Mid-cap mutual funds can be a sweet spot for many investors—offering growth potential and relative stability. You’re in luck if you’re exploring your options in this category. Let’s dive deep into some of Top Mid-Cap Funds of 2024 and analyse their performances over the past few years. We’ll make this as engaging and data-oriented as possible with interactive tables and insightful takeaways. So, buckle up and let’s get started!

Returns Analysis

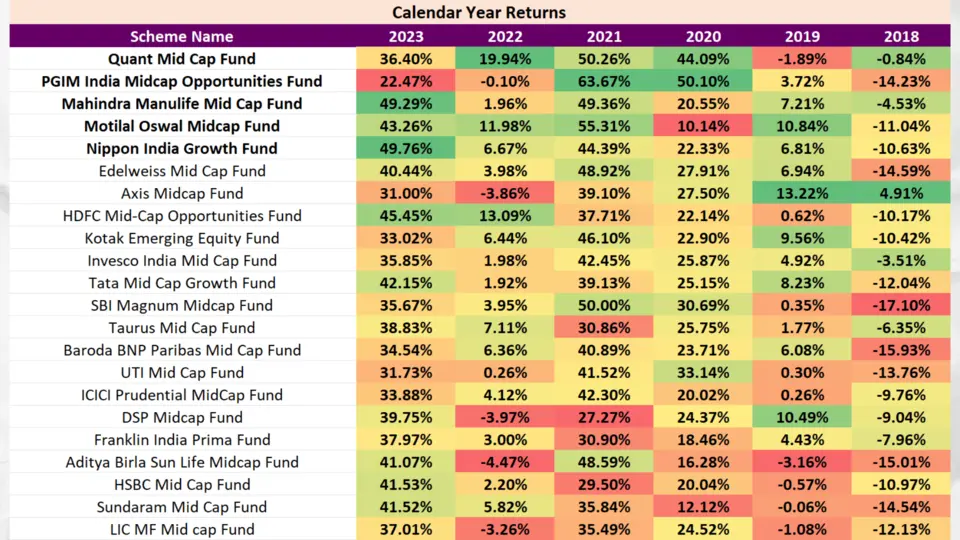

Calendar Year Returns Analysis of Top Mid-Cap Funds

Here’s a detailed comparative analysis of the top mid-cap mutual funds based on their calendar year returns from 2018 to 2023.

Key Takeaways

Top Performers

- Mahindra Manulife Mid Cap Fund: Leading with a 49.29% return in 2023, demonstrating strong growth potential.

- Nippon India Growth Fund: Close behind with a 49.76% return, showcasing resilience and consistent performance.

- Quant Mid Cap Fund: Maintaining a solid track record with a 36.40% return in 2023, highlighting stability.

Consistent Performers

- Edelweiss Mid Cap Fund: Consistently positive returns, proving a reliable choice.

- HDFC Mid-Cap Opportunities Fund: Strong performance with a 45.45% return in 2023, emphasizing steady growth.

Funds with Room for Improvement

- Axis Midcap Fund: Experienced fluctuations but showed recovery potential with a 31.00% return in 2023.

- Aditya Birla Sun Life Midcap Fund: Overcame challenges in 2022, bouncing back with a 41.07% return in 2023.

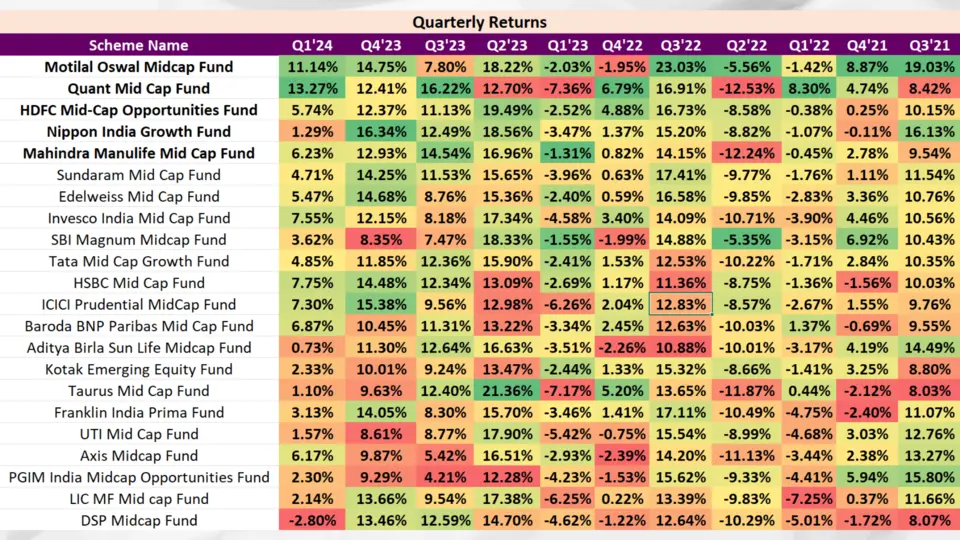

Quarterly Returns Analysis of Mid-Cap Funds

Let’s closely examine the quarterly returns of some of the top mid-cap mutual funds for 2024. This analysis will provide insights into their performance trends and help identify the best options for your investment strategy.

Key Takeaways

Top Performers

- Motilal Oswal Midcap Fund: Leading with consistent returns, especially in Q4’23 (14.75%) and Q3’23 (7.80%), making it a top choice for growth-oriented investors.

