Introduction

Hey there, savvy investor! Ready to dive into the exciting world of Contra funds? If you’re searching for the perfect investment opportunity and craving clarity on the SBI Contra Fund vs Kotak India EQ Contra Fund showdown, look no further! In this article, we’re your trusty guides on a mission to demystify these two Contra mutual funds. Our goal? We aim to equip you with all the insights you need to pick the ultimate gem for your long-term investment portfolio. So, buckle up and get ready for a deep dive into the world of Contra funds!

Investment Style

Regarding investment style, Kotak India EQ Contra Fund and SBI Contra Fund follow a Growth strategy.

Returns Analysis

Trailing Returns

Let’s begin by analyzing the trailing returns of both funds as of 28th March 2024:

| Period Invested for | Kotak India EQ Contra Fund | SBI Contra Fund |

| 1 Year | 52.20% | 52.18% |

| 2 Year | 25.53% | 31.27% |

| 3 Year | 24.11% | 31.30% |

| 5 Year | 21.55% | 26.47% |

| 10 Year | 18.75% | 19.39% |

Analysis:

- 1 Year: Both funds have delivered impressive returns, with Kotak India EQ Contra Fund slightly edging ahead.

- 2 Year: SBI Contra Fund outperforms Kotak India EQ Contra Fund by a notable margin.

- 3 Year: Similar to the 2 years, SBI Contra Fund maintains its lead over Kotak India EQ Contra Fund.

- 5 Year: While both funds exhibit growth, Kotak India EQ Contra Fund has a slight advantage.

- 10 Year: Over the long term, Kotak India EQ Contra Fund has consistently performed marginally better than SBI Contra Fund.

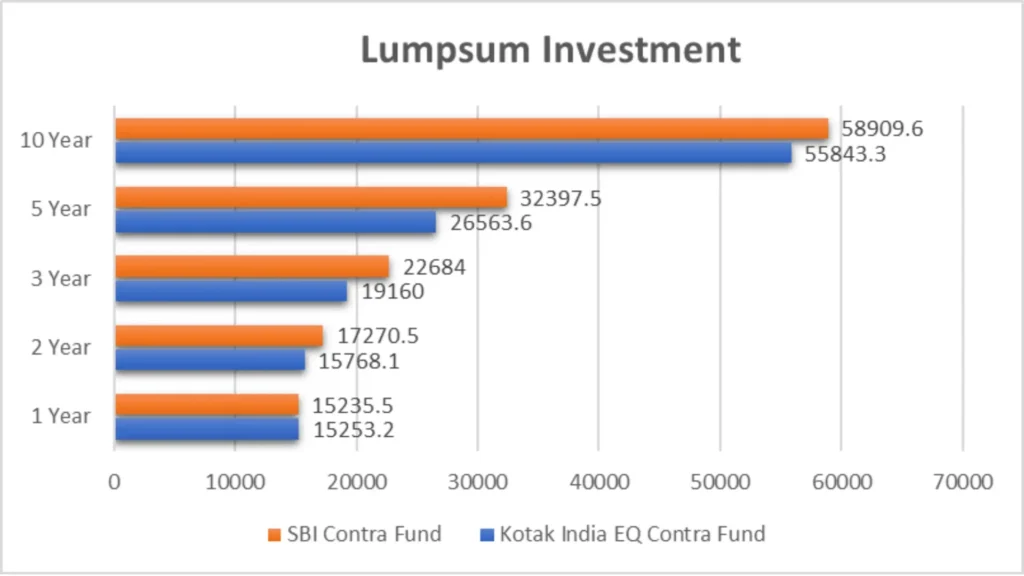

Lumpsum Investment Value

Next, let’s examine the lump sum investment values for different investment durations, based on NAV as of 28th March 2024:

Analysis:

- 1 Year: Both funds showcase similar lump sum investment values, with Kotak India EQ Contra Fund slightly higher.

- 2 Year: Kotak India EQ Contra Fund maintains a lead over SBI Contra Fund in lump sum investment value.

- 3 Year: The gap between the two funds widens, with Kotak India EQ Contra Fund leading significantly.

- 5 Year: Kotak India EQ Contra Fund continues outperforming SBI Contra Fund in lump sum investment value.

- 10 Year: Over the long term, Kotak India EQ Contra Fund consistently provides higher returns than SBI Contra Fund.

Key Takeaways

- Consistency: Kotak India EQ Contra Fund demonstrates consistent performance across various time frames, outpacing SBI Contra Fund in most cases.

- Long-Term Growth: Investors seeking long-term growth may find Kotak India EQ Contra Fund more appealing, as it consistently delivers higher returns over extended periods.

- Risk Management: While both funds offer growth-oriented investment strategies, Kotak India EQ Contra Fund’s risk-adjusted returns indicate effective risk management practices.

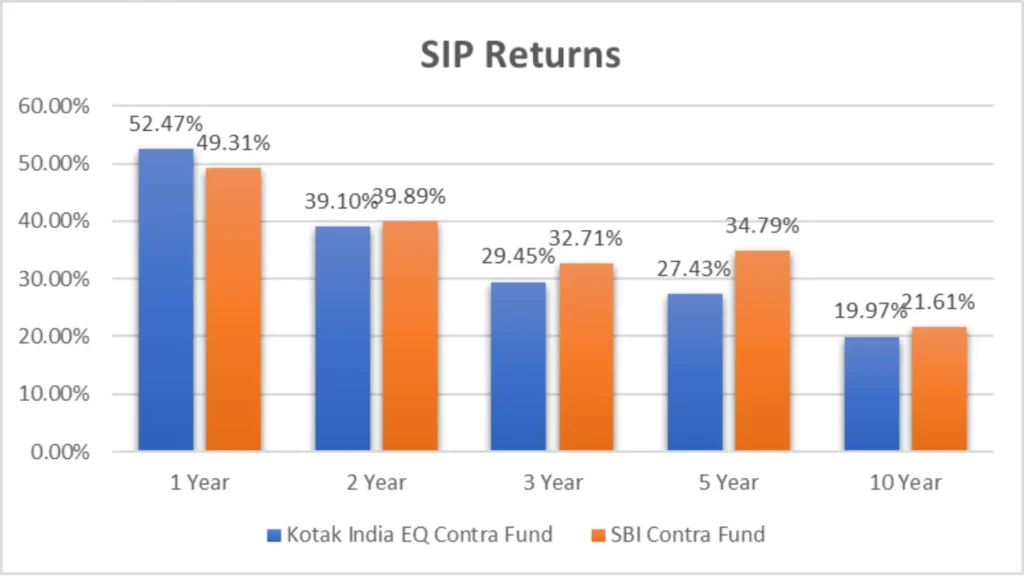

SIP Returns Analysis

Let’s begin by examining the SIP returns for different investment durations:

Analysis:

- 1 Year: Both funds demonstrate impressive SIP returns, with Kotak India EQ Contra Fund slightly ahead.

