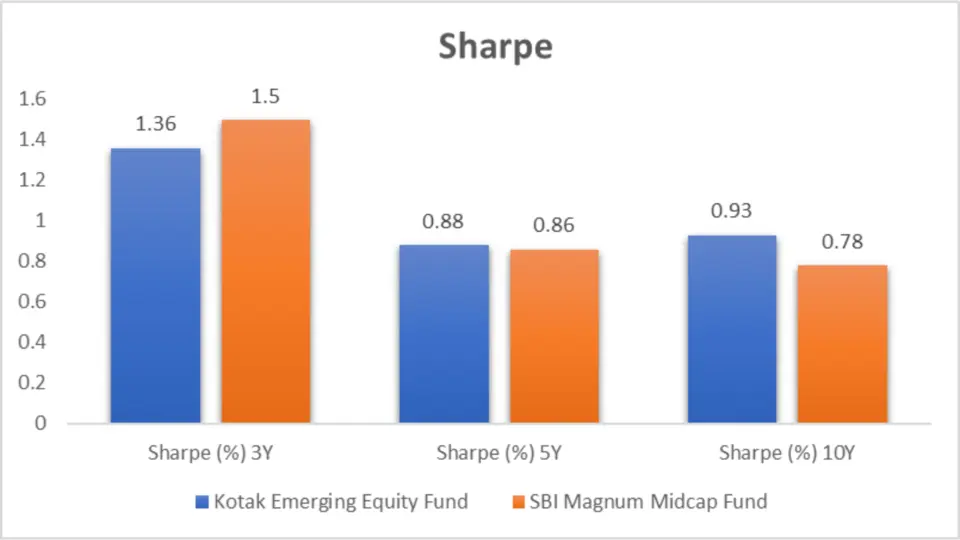

Sharpe Ratio Analysis

Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| Sharpe (%) 3Y | 1.36 | 1.5 |

| Sharpe (%) 5Y | 0.88 | 0.86 |

| Sharpe (%) 10Y | 0.93 | 0.78 |

Analysis:

- 3 Years: SBI Magnum Midcap Fund has a higher Sharpe ratio (1.50) than Kotak (1.36), indicating better risk-adjusted returns.

- 5 Years: Kotak Emerging Equity Fund leads with a higher Sharpe ratio (0.88) than SBI (0.86).

- 10 Years: Kotak Emerging Equity Fund again leads with a higher Sharpe ratio (0.93) than SBI (0.78).

A higher Sharpe ratio indicates better risk-adjusted returns. Kotak Emerging Equity Fund demonstrates superior risk-adjusted returns in the long term (5 and 10 years). In comparison, SBI Magnum Midcap Fund excels in the short term (3 years).

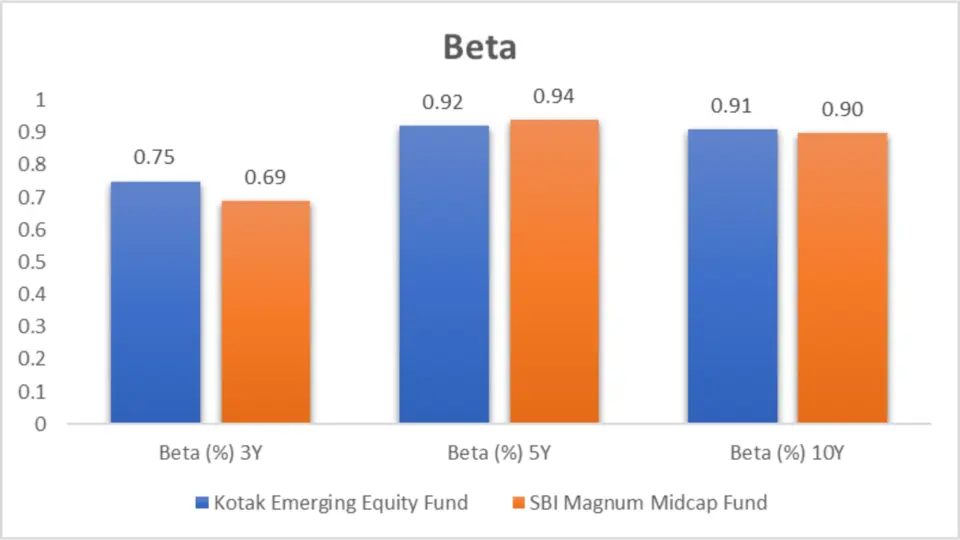

Beta Analysis

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| Beta (%) 3Y | 0.75 | 0.69 |

| Beta (%) 5Y | 0.92 | 0.94 |

| Beta (%) 10Y | 0.91 | 0.90 |

Analysis:

- 3 Years: SBI Magnum Midcap Fund has a lower beta (0.69) than Kotak (0.75), indicating lower market risk.