- Quant Mid Cap Fund: Demonstrating resilience with solid returns in Q3’23 (16.22%) and Q4’23 (12.41%), highlighting its potential for sustained growth.

- Nippon India Growth Fund: Highlighting growth potential with Q4’23 (16.34%) and Q2’23 (18.56%) returns despite occasional setbacks.

Consistent Performers

- Edelweiss Mid Cap Fund: Maintaining steady growth with Q4’23 (14.68%) and Q3’23 (8.76%) returns is a reliable choice for investors.

- HDFC Mid-Cap Opportunities Fund: Showing resilience and steady growth with Q2’23 (19.49%) and Q3’23 (11.13%) returns, making it a best option for long-term growth.

Funds with Room for Improvement

- Axis Midcap Fund: Experienced fluctuations but showed recovery potential with Q3’23 (5.42%) and Q2’23 (16.51%) returns, indicating its ability to bounce back.

- DSP Midcap Fund: Overcame challenges in Q1’23 and Q4’22, bouncing back with Q3’23 (12.59%) and Q2’23 (14.70%) returns, suggesting its potential for growth despite occasional volatility.

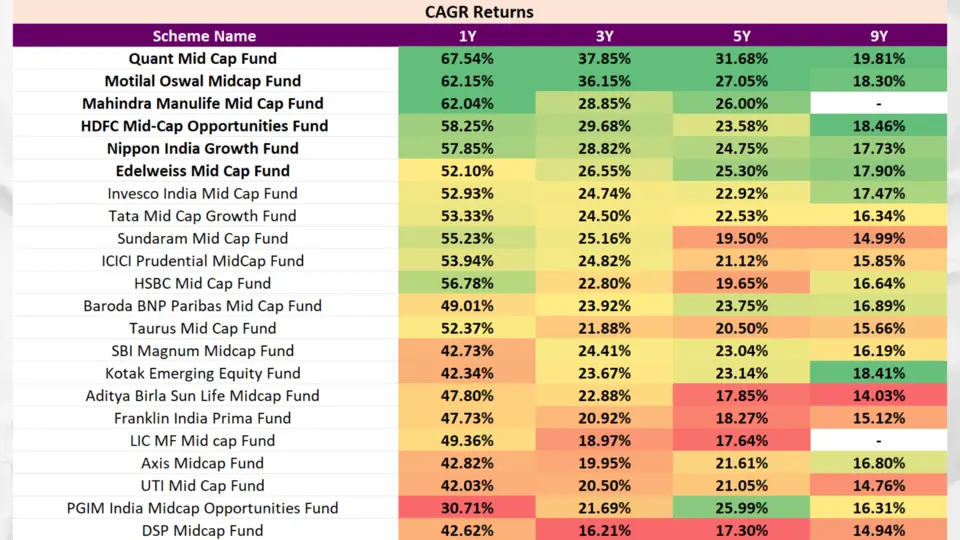

CAGR Returns Analysis of Best Mid-Cap Funds

Key Takeaways

Top Performers

- Quant Mid Cap Fund: Leading with a 1-year return of 67.54%, this fund has demonstrated strong performance across multiple periods, making it a top choice for growth-oriented investors.

- Motilal Oswal Midcap Fund: With a 1-year CAGR of 62.15% and strong returns over 3 and 5 years, this fund is ideal for investors seeking consistent performance.

- Mahindra Manulife Mid Cap Fund: Delivering a stellar 62.04% return over the past year, this fund shows strong growth potential, particularly over the medium term.

Consistent Performers

- HDFC Mid-Cap Opportunities Fund: Showing resilience and steady growth with a 1-year return of 58.25% and solid 3-year and 5-year returns, this fund is a solid choice for long-term growth.

- Nippon India Growth Fund: With a 1-year return of 57.85% and consistent performance over 3 and 5 years, this fund is ideal for investors seeking a mix of short-term and long-term growth.

Funds with Room for Improvement

- Axis Midcap Fund: While it has shown potential with a 1-year return of 42.82%, the fund faces challenges in maintaining consistent performance, making it suitable for conservative investors.

- DSP Midcap Fund: Despite achieving a 1-year return of 42.62%, this fund has struggled to deliver high returns over more extended periods, indicating room for improvement.

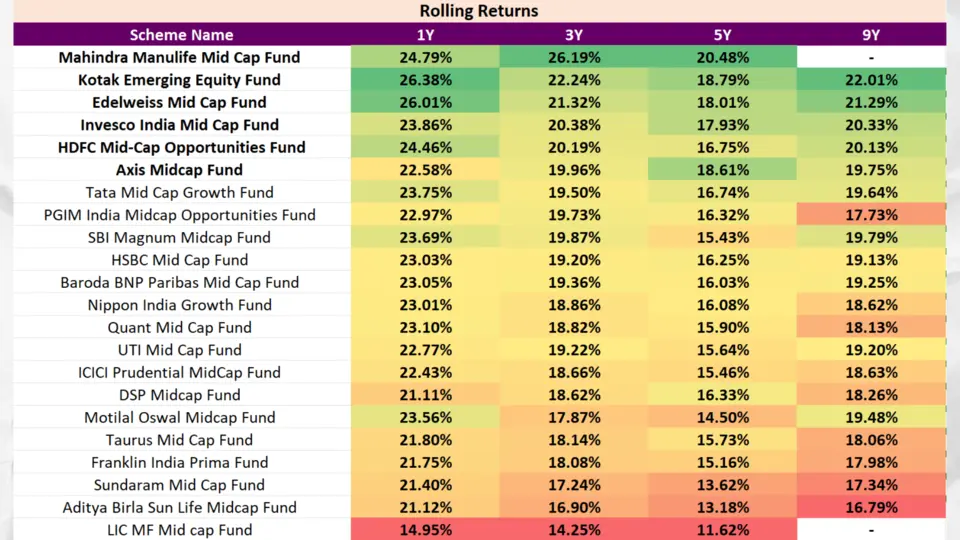

Rolling Returns Analysis of Best Mid-Cap Funds

Key Takeaways

Top Performers

- Kotak Emerging Equity Fund: Leading with a 1-year return of 26.38%, this fund has demonstrated strong performance across multiple periods, making it a top choice for growth-oriented investors.