- 2 Year: Kotak India EQ Contra Fund and SBI Contra Fund exhibit similar SIP returns over a 2-year investment period.

- 3 Year: SBI Contra Fund surpasses Kotak India EQ Contra Fund in terms of SIP returns over a 3-year.

- 5 Year: SBI Contra Fund continues outperforming Kotak India EQ Contra Fund in SIP returns over 5 years.

- 10 Year: Kotak India EQ Contra Fund lags slightly behind SBI Contra Fund in SIP returns over a 10-year horizon.

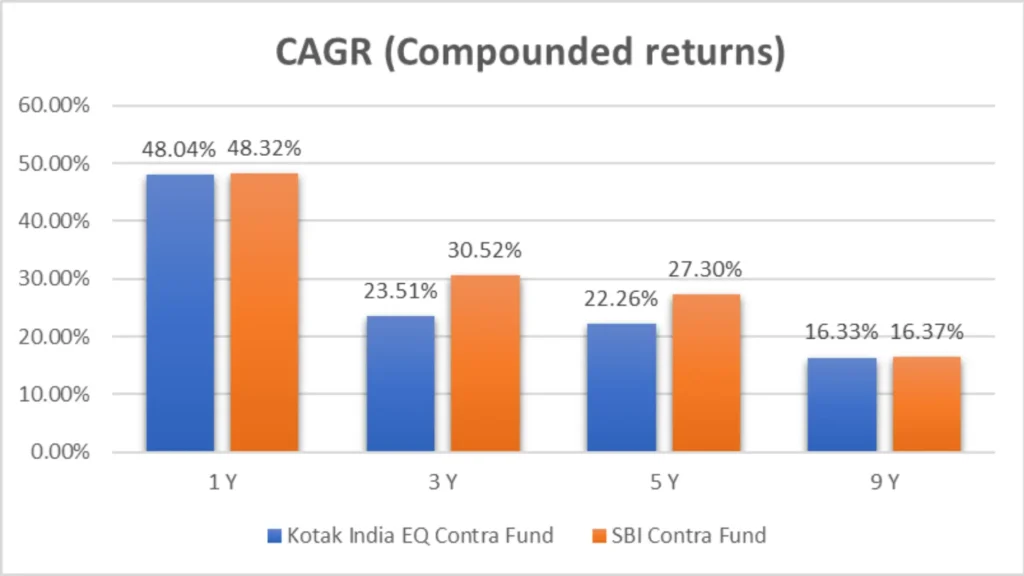

CAGR Analysis

Next, let’s analyze the Compound Annual Growth Rate (CAGR) for both funds across different investment durations:

Analysis:

- 1 Year: The CAGR for both funds is remarkably high, with SBI Contra Fund marginally edging ahead.

- 3 Year: SBI Contra Fund exhibits a higher CAGR than Kotak India EQ Contra Fund over a 3-year.

- 5 Year: SBI Contra Fund maintains its lead in CAGR over Kotak India EQ Contra Fund for a 5-year.

- 9-Year: Both funds demonstrate similar CAGR over a 9-year investment period.

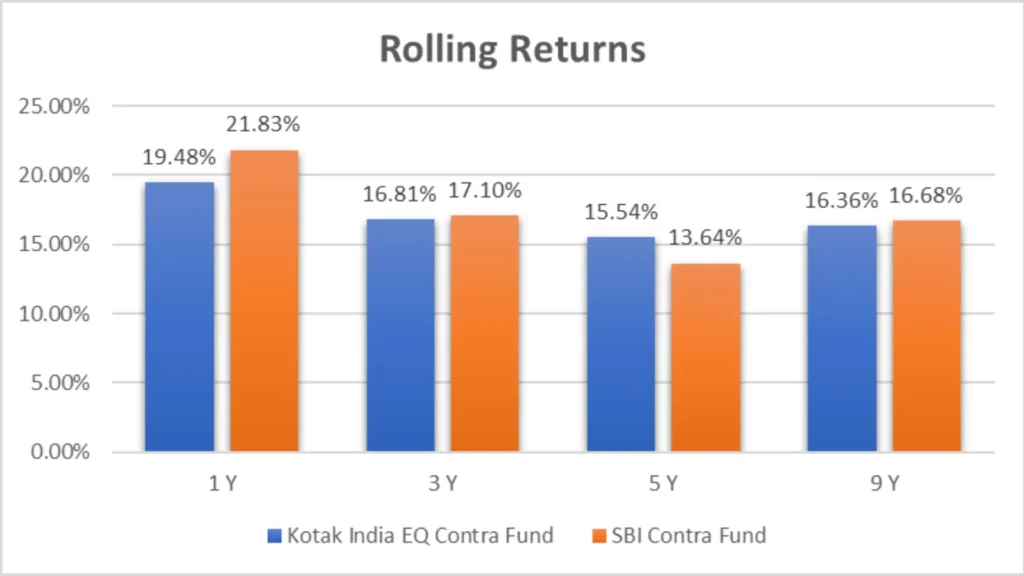

Rolling Returns Analysis

Lastly, let’s delve into Rolling Returns for both funds:

Analysis:

- 1 Year: SBI Contra Fund demonstrates higher Rolling Returns than Kotak India EQ Contra Fund over 1 year.

- 3 Year: Both funds exhibit similar Rolling Returns over 3 years.

- 5 Year: Kotak India EQ Contra Fund maintains higher Rolling Returns than SBI Contra Fund over 5 years.

- 9 Year: Both funds demonstrate similar Rolling Returns over 9 years.

Key Takeaways

- Consistency: While both funds showcase impressive SIP returns, SBI Contra Fund demonstrates greater consistency across various investment durations.

- Growth Potential: Investors seeking higher growth potential over shorter durations may find Kotak India EQ Contra Fund appealing, whereas SBI Contra Fund offers stability and steady growth over longer durations.

- Risk Management: SBI Contra Fund exhibits effective risk management practices, as evidenced by its consistent performance in Rolling Returns metrics.

