Choosing the right one in the dynamic landscape of mutual funds can be daunting, especially when faced with options like Nippon India Small Cap Fund vs. Quant Small Cap Fund. Both funds have unique investment styles, returns, and potential growth trajectories. Let’s delve into a detailed comparative analysis to understand which option might be better for you.

Investment Style

Nippon India Small Cap Fund: Growth

Nippon India Small Cap Fund follows a growth investment style, focusing on companies with high growth potential. This strategy aims to maximize capital appreciation over the long term by investing in small-cap stocks poised for significant expansion.

Quant Small Cap Fund: Blend

On the other hand, Quant Small Cap Fund adopts a blend investment style, combining growth and value investing elements. This approach seeks to balance growth opportunities and undervalued stocks, offering a diversified portfolio that can withstand market fluctuations.

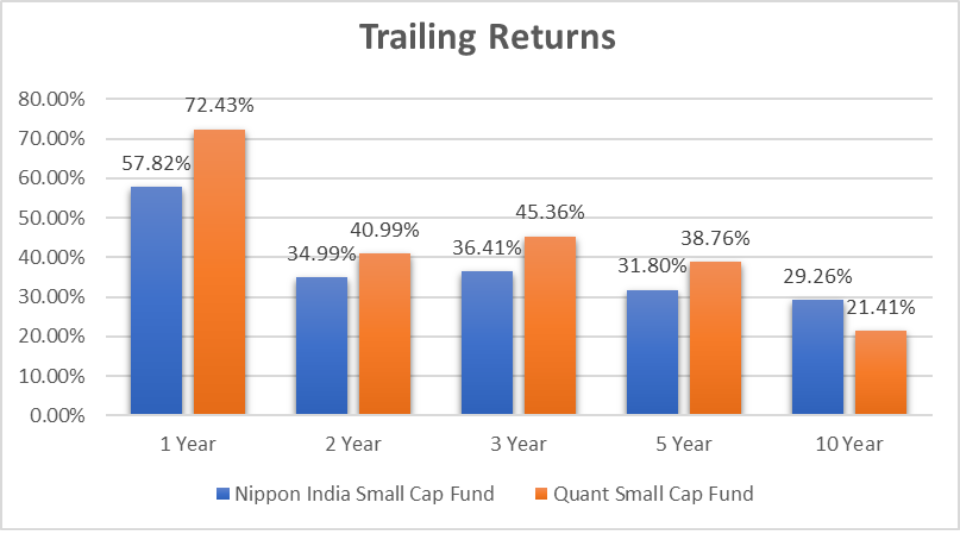

Returns Analysis

Annualized Returns

| Period Invested for | Nippon India Small Cap Fund | Quant Small Cap Fund |

| 1 Year | 57.82% | 72.43% |

| 2 Year | 34.99% | 40.99% |

| 3 Year | 36.41% | 45.36% |

| 5 Year | 31.80% | 38.76% |

| 10 Year | 29.26% | 21.41% |

Analysis:

- Over the past year, Quant Small Cap Fund has outperformed Nippon India Small Cap Fund with a higher annualized return of 72.43% compared to 57.82%.

- Similarly, Quant Small Cap Fund has shown better performance over the 2-year, 3-year, and 5-year periods, indicating its consistency in delivering returns.

- However, Nippon India Small Cap Fund has demonstrated a more robust performance over ten years with an annual return of 29.26% compared to 21.41% for Quant Small Cap Fund.

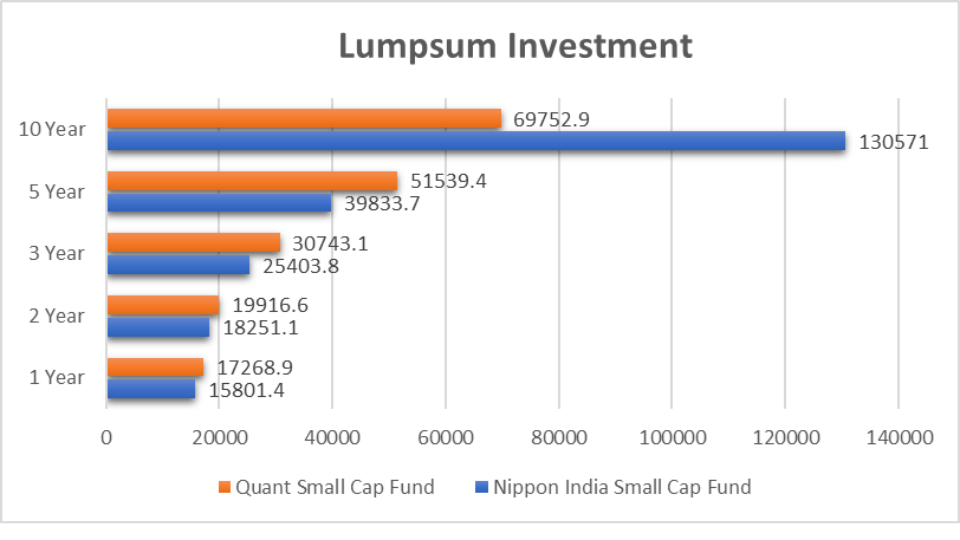

Lumpsum Investment Value

| Period Invested for | Nippon India Small Cap Fund (₹) | Quant Small Cap Fund (₹) |

| 1 Year | 15,801.4 | 17,268.9 |

| 2 Year | 18,251.1 | 19,916.6 |

| 3 Year | 25,403.8 | 30,743.1 |

| 5 Year | 39,833.7 | 51,539.4 |

| 10 Year | 1,30,571 | 69,752.9 |

Analysis:

- The lumpsum investment value is higher for Quant Small Cap Fund than Nippon India Small Cap Fund for all investment durations.

- Over ten years, the disparity in lumpsum investment value is significant, with Quant Small Cap Fund providing a value of ₹69,752.9 compared to ₹1,30,571 for Nippon India Small Cap Fund.

Key Takeaways

- Investment Style: Nippon India Small Cap Fund focuses on growth, while Quant Small Cap Fund adopts a blend of growth and value investing.

- Returns Analysis: Quant Small Cap Fund has shown better short to medium-term performance. At the same time, Nippon India Small Cap Fund has demonstrated more robust long-term performance.

- Lumpsum Investment Value: Quant Small Cap Fund offers higher lumpsum investment value across all investment durations.

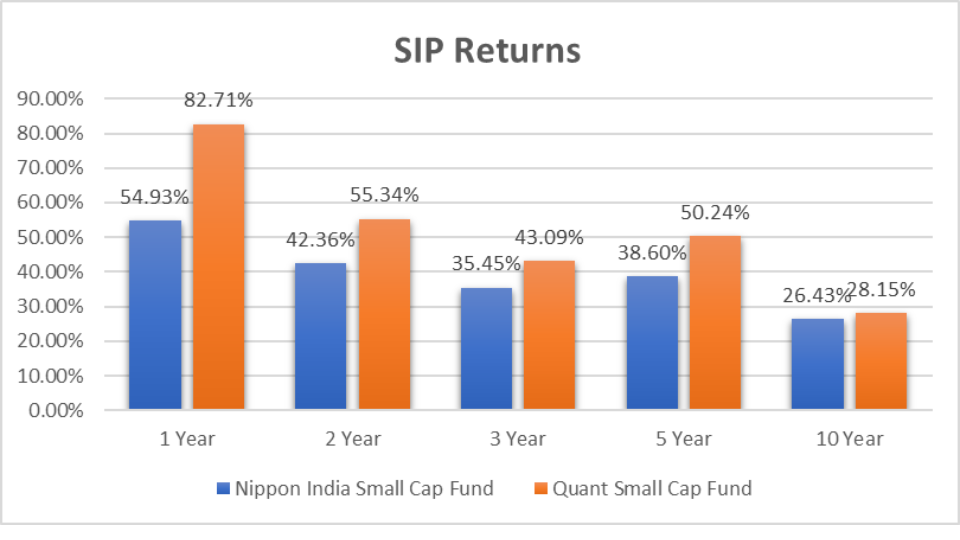

SIP Returns Analysis

SIP Returns (NAV as of 4th March 2024)

| Period Invested for | Nippon India Small Cap Fund | Quant Small Cap Fund |

| 1 Year | 54.93% | 82.71% |

| 2 Year | 42.36% | 55.34% |

| 3 Year | 35.45% | 43.09% |

| 5 Year | 38.60% | 50.24% |

| 10 Year | 26.43% | 28.15% |

Analysis:

- Over the past year, Quant Small Cap Fund has delivered higher SIP returns with a growth rate of 82.71% compared to 54.93% for Nippon India Small Cap Fund.