- 5 Years: Kotak Emerging Equity Fund has a lower beta (0.92) than SBI (0.94).

- 10 Years: SBI Magnum Midcap Fund has a slightly lower beta (0.90) than Kotak (0.91).

A lower beta indicates less market risk. SBI Magnum Midcap Fund shows lower market risk in the short-term (3 years) and long-term (10 years). In contrast, Kotak Emerging Equity Fund shows lower market risk in the mid-term (5 years).

Key Takeaways

1. Volatility and Risk:

- Short-Term (3 Years): SBI Magnum Midcap Fund shows lower volatility and market risk, making it a safer option in the short term.

- Mid-Term (5 Years): Kotak Emerging Equity Fund demonstrates lower volatility and better risk-adjusted returns.

- Long-Term (10 Years): Kotak Emerging Equity Fund exhibits lower volatility, better risk-adjusted returns, and slightly higher market risk than SBI.

2. Risk-Adjusted Returns:

- Short-Term: SBI Magnum Midcap Fund offers better risk-adjusted returns with a higher Sharpe ratio.

- Mid to Long-Term: Kotak Emerging Equity Fund provides superior risk-adjusted returns with higher Sharpe ratios over 5 and 10 years.

3. Market Risk:

- Short-Term: SBI Magnum Midcap Fund has a lower beta, indicating less market risk.

- Mid-Term: Kotak Emerging Equity Fund shows lower market risk with a lower beta.

- Long-Term: Both funds have similar market risks, with Kotak having a slightly higher beta.

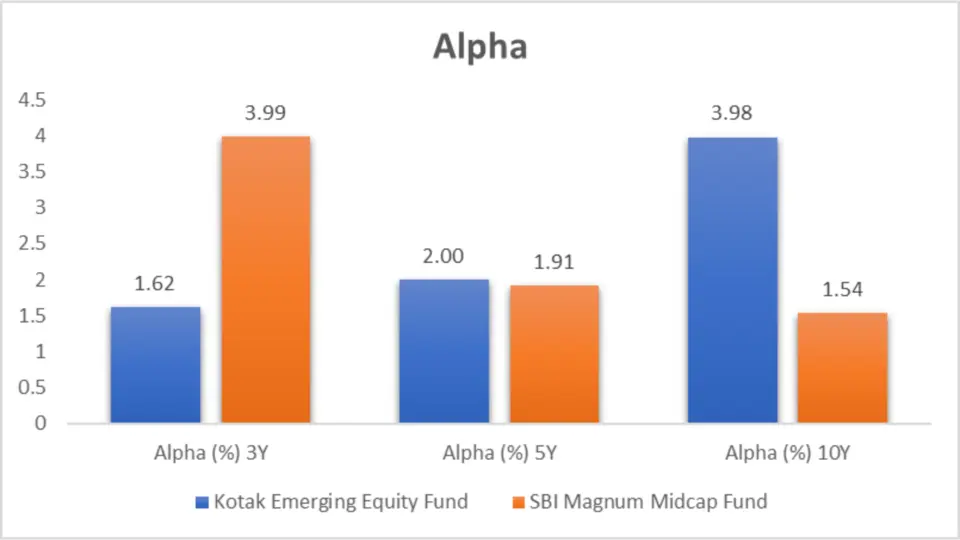

Alpha Performance

Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| Alpha (%) 3Y | 1.62 | 3.99 |

| Alpha (%) 5Y | 2.00 | 1.91 |

| Alpha (%) 10Y | 3.98 | 1.54 |

Analysis:

- 3 Years: SBI Magnum Midcap Fund has a significantly higher alpha (3.99%) compared to Kotak Emerging Equity Fund (1.62%), indicating better performance relative to the benchmark (NIFTY 100).

- 5 Years: Kotak Emerging Equity Fund leads with an alpha of 2.00%, slightly higher than SBI’s 1.91%.

- 10 Years: Kotak Emerging Equity Fund demonstrates strong outperformance with an alpha of 3.98%, compared to SBI’s 1.54%.

A higher alpha indicates better performance relative to the benchmark. While SBI Magnum Midcap Fund shows superior short-term performance, Kotak Emerging Equity Fund excels in the mid to long-term horizons.