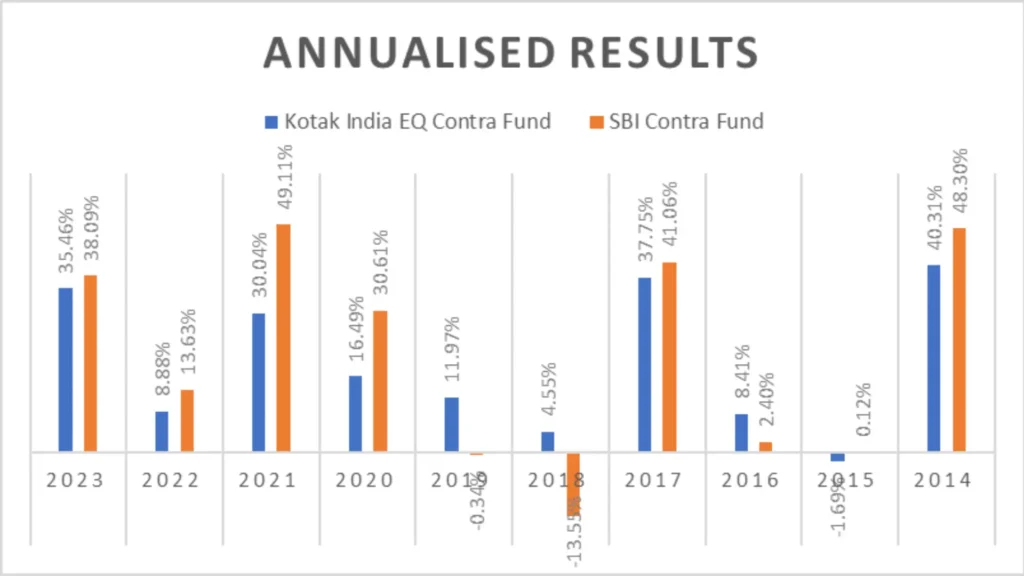

Annualized/Calendar Year Returns

Let’s start by comparing the annualized/calendar year returns of Kotak India EQ Contra Fund and SBI Contra Fund:

Analysis:

- 2023: SBI Contra Fund outperformed Kotak India EQ Contra Fund with a return of 38.09% compared to 35.46%.

- 2022: SBI Contra Fund had a higher return of 13.63%, while Kotak India EQ Contra Fund stood at 8.88%.

- 2021: SBI Contra Fund had a significant lead with a return of 49.11% against 30.04% for Kotak India EQ Contra Fund.

- 2020: SBI Contra Fund outperformed Kotak India EQ Contra Fund with a return of 30.61% compared to 16.49%.

- 2019: Kotak India EQ Contra Fund had a positive return of 11.97%, while SBI Contra Fund had a slightly negative return of -0.34%.

- 2018: Both funds had positive returns, with SBI Contra Fund’s Return at -13.55% and Kotak India EQ Contra Fund at 4.55%.

- 2017: SBI Contra Fund performed slightly better, with a return of 41.06% compared to 37.75% for Kotak India EQ Contra Fund.

- 2016: SBI Contra Fund had a return of 2.40%, while Kotak India EQ Contra Fund stood at 8.41%.

- 2015: Both funds had negative returns, with SBI Contra Fund slightly better at 0.12% compared to -1.69% for Kotak India EQ Contra Fund.

- 2014: SBI Contra Fund outperformed Kotak India EQ Contra Fund with a return of 48.30% compared to 40.31%.

- 2013: Kotak India EQ Contra Fund had a return of 6.47%, while SBI Contra Fund had a slightly negative return of -2.49%.

Number of Times Outperformance:

- Kotak India EQ Contra Fund: 4

- SBI Contra Fund: 7

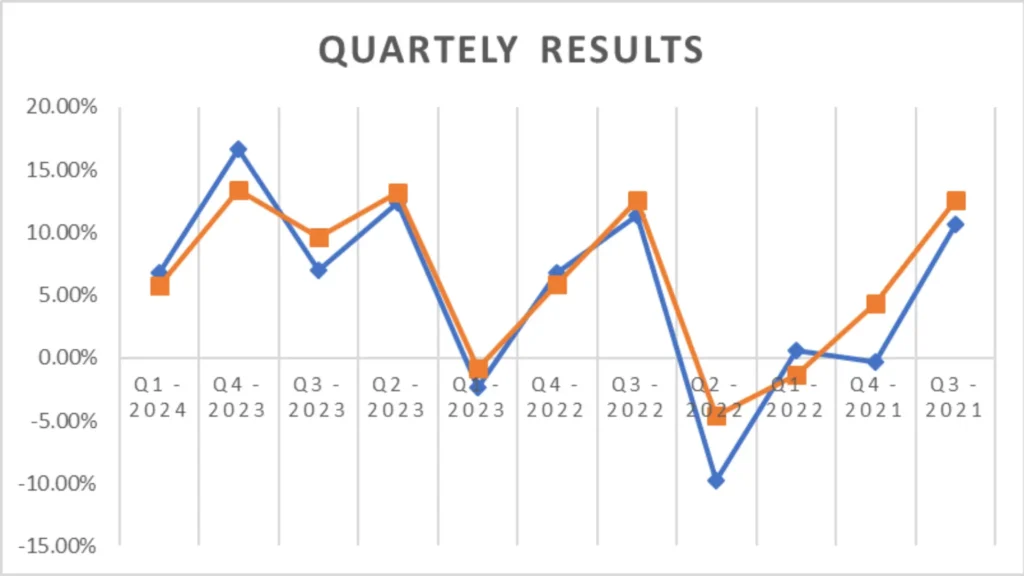

Quarterly Results

Now, let’s examine the quarterly results of both funds:

Analysis:

- Q1 – 2024: Kotak India EQ Contra Fund had a return of 6.79%, while SBI Contra Fund stood at 5.72%.

- Q4 – 2023: Kotak India EQ Contra Fund outperformed SBI Contra Fund with a return of 16.58% compared to 13.40%.

- Q3 – 2023: SBI Contra Fund had a higher return of 9.62%, while Kotak India EQ Contra Fund stood at 6.99%.

- Q2 – 2023: SBI Contra Fund outperformed Kotak India EQ Contra Fund with a return of 13.20% compared to 12.40%.

- Q1 – 2023: Both funds had negative returns, with Kotak India EQ Contra Fund at -2.37% and SBI Contra Fund at -0.85%.

- Q4 – 2022: Kotak India EQ Contra Fund had a return of 6.79%, while SBI Contra Fund stood at 5.81%.

- Q3 – 2022: SBI Contra Fund outperformed Kotak India EQ Contra Fund with a return of 12.55% compared to 11.32%.

- Q2 – 2022: Both funds had negative returns, with Kotak India EQ Contra Fund at -9.80% and SBI Contra Fund at -4.56%.

- Q1 – 2022: Kotak India EQ Contra Fund had a return of 0.58%, while SBI Contra Fund stood at -1.33%.

- Q4 – 2021: Both funds had negative returns, with Kotak India EQ Contra Fund at -0.30% and SBI Contra Fund at 4.34%.