- Similarly, Quant Small Cap Fund has outperformed Nippon India Small Cap Fund over the 2-year, 3-year, and 5-year periods, consistently delivering higher returns.

- However, over ten years, the SIP returns for both funds are relatively close, with Nippon India Small Cap Fund slightly lagging.

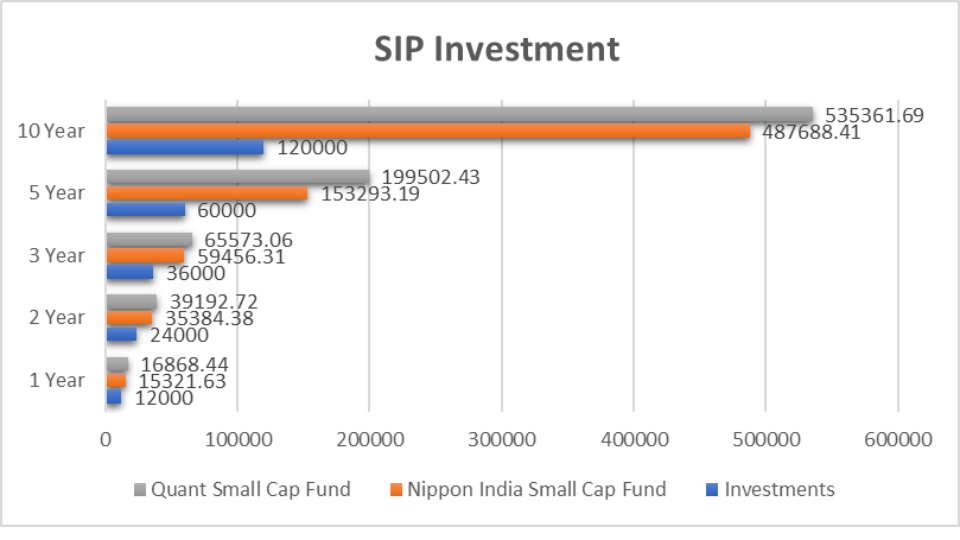

SIP Investment Value Analysis

SIP Investment Value (NAV as of 4th March 2024)

| Period Invested for | Investments (₹) | Nippon India Small Cap Fund (₹) | Quant Small Cap Fund (₹) |

| 1 Year | 12,000 | 15,321.63 | 16,868.44 |

| 2 Year | 24,000 | 35,384.38 | 39,192.72 |

| 3 Year | 36,000 | 59,456.31 | 65,573.06 |

| 5 Year | 60,000 | 1,53,293.19 | 1,99,502.43 |

| 10 Year | 1,20,000 | 4,87,688.41 | 5,35,361.69 |

Analysis:

- For all investment durations, the SIP investment value is higher for Quant Small Cap Fund than Nippon India Small Cap Fund, indicating its potential for wealth accumulation over time.

- Over ten years, the disparity in SIP investment value between the two funds is significant, with Quant Small Cap Fund offering higher returns.

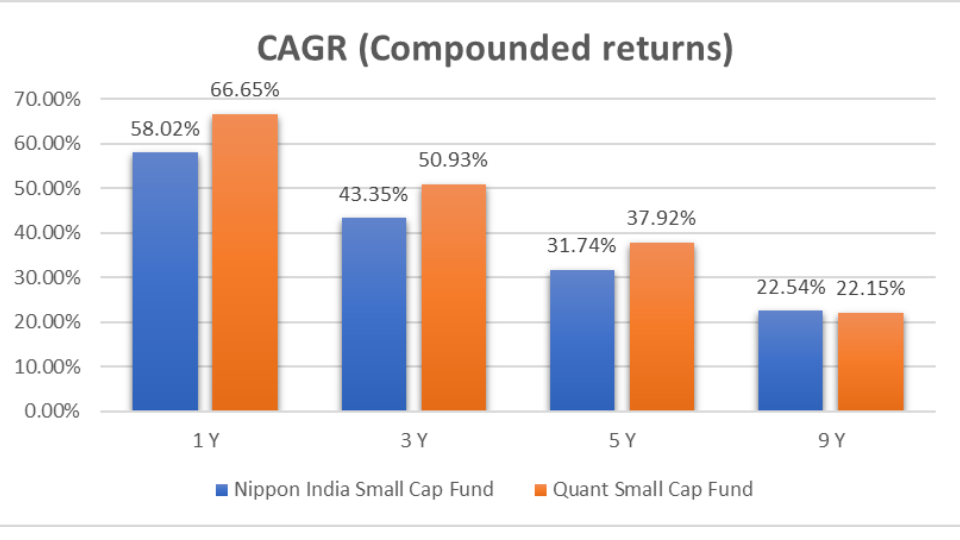

CAGR (Compounded Annual Growth Rate) Analysis

CAGR

| Category | 1 Year | 3 Year | 5 Year | 9 Year |

| Nippon India Small Cap Fund | 58.02% | 43.35% | 31.74% | 22.54% |

| Quant Small Cap Fund | 66.65% | 50.93% | 37.92% | 22.15% |

Analysis:

- The compound annual Growth Rate (CAGR) reflects the annualized growth rate of an investment over a specified period.

- Quant Small Cap Fund has consistently demonstrated higher CAGR across all categories than Nippon India Small Cap Fund, indicating its superior performance in generating returns over time.

Key Takeaways

- SIP Returns: Quant Small Cap Fund has consistently outperformed Nippon India Small Cap Fund in terms of SIP returns over various investment durations.

- SIP Investment Value: Quant Small Cap Fund offers higher SIP investment value across all investment durations, highlighting its potential for wealth creation.

- CAGR: Quant Small Cap Fund has shown a higher CAGR than Nippon India Small Cap Fund, indicating better long-term growth prospects.

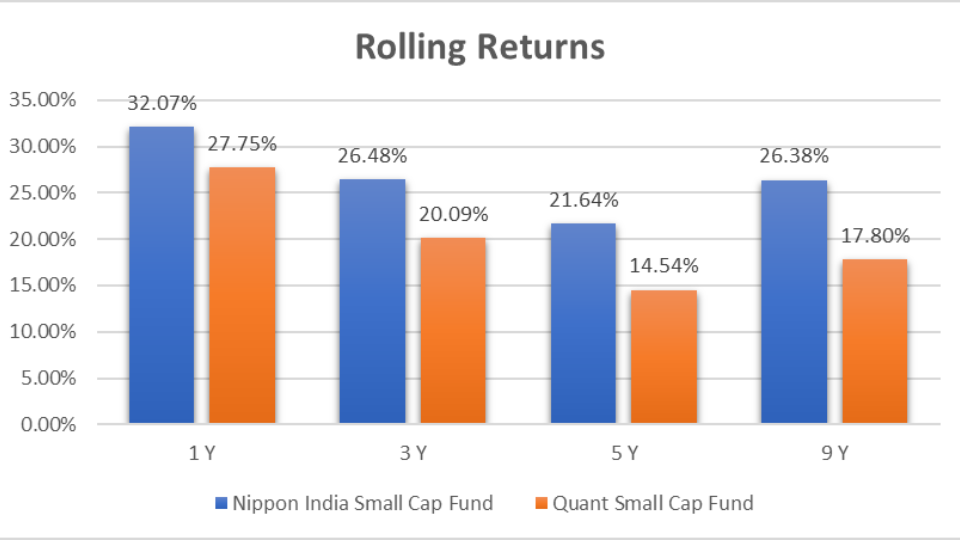

Rolling Returns Analysis

Rolling Returns

| Category | 1 Year | 3 Years | 5 Years |

| Nippon India Small Cap Fund | 32.07% | 26.48% | 21.64% |

| Quant Small Cap Fund | 27.75% | 20.09% | 14.54% |

Analysis:

- Rolling returns provide a snapshot of a fund’s performance over various overlapping periods.

- Nippon India Small Cap Fund has consistently shown higher rolling returns than Quant Small Cap Fund across all categories, indicating its potential for generating superior returns over time.