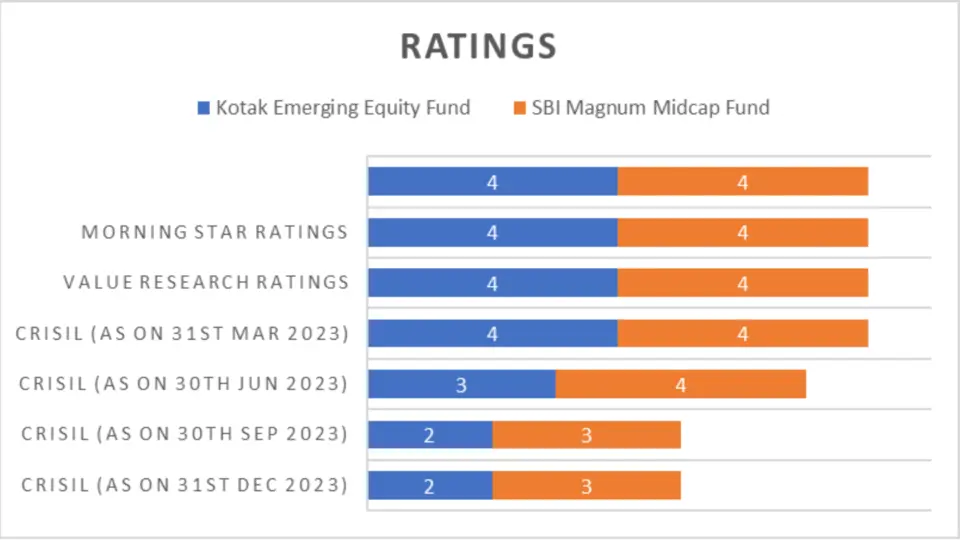

Ratings

Ratings

| Crisil Rank Ratings | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| CRISIL (as on 31st Mar 2024) | 2 | 3 |

| CRISIL (as on 31st Dec 2023) | 2 | 3 |

| CRISIL (as on 30th Sep 2023) | 3 | 4 |

| CRISIL (as on 30th Jun 2023) | 4 | 4 |

| CRISIL (as on 31st Mar 2023) | 4 | 4 |

| Value Research Ratings | 4 | 4 |

| Morning Star Ratings | 4 | 4 |

Analysis:

- CRISIL Ratings: Kotak Emerging Equity Fund consistently receives better CRISIL ratings in recent periods, indicating higher performance and lower risk than SBI Magnum Midcap Fund.

- Value Research Ratings: Both funds receive an equal rating of 4, suggesting they are both strong contenders in their category.

- Morning Star Ratings: Both funds are rated equally at 4, indicating good overall performance.

Kotak Emerging Equity Fund has a slight edge in recent CRISIL ratings. At the same time, both funds are equally rated by Value Research and Morning Star.

Key Takeaways

1. Alpha Performance:

- Short-Term (3 Years): SBI Magnum Midcap Fund demonstrates superior performance with a higher alpha.

- Mid-Term (5 Years): Kotak Emerging Equity Fund performs better with a higher alpha.

- Long-Term (10 Years): Kotak Emerging Equity Fund significantly outperforms with the highest alpha.

2. Ratings:

- CRISIL Ratings: Kotak Emerging Equity Fund has consistently improved and has better recent ratings.

- Value Research and Morning Star: Both funds are equally rated, suggesting strong performance in their category.

Portfolio Analysis

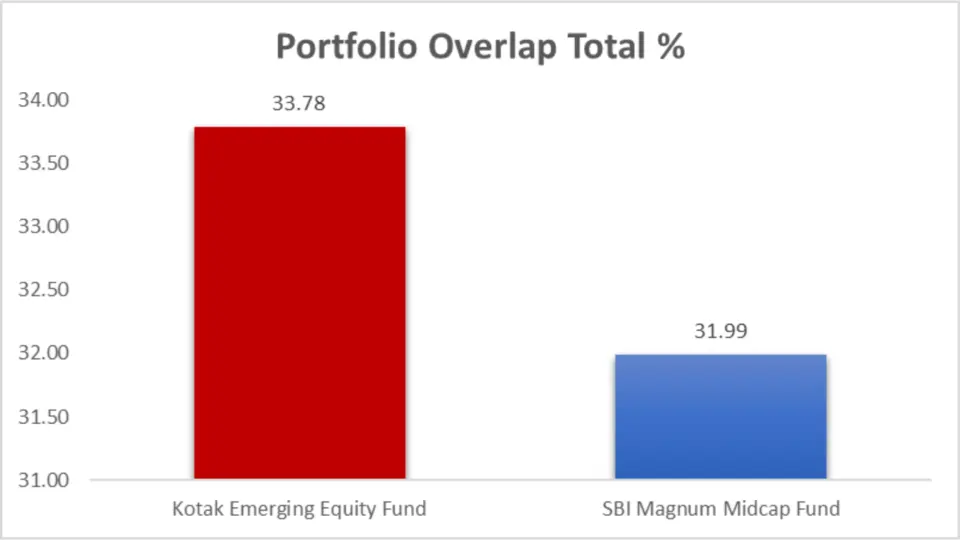

Portfolio Overlapping Comparison

Analysis:

Portfolio Overlap: Both funds have a significant overlap in their portfolios, with Kotak Emerging Equity Fund having a slightly higher overlap of 33.78% compared to SBI Magnum Midcap Fund’s 31.99%. This indicates a similarity in the stocks held by both funds, reflecting common investment strategies to some extent.