- Q3 – 2021: SBI Contra Fund outperformed Kotak India EQ Contra Fund with a return of 12.60% compared to 10.68%.

Key Takeaways

- Annualized/Calendar Year Returns: SBI Contra Fund has outperformed Kotak India EQ Contra Fund in annualized returns for most years, indicating its consistent performance.

- Quarterly Results: While both funds have shown fluctuations in quarterly returns, SBI Contra Fund has maintained a slight edge in several quarters, suggesting its ability to adapt to market dynamics.

Risk Analysis Metrics

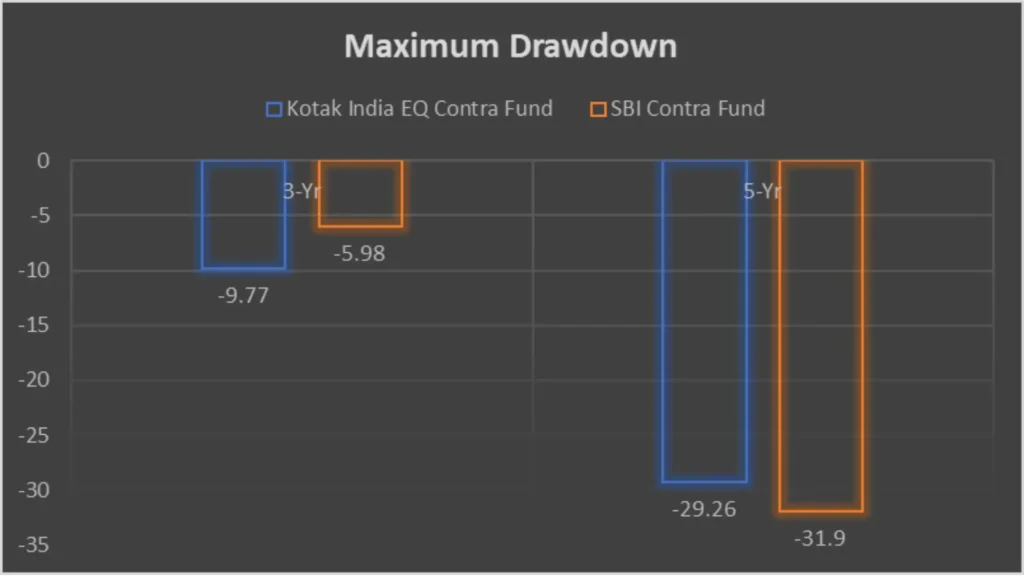

Maximum Drawdown

Let’s kick off our risk analysis by looking at the maximum drawdown of both funds over different periods:

Analysis:

- 3-Year Maximum Drawdown: Kotak India EQ Contra Fund experienced a maximum drawdown of -9.77%, whereas SBI Contra Fund had a lower drawdown of -5.98% over the past 3 years.

- 5-Year Maximum Drawdown: Both funds exhibited significant drawdowns over the 5 years, with Kotak India EQ Contra Fund at -29.26% and SBI Contra Fund at -31.9%.