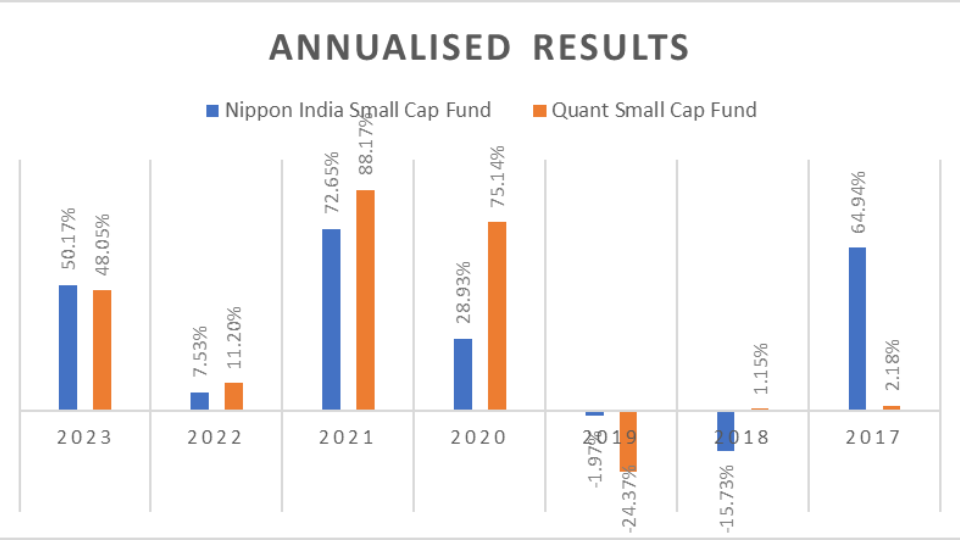

Annualized Results Analysis

Annualized Results (NAV as of 4th March 2024)

| Period | Nippon India Small Cap Fund | Quant Small Cap Fund |

| 2023 | 50.17% | 48.05% |

| 2022 | 7.53% | 11.20% |

| 2021 | 72.65% | 88.17% |

| 2020 | 28.93% | 75.14% |

| 2019 | -1.97% | -24.37% |

| 2018 | -15.73% | 1.15% |

| 2017 | 64.94% | 2.18% |

Analysis:

- The annualized results provide a comprehensive view of a fund’s performance over consecutive years.

- Nippon India Small Cap Fund has outperformed Quant Small Cap Fund in specific years, such as 2021 and 2017, while Quant Small Cap Fund has shown better performance in other years, like 2020.

- Over the analyzed period, both funds have experienced fluctuations in performance, influenced by market conditions and investment strategies.

Outperformance Analysis

Outperformance

| Nippon India Small Cap Fund | Quant Small Cap Fund | |

| No. of times Outperformance | 3 | 4 |

Analysis:

- Quantifying the number of times each fund has outperformed the other provides valuable insights into their relative strengths.

- Quant Small Cap Fund has outperformed Nippon India Small Cap Fund in slightly higher instances, indicating its potential for delivering superior returns under certain market conditions.

Key Takeaways

- Rolling Returns: Nippon India Small Cap Fund has consistently demonstrated higher rolling returns than Quant Small Cap Fund, suggesting better performance over various overlapping periods.

- Annualized Results: Both funds have experienced fluctuations in performance over the analyzed period, with Nippon India Small Cap Fund outperforming in some years and Quant Small Cap Fund in others.

- Outperformance: Quant Small Cap Fund has outperformed Nippon India Small Cap Fund in slightly more instances, highlighting its competitive edge in certain market conditions.

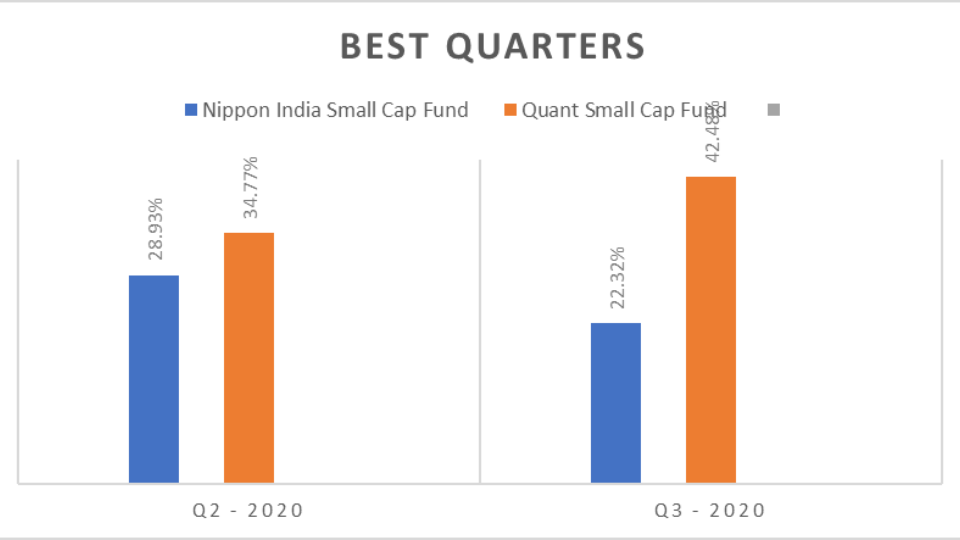

Best Quarters Analysis

Best Quarters

| Period | Nippon India Small Cap Fund | Quant Small Cap Fund |

| Q2 – 2020 | 28.93% | 34.77% |

| Q3 – 2020 | 22.32% | 42.48% |

Analysis:

- The best quarters showcase the highest returns achieved by each fund during specific periods.

- Quant Small Cap Fund outperformed Nippon India Small Cap Fund in Q2 and Q3 of 2020, indicating its ability to capitalize on market opportunities and deliver substantial returns to investors during those quarters.

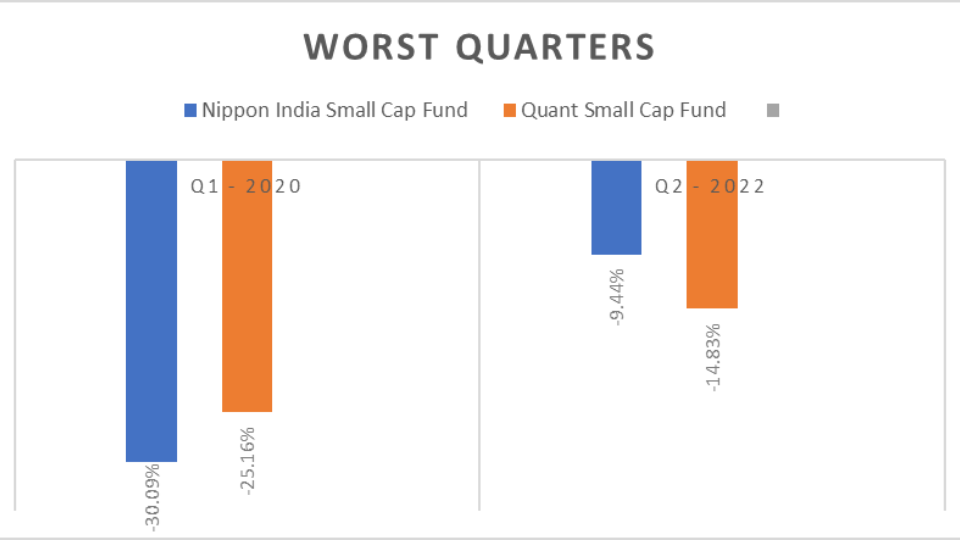

Worst Quarters Analysis

Worst Quarters

| Period | Nippon India Small Cap Fund | Quant Small Cap Fund |

| Q1 – 2020 | -30.09% | -25.16% |

| Q2 – 2022 | -9.44% | -14.83% |

Analysis:

- The worst quarters highlight the periods of significant decline in the performance of each fund.

- Both funds experienced negative returns during Q1 of 2020, with Nippon India Small Cap Fund showing a slightly higher decline than Quant Small Cap Fund.

- In Q2 of 2022, both funds again saw negative returns. Still, Nippon India Small Cap Fund experienced a relatively higher decline than Quant Small Cap Fund.