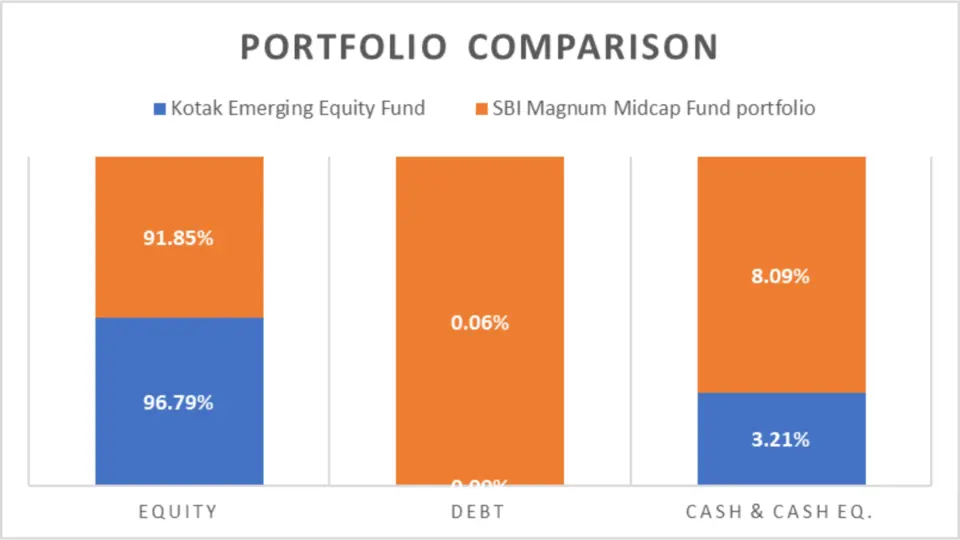

Portfolio Comparison

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| Equity | 96.79% | 91.85% |

| Debt | 0.00% | 0.06% |

| Cash & Cash Eq. | 3.21% | 8.09% |

| Real Estate, Gold, Others | ||

| Commodities |

Analysis:

- Equity Allocation: Kotak Emerging Equity Fund has a higher equity allocation (96.79%) than SBI Magnum Midcap Fund (91.85%). This suggests Kotak is more aggressively positioned in equities.

- Debt Allocation: Both funds have minimal exposure to debt, with SBI Magnum Midcap Fund having a slight 0.06% allocation.

- Cash & Cash Equivalents: SBI Magnum Midcap Fund holds a higher amount of cash and cash counterparts (8.09%) than Kotak (3.21%), indicating a more conservative approach or readiness to capitalize on new opportunities.

Kotak Emerging Equity Fund’s higher equity allocation suggests a more aggressive growth strategy. SBI Magnum Midcap Fund’s higher cash allocation indicates a balanced approach with flexibility for new investments.

Key Takeaways

1. Portfolio Overlap:

- Overlap: Both funds show significant overlap, with Kotak having a slightly higher overlap. This could indicate similar stock-picking strategies but with slight differences that could affect returns.

2. Asset Allocation:

- Equity Dominance: Kotak Emerging Equity Fund is more heavily invested in equities, suggesting a focus on capital growth.

- Cash Holdings: SBI Magnum Midcap Fund’s higher cash holdings indicate a more conservative or opportunistic stance, potentially reducing volatility but also indicating readiness to invest in opportunities as they arise.

3. Investment Strategy:

- Aggressive Growth: Kotak Emerging Equity Fund’s higher equity allocation suits investors looking for aggressive growth and higher risk.

- Balanced Approach: SBI Magnum Midcap Fund’s significant cash allocation suggests a balanced strategy, providing flexibility and potentially lower volatility.