- Edelweiss Mid Cap Fund: Delivering a solid 26.01% return over the past year and maintaining consistent performance over extended periods, this fund is ideal for investors seeking stability and growth.

- Mahindra Manulife Mid Cap Fund: With a 1-year return of 24.79% and 3-year solid and 5-year returns, this fund shows robust short- to medium-term growth potential.

Consistent Performers

- HDFC Mid-Cap Opportunities Fund: Showing resilience and steady growth with a 1-year return of 24.46% and solid returns over 3, 5, and 9 years, this fund is a best choice for long-term growth.

- Invesco India Mid Cap Fund: With a 1-year return of 23.86% and consistent performance over 3, 5, and 9 years, this fund suits investors who value long-term stability.

Funds with Room for Improvement

- LIC MF Mid Cap Fund: Despite delivering a 1-year return of 14.95%, this fund has struggled to achieve higher returns over more extended periods, indicating room for improvement.

- Aditya Birla Sun Life Midcap Fund: While showing consistent performance, the fund’s returns over more extended periods are lower compared to top performers, suggesting growth potential.

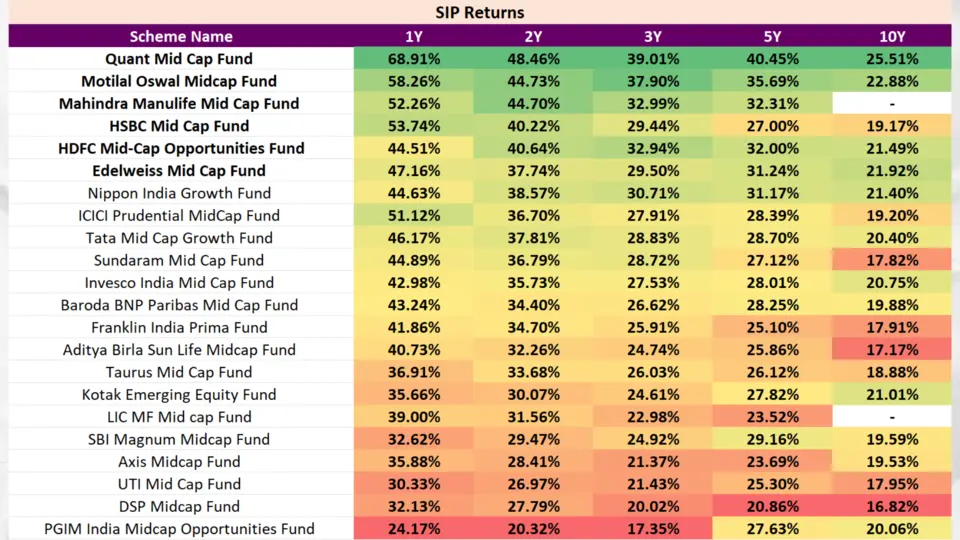

SIP Returns Analysis of Mid-Cap Funds

Key Takeaways

Top Performers

- Quant Mid Cap Fund: Leading with a 1-year SIP return of 68.91%, this fund has demonstrated strong performance across multiple periods, making it a top choice for growth-oriented investors.

- Motilal Oswal Midcap Fund: With a 1-year SIP return of 58.26% and strong returns over 2, 3, 5, and 10 years, this fund is ideal for investors seeking consistent high returns.

- Mahindra Manulife Mid Cap Fund: This fund shows robust growth potential by delivering a solid 1-year SIP return of 52.26% and maintaining strong performance over 2 and 3 years.

Consistent Performers

- HSBC Mid Cap Fund: Showing resilience and steady growth with a 1-year SIP return of 53.74% and solid returns over 2, 3, 5, and 10 years, this fund is a solid choice for long-term growth.

- HDFC Mid-Cap Opportunities Fund: With a 1-year SIP return of 44.51% and consistent performance over extended periods, this fund suits investors seeking stable returns.

Funds with Room for Improvement

- LIC MF Mid Cap Fund: Despite delivering a 1-year SIP return of 39.00%, this fund has struggled to achieve higher returns over extended periods, indicating room for improvement.

- DSP Midcap Fund: While showing consistent performance, the fund’s returns over more extended periods are lower than top performers, suggesting growth potential.