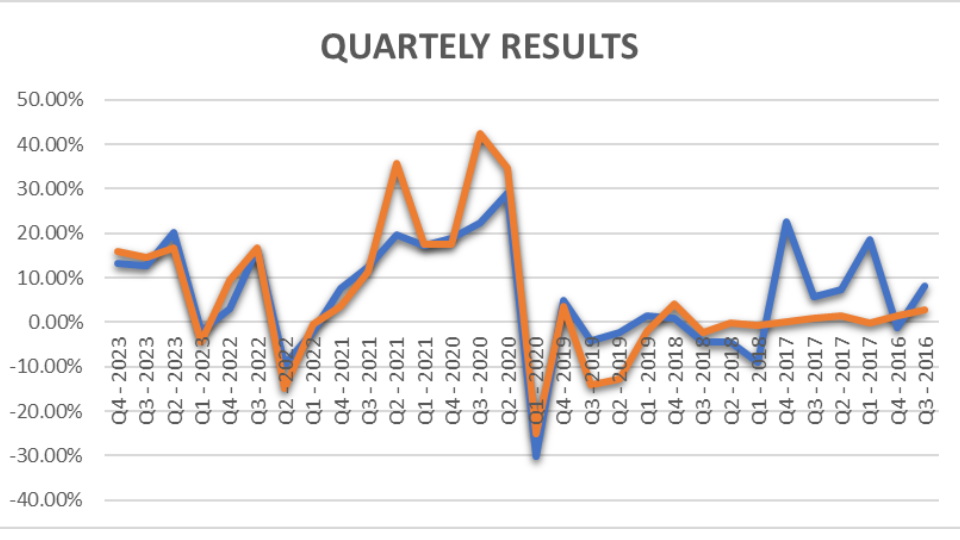

Quarterly Results Analysis

Quarterly Results (NAV as of 4th March 2024)

| Period | Nippon India Small Cap Fund | Quant Small Cap Fund |

| Q4 – 2023 | 13.17% | 15.93% |

| Q3 – 2023 | 12.77% | 14.52% |

| Q2 – 2023 | 20.10% | 16.73% |

| Q1 – 2023 | -2.02% | -4.47% |

| Q4 – 2022 | 2.91% | 9.36% |

| Q3 – 2022 | 16.47% | 16.69% |

| Q2 – 2022 | -9.44% | -14.83% |

| Q1 – 2022 | -2.12% | -0.53% |

| Q4 – 2021 | 7.70% | 3.47% |

| Q3 – 2021 | 12.38% | 11.25% |

| Q2 – 2021 | 19.76% | 35.72% |

| Q1 – 2021 | 17.22% | 17.48% |

| Q4 – 2020 | 18.81% | 17.45% |

| Q3 – 2020 | 22.32% | 42.48% |

| Q2 – 2020 | 28.93% | 34.77% |

| Q1 – 2020 | -30.09% | -25.16% |

| Q4 – 2019 | 5.03% | 3.53% |

| Q3 – 2019 | -4.17% | -14.02% |

| Q2 – 2019 | -2.44% | -12.66% |

| Q1 – 2019 | 1.50% | -2.04% |

| Q4 – 2018 | 1.02% | 4.07% |

| Q3 – 2018 | -4.34% | -2.22% |

| Q2 – 2018 | -4.46% | -0.19% |

| Q1 – 2018 | -8.89% | -0.80% |

| Q4 – 2017 | 22.65% | -0.02% |

| Q3 – 2017 | 5.76% | 0.96% |

| Q2 – 2017 | 7.30% | 1.36% |

| Q1 – 2017 | 18.51% | -0.13% |

| Q4 – 2016 | -1.19% | 1.50% |

| Q3 – 2016 | 8.20% | 2.89% |

Analysis:

- The quarterly results showcase the performance of each fund over consecutive quarters.

- Both Nippon India Small Cap Fund and Quant Small Cap Fund experienced fluctuations in performance, with some quarters showing positive returns while others showed negative returns.

- Quant Small Cap Fund demonstrated higher returns in certain quarters, such as Q2 of 2021 and Q3 of 2020, while Nippon India Small Cap Fund performed better in other quarters, like Q2 of 2020.

Outperformance Analysis

Outperformance

| Nippon India Small Cap Fund | Quant Small Cap Fund | |

| Outperformance | 15 | 15 |

Analysis:

- Both funds have outperformed each other several times, indicating a competitive performance.

Key Takeaways

- Performance Fluctuations: Both Nippon India Small Cap Fund vs. Quant Small Cap Fund exhibited fluctuations in performance over consecutive quarters, influenced by market conditions and investment strategies.

- Competitive Performance: Despite variations in quarterly results, both funds have demonstrated competitive performance, with each outperforming the other an equal number of times.

- Investor Considerations: Investors should consider the quarterly performance of each fund along with their investment objectives, risk tolerance, and time horizon when making investment decisions.

Risk Analysis

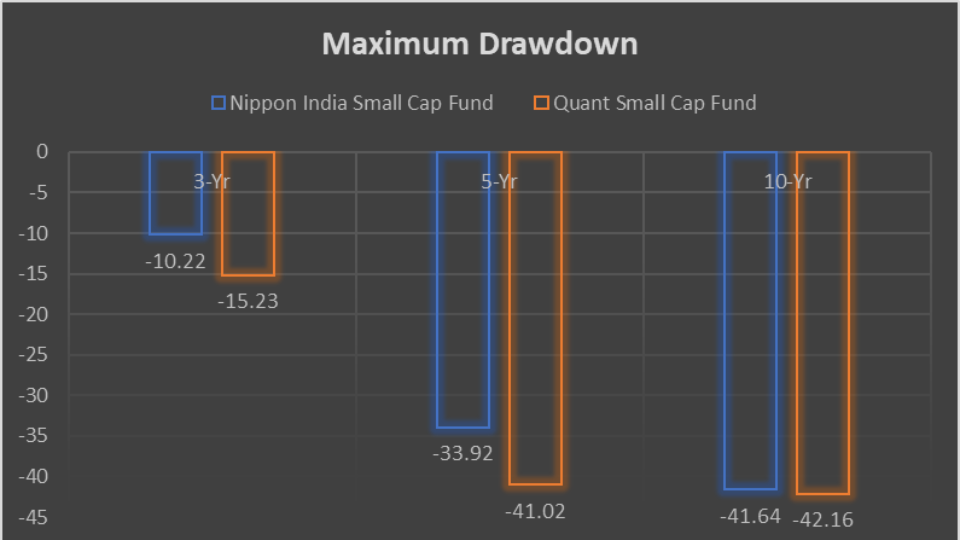

Maximum Drawdown Analysis

Maximum Drawdown

| Period | Nippon India Small Cap Fund | Quant Small Cap Fund |

| 3-Year | -10.22 | -15.23 |

| 5-Year | -33.92 | -41.02 |

| 10-Year | -41.64 | -42.16 |

Analysis:

- Maximum drawdown represents the peak-to-trough decline during a specific period.

- Both funds experienced varying degrees of drawdown over different timeframes.

- Quant Small Cap Fund has shown slightly deeper drawdowns than Nippon India Small Cap Fund across the 3-year, 5-year, and 10-year periods.

Key Takeaways

- Best Quarters: Quant Small Cap Fund demonstrated superior performance during the best quarters, delivering higher returns than Nippon India Small Cap Fund.

- Worst Quarters: While both funds experienced negative returns during the worst quarters, Nippon India Small Cap Fund showed relatively higher declines.

- Maximum Drawdown: Quant Small Cap Fund exhibited slightly deeper drawdowns than Nippon India Small Cap Fund over different timeframes, indicating higher volatility.