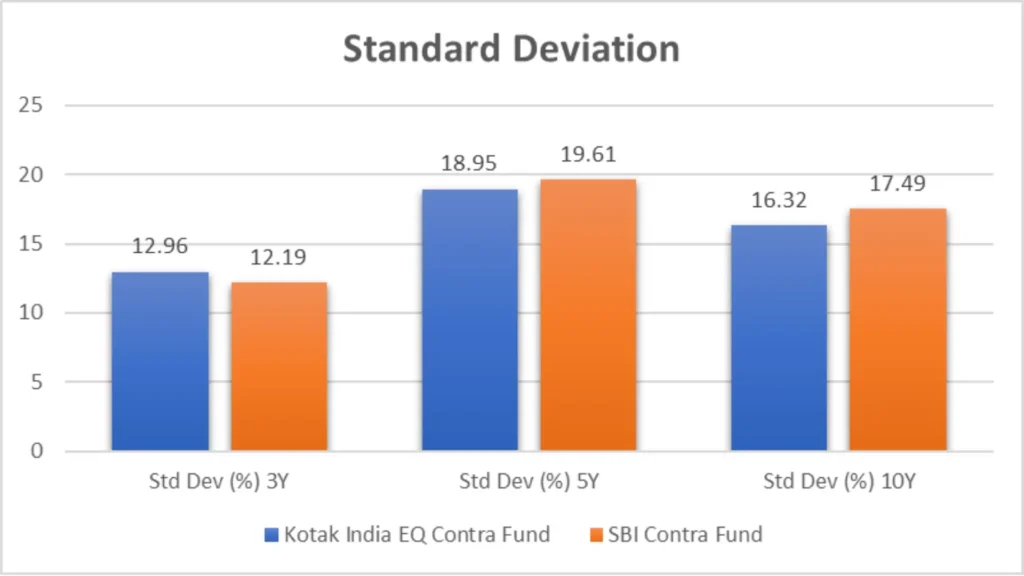

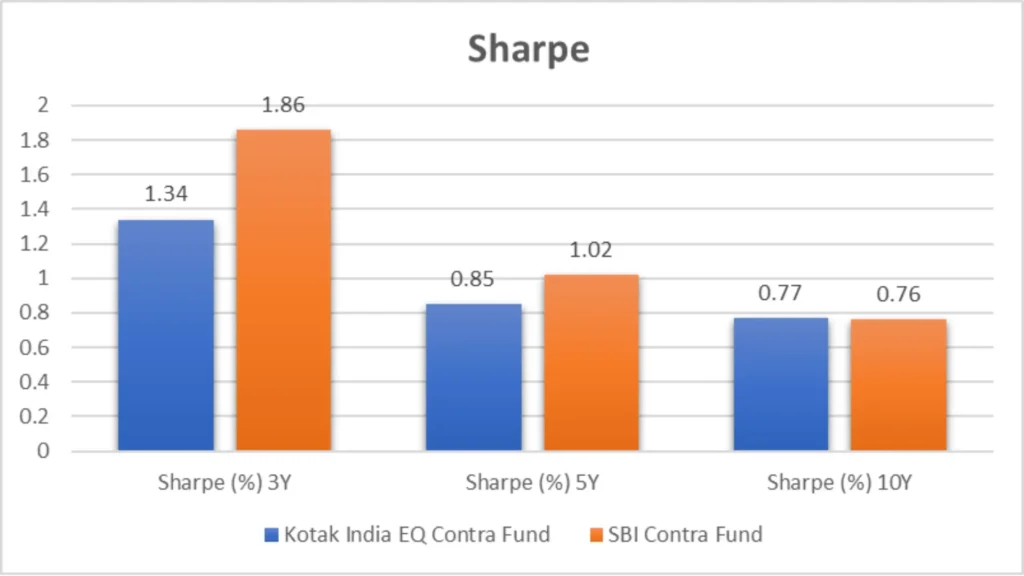

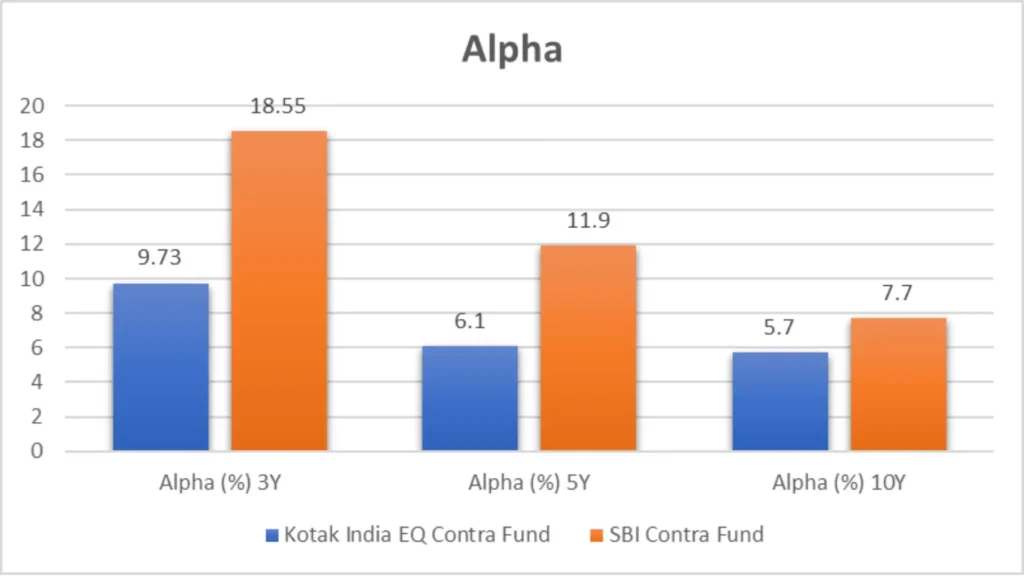

Mean Return, Sortino Ratio, Treynor’s Ratio, Standard Deviation, Sharpe Ratio, Beta And Alpha

Next, let’s delve into various risk analysis metrics to assess the risk-return profile of each fund:

| Metric | Kotak India EQ Contra Fund | SBI Contra Fund |

| Mean Return (%) | 22.57 | 27.89 |

| Sortino (%) | 2.56 | 3.24 |

| Treynor’s Ratio (%) | 0.14 | 0.22 |

| Std Dev (%) 3Y | 12.96 | 12.19 |

| Std Dev (%) 5Y | 18.95 | 19.61 |

| Std Dev (%) 10Y | 16.32 | 17.49 |

| Sharpe (%) 3Y | 1.34 | 1.86 |

| Sharpe (%) 5Y | 0.85 | 1.02 |

| Sharpe (%) 10Y | 0.77 | 0.76 |

| Beta (%) 3Y | 0.94 | 0.84 |

| Beta (%) 5Y | 0.98 | 0.99 |

| Beta (%) 10Y | 0.95 | 0.99 |

| Alpha (%) 3Y | 9.73 | 18.55 |

| Alpha (%) 5Y | 6.1 | 11.9 |

| Alpha (%) 10Y | 5.7 | 7.7 |

Analysis:

- Mean Return: SBI Contra Fund demonstrates a higher mean return of 27.89% compared to 22.57% for Kotak India EQ Contra Fund.

- Sortino Ratio: SBI Contra Fund exhibits a higher Sortino ratio, indicating better risk-adjusted returns.

- Treynor’s Ratio: SBI Contra Fund also shows a higher Treynor’s Ratio, suggesting superior risk-adjusted performance concerning market risk.

- Standard Deviation: While both funds have varying standard deviations across different time frames, SBI Contra Fund generally maintains slightly lower deviations, indicating lower volatility.

- Sharpe Ratio: SBI Contra Fund consistently outperforms Kotak India EQ Contra Fund in terms of Sharpe ratio, reflecting better risk-adjusted returns.

- Beta: SBI Contra Fund demonstrates lower beta values across all time frames, indicating lower volatility than the market.

- Alpha: SBI Contra Fund exhibits higher alpha values across all time frames, indicating superior performance relative to the market.

Key Takeaways

- Volatility and Risk: SBI Contra Fund generally exhibits lower volatility and drawdowns than Kotak India EQ Contra Fund, suggesting potentially lower risk.

- Return Potential: While SBI Contra Fund shows higher mean returns and risk-adjusted metrics, Kotak India EQ Contra Fund may appeal to investors seeking a balance between risk and Return.

- Performance against Market: SBI Contra Fund consistently performs better against market benchmarks, as evidenced by higher alpha and lower beta values.

Star Ratings Comparison

| Ratings Source | Kotak India EQ Contra Fund | SBI Contra Fund |

|---|---|---|

| CRISIL Ratings (as on 31st Mar 2024) | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐⭐ |

| CRISIL Ratings (as on 31st Dec 2023) | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐⭐ |

| CRISIL Ratings (as on 30th Sep 2023) | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐⭐ |

| CRISIL Ratings (as on 30th Jun 2023) | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐⭐ |

| CRISIL Ratings (as on 31st Mar 2023) | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐⭐ |

| Value Research Ratings | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐⭐ |

| Morning Star Ratings | NA | NA |

| Economic Times Ratings | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐⭐ |

| Groww Ratings | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐⭐ |

| AngelOne AQR Ratings | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐⭐ |