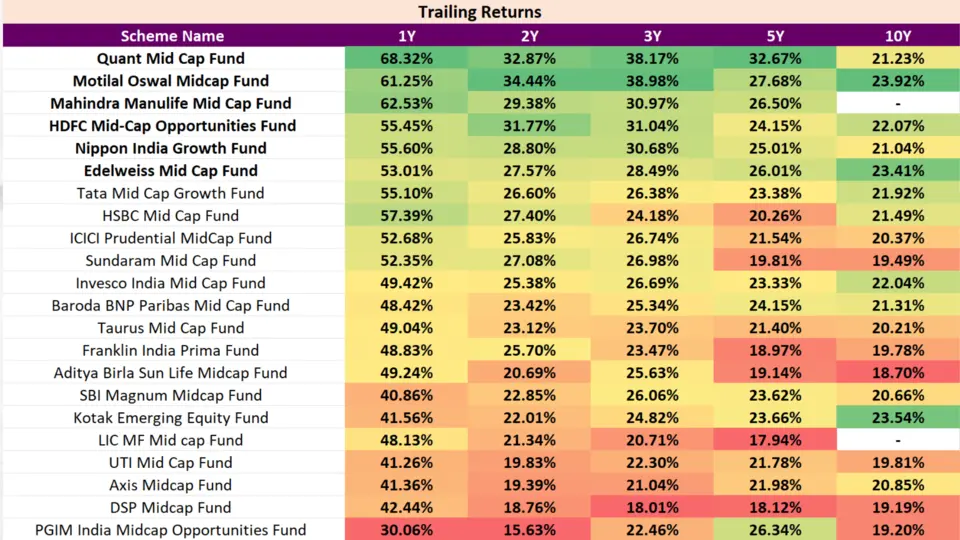

Trailing Returns Analysis of Top Mid-Cap Mutual Funds

Here’s a detailed analysis of the top mid-cap mutual funds based on their trailing returns over 1-year, 2-year, 3-year, 5-year, and 10-year periods.

Key Takeaways

Top Performers

- Quant Mid Cap Fund: Leading with a 1-year trailing return of 68.32%, this fund has demonstrated strong performance across multiple periods, making it a top choice for growth-oriented investors.

- Motilal Oswal Midcap Fund: With a 1-year trailing return of 61.25% and strong returns over 2, 3, 5, and 10 years, this fund is ideal for investors seeking consistently high returns.

- Mahindra Manulife Mid Cap Fund: This fund shows robust growth potential by delivering a solid 1-year trailing return of 62.53% and maintaining strong performance over 2 and 3 years.

Consistent Performers

- HDFC Mid-Cap Opportunities Fund: Showing resilience and steady growth with a 1-year trailing return of 55.45% and solid returns over 2, 3, 5, and 10 years, this fund is a solid choice for long-term growth.

- Nippon India Growth Fund: With a 1-year trailing return of 55.60% and consistent performance over more extended periods, this fund suits investors seeking stable returns.

Funds with Room for Improvement

- DSP Midcap Fund: Despite delivering a 1-year trailing return of 42.44%, this fund has struggled to achieve higher returns over extended periods, indicating room for improvement.

- LIC MF Mid Cap Fund: While showing consistent performance, the fund’s returns over more extended periods are lower compared to top performers, suggesting growth potential.

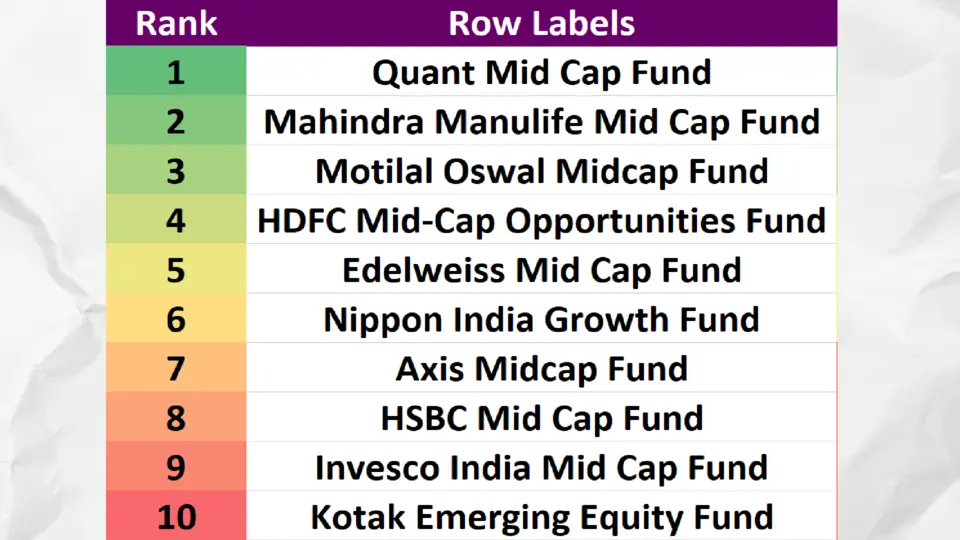

Top 10 Mid-Cap Funds Based on Returns in 2024

1. Quant Mid Cap Fund

Quant Mid Cap Fund has shown exceptional performance, particularly in the short term, with a 1-year return of 68.91%. Its 3-year solid and 5-year returns also make it a top choice for investors looking for high-growth potential.

2. Mahindra Manulife Mid Cap Fund

The Mahindra Manulife Mid-Cap Fund has consistently delivered impressive returns, making it the top mid-cap fund for 2024. Its robust performance over the past few years indicates strong management and a strategic investment approach. The fund’s ability to generate high returns in both the short and medium term makes it a favourite among investors seeking substantial growth.

3. HDFC Mid-Cap Opportunities Fund

HDFC Mid-Cap Opportunities Fund has shown remarkable consistency and growth over various periods. Its solid 10-year return of 22.07% highlights its long-term reliability. This fund is ideal for investors looking for steady growth and stability over an extended period.