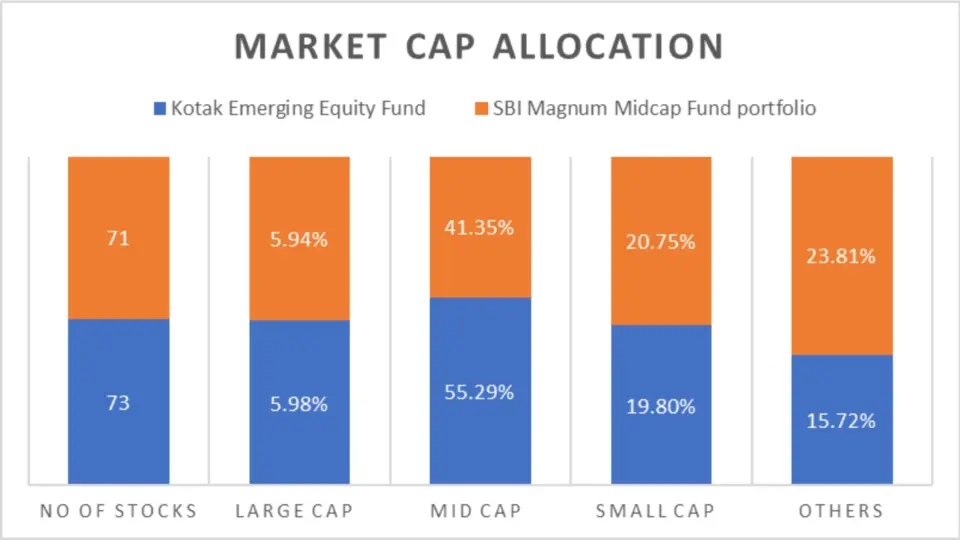

Market Cap Allocation

Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund

| Kotak Emerging Equity Fund | SBI Magnum Midcap Fund | |

| No of Stocks | 73 | 71 |

| Large Cap | 5.98% | 5.94% |

| Mid Cap | 55.29% | 41.35% |

| Small Cap | 19.80% | 20.75% |

| Others | 15.72% | 23.81% |

| Foreign Equity Holdings |

Analysis:

- Number of Stocks: Kotak Emerging Equity Fund holds 73 stocks. In contrast, SBI Magnum Midcap Fund holds 71, indicating a slightly broader diversification in Kotak.

- Large Cap Allocation: Both funds have similar exposure to large-cap stocks, with Kotak at 5.98% and SBI at 5.94%.

- Mid-Cap Allocation: Kotak has a significantly higher mid-cap allocation at 55.29%, compared to SBI’s 41.35%. This suggests Kotak is more focused on mid-cap growth opportunities.

- Small Cap Allocation: Both funds have comparable small-cap allocations, with Kotak at 19.80% and SBI at 20.75%.

- Others: SBI has a higher allocation to other investments at 23.81% compared to Kotak’s 15.72%, indicating a broader range of asset types.

Kotak Emerging Equity Fund has a higher emphasis on mid-cap stocks. At the same time, SBI Magnum Midcap Fund shows a more diversified approach with significant allocations to other investments.

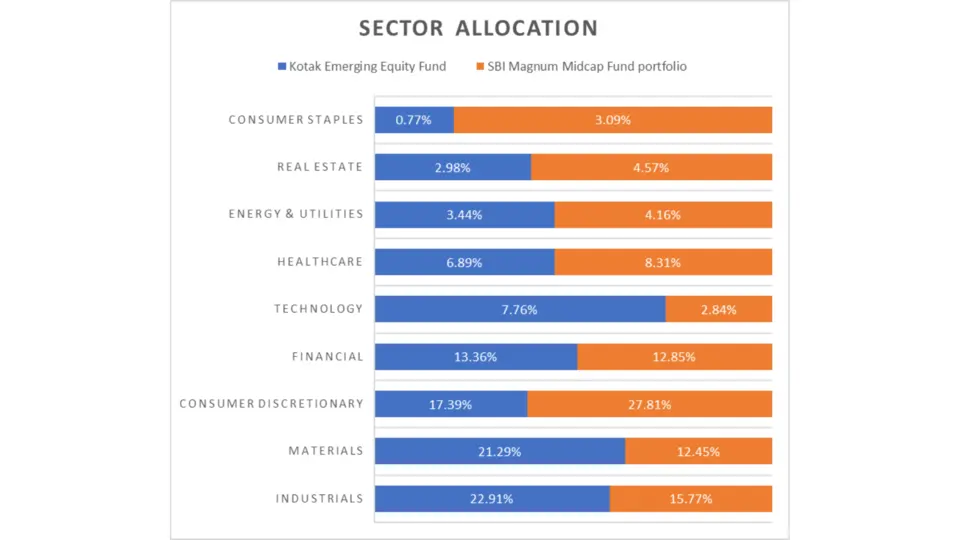

Sector Allocation

Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund

Sector Allocation

| Sector Allocation | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| Industrials | 22.91% | 15.77% |

| Materials | 21.29% | 12.45% |

| Consumer Discretionary | 17.39% | 27.81% |

| Financial | 13.36% | 12.85% |

| Technology | 7.76% | 2.84% |

| Healthcare | 6.89% | 8.31% |

| Energy & Utilities | 3.44% | 4.16% |

| Real Estate | 2.98% | 4.57% |

| Consumer Staples | 0.77% | 3.09% |

Analysis:

- Industrials and Materials: Kotak Emerging Equity Fund has higher allocations to industrials (22.91%) and materials (21.29%) compared to SBI (15.77% and 12.45%, respectively), indicating a focus on these sectors.

- Consumer Discretionary: SBI Magnum Midcap Fund has a significant allocation to consumer discretionary at 27.81%, compared to Kotak’s 17.39%, suggesting a solid belief in consumer growth.