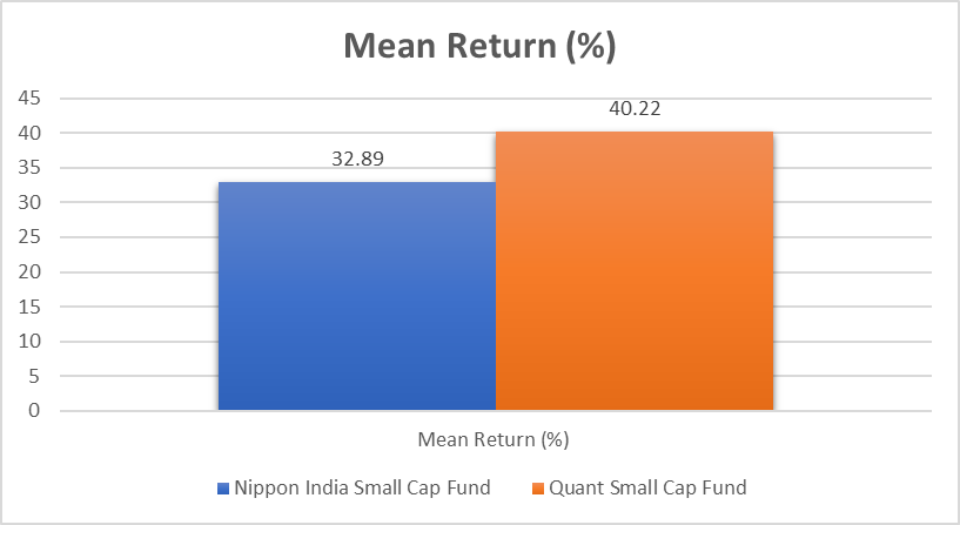

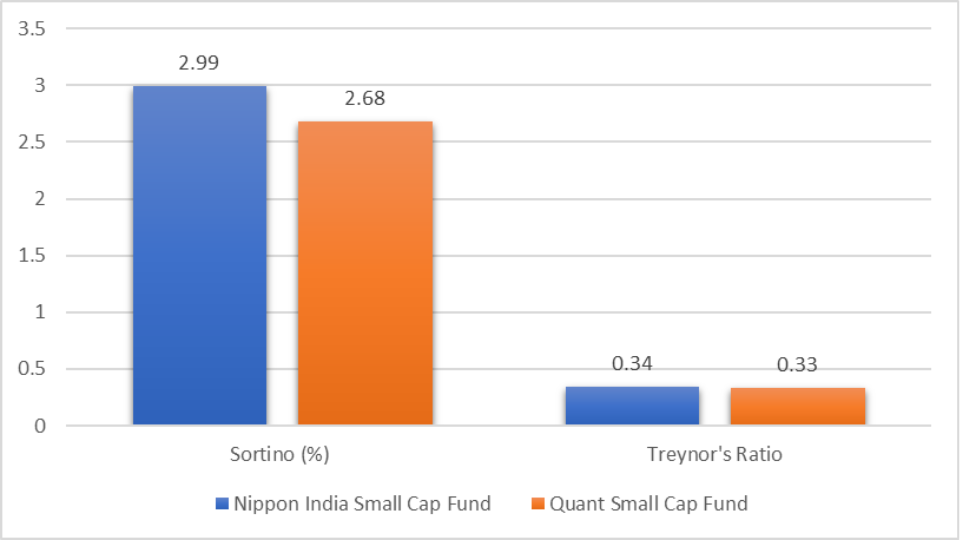

Mean Return, Sortino Ratio, and Treynor’s Ratio

| Mean Return (%) | Sortino Ratio (%) | Treynor’s Ratio | |

| Nippon India Small Cap Fund | 32.89 | 2.99 | 0.34 |

| Quant Small Cap Fund | 40.22 | 2.68 | 0.33 |

Analysis:

- Mean Return: Quant Small Cap Fund has a higher mean return than Nippon India Small Cap Fund, indicating potentially higher average returns for investors.

- Sortino Ratio: Nippon India Small Cap Fund has a slightly higher Sortino ratio, suggesting better risk-adjusted returns during downward market movements.

- Treynor’s Ratio: Both funds have similar Treynor’s ratios, indicating comparable risk-adjusted returns relative to systematic risk.

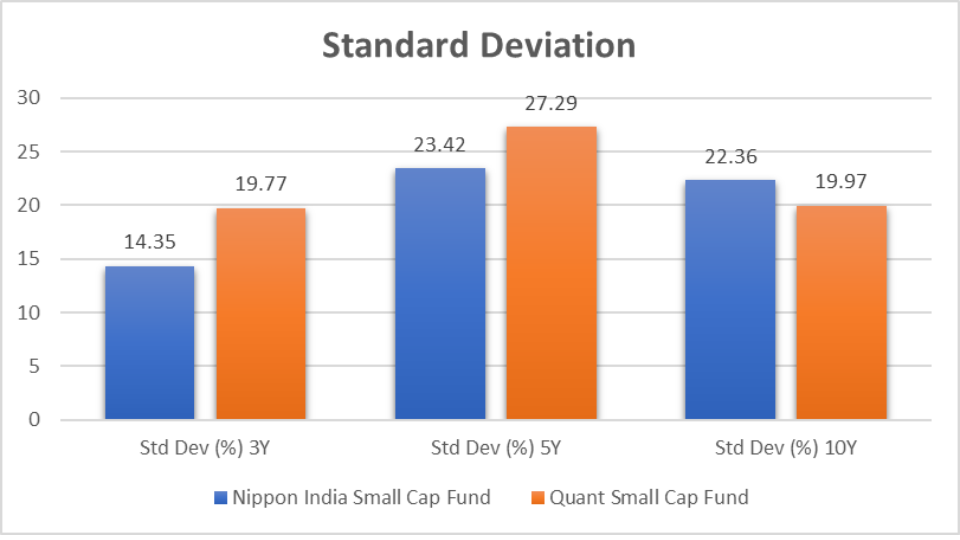

Standard Deviation

| Std Dev (%) 3Y | Std Dev (%) 5Y | Std Dev (%) 10Y | |

| Nippon India Small Cap Fund | 14.35 | 23.42 | 22.36 |

| Quant Small Cap Fund | 19.77 | 27.29 | 19.97 |

Analysis:

- Nippon India Small Cap Fund exhibits a lower standard deviation across all timeframes, indicating lower volatility than Quant Small Cap Fund.

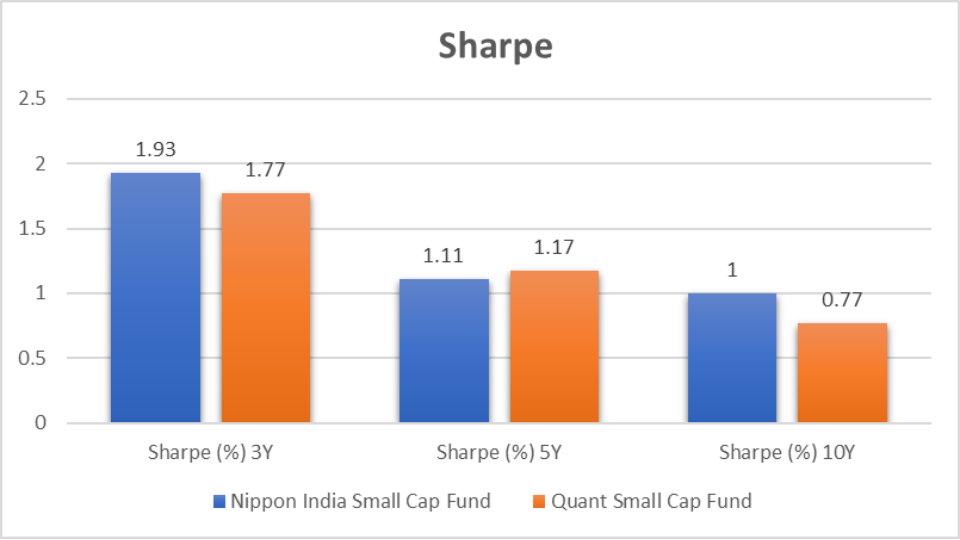

Sharpe Ratio

| Sharpe Ratio (%) 3Y | Sharpe Ratio (%) 5Y | Sharpe Ratio (%) 10Y | |

| Nippon India Small Cap Fund | 1.93 | 1.11 | 1 |

| Quant Small Cap Fund | 1.77 | 1.17 | 0.77 |

Analysis:

- Nippon India Small Cap Fund demonstrates higher Sharpe ratios across most timeframes, suggesting better risk-adjusted returns per unit of risk than Quant Small Cap Fund.

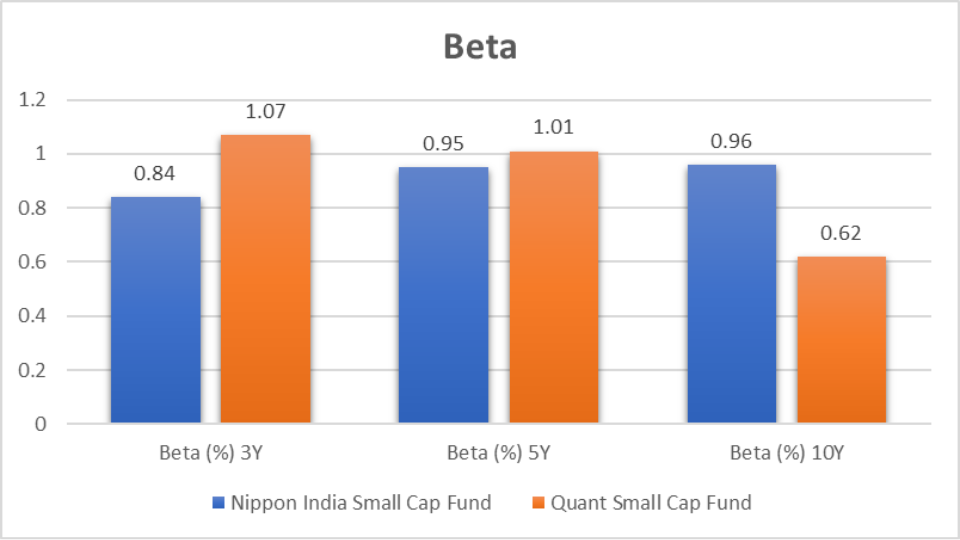

Beta

| Beta (%) 3Y | Beta (%) 5Y | Beta (%) 10Y | |

| Nippon India Small Cap Fund | 0.84 | 0.95 | 0.96 |

| Quant Small Cap Fund | 1.07 | 1.01 | 0.62 |

Analysis:

- Nippon India Small Cap Fund has lower beta values across all timeframes, indicating lower volatility relative to the market than Quant Small Cap Fund.