| 5Paisa Ratings | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐⭐ |

| KUVERA ratings | ⭐⭐⭐⭐☆ | ⭐⭐☆☆☆ |

| Average Ratings | ⭐⭐⭐☆☆ | ⭐⭐⭐⭐☆ |

Portfolio Analysis

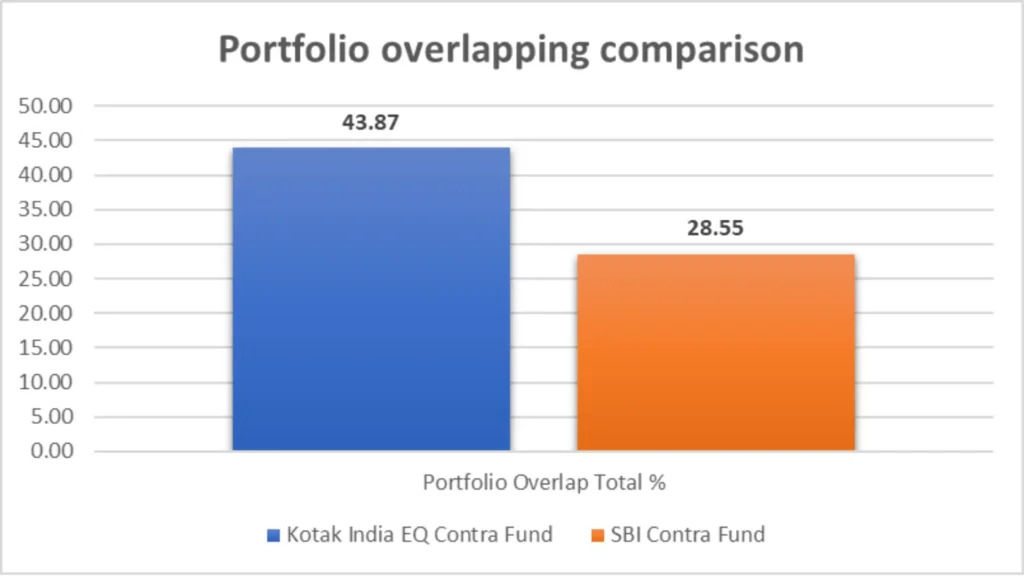

Portfolio Overlapping Comparison

Understanding the degree of portfolio overlap between two funds is crucial for investors to diversify effectively and minimize risk. Let’s compare the portfolio overlapping percentages:

Analysis:

- Portfolio Overlap Total %: Kotak India EQ Contra Fund exhibits a higher portfolio overlap percentage of 43.87%, indicating more significant similarities in holdings than SBI Contra Fund, which has a portfolio overlap of 28.55%.

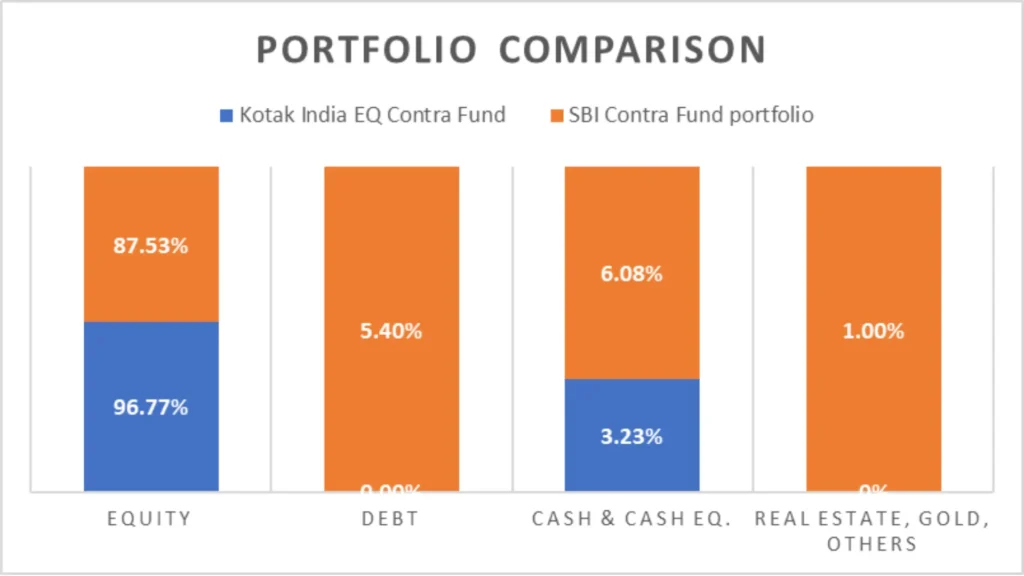

Portfolio Composition

Examining the composition of each fund’s portfolio provides insights into their asset allocation strategies:

Analysis:

- Equity Allocation: Both funds are predominantly allocated to equities, with Kotak India EQ Contra Fund at 96.77% and SBI Contra Fund at 87.53%.

- Debt Allocation: The SBI Contra Fund holds a higher proportion of debt instruments than Kotak India EQ Contra Fund, which has a negligible allocation.

- Cash & Cash Equivalents: SBI Contra Fund also maintains a higher allocation to cash and cash equivalents, indicating a more conservative approach to managing liquidity.

- Others: SBI Contra Fund allocates a small portion to real estate, gold, and other assets, whereas Kotak India EQ Contra Fund does not have any allocation in this category.

Market Cap Allocation

The distribution of investments across different market capitalization segments offers insights into the funds’ risk-return profiles:

Analysis:

- Number of Stocks: SBI Contra Fund holds more stocks (90) than Kotak India EQ Contra Fund (58), indicating a broader diversification strategy.

- Large Cap Allocation: Kotak India EQ Contra Fund has a higher allocation to large-cap stocks (57.68%) than SBI Contra Fund (35.65%).

- Mid-Cap and Small-Cap Allocation: Both funds have similar allocations to mid-cap and small-cap stocks, with slight variations.

- Foreign Equity: SBI Contra Fund allocates a portion of its portfolio to foreign equities, which Kotak India EQ Contra Fund does not.

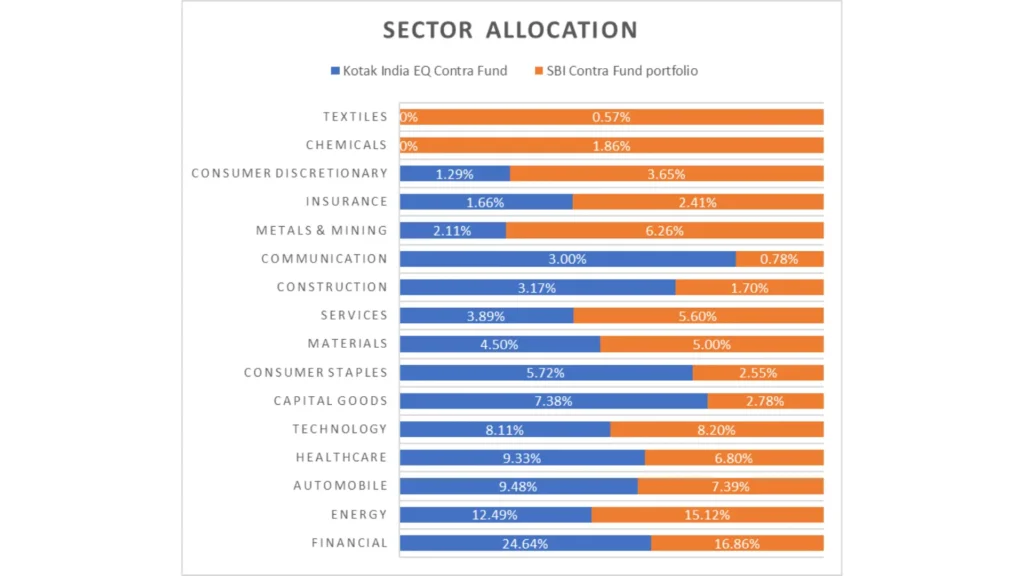

Sector Allocation

Analyzing sector allocations provides insights into each fund’s exposure to different segments of the economy:

Analysis:

- Both funds have varied sector allocations, with some overlapping sectors such as financials, energy, and technology.