4. Motilal Oswal Midcap Fund

Motilal Oswal Midcap Fund stands out with its exceptional short-term and long-term performance. The fund’s impressive 1-year return of 61.25% and 10-year return of 23.92% make it a strong contender for investors looking for high returns with a proven track record.

5. Edelweiss Mid Cap Fund

Edelweiss Mid Cap Fund has consistently provided solid returns over various periods. Its strong 10-year return of 21.29% and steady performance make it a reliable choice for investors seeking long-term growth with moderate risk.

6. Nippon India Growth Fund

Nippon India Growth Fund’s robust performance, especially in the short term, makes it a top performer. Its 1-year return of 55.60% and consistent returns over extended periods highlight its potential for steady growth and reliability.

7. Axis Midcap Fund

Axis Midcap Fund’s consistent performance over various periods makes it a reliable choice. Its steady 10-year return of 19.75% highlights its long-term growth and stability potential.

8. HSBC Mid Cap Fund

HSBC Mid Cap Fund has delivered solid returns, particularly in the short term. Its 1-year return of 57.39% and consistent performance over more extended periods make it an attractive option for investors.

9. Invesco India Mid Cap Fund

Invesco India Mid Cap Fund’s robust performance across various periods, particularly its 1-year return of 49.42%, makes it a strong contender for investors seeking steady returns.

10. Kotak Emerging Equity Fund

Kotak Emerging Equity Fund rounds out the top 10 with its consistent performance. Its solid 10-year return of 23.54% and reliable returns over shorter periods make it a dependable choice for long-term growth.

Risk Analysis

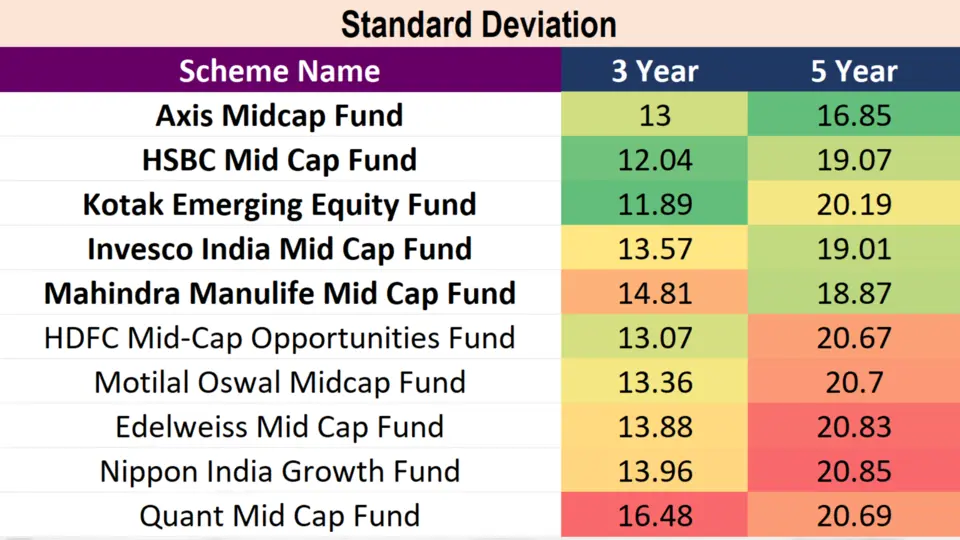

Standard Deviation Analysis

Here’s a detailed analysis of the top mid-cap mutual funds based on their 3-year and 5-year standard deviation.

Key Takeaways

Low Volatility Funds

- Kotak Emerging Equity Fund: With the lowest 3-year standard deviation of 11.89, this fund offers minimal short-term risk, making it suitable for conservative investors.

- HSBC Mid Cap Fund: Exhibiting low volatility with a 3-year standard deviation of 12.04, this fund balances short-term stability with moderate long-term risk.

Moderate Volatility Funds

- Invesco India Mid Cap Fund: With a 3-year standard deviation of 13.57 and a 5-year standard deviation of 19.01, this fund offers a balanced risk-reward profile.

- HDFC Mid-Cap Opportunities Fund: This fund is ideal for diversified portfolios, showing consistent moderate volatility.

High Volatility Funds

- Quant Mid Cap Fund: With the highest 3-year standard deviation of 16.48, this fund is suited for investors seeking high growth and are comfortable with significant risk.