- Financials: Both funds have similar allocations to financials, with Kotak at 13.36% and SBI at 12.85%.

- Technology: Kotak has a higher allocation to technology (7.76%) than SBI (2.84%), indicating a stronger focus on tech growth.

- Healthcare: SBI leads with an 8.31% allocation to healthcare, compared to Kotak’s 6.89%.

- Energy & Utilities and Real Estate: Both funds have similar but slightly different allocations, with SBI having higher percentages.

- Consumer Staples: SBI has a higher allocation to consumer staples at 3.09% compared to Kotak’s 0.77%.

Kotak Emerging Equity Fund focuses more on the industrial, materials, and technology sectors, while SBI Magnum Midcap Fund emphasizes consumer discretion and healthcare sectors. This indicates different strategic approaches in sector allocation.

Key Takeaways

1. Market Cap Allocation:

- Mid-Cap Focus: Kotak Emerging Equity Fund is heavily invested in mid-cap stocks, which could offer higher growth potential and risk.

- Diversification: SBI Magnum Midcap Fund shows a more diversified asset allocation, including a significant proportion in other investments.

2. Sector Allocation:

- Sector Focus: Kotak emphasizes industrials, materials, and technology, while SBI focuses on consumer discretionary and healthcare.

- Strategic Differences: The differing sector allocations reflect the fund managers’ unique strategies and growth outlooks.

3. Investment Strategy:

- Growth Potential: Kotak’s higher mid-cap and technology focus might appeal to investors seeking aggressive growth.

- Balanced Approach: SBI’s diversified sector approach and higher allocation to consumer discretionary might suit investors looking for balanced growth with consumer-driven stability.

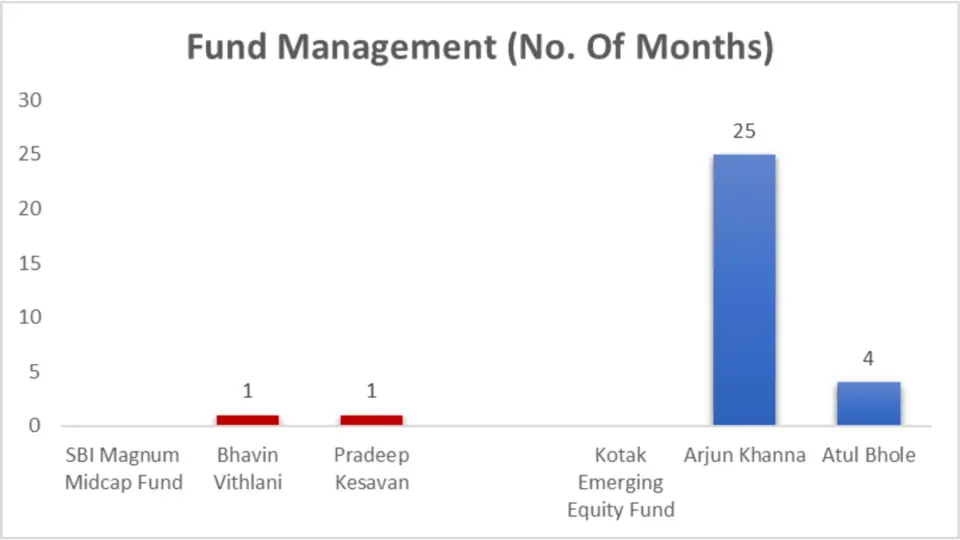

Fund Management Comparison

| Fund Manager | SBI Magnum Midcap Fund | Kotak Emerging Equity Fund |

| Bhavin Vithlani | 1 | |

| Pradeep Kesavan | 1 | |

| Arjun Khanna | 25 | |

| Atul Bhole | 4 |

Analysis:

- SBI Magnum Midcap Fund:

- Bhavin Vithlani and Pradeep Kesavan have managed the fund for just 1 month. This indicates a recent change in management, which could bring fresh perspectives and some initial instability as the new managers settle into their roles.

- Kotak Emerging Equity Fund:

- Arjun Khanna has been managing the fund for 25 months, showing a solid period of oversight and strategic implementation.

- Atul Bhole has been with the fund for 4 months, providing support and additional insights to the fund management.

The Kotak Emerging Equity Fund benefits from a more stable and experienced fund management team compared to the newly appointed managers of the SBI Magnum Midcap Fund.

Key Takeaways

1. Fund Management Stability:

- SBI Magnum Midcap Fund: With Bhavin Vithlani and Pradeep Kesavan being newly appointed (1 month each), there might be initial strategic adjustments and possible short-term volatility as they bring their perspectives to the fund.

- Kotak Emerging Equity Fund: The fund enjoys stability, with Arjun Khanna having a longer tenure (25 months), which often translates to more consistent performance and a well-established strategy.