- SBI Contra Fund has higher exposure to sectors like energy, healthcare, and metals & mining than Kotak India EQ Contra Fund.

- Kotak India EQ Contra Fund holds more prominent positions in financials, automobiles, and capital goods.

Key Takeaways

- Portfolio Overlap: Kotak India EQ Contra Fund exhibits a higher degree of portfolio overlap than SBI Contra Fund, suggesting potential similarities in investment strategies.

- Asset Allocation: While both funds primarily invest in equities, SBI Contra Fund maintains a more diversified allocation across asset classes, including debt and cash equivalents.

- Market Cap and Sector Allocation: SBI Contra Fund holds a more significant number of stocks and has different sector allocations than Kotak India EQ Contra Fund, offering investors a broader exposure to various market segments.

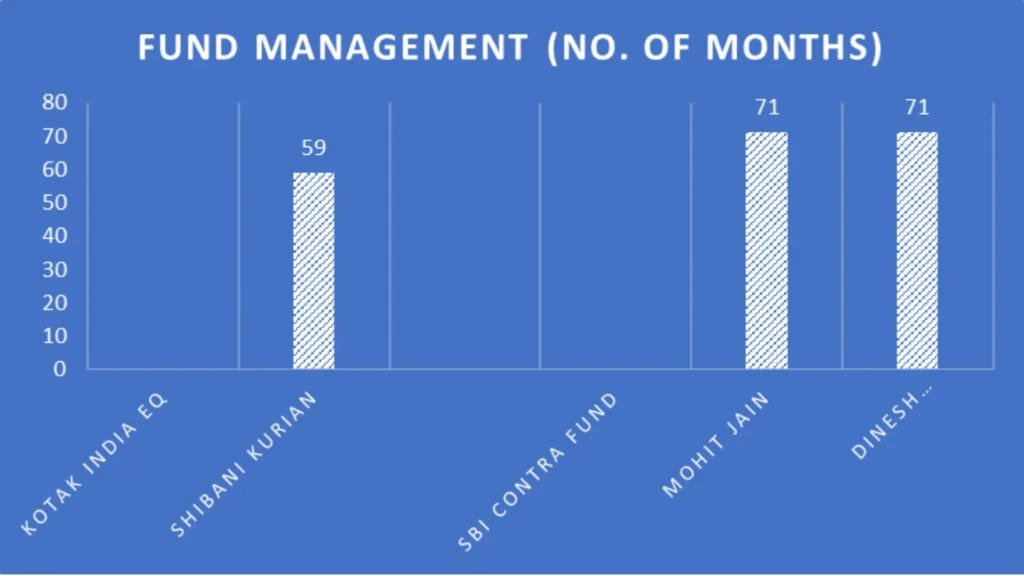

Fund Managers and Experience

Effective fund management plays a pivotal role in the performance of mutual funds. Let’s compare the experience of the fund managers for Kotak India EQ Contra Fund and SBI Contra Fund:

Analysis:

- Kotak India EQ Contra Fund: Managed by Shibani Kurian for 59 months.

- SBI Contra Fund: Managed by Mohit Jain and Dinesh Balachandran, each with 71 months of experience.

Key Takeaway:

SBI Contra Fund benefits from a longer tenure of fund managers, potentially indicating more excellent expertise and understanding of market dynamics.

Other Important Details

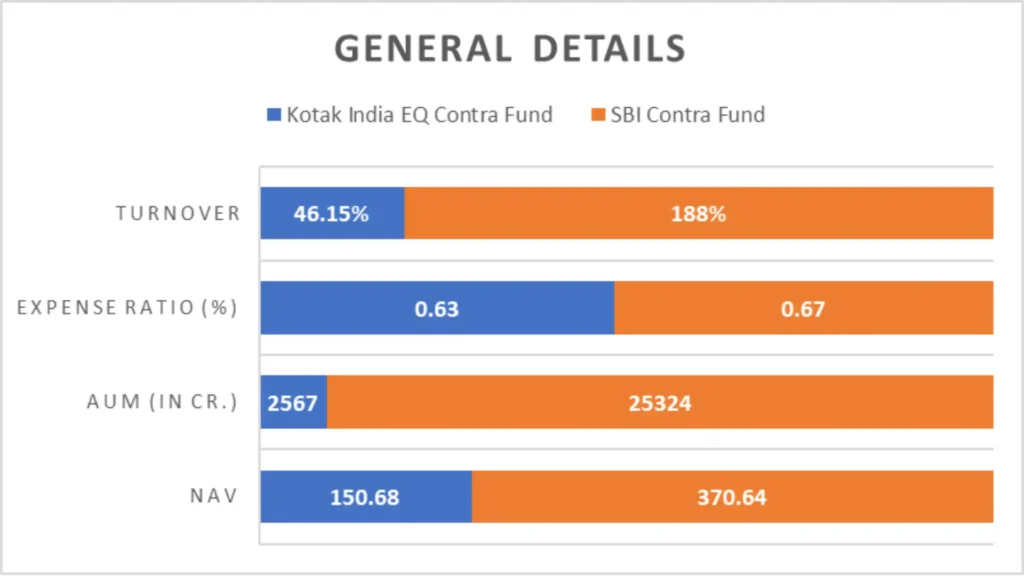

Now, let’s delve into other crucial details that influence investors’ decisions:

Analysis:

- NAV: The NAV of the SBI Contra Fund is significantly higher than Kotak India EQ Contra Fund, indicating a higher price per share.

- AUM: SBI Contra Fund manages a larger corpus of assets than Kotak India EQ Contra Fund, suggesting higher investor confidence and trust.

- Expense Ratio: Both funds have relatively low expense ratios, with Kotak India EQ Contra Fund marginally lower at 0.63%.

- Turnover: SBI Contra Fund has a notably higher turnover rate of 188% compared to Kotak India EQ Contra Fund’s 46.15%, indicating a higher frequency of buying and selling securities.

- Benchmark: Kotak India EQ Contra Fund benchmarks against NIFTY 50, while SBI Contra Fund benchmarks against NIFTY 100.

Key Takeaway:

While SBI Contra Fund has a higher NAV, AUM, and turnover rate, Kotak India EQ Contra Fund boasts a slightly lower expense ratio, potentially offering cost benefits to investors.