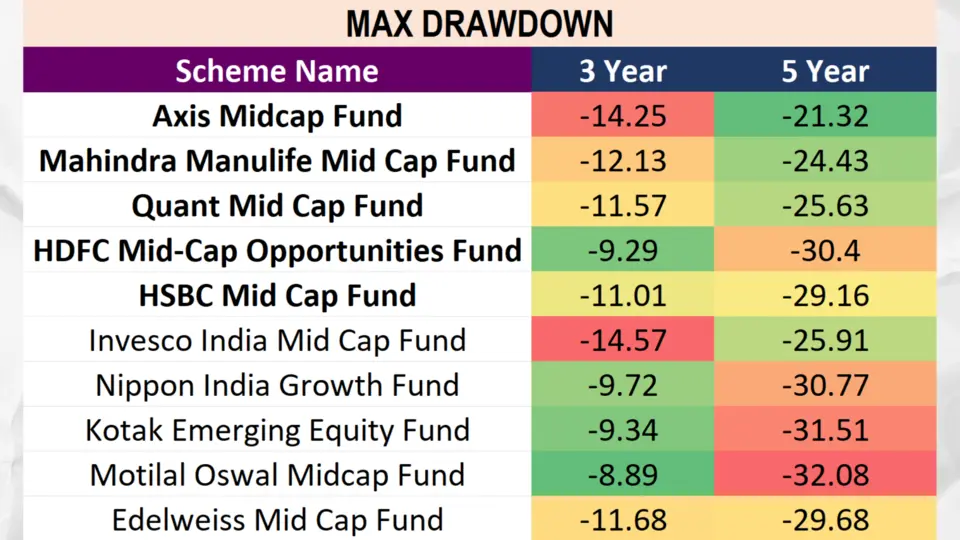

Maximum Drawdown Analysis

Here’s a detailed analysis of the top mid-cap mutual funds based on their 3-year and 5-year maximum drawdown.

Key Takeaways

Low Drawdown Funds

- Motilal Oswal Midcap Fund: With the lowest 3-year drawdown of -8.89%, this fund offers minimal short-term risk, making it suitable for conservative investors.

- HDFC Mid-Cap Opportunities Fund: Exhibiting the lowest 5-year drawdown of -30.4%, this fund balances short-term stability with long-term risk.

Moderate Drawdown Funds

- Quant Mid Cap Fund: With a 3-year drawdown of -11.57% and a 5-year drawdown of -25.63%, this fund offers a balanced risk-reward profile.

- HSBC Mid Cap Fund: This fund is ideal for diversified portfolios, showing a consistent moderate drawdown.

High Drawdown Funds

- Nippon India Growth Fund: Despite its low 3-year drawdown of -9.72%, its 5-year drawdown of -30.77% indicates higher long-term volatility.

- Kotak Emerging Equity Fund: With a significant long-term drawdown, this fund suits those seeking high returns and can tolerate substantial fluctuations.

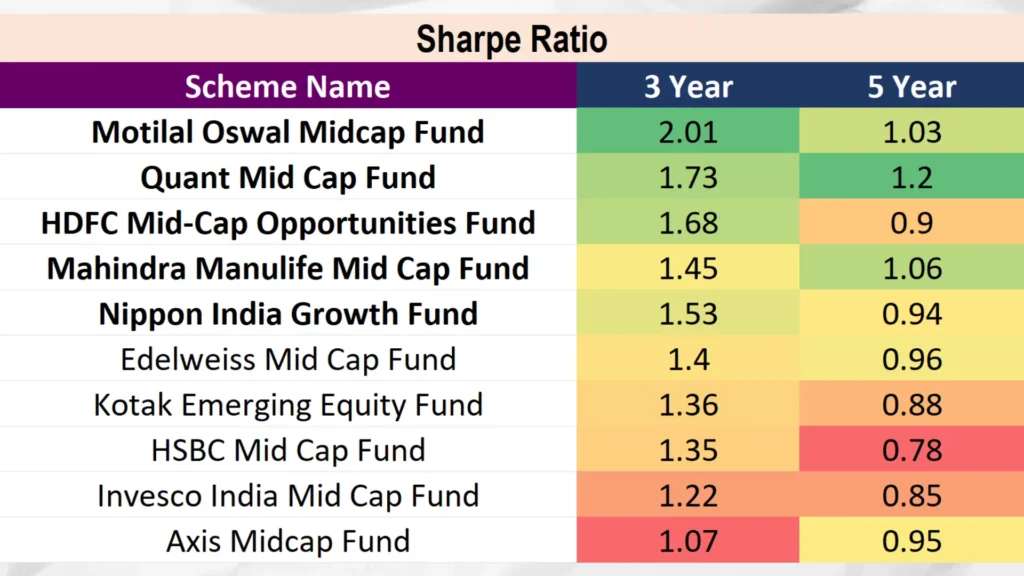

Sharpe Ratio Analysis

Here’s a detailed analysis of the top mid-cap mutual funds based on their 3-year and 5-year Sharpe Ratios.

Key Takeaways

High Risk-Adjusted Return Funds

- Motilal Oswal Midcap Fund: With the highest 3-year Sharpe Ratio of 2.01, this fund offers exceptional risk-adjusted returns, making it a top choice for growth-oriented investors.

- Quant Mid Cap Fund: This fund balances growth and risk effectively by showing strong performance with a 3-year Sharpe Ratio of 1.73 and a 5-year Sharpe Ratio of 1.2.

Consistent Performers

- HDFC Mid-Cap Opportunities Fund: With a 3-year Sharpe Ratio of 1.68, this fund offers solid short-term risk-adjusted returns, making it suitable for steady growth.

- Mahindra Manulife Mid Cap Fund: This fund has maintained good risk-adjusted returns with a 3-year Sharpe Ratio of 1.45 and a 5-year Sharpe Ratio of 1.06.

Moderate Risk-Adjusted Return Funds

- Nippon India Growth Fund: With a 3-year Sharpe Ratio of 1.53, this fund provides consistent short-term performance.

- Kotak Emerging Equity Fund: Showing good short-term risk-adjusted returns with a 3-year Sharpe Ratio of 1.36, this fund is ideal for steady growth.