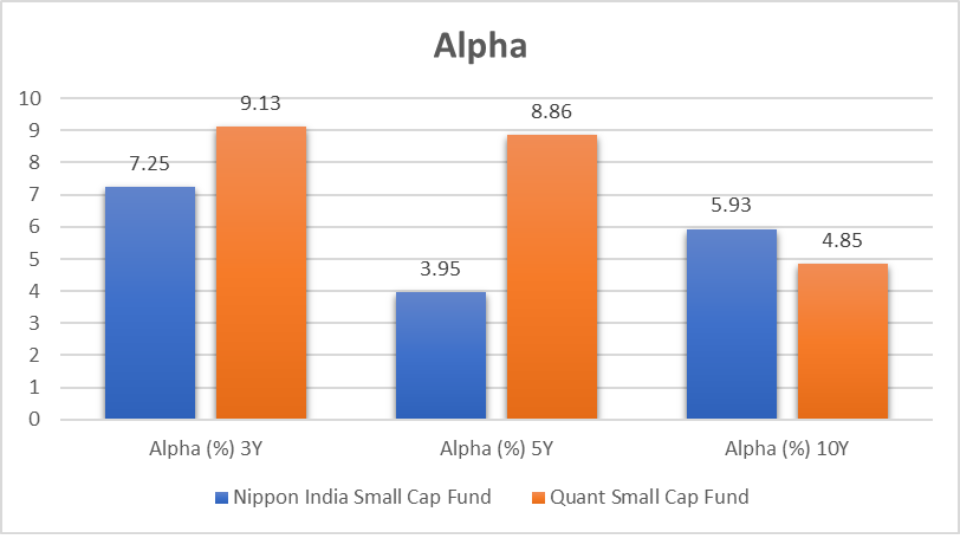

Alpha

| Alpha (%) 3Y | Alpha (%) 5Y | Alpha (%) 10Y | |

| Nippon India Small Cap Fund | 7.25 | 3.95 | 5.93 |

| Quant Small Cap Fund | 9.13 | 8.86 | 4.85 |

Analysis:

- Both funds exhibit positive alpha values, indicating their ability to generate returns above the benchmark. Quant Small Cap Fund shows higher alpha values across most timeframes, suggesting better risk-adjusted returns.

Key Takeaways

- Mean Return and Ratios: Quant Small Cap Fund offers higher mean returns, while Nippon India Small Cap Fund demonstrates better risk-adjusted returns, as indicated by the Sortino and Sharpe ratios.

- Volatility: Nippon India Small Cap Fund exhibits lower volatility than Quant Small Cap Fund, as reflected by its lower standard deviation and beta values.

- Alpha: Both funds generate positive alpha values, but Quant Small Cap Fund shows higher alpha values, indicating its potential for outperforming the benchmark.

Star Ratings Comparison

| Ratings Source | Nippon India Small Cap Fund | Quant Small Cap Fund |

|---|---|---|

| CRISIL Ratings (as on 31st Mar 2024) | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐⭐ |

| CRISIL Ratings (as on 31st Dec 2023) | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐☆ |

| CRISIL Ratings (as on 30th Sep 2023) | ⭐⭐⭐⭐⭐ | ⭐⭐⭐☆☆ |

| CRISIL Ratings (as on 30th Jun 2023) | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| CRISIL Ratings (as on 31st Mar 2023) | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Value Research Ratings | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐☆ |

| Morning Star Ratings | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐☆ |

| Economic Times Ratings | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐☆ |

| Groww Ratings | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐☆ |

| AngelOne AQR Ratings | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐☆ |

| 5Paisa Ratings | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐☆ |

| KUVERA ratings | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐⭐ |

| Average Ratings | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐☆ |

Analysis:

- Nippon India Small Cap Fund consistently maintains higher CRISIL ratings than Quant Small Cap Fund in recent quarters, indicating its superior performance and reliability according to CRISIL.

- While both funds have fluctuated in their ratings over different quarters, Nippon India Small Cap Fund generally maintains a higher rank.

Value Research Ratings

| Value Research Ratings | Nippon India Small Cap Fund | Quant Small Cap Fund |

| 4 | 3 |

Analysis:

- Nippon India Small Cap Fund has a higher rating than Quant Small Cap Fund as per Value Research Ratings, suggesting better performance or risk-adjusted returns.

Morning Star Ratings

| Morning Star Ratings | Nippon India Small Cap Fund | Quant Small Cap Fund |

| 5 | 4 |

Analysis:

- According to Morning Star Ratings, Nippon India Small Cap Fund secures a higher rating than Quant Small Cap Fund, indicating its superior performance or potential for future returns.

Key Takeaways

- CRISIL Ratings: Nippon India Small Cap Fund consistently receives higher CRISIL ratings than Quant Small Cap Fund, reflecting its superior performance and reliability in the market.

- Value Research Ratings: Nippon India Small Cap Fund is rated higher than Quant Small Cap Fund based on Value Research Ratings, suggesting better performance or risk-adjusted returns.

- Morning Star Ratings: Nippon India Small Cap Fund outperforms Quant Small Cap Fund in Morning Star Ratings, indicating its more substantial performance potential.

Portfolio Analysis

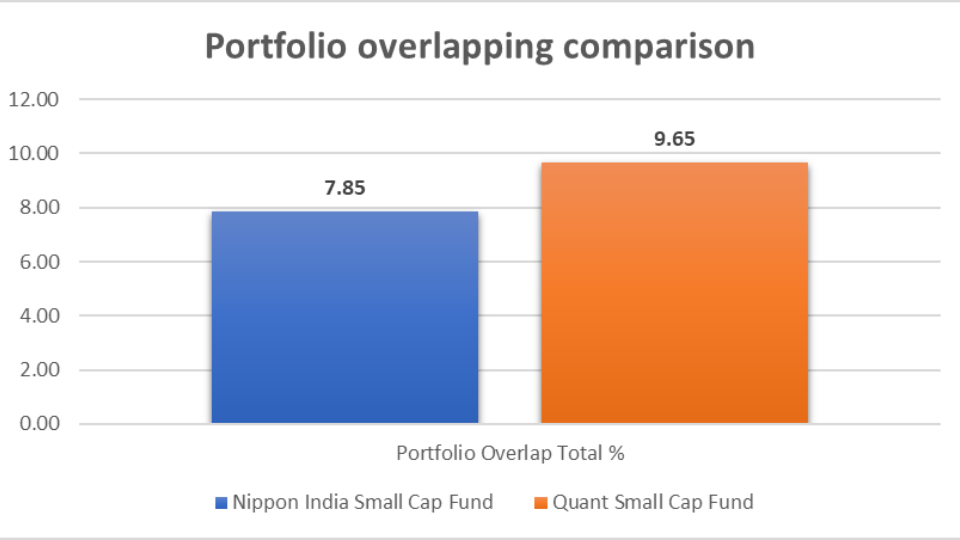

Portfolio Overlapping Comparison

| Nippon India Small Cap Fund | Quant Small Cap Fund | |

| Portfolio Overlap Total (%) | 7.85 | 9.65 |

Analysis:

- Nippon India Small Cap Fund vs. Quant Small Cap Fund have overlapping holdings of approximately 7.85% and 9.65%, respectively. A lower percentage indicates lesser overlap, which is beneficial for portfolio diversification.