2. Experience and Strategy:

- SBI Magnum Midcap Fund: The fresh management team could bring new strategies and perspectives, which can be beneficial in the long run but might also involve some short-term adjustments.

- Kotak Emerging Equity Fund: The longer tenure of Arjun Khanna and the recent addition of Atul Bhole suggest a mix of sustained strategy with new inputs, likely maintaining stability while also adapting to market changes.

3. Impact on Performance:

- Short-Term: SBI Magnum Midcap Fund might experience short-term volatility as the new managers implement their strategies.

- Long-Term: Kotak Emerging Equity Fund’s stable management will likely continue delivering consistent performance based on well-established strategies.

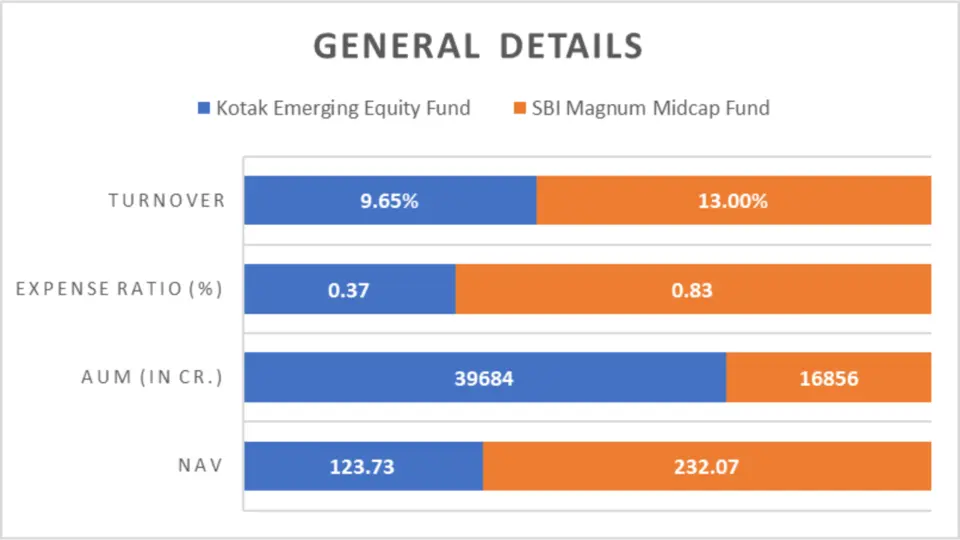

Other Important General Details

| NAV | 123.73 | 232.07 |

| AUM (in Cr.) | 39684 | 16856 |

| Expense Ratio (%) | 0.37 | 0.83 |

| Turnover | 9.65% | 13.00% |

| Benchmark | Nifty Midcap 100 | Nifty Midcap 100 |

Analysis:

- NAV (Net Asset Value): The NAV of SBI Magnum Midcap Fund is higher at 232.07 compared to Kotak Emerging Equity Fund at 123.73. NAV indicates the fund’s per-unit price.

- AUM (Assets Under Management): Kotak Emerging Equity Fund has a significantly higher AUM (₹39684 Cr.) compared to SBI Magnum Midcap Fund (₹16856 Cr.), indicating a more extensive asset base and potentially greater investor confidence.

- Expense Ratio: Kotak Emerging Equity Fund has a lower expense ratio of 0.37%, while SBI Magnum Midcap Fund has a higher expense ratio of 0.83%. A lower expense ratio is useful as it means lower costs for the investor.

- Turnover: SBI Magnum Midcap Fund has a higher turnover rate at 13.00% compared to Kotak’s 9.65%. A higher turnover indicates more frequent buying and selling of assets, which could lead to higher transaction costs and tax implications.

- Benchmark: Both funds use the Nifty Midcap 100 as their benchmark, making it easier to compare their performance against a common standard.

Kotak Emerging Equity Fund offers a lower expense ratio and higher AUM, suggesting cost efficiency and higher investor confidence. SBI Magnum Midcap Fund, while having a higher NAV, has a higher turnover and expense ratio, indicating more active management.

Minimum Investment Amount

Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund

| Investment Type | Kotak Emerging Equity Fund | SBI Magnum Midcap Fund |

| SIP | ₹ 100 | ₹ 500 |

| Lumpsum | ₹ 100 | ₹ 5,000 |

Analysis:

- SIP (Systematic Investment Plan): Kotak Emerging Equity Fund allows investors to start a SIP with as little as ₹100, making it highly accessible to small investors. In contrast, the SBI Magnum Midcap Fund requires a minimum of ₹500.

- Lumpsum Investment: Kotak Emerging Equity Fund also allows a lumpsum investment starting at ₹100. At the same time, SBI Magnum Midcap Fund has a higher entry barrier with a minimum lump sum amount of ₹5,000.

Kotak Emerging Equity Fund is more accessible for investors with lower investment amounts, both for SIP and lumpsum, making it a more flexible option for small investors.