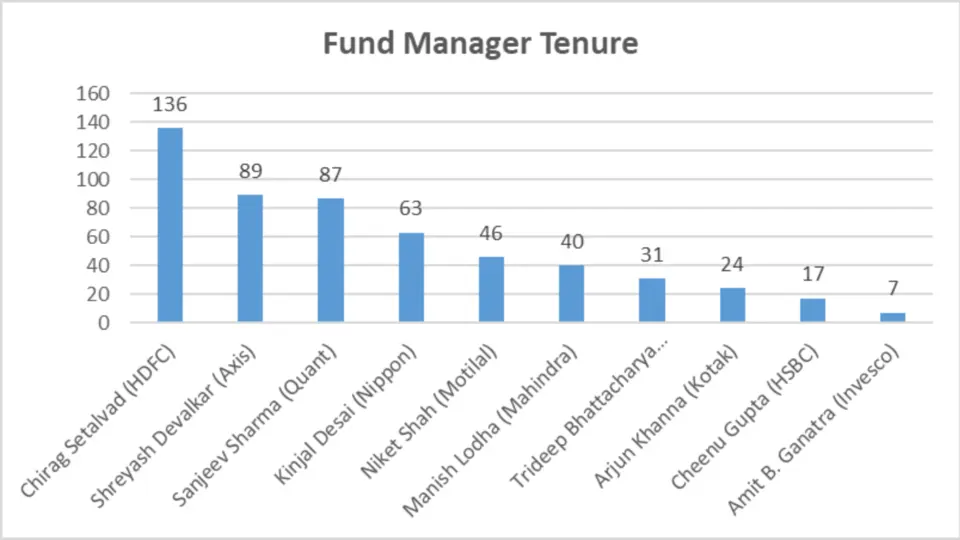

Analysis of Mid-Cap Funds Based on Fund Manager Tenure

Here’s a detailed analysis of the top mid-cap mutual funds based on the tenure of their fund managers.

| Fund Manager | No. OF Months |

| Chirag Setalvad (HDFC) | 136 |

| Shreyash Devalkar (Axis) | 89 |

| Sanjeev Sharma (Quant) | 87 |

| Kinjal Desai (Nippon) | 63 |

| Niket Shah (Motilal) | 46 |

| Manish Lodha (Mahindra) | 40 |

| Trideep Bhattacharya (Edelweiss) | 31 |

| Arjun Khanna (Kotak) | 24 |

| Cheenu Gupta (HSBC) | 17 |

| Amit B. Ganatra (Invesco) | 7 |

Key Takeaways

Most Experienced Fund Managers

- Chirag Setalvad (HDFC Mid-Cap Opportunities Fund): With 136 months of experience, Chirag’s extensive tenure offers stability and consistent performance.

- Shreyash Devalkar (Axis Midcap Fund): His 89-month tenure provides significant experience and strategic management, making the fund reliable.

Emerging Leaders

- Sanjeev Sharma (Quant Mid Cap Fund): With 87 months of experience, Sanjeev has shown strong leadership and effective risk management.

- Kinjal Desai (Nippon India Growth Fund): Her 63-month tenure highlights her ability to navigate various market conditions successfully.

New and Innovative Approaches

- Arjun Khanna (Kotak Emerging Equity Fund): Despite a shorter tenure of 24 months, Arjun brings innovative strategies and fresh perspectives.

- Amit B. Ganatra (Invesco India Mid Cap Fund): With just 7 months, Amit offers new leadership and strategic vision, potentially driving future success.

TOP 3 Mutual funds for 2024

Low-Risk Mid cap Funds with Better Risk-Adjusted Returns

- Mahindra Manulife Mid- Cap Fund: With strong Sharpe Ratios and moderate drawdowns, this fund offers stable returns under the experienced management of Manish Lodha.

- Nippon India Growth Fund: Demonstrating good risk management and balanced returns, this fund is ideal for conservative investors under Kinjal Desai’s experienced management.

- Edelweiss Mid Cap Fund: With solid risk-adjusted returns and moderate risk, this fund is suitable for balanced growth under Trideep Bhattacharya’s strategic management.

High-Risk Mid cap Funds with High Returns

- Quant Mid Cap Fund: High Sharpe Ratios and potential for significant growth make this fund suitable for aggressive investors under the experienced leadership of Sanjeev Sharma.

- Motilal Oswal Midcap Fund: Offering outstanding risk-adjusted returns with a high Sharpe Ratio, this fund is ideal for those willing to accept greater volatility for higher returns, managed by Niket Shah.

- HDFC Mid-Cap Opportunities Fund: Focusing on stability and consistent performance, this fund offers high risk-high reward potential under Chirag Setalvad’s extensive management.

Conclusion:

For investors seeking mid-cap mutual funds that balance risk and returns, Mahindra Manulife Mid Cap Fund, Nippon India Growth Fund, and Edelweiss Mid Cap Fund are top choices based on their solid risk-adjusted returns and moderate drawdowns, making them suitable for conservative investors.

On the other hand, for those with a higher risk appetite aiming for significant returns, Quant Mid Cap Fund, Motilal Oswal Midcap Fund, and HDFC Mid-Cap Opportunities Fund stand out due to their high Sharpe Ratios and potential for substantial growth. Quant Mid Cap Fund is the best performer across various parameters, offering robust returns and effective risk management, making it a versatile option for different investment strategies.

We hope you found this guide on mutual funds helpful.

If you have any mutual fund-related queries, feel free to comment below—we’re here to help! S.K. Singh, a registered professional with the Association of Mutual Funds in India (AMFI), will answer your queries and holds the ARN-251149.

Invest wisely!

FAQs for Top Mid-Cap Funds of 2024

Are mid-cap mutual funds a good investment for 2024?