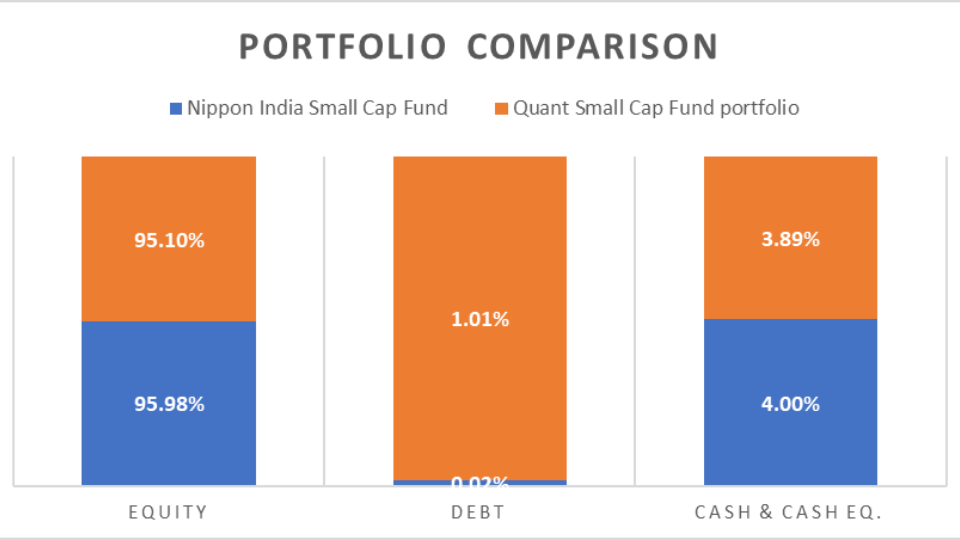

Asset Allocation

| Nippon India Small Cap Fund | Quant Small Cap Fund | |

| Equity (%) | 95.98 | 95.10 |

| Debt (%) | 0.02 | 1.01 |

| Cash & Cash Eq. (%) | 4.00 | 3.89 |

Analysis:

- Both funds primarily invest in equities, with Nippon India Small Cap Fund allocating 95.98% and Quant Small Cap Fund allocating 95.10% of their portfolios to equity holdings.

- Quant Small Cap Fund holds a slightly higher percentage of debt instruments (1.01%) than Nippon India Small Cap Fund (0.02%).

Market Cap Allocation

| Nippon India Small Cap Fund | Quant Small Cap Fund | |

| No of Stocks | 205 | 100 |

| Large Cap (%) | 5.66 | 13.84 |

| Mid Cap (%) | 10.19 | 6.96 |

| Small Cap (%) | 55.09 | 47.39 |

Analysis:

- Nippon India Small Cap Fund holds a more diversified portfolio with 205 stocks compared to Quant Small Cap Fund, which has 100 stocks.

- Both funds have most of their holdings in small-cap companies, with Nippon India Small Cap Fund allocating 55.09% and Quant Small Cap Fund allocating 47.39% of their portfolios to small-cap stocks.

- Quant Small Cap Fund has a higher allocation to large-cap stocks (13.84%) than Nippon India Small Cap Fund (5.66%).

Sector Allocation

| Sector | Nippon India Small Cap Fund | Quant Small Cap Fund |

| Capital Goods | 18.76 | 4.10 |

| Financial | 12.59 | 13.14 |

| Services | 9.78 | 10.14 |

| Healthcare | 7.97 | 8.95 |

| Consumer Staples | 7.30 | 6.56 |

| Chemicals | 6.80 | 3.34 |

| Technology | 6.22 | 0.41 |

| Automobile | 6.02 | 2.43 |

| Construction | 3.57 | 9.66 |

| Metals & Mining | 3.54 | 9.31 |

| Materials | 3.27 | 1.66 |

| Textiles | 3.00 | 3.87 |

| Communication | 1.81 | 4.16 |

| Diversified | 1.49 | 0.43 |

| Energy | 0.84 | 16.14 |

| Insurance | 0.35 | 0.78 |

| Consumer Discretionary | 2.67 | 0 |

Analysis:

- Both funds have significant allocations in capital goods, financial services, and services.

- Nippon India Small Cap Fund allocates more to sectors like Capital Goods, Financial, Services, Healthcare, and Consumer Staples than Quant Small Cap Fund.

- Quant Small Cap Fund has a higher allocation in the Energy sector than Nippon India Small Cap Fund.

Key Takeaways

- Portfolio Overlapping: Both funds have relatively low portfolio overlap, indicating potential for diversification.

- Portfolio Composition: Both funds primarily invest in equities, but Quant Small Cap Fund has a slightly higher allocation to debt.

- Market Cap Allocation: Nippon India Small Cap Fund has a more diversified portfolio with a more significant number of stocks, while Quant Small Cap Fund has a higher allocation to large-cap stocks.

- Sector Allocation: Both funds have significant allocations in similar sectors, but there are variations in specific sector allocations, such as Energy.

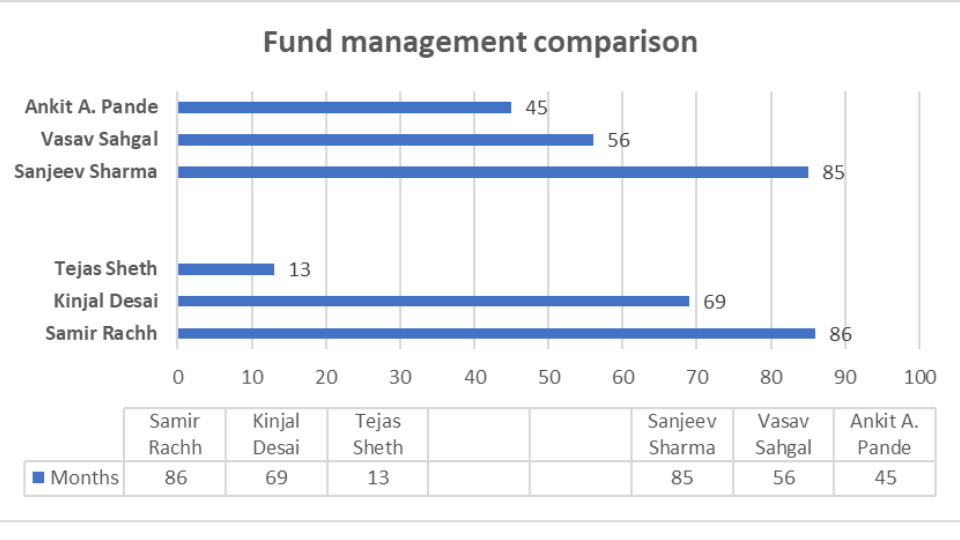

Fund Management

Understanding the fund manager’s experience and expertise is crucial when choosing a mutual fund. In this comparative analysis, we’ll delve into the fund management teams of Nippon India Small Cap Fund vs. Quant Small Cap Fund.

Nippon India Small Cap Fund

| Fund Manager | Months Experience |

| Samir Rachh | 86 |

| Kinjal Desai | 69 |

| Tejas Sheth | 13 |

Analysis:

- Samir Rachh: With 86 months of experience, Samir Rachh brings expertise to Nippon India Small Cap Fund.

- Kinjal Desai: Kinjal Desai has 69 months of experience, providing strong leadership in fund management.

- Tejas Sheth: Although relatively new, with 13 months of experience, Tejas Sheth contributes fresh insights to the fund’s management.

Quant Small Cap Fund

| Fund Manager | Months Experience |

| Sanjeev Sharma | 85 |

| Vasav Sahgal | 56 |

| Ankit A. Pande | 45 |

Analysis:

- Sanjeev Sharma: Leading the team with 85 months of experience, Sanjeev Sharma demonstrates seasoned management skills.

- Vasav Sahgal: With 56 months of experience, Vasav Sahgal brings a solid understanding of market dynamics to Quant Small Cap Fund.

- Ankit A. Pande: Ankit A. Pande, with 45 months of experience, contributes to the fund’s management with a diverse skill set.

Key Takeaways

- Nippon India Small Cap Fund and Quant Small Cap Fund boast experienced fund management teams.

- Investors may consider individual fund managers’ tenure and track record when evaluating these mutual funds.

- While experienced fund managers bring stability and expertise, newer managers may offer fresh perspectives and adaptability to changing market conditions.