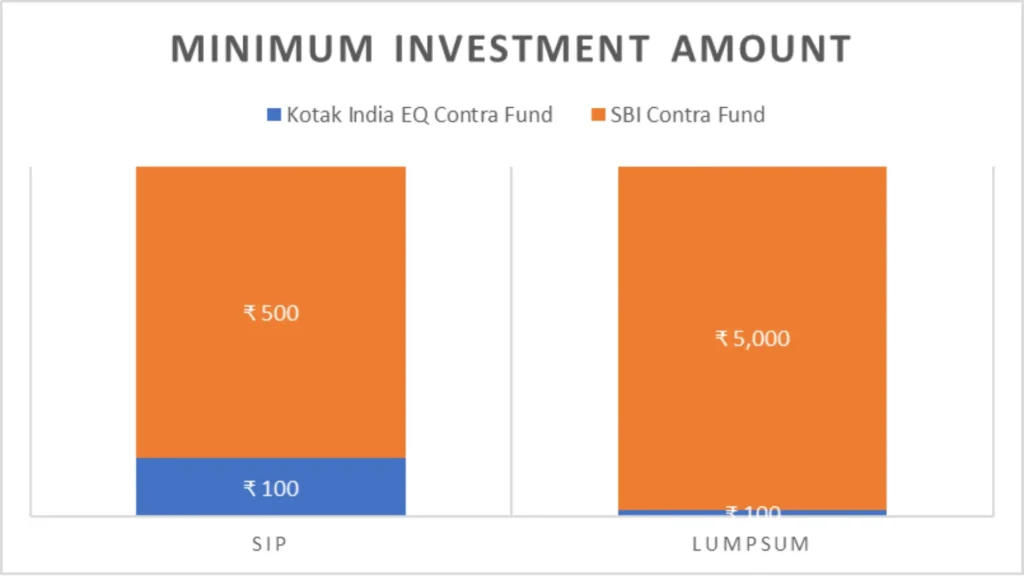

Minimum Investment Amount

Investors often consider the minimum investment amount required for SIP (Systematic Investment Plan) and lump sum investments. Let’s compare:

Analysis:

- Both funds offer accessible entry points for investors, with Kotak India EQ Contra Fund allowing SIP investments starting from ₹ 100. At the same time, SBI Contra Fund requires a minimum SIP investment of ₹ 500.

- For lump sum investments, Kotak India EQ Contra Fund and SBI Contra Fund have minimum investment requirements of ₹ 100 and ₹ 5,000, respectively.

Key Takeaway:

Kotak India EQ Contra Fund offers a lower minimum SIP investment, making it more accessible for investors looking to start with smaller amounts.

Conclusion

In conclusion, after a thorough comparative analysis between Kotak India EQ Contra Fund and SBI Contra Fund, SBI Contra Fund emerges as the superior choice across various parameters. It consistently outperforms Kotak India EQ Contra Fund regarding returns, risk management, portfolio diversification, and fund management experience.

However, for investors with a higher risk appetite seeking potentially higher returns over shorter durations, Kotak India EQ Contra Fund may be more suitable due to its slightly higher trailing returns and lower minimum SIP investments. Conversely, for investors prioritizing stability, lower volatility, and consistent performance against market benchmarks, SBI Contra Fund presents a more attractive option.

We hope you found this guide on mutual funds helpful.

If you have any mutual fund-related queries, feel free to comment below—we’re here to help! S.K. Singh, a registered professional with the Association of Mutual Funds in India (AMFI), will answer your queries and holds the ARN-251149.

Invest wisely!

FAQs – SBI Contra Fund vs Kotak India EQ Contra Fund

What is the investment style of Kotak India EQ Contra Fund and SBI Contra Fund?

Kotak India EQ Contra Fund and SBI Contra Fund follow a Growth strategy.

Which fund performs better regarding returns between Kotak India EQ Contra Fund and SBI Contra Fund?

SBI Contra Fund generally outperforms Kotak India EQ Contra Fund regarding returns across various time frames.

What are the critical differences in lump sum investment values between Kotak India EQ Contra Fund and SBI Contra Fund?

Kotak India EQ Contra Fund tends to have higher lump sum investment values than SBI Contra Fund over different investment durations.

Which fund is better for investors seeking long-term growth?

Kotak India EQ Contra Fund may be more suitable for investors seeking long-term growth, as it consistently delivers higher returns over extended periods.

What are the key takeaways regarding SIP returns analysis?

While both funds demonstrate impressive SIP returns, SBI Contra Fund generally demonstrates greater consistency across various investment durations.

How do the Compound Annual Growth Rates (CAGR) compare between Kotak India EQ Contra Fund and SBI Contra Fund

SBI Contra Fund exhibits a higher CAGR than Kotak India EQ Contra Fund over various investment durations, indicating superior growth potential.

Which fund exhibits better risk management practices?

SBI Contra Fund generally demonstrates more effective risk management practices, as evidenced by its consistent performance in risk-adjusted metrics.

What is the portfolio overlap percentage between Kotak India EQ Contra Fund and SBI Contra Fund?

Kotak India EQ Contra Fund exhibits a higher portfolio overlap than SBI Contra Fund.

Which fund has a more diversified asset allocation strategy?

SBI Contra Fund maintains a more diversified allocation across asset classes, including equities, debt, and cash equivalents, compared to Kotak India EQ Contra Fund.

Who are the fund managers for Kotak India EQ Contra Fund and SBI Contra Fund?

Kotak India EQ Contra Fund is managed by Shibani Kurian. In contrast, the SBI Contra Fund is managed by Mohit Jain and Dinesh Balachandran.

What is the minimum investment amount required for SIP and lump sum investments in both funds?

Kotak India EQ Contra Fund allows SIP investments starting from ₹100, while SBI Contra Fund requires a minimum SIP investment of ₹500. For lump sum investments, Kotak India EQ Contra Fund has a minimum of ₹100. In contrast, the SBI Contra Fund requires a minimum of ₹5,000.

Which benchmark indices do Kotak India EQ Contra Fund and SBI Contra Fund benchmark against?

Kotak India EQ Contra Fund benchmarks against NIFTY 50, while SBI Contra Fund benchmarks against NIFTY 100.

What are the NAV, AUM, and expense ratio differences between Kotak India EQ Contra Fund and SBI Contra Fund?

SBI Contra Fund generally has a higher NAV and AUM than Kotak India EQ Contra Fund, with slightly higher expense ratios.

Which fund exhibits a better risk-return profile according to various risk analysis metrics?

SBI Contra Fund generally exhibits a better risk-return profile than Kotak India EQ Contra Fund, as indicated by multiple risk analysis metrics such as the Sharpe ratio, Treynor’s Ratio, and Sortino ratio.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.