Yes, mid-cap mutual funds balance growth potential and stability, making them a good investment choice for 2024.

How does the HDFC Mid-Cap Opportunities Fund perform?

HDFC Mid-Cap Opportunities Fund shows remarkable consistency with a solid 10-year return of 22.07%, making it ideal for long-term growth.

What are the benefits of investing in mid-cap mutual funds?

Mid-cap mutual funds provide growth potential, diversification, and balanced risk, making them attractive to various investors.

How do SIP returns impact fund evaluation?

SIP returns highlight the fund’s performance for regular investments. Quant Mid Cap Fund shows strong SIP returns, making it attractive for SIP investors.

What is the significance of maximum drawdown?

Maximum drawdown measures the most significant value drop from a fund’s peak. Lower drawdowns, like those of Motilal Oswal Midcap Fund, indicate lower risk.

What does a high Sharpe Ratio indicate?

A high Sharpe Ratio, like Motilal Oswal Midcap Fund’s 2.01, indicates excellent risk-adjusted returns, making it attractive for investors.

Which funds are managed by experienced fund managers?

unds like HDFC Mid-Cap Opportunities Fund and Axis Midcap Fund are managed by highly experienced managers like Chirag Setalvad and Shreyash Devalkar.

Why is Quant Mid Cap Fund suitable for high-risk investors?

Quant Mid Cap Fund offers high Sharpe Ratios and significant growth potential, making it ideal for those comfortable with higher volatility.

What are the top mid-cap funds for conservative investors?

For low-risk, better risk-adjusted returns, the top choices are Mahindra Manulife Mid Cap Fund, Nippon India Growth Fund, and Edelweiss Mid Cap Fund.

How does Edelweiss Mid Cap Fund fare in long-term growth?

Edelweiss Mid Cap Fund provides solid long-term growth with a 10-year return of 21.29%, making it a reliable choice for investors seeking stability and growth.

Which mid-cap fund has the lowest maximum drawdown?

Motilal Oswal Midcap Fund has the lowest 3-year maximum drawdown of -8.89%, indicating minimal short-term risk and suitability for conservative investors.

Why is Quant Mid Cap Fund suitable for high-risk investors?

Quant Mid Cap Fund offers high Sharpe Ratios and significant growth potential, making it ideal for those comfortable with higher volatility.

What are the top mid-cap funds for conservative investors?

For low-risk, better risk-adjusted returns, the top choices are Mahindra Manulife Mid Cap Fund, Nippon India Growth Fund, and Edelweiss Mid Cap Fund.

Which mid-cap fund is best for a diversified portfolio?

Motilal Oswal Midcap Fund has the lowest 3-year maximum drawdown of -8.89%, indicating minimal short-term risk and suitability for conservative investors.

why is HDFC Mid-Cap Opportunities Fund a good choice for long-term investors?

HDFC Mid-Cap Opportunities Fund shows remarkable consistency and growth with a solid 10-year return of 22.07%, making it ideal for long-term growth and stability.

What makes Quant Mid Cap Fund attractive for high-risk investors?

Quant Mid Cap Fund has high Sharpe Ratios and substantial growth potential, making it suitable for aggressive investors seeking significant returns.

How does the Axis Midcap Fund perform in terms of risk-adjusted returns?

xis Midcap Fund provides consistent performance with a 10-year return of 19.75%, making it a trustworthy choice for investors seeking long-term growth and steadiness.

Which funds are recommended for SIP investments?

Quant Mid Cap Fund and Motilal Oswal Midcap Fund lead with high 1-year SIP returns of 68.91% and 58.26%, respectively, making them top choices for SIP investments.

Why is HDFC Mid-Cap Opportunities Fund a good choice for long-term investors?

HDFC Mid-Cap Opportunities Fund shows remarkable consistency and growth with a solid 10-year return of 22.07%, making it ideal for long-term growth and stability.

What role does the experience of fund managers play in the performance of mid-cap funds?

Experienced fund managers like Chirag Setalvad (HDFC) and Shreyash Devalkar (Axis) bring stability and consistent performance to their respective funds.

How does the HSBC Mid Cap Fund balance risk and returns?

HSBC Mid Cap Fund exhibits low volatility with a 3-year standard deviation of 12.04 and solid returns, making it suitable for investors seeking balanced growth.

Which fund has shown the most resilience in the face of market volatility?

HDFC Mid-Cap Opportunities Fund shows resilience with low drawdowns and steady growth, making it a solid option for long-term stability.

What are the top mid-cap funds based on trailing returns?

Quant Mid Cap Fund, Motilal Oswal Midcap Fund, and Mahindra Manulife Mid Cap Fund lead with strong 1-year trailing returns of 68.32%, 61.25%, and 62.53%, respectively.

Which mid-cap fund is best for a diversified portfolio?

HDFC Mid-Cap Opportunities Fund offers consistent moderate volatility and solid returns, making it ideal for a diversified portfolio.

How does Invesco India Mid Cap Fund perform regarding stability and growth?

Invesco India Mid Cap Fund provides a balanced risk-reward profile with consistent performance over various periods, which is suitable for long-term stability.

What makes Mahindra Manulife Mid Cap Fund a top choice for 2024?

Mahindra Manulife Mid Cap Fund’s robust performance, strong management, and strategic investment approach make it a top choice for substantial growth.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus/IPO First and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/ Mutual Fund Focus / IPO First and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.