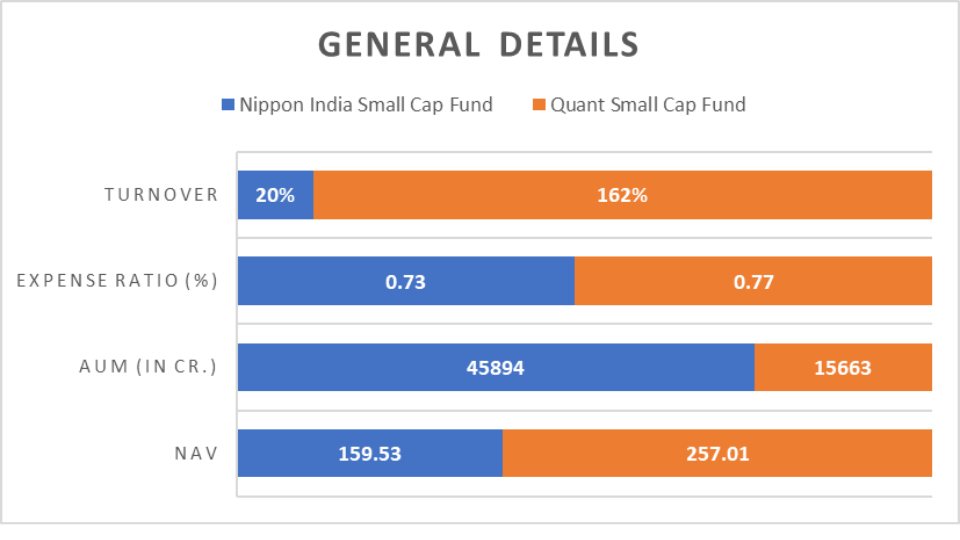

Other Important Details

Nippon India Small Cap Fund

| Metric | Value |

| NAV | ₹159.53 |

| AUM (in Cr.) | ₹45,894 |

| Expense Ratio (%) | 0.73 |

| Turnover | 20% |

| Benchmark | Nifty Small-cap 250 TR |

Analysis:

- NAV: Nippon India Small Cap Fund’s Net Asset Value (NAV) stands at ₹159.53.

- AUM: With assets under management (AUM) of ₹45,894 crore, the fund indicates investor confidence and robust performance.

- Expense Ratio: Nippon India Small Cap Fund boasts a competitive expense ratio of 0.73%, ensuring cost-effectiveness for investors.

- Turnover: The fund maintains a turnover rate of 20%, indicating active management to optimize returns.

- Benchmark: Nifty Small-cap 250 TR is the benchmark for assessing the fund’s performance against the broader market.

Quant Small Cap Fund

| Metric | Value |

| NAV | ₹257.01 |

| AUM (in Cr.) | ₹15,663 |

| Expense Ratio (%) | 0.77 |

| Turnover | 162% |

| Benchmark | Nifty Small-cap 250 TR |

Analysis:

- NAV: Quant Small Cap Fund’s NAV is ₹257.01, reflecting the fund’s unit price per share.

- AUM: The fund manages assets worth ₹15,663 crores, smaller than Nippon India Small Cap Fund.

- Expense Ratio: Quant Small Cap Fund has a marginally higher expense ratio of 0.77%.

- Turnover: With a turnover rate of 162%, the fund demonstrates a higher frequency of buying and selling securities within the portfolio.

- Benchmark: Similar to Nippon India Small Cap Fund, Quant Small Cap Fund benchmarks its performance against Nifty Small Cap 250 TR.

Minimum Investment Amount

| Fund | SIP | Lumpsum |

| Nippon India Small Cap Fund | ₹100 | Not Allowed Currently |

| Quant Small Cap Fund | ₹1,000 | ₹5,000 |

Analysis:

- SIP (Systematic Investment Plan): Nippon India Small Cap Fund offers a lower entry point with a minimum SIP investment of ₹100. However, lump sum investments are not allowed currently.

- Quant Small Cap Fund: Requires a minimum SIP investment of ₹1,000, making it accessible to a broader range of investors. The minimum lump sum investment stands at ₹5,000.

Key Takeaways

- Both Nippon India Small Cap Fund vs. Quant Small Cap Fund have competitive expense ratios, ensuring cost-effective investment options.

- Nippon India Small Cap Fund boasts a significantly higher AUM, indicating greater investor confidence and potentially more significant market influence.

- Quant Small Cap Fund offers a lower minimum investment amount for SIPs, making it accessible to investors with smaller budgets.

Conclusion

In conclusion, the comparative analysis between Nippon India Small Cap Fund vs. Quant Small Cap Fund highlights their distinct investment styles, returns, portfolio compositions, and fund management teams.

While both funds have strengths and weaknesses, Quant Small Cap Fund emerges as the better performer across various parameters, demonstrating superior returns in short to medium-term periods, higher SIP and lump sum investment values, and better CAGR and rolling returns. However, Nippon India Small Cap Fund showcases more robust long-term performance, lower volatility, and higher risk-adjusted returns.

For investors with a high-risk appetite seeking potentially higher returns in the short to medium term, Quant Small Cap Fund may be the preferred choice. Conversely, investors with a more conservative risk appetite and who are focused on long-term stability may find Nippon India Small Cap Fund more suitable.

Ultimately, the decision should align with individual investment objectives, risk tolerance, and time horizon.

We hope you found this guide on mutual funds helpful.

If you have any mutual fund-related queries, feel free to comment below—we’re here to help! S.K. Singh, a registered professional with the Association of Mutual Funds in India (AMFI), will answer your queries and holds the ARN-251149.

Invest wisely!

FAQs About Nippon India Small Cap Fund vs. Quant Small Cap Fund

Which fund has better short-term performance, Nippon India Small Cap Fund or Quant Small Cap Fund?

Nippon India Small Cap Fund: Nippon India Small Cap Fund has shown short-term solid performance, making it a viable option for investors seeking potential growth over a shorter period.

Are there any differences in long-term performance between Nippon India Small Cap Fund vs. Quant Small Cap Fund?

Quant Small Cap Fund: Quant Small Cap Fund demonstrates superior long-term performance, offering investors consistent returns over extended investment periods.

What is the minimum investment required for SIPs and lump sum investments in both funds?

Nippon India Small Cap Fund: Nippon India Small Cap Fund requires a minimum SIP investment of ₹100 and currently does not allow lump sum investments. Quant Small Cap Fund: Quant Small Cap Fund has a minimum SIP investment of ₹1,000 and a minimum lump sum investment of ₹5,000.

How do the expense ratios of Nippon India Small Cap Fund vs. Quant Small Cap Fund compare?

Nippon India Small Cap Fund: Nippon India Small Cap Fund boasts a competitive expense ratio of 0.73%, ensuring cost-effectiveness for investors. Quant Small Cap Fund: Quant Small Cap Fund has a marginally higher expense ratio of 0.77%.

Which fund offers better risk-adjusted returns?

Nippon India Small Cap Fund: Nippon India Small Cap Fund provides better risk-adjusted returns, as indicated by its higher Sortino and Sharpe ratios. Quant Small Cap Fund: Quant Small Cap Fund offers slightly lower risk-adjusted returns than Nippon India Small Cap Fund.

What is the portfolio composition of Nippon India Small Cap Fund vs. Quant Small Cap Fund?

Nippon India Small Cap Fund: Nippon India Small Cap Fund primarily invests in equities, with a slightly lower allocation to large-cap stocks. Quant Small Cap Fund: Quant Small Cap Fund also focuses on equities but holds a slightly higher percentage of debt instruments.

How do the CRISIL and Morning Star ratings compare for both funds?

Nippon India Small Cap Fund: Nippon India Small Cap Fund consistently maintains higher CRISIL ratings than Quant Small Cap Fund, reflecting its superior performance and reliability. Quant Small Cap Fund: Quant Small Cap Fund secures a lower rating than Nippon India Small Cap Fund according to CRISIL ratings.

Which fund offers better diversification through portfolio overlap?

Quant Small Cap Fund: Quant Small Cap Fund provides slightly better diversification, with a lower portfolio overlap percentage than Nippon India Small Cap Fund.

What are the key considerations for investors when choosing between these two funds?

Investors should consider their investment objectives, risk tolerance, and time horizon. For those seeking potentially higher returns in the short to medium term and are comfortable with higher risk, Quant Small Cap Fund may be preferable. Conversely, investors with a conservative risk appetite and who are focused on long-term stability may find Nippon India Small Cap Fund more suitable.

Which fund has a more significant asset under management (AUM)?

Nippon India Small Cap Fund: Nippon India Small Cap Fund boasts a significantly higher AUM than Quant Small Cap Fund, indicating greater investor confidence and potentially more significant market influence.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.