Key Takeaways

1. Cost Efficiency:

- Expense Ratio: Kotak Emerging Equity Fund’s lower expense ratio makes it a cost-effective choice for investors looking to minimize fees.

- Turnover: Lower turnover in Kotak Emerging Equity Fund suggests lower transaction costs and tax implications.

2. Accessibility:

- Minimum Investment: Kotak Emerging Equity Fund’s lower minimum investment amounts make it more accessible to a broader range of investors, especially those looking to start small.

3. Fund Size and Confidence:

- AUM: Higher AUM in Kotak Emerging Equity Fund indicates greater investor confidence and potentially more stability due to a more extensive asset base.

Conclusion

based on the comprehensive analysis, Kotak Emerging Equity Fund is the better choice regarding cost efficiency, accessibility, and investor confidence, given its lower expense ratio, minimal turnover, and higher AUM. This fund is particularly suitable for investors with a lower risk appetite or those starting with smaller investments due to its low minimum investment amounts.

Conversely, SBI Magnum Midcap Fund might appeal more to investors with a higher risk appetite who are looking for a more actively managed fund despite its higher costs and turnover. Ultimately, Kotak Emerging Equity Fund is generally superior across most parameters. Still, SBI Magnum Midcap Fund offers a dynamic approach for those willing to embrace higher risk and costs.

We hope you found this guide on mutual funds helpful.

If you have any mutual fund-related queries, feel free to comment below—we’re here to help! S.K. Singh, a registered professional with the Association of Mutual Funds in India (AMFI), will answer your queries and holds the ARN-251149.

Invest wisely!

FAQs-Kotak Emerging Equity Fund vs SBI Magnum Midcap Fund

Which fund has a lower expense ratio, SBI Magnum Midcap Fund vs Kotak Emerging Equity Fund?

The Kotak Emerging Equity Fund has a significantly lower expense ratio of 0.37% compared to the SBI Magnum Midcap Fund’s 0.83%. A lower expense ratio means lower costs for investors, making Kotak Emerging Equity Fund a more cost-effective choice.

What is the minimum investment amount for SIP and lumpsum for SBI Magnum Midcap Fund and Kotak Emerging Equity Fund?

The minimum investment amount for Kotak Emerging Equity Fund is ₹100 for both SIP and lumpsum investments, making it highly accessible. On the other hand, the SBI Magnum Midcap Fund requires a minimum of ₹500 for SIP and ₹5,000 for lumpsum investments.

How do the fund management tenures compare between Kotak Emerging Equity Fund and SBI Magnum Midcap Fund?

Kotak Emerging Equity Fund benefits from more experienced fund managers, with Arjun Khanna managing for 25 months and Atul Bhole for 4 months. In contrast, SBI Magnum Midcap Fund’s managers, Bhavin Vithlani and Pradeep Kesavan, have managed the fund for just 1 month.

Which fund is better for a conservative investor?

For conservative investors, the Kotak Emerging Equity Fund is more suitable due to its lower expense ratio, higher asset base (AUM), and stable management team. The fund’s accessibility with low minimum investment amounts also makes it ideal for cautious investors looking to start small.

Which fund is preferable for aggressive investors?

Aggressive investors might prefer the SBI Magnum Midcap Fund due to its more active management approach, indicated by its higher turnover rate. This could offer higher returns for those willing to embrace greater risk and higher costs.

How do the NAV and AUM of the two funds compare?

The NAV of SBI Magnum Midcap Fund is higher at ₹232.07 compared to Kotak Emerging Equity Fund’s ₹123.73. Regarding AUM, Kotak Emerging Equity Fund has a more extensive asset base of ₹39684 crore, indicating greater investor confidence, compared to SBI Magnum Midcap Fund’s ₹16856 crore.

Which fund has a higher allocation to mid-cap stocks?

Kotak Emerging Equity Fund has a higher allocation to mid-cap stocks at 55.29%, compared to 41.35% for SBI Magnum Midcap Fund. This suggests Kotak is more focused on mid-cap growth opportunities.

What benchmark do both funds use?

Kotak Emerging Equity Fund and SBI Magnum Midcap Fund use the Nifty Midcap 100 as their benchmark, providing a common standard for performance comparison.

How do the sector allocations differ between the two funds?

Kotak Emerging Equity Fund places more emphasis on industrials, materials, and technology sectors, while SBI Magnum Midcap Fund focuses more on consumer discretionary and healthcare sectors. These differences reflect the unique strategic approaches of the fund managers.

Which fund has shown better historical performance in terms of alpha?

Kotak Emerging Equity Fund has shown superior long-term performance with higher alpha over 5 and 10-year periods. However, SBI Magnum Midcap Fund has demonstrated higher alpha in the 3 years, indicating better short-term performance.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.